San Francisco California Sales Tax

When it comes to understanding the sales tax landscape in the United States, it's important to delve into the specifics of each state and city. San Francisco, a vibrant city nestled in the heart of California, has its own unique sales tax structure. This article aims to provide a comprehensive guide to the San Francisco sales tax, shedding light on its intricacies and how it impacts both residents and businesses.

Unraveling the San Francisco Sales Tax

The sales tax in San Francisco is a complex system that involves multiple tax rates and jurisdictions. It is crucial for consumers and businesses alike to grasp these nuances to ensure compliance and avoid any legal pitfalls.

San Francisco, being a part of California, operates under the state's sales tax regulations. However, it is important to note that the city has its own set of additional taxes and fees that make its sales tax system distinct. Let's break down the key components and explore the specifics of the San Francisco sales tax.

Understanding the California State Sales Tax

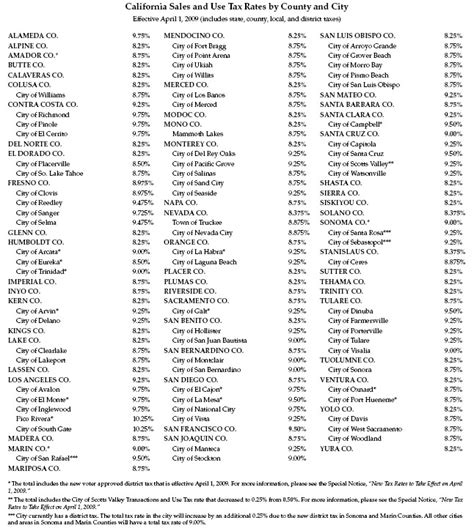

California imposes a statewide sales and use tax on most retail transactions. As of [current year], the state sales tax rate stands at 7.25%. This rate is uniform across the state and is applied to the purchase price of tangible personal property and certain services.

The state sales tax is a fundamental component of California's tax system, contributing significantly to the state's revenue. It is important for businesses to register with the California Department of Tax and Fee Administration to obtain a seller's permit and comply with the reporting requirements.

San Francisco’s Additional Taxes and Fees

In addition to the state sales tax, San Francisco imposes its own local sales and use tax, often referred to as the City and County of San Francisco Tax. This local tax is applied on top of the state rate, resulting in a higher overall sales tax burden for consumers in the city.

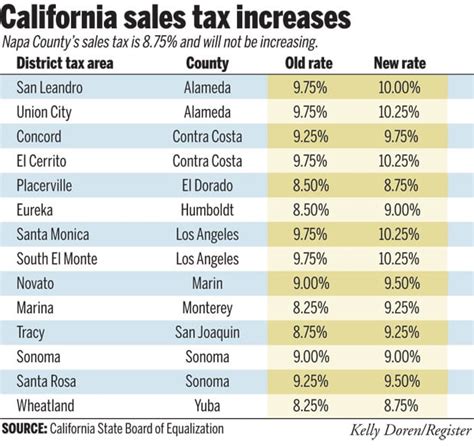

The current San Francisco sales tax rate is 1.5%, bringing the total combined state and local sales tax rate to 8.75%. This rate is subject to change, and it is essential for businesses and individuals to stay updated with any modifications to the tax structure.

Moreover, San Francisco also levies a Special District Tax, which is imposed by specific local entities within the city. This tax varies depending on the district and can further increase the overall sales tax rate. For instance, certain areas within San Francisco may have a Special District Tax rate of 0.5%, bringing the total sales tax rate to 9.25% in those locations.

| Sales Tax Component | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| San Francisco Local Sales Tax | 1.5% |

| Special District Tax (Variable) | Up to 0.5% |

The table above provides a snapshot of the different sales tax components in San Francisco. It is crucial to note that the Special District Tax may vary depending on the specific location within the city.

Sales Tax Exemptions and Special Considerations

While the majority of retail transactions are subject to sales tax in San Francisco, there are certain exemptions and special considerations that businesses and consumers should be aware of.

California, including San Francisco, offers sales tax exemptions for specific categories of goods and services. These exemptions are outlined in the California Revenue and Taxation Code and can vary based on the nature of the transaction.

