Charleston Sc County Tax Records

Welcome to this in-depth exploration of Charleston, South Carolina's County Tax Records. This article aims to provide a comprehensive guide to understanding the intricacies of tax information within this vibrant county. From historical context to modern-day practices, we will delve into the various aspects that make up Charleston's tax landscape.

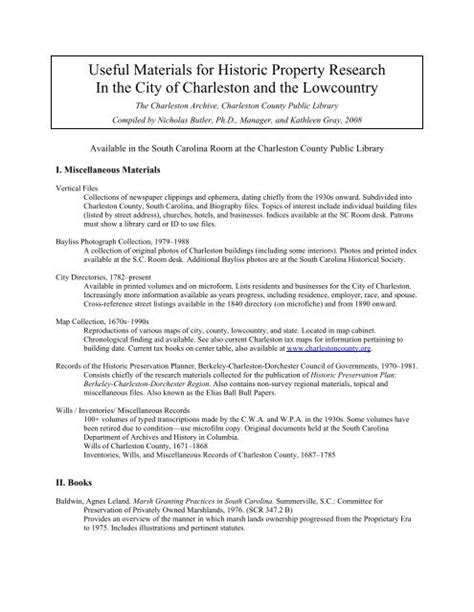

A Historical Perspective on Charleston’s Tax Records

Charleston County, with its rich history dating back to the 17th century, has a long-standing relationship with taxation. The city’s early tax records offer a fascinating glimpse into the economic landscape of the past. During the colonial era, taxes were primarily levied on imports and exports, with duties collected at the bustling port of Charleston.

One notable example is the Moonshine Tax, implemented in the early 1900s to curb the production and sale of illicit liquor. This tax not only generated revenue but also played a role in shaping the cultural identity of the region, with stories of moonshiners and their cunning ways becoming a part of local folklore.

As time progressed, the tax system evolved to accommodate the growing needs of the county. The introduction of property taxes, income taxes, and sales taxes brought Charleston's tax system in line with modern practices, while still retaining a unique local flavor.

The Evolution of Tax Records in Charleston

The transition from manual record-keeping to digital systems revolutionized the way tax information was managed in Charleston. The county’s tax department embraced technology, implementing an online platform that allows residents to access their tax records with ease.

Today, property owners can view their annual tax assessments, understand the breakdown of tax rates, and even dispute assessments if needed. This digital transformation has not only improved efficiency but has also enhanced transparency, making tax information more accessible to the public.

| Tax Type | Historical Context |

|---|---|

| Import/Export Duties | Predominant during colonial times, these taxes supported the British Empire's economy. |

| Moonshine Tax | A unique tax implemented to curb illegal liquor production, shaping local culture. |

| Property Taxes | Modernized tax system introduced to generate revenue for county services and infrastructure. |

Understanding Property Taxes in Charleston County

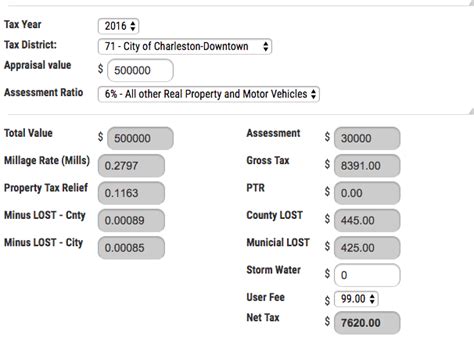

Property taxes form a significant portion of Charleston’s tax revenue. The county assesses properties annually, taking into account factors such as location, size, and improvements made to determine the taxable value.

The Assessment Process

Charleston County employs a team of dedicated assessors who conduct thorough evaluations of each property. They consider market trends, recent sales data, and physical inspections to ensure an accurate assessment.

Property owners are provided with a detailed report outlining the assessed value, any exemptions or deductions applied, and the resulting tax liability. This transparent process ensures fairness and allows homeowners to understand the factors influencing their tax bill.

Tax Rates and Exemptions

The tax rate in Charleston County is determined by the county council, taking into account the budgetary needs and the desire to provide essential services to residents. The rate is expressed as a millage, where one mill represents 1 of tax for every 1,000 of assessed property value.

