Inheritance Tax Georgia

Welcome to a comprehensive guide on the intricate world of inheritance tax in the state of Georgia. As an expert in estate planning and taxation, I will unravel the complexities surrounding this often misunderstood topic. Georgia's inheritance tax landscape is unique and ever-evolving, making it crucial for residents and stakeholders to stay informed.

Understanding Inheritance Tax in Georgia

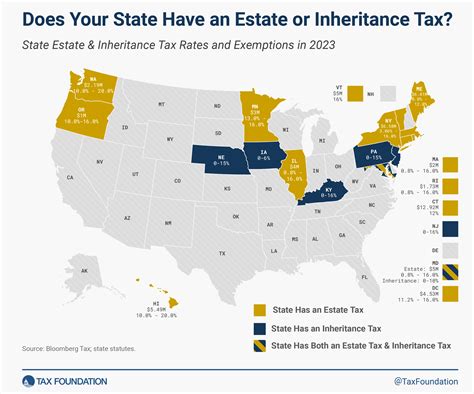

The state of Georgia, like many others, imposes an inheritance tax on certain estates. This tax is levied on the beneficiaries who receive assets from the deceased individual’s estate. It is distinct from estate taxes, which are typically paid by the estate itself before distribution to beneficiaries. Understanding this distinction is key to effective estate planning.

Who Pays Inheritance Tax in Georgia?

Inheritance tax in Georgia is primarily applicable to beneficiaries who are not closely related to the deceased. Spouses and lineal descendants, such as children and grandchildren, are generally exempt from inheritance tax. However, collateral relatives like siblings, aunts, uncles, nieces, and nephews may be subject to this tax.

| Relationship | Inheritance Tax Status |

|---|---|

| Spouse | Exempt |

| Lineal Descendants (Children, Grandchildren) | Exempt |

| Collateral Relatives (Siblings, Aunts, Uncles) | Subject to Tax |

| Non-Relatives | Subject to Tax |

The tax rate varies depending on the beneficiary's relationship to the deceased and the value of the inheritance. It's essential to note that Georgia's inheritance tax laws are complex and subject to frequent changes, so consulting a legal or tax professional is advisable.

Exemptions and Deductions

Georgia offers certain exemptions and deductions that can reduce the overall inheritance tax liability. These include the spousal exemption, which allows spouses to inherit an unlimited amount without incurring inheritance tax. Additionally, the state provides a basic exclusion amount, which is a certain dollar amount of inheritance that is exempt from tax. For 2023, this amount is set at $500,000.

Furthermore, charitable deductions are available for beneficiaries who inherit assets that are designated for charitable purposes. These deductions can significantly reduce the taxable value of the inheritance.

Calculating Inheritance Tax in Georgia

Calculating inheritance tax in Georgia involves several steps. First, the taxable value of the inheritance is determined by subtracting any applicable deductions and exemptions from the total value of the inherited assets. This taxable value is then multiplied by the appropriate tax rate based on the beneficiary’s relationship to the deceased.

For example, let's consider a scenario where a beneficiary inherits $1,000,000 from a deceased relative who is not a spouse or lineal descendant. After applying the basic exclusion amount of $500,000, the taxable value is $500,000. The tax rate for this relationship category is currently 10%, so the inheritance tax would be $50,000.

It's important to note that inheritance tax is calculated separately for each beneficiary, and the rates and thresholds may change annually, so staying updated with the latest regulations is crucial.

Impact of Estate Planning Strategies

Estate planning strategies can significantly impact the amount of inheritance tax owed. Techniques such as gifting, establishing trusts, and utilizing life insurance policies can help reduce the taxable value of an estate and minimize inheritance tax liability. For instance, gifts made during the deceased’s lifetime can reduce the value of the estate and potentially lower the inheritance tax burden.

Working with an experienced estate planning attorney and a tax professional can help individuals navigate these strategies effectively and ensure compliance with Georgia's inheritance tax laws.

Future of Inheritance Tax in Georgia

The future of inheritance tax in Georgia is uncertain and subject to legislative changes. While the state currently imposes this tax, there have been discussions and proposals to repeal or modify the inheritance tax laws. Keeping abreast of any legislative developments is essential for effective estate planning.

Additionally, as the federal estate tax landscape continues to evolve, it may impact Georgia's inheritance tax structure. Any changes at the federal level could influence state tax policies, potentially leading to reforms or adjustments in Georgia's inheritance tax framework.

Potential Reforms and Their Impact

If inheritance tax reforms were to occur in Georgia, they could take various forms. These might include raising or lowering the tax rates, altering the basic exclusion amount, or introducing new exemptions. For example, expanding the categories of exempt beneficiaries or increasing the basic exclusion amount could significantly reduce the number of estates subject to inheritance tax.

Alternatively, simplifying the tax structure or aligning it more closely with federal estate tax laws could provide clarity and ease compliance for taxpayers and professionals.

Conclusion: Navigating Georgia’s Inheritance Tax Landscape

Inheritance tax in Georgia is a complex and evolving aspect of estate planning. By understanding the current laws, utilizing exemptions and deductions, and implementing effective estate planning strategies, individuals can minimize their inheritance tax liability. Staying informed about potential legislative changes and seeking professional guidance are essential steps in navigating this complex landscape.

As the state's tax policies continue to evolve, staying proactive and adapting estate plans accordingly will ensure individuals and their beneficiaries are prepared for any future changes.

Are there any special considerations for estates with multiple beneficiaries in Georgia?

+Yes, when an estate has multiple beneficiaries, the inheritance tax is calculated separately for each beneficiary based on their individual relationship to the deceased and the value of their inheritance. This can result in different tax rates and liabilities for each beneficiary.

How often do inheritance tax laws in Georgia change?

+Inheritance tax laws in Georgia can change annually, especially regarding tax rates and exemption amounts. It is crucial to stay updated with the latest regulations to ensure accurate tax planning and compliance.

Can an inheritance tax liability be contested in Georgia?

+Yes, if a beneficiary believes the inheritance tax assessment is incorrect, they have the right to contest it. This typically involves a review process and potentially legal action. It is advisable to seek professional guidance if considering a contest.