Sales Tax Las Vegas Surpasses 8%: How It Affects Your Shopping Budget

Imagine strolling through the neon-lit corridors of Las Vegas, where every flicker of a slot machine and shimmer of a blackjack table signals a promise of wealth—or so it seems—only to be blindsided by a sales tax hike that nudges the total cost of your Vegas splurging into the realm of the extravagant. Developments in sales tax policies are rarely glamorous news, but when Las Vegas—the unparalleled adult playground—pays surreptitious homage to fiscal austerity by pushing its sales tax above the 8% threshold, savvy shoppers and casual tourists alike start to feel the sting. This isn't just a bureaucratic footnote; it fundamentally recalibrates the economic calculus of spending in one of America's most entertainment-rich cities.

Vegas’ Shift into the 8%+ Sales Tax Realm: What’s Behind the Surge?

Las Vegas, long celebrated for its freewheeling extravagance and ability to turn a modest weekend into a financial marathon, has lately embarked on a fiscal journey that echoes the city’s notorious flair for the dramatic. The nudge past the 8% mark in sales tax isn’t accidental but a product of a cocktail of economic factors ranging from burgeoning infrastructure expenses, social programs, and the city’s insatiable appetite for casino investments. It’s a balancing act that leaves the average shopper pondering whether their souvenir mug or high-stakes poker chips are about to become pricier than the last presidential election.

The Anatomy of an 8%+ Sales Tax: How Did Las Vegas Get Here?

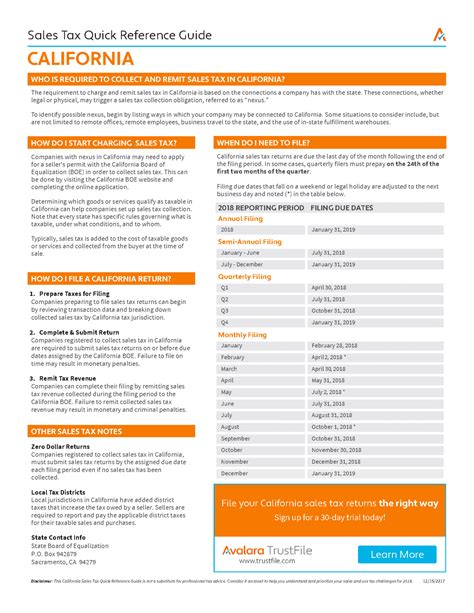

To understand the upward tick in sales tax, it’s necessary to peel back a few layers of governmental fiscal strategies. First, Nevada’s state sales tax sits at a modest 6.85%, but local governments, in their quest to fund everything from road repairs to extravagant projects like the Las Vegas Convention Center expansion, deploy surtaxes that push totals beyond 8%. These measures, often justified as necessary for economic growth, have the unintended consequence of turning every shopping trip into a mini financial confrontation.

| Relevant Category | Substantive Data |

|---|---|

| State Sales Tax | 6.85% in Nevada |

| Local Surtaxes | Additional 1.5% to 2% in Las Vegas |

| Total Sales Tax | Exceeds 8% in certain districts |

Impacts on Your Vegas Shopping Budget: How High is Too High?

The sudden rise above 8% isn’t merely a numeric milestone; it’s a tangible shift in the dynamics of how much cash sneaks out of visitors’ wallets. When you factor in taxes, the sticker prices of boutique accessories, gourmet meals, and even casino chips become more akin to a futbol match’s final score—exciting but with potentially devastating consequences for your liquidity.

What Does an 8%+ Sales Tax Mean for Tourist Spending?

For tourists, especially those accustomed to lower tax rates elsewhere, this increment translates into a direct hit on the holiday budget. A 100 purchase now effectively costs 108 or more—an increase that can turn a spontaneous shopping spree into a painstaking assessment of whether that flashy Rolex is worth the premium. Persistent tax hikes also risk dampening high-volume tourism, which historically has been the backbone of Vegas’s economy. If shopping becomes less economical, tourists may reconsider their impulse buys, thereby potentially stunting a vital revenue stream.