Charleston County offers various exemptions to eligible homeowners, including the Homestead Exemption for primary residences and the Veterans Exemption for those who have served in the military. These exemptions help reduce the tax burden for specific segments of the population.

| Exemption Type | Eligibility Criteria |

|---|---|

| Homestead Exemption | Primary residence owners who meet income and residency requirements. |

| Veterans Exemption | Veterans with a service-connected disability or who have received an honorable discharge. |

| Senior Citizen Exemption | Seniors aged 65 and above with limited income. |

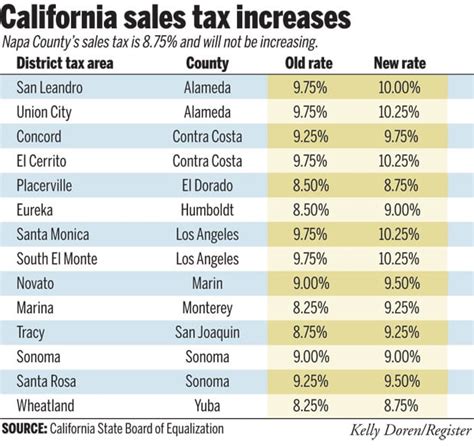

Sales and Income Taxes: A Snapshot of Charleston’s Economy

Beyond property taxes, Charleston County collects sales and income taxes, providing insights into the economic activities within the region.

Sales Tax: A Vital Revenue Stream

Sales tax is applied to most goods and services sold within Charleston County. The tax rate is determined by the state and county, with the revenue collected going towards funding public services, infrastructure, and community development projects.

The sales tax rate in Charleston varies depending on the type of goods or services being purchased. For instance, prepared food and restaurant meals are subject to a different tax rate compared to groceries and clothing, offering a nuanced view of consumer spending habits.

Income Tax: Reflecting Economic Growth

Charleston County, along with the rest of South Carolina, operates on a graduated income tax system. This means that as income increases, so does the tax rate, ensuring a fair contribution from all residents.

The income tax revenue plays a crucial role in funding essential services such as education, healthcare, and public safety. It also reflects the economic growth and prosperity of the county, as a higher tax base indicates a thriving and prosperous community.

| Tax Type | Rate (%) |

|---|---|

| Sales Tax (General Merchandise) | 6.5% |

| Sales Tax (Groceries) | 3.0% |

| Sales Tax (Restaurant Meals) | 7.0% |

| Income Tax (Lowest Bracket) | 2.0% |

| Income Tax (Highest Bracket) | 7.0% |

The Future of Charleston’s Tax Landscape

As Charleston continues to thrive and evolve, its tax system will adapt to meet the changing needs of the community. The county’s commitment to transparency and accessibility ensures that residents remain informed about their tax obligations and the benefits they receive in return.

Emerging Trends and Technologies

Charleston’s tax department is exploring innovative technologies to enhance the tax collection process. From blockchain-based record-keeping to AI-powered tax assessment tools, the county aims to stay at the forefront of technological advancements.

These technologies not only improve efficiency but also reduce the potential for errors, ensuring a fair and accurate tax system. Additionally, they open up opportunities for more sophisticated data analysis, allowing the county to make informed decisions about resource allocation and future planning.

Community Engagement and Tax Education

Charleston County recognizes the importance of community engagement in shaping its tax policies. The county actively involves residents through public forums, town hall meetings, and online platforms, ensuring that tax decisions are made with the community’s best interests at heart.

Furthermore, the tax department offers educational resources and workshops to help residents understand their tax obligations and the impact of their contributions. This proactive approach fosters a sense of responsibility and trust between the government and its citizens.

Conclusion: A Transparent and Modern Tax System

Charleston County’s tax records reflect the rich history and vibrant present of this remarkable region. From the early days of import/export duties to the modern complexities of property, sales, and income taxes, the county’s tax system has evolved to meet the needs of its diverse population.

With a commitment to transparency, technological innovation, and community engagement, Charleston's tax landscape is poised for continued success. As the county moves forward, its tax records will remain a valuable resource, offering insights into the economic pulse of this dynamic community.

How can I access my property tax records in Charleston County?

+You can access your property tax records online through the Charleston County Assessor’s Office website. Simply search for your property using your address or parcel number, and you will be able to view your assessment details, tax rates, and payment history.

What are the current sales tax rates in Charleston County?

+The current sales tax rate in Charleston County is 6.5% for general merchandise. However, certain items like groceries and clothing have a reduced rate of 3.0%, and restaurant meals are taxed at 7.0%. These rates are subject to change, so it’s advisable to check the official Charleston County website for the most up-to-date information.

Are there any upcoming changes to Charleston’s tax system?

+The county regularly reviews its tax policies and may propose changes to keep up with economic trends and community needs. It’s recommended to stay informed by following local news and attending community meetings or workshops where tax-related topics are discussed.