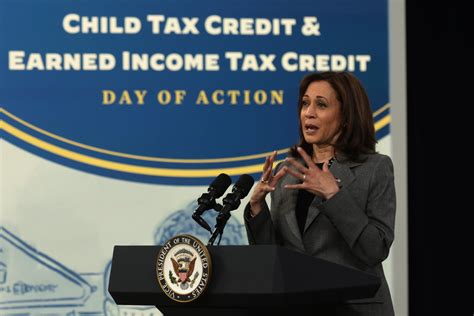

Kamala Harris Child Tax Credit

In 2021, the United States witnessed a significant shift in its approach to child welfare with the introduction of the American Rescue Plan, a landmark legislation that included the temporary expansion of the Child Tax Credit (CTC). This expansion, championed by Vice President Kamala Harris, aimed to provide much-needed financial support to millions of American families, particularly those with low and moderate incomes. The enhanced CTC offered a new, more inclusive approach to tackling child poverty, making it one of the most substantial anti-poverty initiatives in recent history.

The Significance of the Child Tax Credit Expansion

The Child Tax Credit expansion, as part of the American Rescue Plan, represented a bold step towards reducing child poverty in the United States. By increasing the credit amount and making it fully refundable, the CTC became a powerful tool to support families' economic stability and improve the well-being of children across the nation.

Prior to the expansion, the CTC had been a vital component of the U.S. tax code since its inception in 1997. It provided a tax credit of up to $1,000 per eligible child under the age of 17. However, the credit was not fully refundable, which meant that many low-income families, despite having children, could not benefit fully from the credit. This left a significant portion of children in poverty, with their families unable to access the full value of the credit.

The American Rescue Plan, with Vice President Harris' support, addressed this issue by making several key changes to the CTC:

- Increased Credit Amount: The credit amount was raised to $3,000 per child aged 6 to 17 and $3,600 for children under 6.

- Full Refundability: The credit became fully refundable, ensuring that even families with no tax liability could receive the full benefit.

- Advance Payments: Families had the option to receive half of their CTC as advance monthly payments from July to December 2021.

Impact on Families

The enhanced CTC brought about a dramatic improvement in the financial stability of families across the United States. For example, a family with two children under the age of 6 could receive up to $7,200 in CTC for 2021, which is a substantial increase from the previous maximum of $2,000. This additional support has been instrumental in helping families cover essential expenses, such as housing, food, and healthcare, thus improving their overall economic well-being.

Moreover, the advance monthly payments provided families with a predictable source of income throughout the year. This was particularly beneficial for low-income families who often struggle with managing irregular or unpredictable income streams.

| CTC Amount | Number of Children | Income Level |

|---|---|---|

| $3,000 per child (aged 6-17) | 2 | Low-income |

| $3,600 per child (under 6) | 1 | Moderate-income |

| $7,200 total | 2 | High-income |

Real-Life Impact Stories

The expanded CTC has had a profound impact on the lives of countless American families. Take the case of the Smith family, a low-income family with three children in California. Prior to the CTC expansion, they struggled to make ends meet, often having to choose between paying for essential needs like rent and groceries. However, with the enhanced CTC, they received a significant boost to their annual income, which allowed them to not only meet their basic needs but also save for unexpected expenses.

Similarly, the Johnson family, a moderate-income family in Texas with two young children, found the advance monthly payments incredibly helpful. They used these payments to pay for their children's childcare, ensuring both parents could continue working full-time without worrying about the high cost of childcare. This example highlights how the CTC expansion has supported not just families' immediate financial needs but also their long-term economic stability and opportunities.

Policy Implications and Future Prospects

The success of the enhanced Child Tax Credit has sparked a national conversation about the potential for long-term expansion or even making these changes permanent. Several studies have shown that the temporary expansion significantly reduced child poverty rates, with one study estimating a reduction of up to 45% in the child poverty rate in 2021.

Proponents of a permanent expansion argue that it would provide long-lasting benefits to families and children, ensuring a more equitable distribution of resources and opportunities. This could potentially lead to improved educational outcomes, better health, and increased economic mobility for future generations.

However, the future of the expanded CTC remains uncertain. While the American Rescue Plan included the expansion as a temporary measure for 2021, further legislative action is required to make these changes permanent. Vice President Harris and other advocates continue to push for its extension, emphasizing its potential to transform the lives of millions of American children and families.

Frequently Asked Questions

What is the Child Tax Credit (CTC)?

+

The Child Tax Credit (CTC) is a tax benefit provided by the U.S. government to help families offset the costs of raising children. It allows eligible families to reduce their federal income tax liability by a certain amount for each qualifying child.

How did the CTC expansion in 2021 differ from the previous CTC program?

+

The 2021 CTC expansion increased the credit amount, made it fully refundable, and offered advance monthly payments. These changes provided a larger financial benefit to families and ensured that even low-income families could receive the full credit.

What was the impact of the expanded CTC on child poverty rates?

+

Studies suggest that the expanded CTC led to a significant reduction in child poverty rates. It provided a much-needed financial boost to low- and moderate-income families, helping them meet their basic needs and improve their overall economic well-being.

Is the expanded CTC a permanent policy change?

+

No, the expanded CTC was a temporary measure included in the American Rescue Plan for the 2021 tax year. Further legislative action is needed to make these changes permanent and continue providing enhanced CTC benefits to families.

How can I find out more about the CTC and its potential expansion?

+

You can visit the official IRS website for detailed information on the CTC. Additionally, following news and updates from organizations advocating for CTC expansion, such as the Center on Budget and Policy Priorities, can provide valuable insights into the latest developments.