Tax Free Holiday In Ma

The Tax Free Holiday, a much-anticipated event in the state of Massachusetts, is a strategic initiative by the government to stimulate the economy and provide a financial boost to residents during specific periods. This unique shopping period offers an excellent opportunity for residents to save significantly on their purchases, making it a popular event among consumers and retailers alike. In this comprehensive guide, we will delve into the intricacies of the Tax Free Holiday in MA, exploring its history, benefits, eligible items, and how to make the most of this tax-saving opportunity.

A Brief History of the Tax Free Holiday in MA

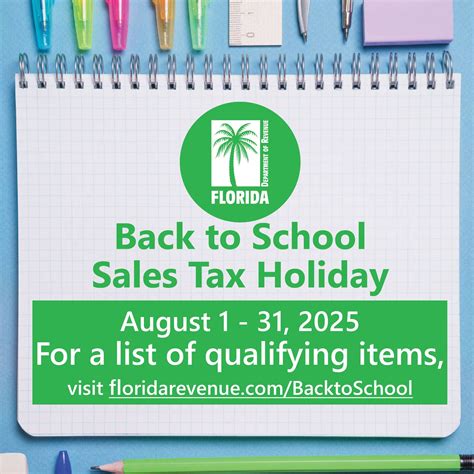

The concept of tax-free holidays is not a novel idea in the United States. Many states, including Massachusetts, have implemented these initiatives to encourage spending and boost local economies. The first Tax Free Holiday in MA was introduced in 2004, as a response to the economic challenges faced by the state. It was a resounding success, with consumers flocking to stores to take advantage of the tax-free shopping. Since then, the event has become an annual tradition, eagerly awaited by residents and businesses.

Over the years, the Tax Free Holiday has evolved, with adjustments made to the eligible items and the duration of the event. The state government recognizes the impact of this initiative on the economy and has worked to optimize it for maximum benefit.

The Benefits of the Tax Free Holiday

The Tax Free Holiday in MA presents a myriad of advantages for both consumers and businesses. For consumers, it offers a unique opportunity to save a substantial amount on essential purchases, providing significant relief on their financial burdens. During this period, consumers can make significant savings, especially on large-ticket items such as clothing, electronics, and school supplies.

For businesses, the Tax Free Holiday acts as a catalyst for increased sales and revenue. It encourages customers to visit stores, browse products, and make purchases, thereby boosting the local economy. Many retailers also offer special discounts and promotions during this time, further enhancing the savings for customers.

Moreover, the Tax Free Holiday promotes a sense of community and encourages local spending. Residents are more likely to support local businesses during this period, fostering a stronger local economy and a sense of unity.

Eligible Items and Exclusions

Understanding the eligible items and exclusions during the Tax Free Holiday is crucial to making the most of this event. The Massachusetts Department of Revenue carefully curates the list of items that qualify for tax exemption during this period.

Clothing and Footwear

One of the most significant categories of eligible items is clothing and footwear. During the Tax Free Holiday, Massachusetts residents can purchase a wide range of clothing items, including shirts, pants, dresses, jackets, and shoes, without paying any sales tax. This exemption extends to all clothing items, regardless of their style, material, or price.

However, it's important to note that certain clothing accessories may not be exempt. Items such as jewelry, watches, and handbags are often excluded from the tax-free category.

School Supplies

The Tax Free Holiday is a boon for parents and students preparing for the new academic year. School supplies, including books, stationery, backpacks, and even computers and tablets, are often exempt from sales tax during this period. This exemption provides a significant financial relief for families with school-going children.

Electronics

Massachusetts residents can also take advantage of the Tax Free Holiday to purchase electronics without paying sales tax. This category includes items such as laptops, desktops, tablets, smartphones, and gaming consoles. The exemption on electronics can lead to substantial savings, especially for those looking to upgrade their technology.

It's important to note that there may be certain restrictions on the price of eligible electronics. The state may set a maximum price limit above which the tax exemption does not apply.

Other Eligible Items

In addition to the aforementioned categories, the Tax Free Holiday may also cover other essential items. These could include sporting goods, certain home improvement supplies, and even baby items. The specific eligible items may vary from year to year, so it’s essential to check the official guidelines before making your purchases.

