Illinois State Refund Tax

The Illinois State Refund Tax is a crucial aspect of financial management for residents and businesses operating within the state. This refund process allows individuals and entities to reclaim overpaid taxes, providing a financial boost and contributing to economic stability. Understanding the intricacies of the Illinois State Refund Tax is essential for navigating the complex tax landscape effectively.

Understanding the Illinois State Refund Tax

The Illinois State Refund Tax is a mechanism designed to return excess tax payments to taxpayers. It is an integral part of the state’s tax system, ensuring fairness and providing a safety net for those who have overcontributed to the state’s revenue.

This refund process is governed by specific regulations and timelines, making it imperative for taxpayers to stay informed and adhere to the stipulated guidelines. Failure to comply with the refund procedures may result in delays or complications, underscoring the importance of a thorough understanding of the process.

Eligibility and Criteria

Eligibility for an Illinois State Refund Tax hinges on various factors, including the type of tax paid, the taxpayer’s financial situation, and the specific circumstances leading to the overpayment. Generally, taxpayers who have paid more in taxes than they legally owe are entitled to a refund.

Key criteria for eligibility include accurate filing of tax returns, timely submission of necessary documentation, and adherence to the prescribed refund application process. It is essential to note that certain tax types, such as income tax, sales tax, and property tax, have distinct refund procedures, each with its unique requirements.

| Tax Type | Refund Process |

|---|---|

| Income Tax | Online filing through the IDOR website or by mail with the required forms. |

| Sales Tax | Submit a refund claim form to the Department of Revenue, along with supporting documentation. |

| Property Tax | Contact the local county assessor's office for refund procedures, which may vary by county. |

The Refund Process: Step-by-Step

Initiating the Illinois State Refund Tax process involves a series of well-defined steps. Taxpayers must begin by identifying the tax type for which they are seeking a refund and then gathering the necessary documentation to support their claim.

- Determine Tax Type: Identify whether the overpayment is related to income tax, sales tax, property tax, or another tax type.

- Gather Documentation: Collect relevant tax returns, payment records, and any other supporting documents that validate the overpayment.

- Choose Refund Method: Select the preferred refund method, which can be direct deposit, check, or a credit to the taxpayer's account.

- Complete Refund Application: Fill out the appropriate refund application form, ensuring all required information is provided accurately.

- Submit Application: Submit the completed application, along with supporting documents, to the relevant state agency. This can be done online, by mail, or in person, depending on the tax type and the taxpayer's preference.

- Wait for Processing: Allow sufficient time for the state to process the refund application. Processing times may vary based on the complexity of the claim and the state's workload.

- Receive Refund: Once the application is approved, the taxpayer will receive their refund according to the selected method. It's important to keep track of the application status to ensure timely receipt of the refund.

Maximizing Your Illinois State Refund

Maximizing the Illinois State Refund Tax involves a strategic approach to tax planning and management. By adopting certain practices and staying informed about tax laws and regulations, taxpayers can ensure they receive the maximum refund they are entitled to.

Strategies for Optimizing Refunds

One of the most effective strategies for maximizing refunds is staying updated with the latest tax laws and regulations. This includes being aware of any changes in tax rates, deductions, credits, and other incentives that can impact the taxpayer’s refund amount.

Additionally, taxpayers should consider seeking professional tax advice. A qualified tax professional can provide personalized guidance, ensuring that all eligible deductions and credits are claimed, and helping to identify potential opportunities for tax savings. This expertise can be especially beneficial for complex tax situations or when dealing with multiple tax types.

Common Misconceptions and Pitfalls

Despite the benefits of tax refunds, there are several misconceptions and pitfalls that taxpayers should be aware of. One common misconception is that all overpayments will automatically result in a refund. However, the state may apply overpayments to future tax liabilities or other outstanding debts, so it is essential to clarify the status of any overpayments.

Another pitfall is the tendency to overlook potential deductions and credits. Taxpayers should thoroughly review their financial records and consider all eligible deductions and credits to ensure they are not leaving any potential savings on the table. This may include deductions for charitable contributions, education expenses, or certain business-related expenses.

| Deduction/Credit | Description |

|---|---|

| Charitable Contributions | Taxpayers can deduct donations made to qualified charitable organizations. |

| Education Expenses | Eligible expenses for tuition, fees, and books for higher education may qualify for a tax credit. |

| Business Expenses | Certain business-related expenses, such as travel, meals, and entertainment, can be deducted. |

Illinois State Refund Tax: A Recap

The Illinois State Refund Tax process is a critical aspect of financial management for residents and businesses in the state. By understanding the eligibility criteria, adhering to the prescribed procedures, and adopting strategic tax planning practices, taxpayers can effectively reclaim overpaid taxes and optimize their financial position.

Staying informed about tax laws, seeking professional advice when needed, and maintaining detailed tax records are key strategies for a successful refund journey. With the right approach, taxpayers can navigate the complexities of the Illinois State Refund Tax process and ensure they receive the maximum refund they are entitled to.

How long does it typically take to receive an Illinois State Refund Tax?

+The processing time for an Illinois State Refund Tax can vary based on several factors, including the complexity of the refund claim, the accuracy of the application, and the state’s workload. On average, taxpayers can expect to receive their refund within 4-6 weeks from the date of submission. However, it is advisable to allow for additional time during peak tax seasons or if the claim involves a complex situation.

What happens if my Illinois State Refund Tax application is denied?

+If an Illinois State Refund Tax application is denied, the taxpayer will receive a notification from the state explaining the reasons for the denial. In such cases, it is crucial to carefully review the denial notice and understand the specific issues that led to the denial. Taxpayers may have the opportunity to appeal the decision, and it is advisable to seek professional advice to navigate the appeals process effectively.

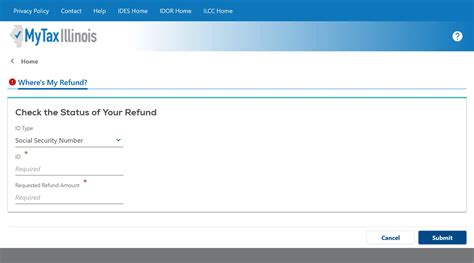

Can I check the status of my Illinois State Refund Tax application online?

+Yes, taxpayers can check the status of their Illinois State Refund Tax application online through the Illinois Department of Revenue’s website. By logging into their account or using the provided tracking number, taxpayers can access real-time updates on the progress of their refund application. This feature allows for convenient monitoring and provides clarity on the refund process.