For instance, certain types of food products, prescription medications, and select medical devices are exempt from sales tax. Additionally, there are exemptions for specific types of business-to-business transactions, such as sales to government entities or sales for resale.

It is crucial for businesses to understand these exemptions and ensure they are properly applying them to eligible transactions. Failure to do so can result in overpayment of sales tax and potential penalties.

Sales Tax Collection and Remittance

Businesses operating in San Francisco have the responsibility of collecting and remitting sales tax on behalf of the state and local governments. This process involves registering with the appropriate tax authorities, calculating the applicable tax rates, and filing periodic tax returns.

The California Department of Tax and Fee Administration provides resources and guidance for businesses to navigate the sales tax collection process. It is essential for businesses to maintain accurate records and report sales tax payments accurately to avoid any compliance issues.

For online businesses or those with out-of-state customers, the concept of nexus comes into play. Nexus refers to the connection or presence that triggers a business's obligation to collect and remit sales tax in a particular state. San Francisco, being a part of California, may have specific nexus rules that businesses should be aware of.

Sales Tax Audits and Compliance

Sales tax compliance is a critical aspect of doing business in San Francisco. Tax authorities regularly conduct audits to ensure businesses are accurately calculating and remitting sales taxes. Non-compliance can result in significant penalties and legal consequences.

It is advisable for businesses to maintain meticulous records, including sales receipts, invoices, and tax return filings. These records serve as evidence of compliance and can help resolve any discrepancies during an audit.

Additionally, staying updated with any changes in sales tax laws and regulations is crucial. Tax authorities often issue guidance and notices to help businesses stay informed and compliant.

Future Implications and Potential Changes

The sales tax landscape is subject to change, and San Francisco is no exception. While the current sales tax rates are well-defined, there are ongoing discussions and proposals that could impact the tax structure in the future.

Some potential changes include adjustments to the state sales tax rate, modifications to local taxes, or the introduction of new taxes to address specific budgetary needs. It is important for businesses and individuals to stay informed about any proposed changes and their potential impact.

Furthermore, advancements in technology and e-commerce have led to evolving tax regulations. The concept of economic nexus, where out-of-state sellers are required to collect sales tax based on their economic presence, has gained traction. San Francisco, as a hub for tech and online businesses, may see further developments in this area.

Conclusion

Understanding the San Francisco sales tax is essential for both consumers and businesses operating in the city. With its unique tax structure, it is imperative to grasp the intricacies of the state and local sales taxes, as well as any additional taxes and exemptions.

By staying informed and compliant, businesses can navigate the sales tax landscape effectively and avoid any legal pitfalls. For consumers, being aware of the sales tax rates helps in making informed purchasing decisions and understanding the overall cost of goods and services in San Francisco.

As the sales tax regulations evolve, staying updated and adapting to any changes will be key for businesses and individuals alike. The San Francisco sales tax is a dynamic and complex system, and staying ahead of the curve ensures a smooth and compliant business operation in this vibrant city.

How often do sales tax rates change in San Francisco?

+Sales tax rates in San Francisco, like many other jurisdictions, can change periodically. These changes are typically proposed and approved by local government bodies and may occur annually or as needed to address budgetary concerns. It is important for businesses and consumers to stay updated with any changes to ensure compliance.

Are there any special sales tax holidays in San Francisco?

+As of my knowledge cutoff in January 2023, San Francisco does not have designated sales tax holidays like some other states. However, it is worth noting that California as a whole may have certain sales tax holidays for specific items, such as back-to-school supplies or energy-efficient appliances. These holidays are typically announced and promoted by the state government.

How do I calculate the total sales tax for a purchase in San Francisco?

+To calculate the total sales tax for a purchase in San Francisco, you need to consider the applicable tax rates. As of my knowledge cutoff, the state sales tax rate is 7.25%, the San Francisco local sales tax rate is 1.5%, and the Special District Tax can vary up to 0.5%. Add these rates together to get the total sales tax rate, which is then applied to the purchase price. For example, if the Special District Tax is 0.5%, the total sales tax rate would be 9.25%.