Exclusions

While the Tax Free Holiday provides significant savings, it’s crucial to understand the exclusions. Certain items are always excluded from the tax exemption, regardless of the event. These typically include luxury items, vehicles, and certain services. It’s important to review the official guidelines to understand the complete list of exclusions.

Maximizing Your Savings During the Tax Free Holiday

To make the most of the Tax Free Holiday in MA, it’s essential to plan your purchases strategically. Here are some tips to maximize your savings during this period:

Create a Shopping List

Before the Tax Free Holiday begins, create a comprehensive shopping list of items you need or plan to purchase. This list should include essential items such as clothing, school supplies, and electronics. By having a clear plan, you can ensure you don’t miss out on any tax-free opportunities.

Research Prices

Take some time to research the prices of items on your shopping list. Compare prices across different retailers, both online and offline. This will help you identify the best deals and ensure you’re getting the most value for your money.

Look for Additional Discounts

Many retailers offer additional discounts and promotions during the Tax Free Holiday to attract customers. Keep an eye out for these deals and combine them with the tax-free savings to maximize your savings.

Shop Early

The Tax Free Holiday is a popular event, and stores can get crowded quickly. To avoid the rush and ensure you get the items you want, consider shopping early. You can also take advantage of online shopping options, which often offer the same tax-free benefits as in-store purchases.

Consider Bundling Purchases

If you’re planning to purchase multiple items, consider bundling your purchases. Some retailers offer discounts or free items when you purchase a certain number of products. This can further enhance your savings during the Tax Free Holiday.

The Impact of the Tax Free Holiday on the Economy

The Tax Free Holiday in MA has a significant impact on the state’s economy. By encouraging spending and stimulating the local market, this initiative boosts revenue for businesses and generates tax income for the state government.

During the Tax Free Holiday, retailers experience a surge in sales, leading to increased revenue. This boost in sales not only benefits the retailers but also the entire supply chain, including manufacturers and distributors. The increased economic activity during this period creates a positive ripple effect throughout the state's economy.

Moreover, the Tax Free Holiday encourages consumers to support local businesses. By shopping locally, residents contribute to the growth and sustainability of small businesses, which are vital to the state's economic health.

Future Implications and Potential Changes

The Tax Free Holiday in MA has become an integral part of the state’s economic strategy, and its future looks promising. The state government recognizes the benefits of this initiative and is committed to continuing and improving it.

Looking ahead, there may be potential changes and enhancements to the Tax Free Holiday. The state may consider expanding the eligible items or extending the duration of the event to further stimulate the economy. Additionally, the government may explore ways to promote the event more effectively, ensuring maximum participation from residents and businesses.

As the Tax Free Holiday gains popularity and traction, it is expected to evolve and adapt to the changing needs of the economy and consumers. The state's commitment to this initiative bodes well for its future success and impact.

| Year | Tax Free Holiday Dates |

|---|---|

| 2023 | August 13-19 |

| 2022 | August 14-20 |

| 2021 | August 15-21 |

What is the purpose of the Tax Free Holiday in MA?

+The Tax Free Holiday is designed to stimulate the economy by encouraging spending and providing financial relief to residents. It offers a unique opportunity for consumers to save on essential purchases, while boosting revenue for local businesses.

Are there any restrictions on the amount I can spend during the Tax Free Holiday?

+No, there are no restrictions on the amount you can spend during the Tax Free Holiday. However, certain items may have price limits above which the tax exemption does not apply.

Can I combine the Tax Free Holiday with other discounts or promotions?

+Absolutely! You can combine the Tax Free Holiday with other discounts and promotions offered by retailers. This can further enhance your savings and provide additional value for your purchases.

Are there any online shopping benefits during the Tax Free Holiday?

+Yes, many online retailers also offer tax-free benefits during the Tax Free Holiday. You can shop online and enjoy the same savings as in-store purchases. This provides added convenience and flexibility for your shopping experience.

How can I stay updated on the latest Tax Free Holiday information and guidelines?

+You can stay informed by regularly checking the official website of the Massachusetts Department of Revenue. They provide detailed guidelines, eligible items, and any updates regarding the Tax Free Holiday. Additionally, you can follow local news sources and retailer announcements for the latest information.