Olmsted Property Tax

Understanding property taxes is an essential aspect of homeownership, especially for residents of Olmsted County, Minnesota. The Olmsted Property Tax system, which is a crucial component of the county's financial infrastructure, impacts every homeowner and business owner in the area. In this comprehensive guide, we will delve into the intricacies of Olmsted Property Tax, exploring how it is calculated, its potential impacts on local residents, and the role it plays in supporting essential community services.

Unraveling the Olmsted Property Tax System

The Olmsted Property Tax is an ad valorem tax, which means it is based on the assessed value of real estate properties within the county. This assessment is a critical step in the process, as it determines the tax liability for each property owner. The process of property assessment is handled by the Olmsted County Assessor's Office, which employs certified assessors to ensure fairness and accuracy in the valuation process.

The assessment process typically occurs every year, and it involves evaluating various factors such as the property's size, location, improvements, and recent sales data. This data is then used to calculate the property's market value, which forms the basis for tax assessments. It's important to note that property values can fluctuate due to market conditions, improvements made to the property, or changes in the surrounding area.

How Property Values are Determined

The Olmsted County Assessor's Office employs a comprehensive approach to property valuation. They consider the property's unique characteristics, including its physical attributes, such as the number of bedrooms and bathrooms, the type of construction, and the property's overall condition. Additionally, the assessor takes into account the property's location, including its proximity to schools, parks, and other amenities, as these factors can significantly influence its value.

To ensure accuracy, the assessor's office also analyzes recent sales data of similar properties in the area. By comparing these sales to the subject property, they can determine a fair market value. This process, known as market analysis, is a key component of the assessment methodology and helps to ensure that property owners are taxed equitably based on the true value of their property.

| Assessment Year | Market Value (USD) | Tax Rate (per $1000) | Estimated Taxes (USD) |

|---|---|---|---|

| 2023 | 350,000 | 10.50 | 3,675 |

| 2022 | 340,000 | 10.25 | 3,475 |

| 2021 | 330,000 | 10.00 | 3,300 |

Calculating Property Taxes

Once the market value of a property is determined, the Olmsted Property Tax is calculated using a straightforward formula. The property's market value is multiplied by the applicable tax rate, which is set by the local government. This tax rate can vary depending on the type of property (residential, commercial, or agricultural) and the specific taxing district in which the property is located.

For instance, consider a residential property with a market value of $350,000 located in Rochester, the largest city in Olmsted County. If the applicable tax rate for this property is 10.50%, the annual property tax would be calculated as follows: $350,000 x 10.50% = $3,675. This means the homeowner would owe $3,675 in property taxes for the year.

It's important to understand that property taxes are typically due in two installments, with payment deadlines set by the county. Late payments can incur penalties and interest, so it's crucial for property owners to stay informed about their tax obligations and payment due dates.

The Impact of Olmsted Property Tax

The Olmsted Property Tax is a significant source of revenue for the county, funding essential services and infrastructure projects. These funds support local schools, police and fire departments, road maintenance, and other vital community services. By understanding the impact of their property taxes, residents can appreciate the direct correlation between their tax contributions and the quality of life in their community.

Supporting Local Education

A substantial portion of Olmsted Property Tax revenue is allocated to the county's education system. This funding ensures that local schools have the resources they need to provide quality education to students. It covers a wide range of expenses, including teacher salaries, textbooks, technology, and extracurricular activities. By investing in education, Olmsted County is nurturing the next generation and preparing them for future success.

For instance, the property taxes collected from a single residential property with a market value of $350,000 could contribute approximately $1,000 to the local school district's budget. This funding helps maintain small class sizes, supports specialized programs like STEM education or arts initiatives, and ensures that students have access to the latest educational resources.

Enhancing Public Safety

Property taxes also play a critical role in maintaining public safety within Olmsted County. The funds generated from these taxes support the county's police and fire departments, ensuring that residents have access to prompt and effective emergency services. Additionally, property taxes contribute to the maintenance and improvement of local infrastructure, including roads, bridges, and public transportation systems.

Consider the scenario where a residential property with a market value of $350,000 generates $250 in property taxes that are specifically allocated for public safety. This funding helps to ensure that the local police department has the resources needed to hire and train officers, purchase equipment, and maintain a strong presence in the community. Similarly, it contributes to the fire department's ability to acquire state-of-the-art firefighting equipment and provide training for firefighters.

Understanding Tax Appeals and Exemptions

While property taxes are an essential component of community funding, it's natural for property owners to seek ways to reduce their tax liability. Olmsted County offers various avenues for taxpayers to appeal their property assessments or qualify for exemptions. These options can provide relief to certain property owners, especially those facing financial challenges or unique circumstances.