The Supply Side: Retailers, Casinos, and Revenue Streams

Retail outlets in Vegas have adapted to this new normal by recalibrating their pricing strategies. Some offset the increased tax burden with promotional discounts, while others absorb the cost, risking reduced profit margins. Casinos, too, face a subtle but real impact: if patrons spend less on souvenirs or dining, the ripple effects could undermine long-term revenue growth, prompting city officials to weigh the benefits of higher taxes against the risk of driving away the very crowds who fund much of Vegas’s fiscal needs.

| Relevant Category | Substantive Data |

|---|---|

| Consumer Spending Trends | Projected 2-3% decline in retail sales |

| Tourist Expenditure | Estimated reduction of $5-$10 per trip |

| City Revenue | Potential increase of 1.2% in sales tax collections |

Historically, Vegas and Taxation: A Tale of Surprises and Strategy

Vegas has long been an economy that’s driven by perception and the art of the deal. Its history with taxation is no different. From the Nevada silver boom to the perpetual tax battles over licensing and gaming taxes, the city’s fiscal policies mirror its underlying ethos—bold, sometimes brash, and unapologetically geared toward maximizing revenue without scaring off its core clientele.

Evolution of Sales Tax Policies in Nevada

Initially, sales taxes in Nevada hovered around the 4-5% mark, with Vegas benefiting from a developer-friendly environment and a relatively low tax environment. As the city’s economic ambitions grew, so did the taxes—culminating in recent measures that tip the scales above 8%. This evolution reflects broader trends: urban centers increasingly turning to consumption taxes as a primary revenue source, especially when traditional income, property taxes, and gaming taxes reach saturation points.

Key Points

- Tax increase impact: Consumers face a tangible hike in the final checkout price, reshaping spending habits.

- Strategic revenue modeling: Vegas’s approach exemplifies how local governments leverage surtaxes to finance urban development projects.

- Economic ripple effects: Elevated sales taxes may dampen retail growth, influence tourist behavior, and subtly shift the city’s economic equilibrium.

- Historical context: The tax philosophy in Vegas balances the city’s opulence with fiscal necessity, highlighting an ongoing fiscal chess match.

- Future considerations: Sustainability of revenue gains in the face of potential downturns is a gamble Vegas cannot afford to lose.

What Can Visitors Do? Strategies to Mitigate the Tax Impact

Traveler savvy can navigate this fiscal landscape by strategic planning, much like a seasoned poker player reading the table. Timing purchases during tax holidays, seeking tax-exempt shopping zones, or investing in experiences rather than tangible goods can slightly soften the blow of Vegas’s higher-than-expected sales tax bite.

Using Technology and Local Knowledge

Apps that locate tax-free outlets or provide real-time updates on district-specific rates serve as invaluable tools. In addition, understanding that certain districts—particularly those centered around the Strip—may have different rates, allows discerning shoppers to optimize their spending. Collaboration between retailers and tourist information centers could further empower visitors to make informed choices, turning a taxing experience into a tactical advantage.

Key Points

- Planning purchases: Utilize tax holidays, designated tax-free zones, and timing to minimize additional costs.

- Smart shopping apps: Leverage technology to identify the lowest tax jurisdictions and discounts.

- Experience over goods: Focus on unique Vegas experiences—shows, concerts, guided tours—that often aren't taxed or are taxed less heavily.

- Informed data: Stay updated on district-specific tax rates for strategic spending decisions.

- Maximize value: Combine shopping with entertainment to optimize overall Trip expenditure.

Looking Ahead: Will Vegas’s Revenue Gambler Win?

Ultimately, whether Las Vegas’s flirtation with the 8%+ sales tax threshold proves a high-stakes success or a costly misadventure hinges on a delicate balancing act. The city’s policymakers must continually jockey between maximizing immediate revenue and preserving the allure that makes Vegas unique—a place where fortunes are won and lost not just at the tables, but in the subtle calculus of taxes. Historical precedents suggest that such bold financial gambles can either flourish or falter, depending on consumer sentiment, economic trends, and the city’s ability to adapt.

How does the Vegas sales tax compare to other major cities?

+While cities like Chicago and New York boast total sales taxes around 9-10%, Las Vegas’s recent push above 8% places it in a competitive, yet slightly less burdensome position. However, regional differences, entertainment taxes, and local surcharges create a complex landscape that demands smart navigation.

Are there any tax exemptions or ways to avoid high sales tax in Vegas?

+Yes, certain items like unprepared food, prescription medications, and specific clothing may be exempt or taxed at lower rates depending on district regulations. Additionally, shopping during promotional tax holidays or in districts with lower surtax rates can help visitors keep more of their dollars.

Will the sales tax in Vegas continue to rise?

+Predicting future tax policies is always tricky, but given recent trends and the city’s ongoing infrastructure projects, a cautious rise beyond 8% is plausible. Economic stability, political will, and consumer response will ultimately shape the next chapter in Vegas’s taxation saga.