The Appeal Process

If a property owner believes that their property has been assessed at a value higher than its actual market value, they have the right to appeal the assessment. The appeal process in Olmsted County is straightforward and begins with a review by the county assessor's office. If the assessor upholds the original assessment, the property owner can then appeal to the county board of equalization, which is an independent body responsible for hearing such appeals.

During the appeal process, property owners are encouraged to provide evidence supporting their claim, such as recent sales data of similar properties or appraisals from licensed professionals. The board of equalization carefully considers all the evidence presented and makes a final determination on the property's assessed value. If the appeal is successful, the property owner's tax liability can be reduced accordingly.

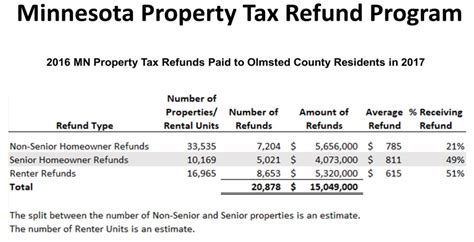

Exemptions and Relief Programs

Olmsted County offers several exemption programs designed to provide relief to specific groups of property owners. For instance, the Homestead Credit Refund program provides a credit on property taxes for homeowners who meet certain income criteria. This program aims to assist low- and moderate-income homeowners in managing their tax obligations.

Additionally, Olmsted County offers a Disabled Veterans Exemption, which provides a partial or full exemption from property taxes for qualifying veterans. This exemption recognizes the sacrifices made by veterans and provides financial relief to those who have served our country. Other exemptions may be available for senior citizens, certain agricultural lands, and properties owned by nonprofit organizations.

Future Implications and Tax Planning

As Olmsted County continues to grow and evolve, the property tax system will play a pivotal role in shaping its future. Understanding the potential impacts of property taxes and effective tax planning strategies can help residents and businesses make informed decisions about their real estate investments.

Economic Development and Property Values

Olmsted County's commitment to economic development can influence property values and, consequently, property taxes. As the county attracts new businesses and industries, it can lead to increased demand for commercial and residential properties, driving up property values. This, in turn, can result in higher property taxes for residents and businesses.

However, the county's efforts to promote economic growth can also bring about positive changes. For instance, the influx of new businesses can lead to job creation, boosting the local economy and potentially increasing the tax base. This can provide the county with additional revenue, which can be reinvested into community development and infrastructure projects, ultimately benefiting all residents.

Tax Planning Strategies

For property owners in Olmsted County, tax planning is an essential aspect of financial management. Here are some strategies to consider:

- Regular Property Assessments: Stay informed about your property's assessed value. Regularly review your assessment notices and compare them to recent sales data of similar properties in your area. If you believe your property is overvalued, consider appealing the assessment.

- Explore Exemptions: Research the various exemption programs offered by Olmsted County. If you qualify for any of these programs, such as the Homestead Credit Refund or Disabled Veterans Exemption, take advantage of them to reduce your tax liability.

- Consider Rental Properties: If you own rental properties, you may be eligible for different tax treatments. Consult with a tax professional to understand the potential benefits and drawbacks of different rental property tax structures.

- Keep Records: Maintain accurate records of improvements made to your property. These improvements can increase your property's value, but they may also qualify you for certain tax deductions or credits. Keep receipts and documentation to support these improvements.

It's important to note that tax laws and regulations can change, so staying updated on any legislative changes that may impact property taxes is crucial. Consulting with a tax professional or financial advisor can provide valuable insights and help you navigate the complexities of the Olmsted Property Tax system.

Frequently Asked Questions

How often are property values assessed in Olmsted County?

+Property values are typically assessed annually by the Olmsted County Assessor’s Office. This process ensures that property taxes remain fair and accurate, reflecting the current market value of each property.

Can I appeal my property’s assessed value if I believe it is incorrect?

+Yes, property owners have the right to appeal their assessed values if they believe they are inaccurate. The appeal process begins with a review by the county assessor’s office, and if the assessment is upheld, the property owner can appeal to the county board of equalization.

What are some common exemption programs available in Olmsted County?

+Olmsted County offers a range of exemption programs, including the Homestead Credit Refund for homeowners, the Disabled Veterans Exemption, and exemptions for senior citizens and certain agricultural lands. These programs provide tax relief to eligible property owners.

How can I stay informed about changes to the Olmsted Property Tax system?

+It’s essential to stay updated on any changes to tax laws and regulations. You can follow local news sources, attend community meetings, and consult with tax professionals or financial advisors to ensure you have the latest information about tax changes and their potential impact on your property.