Tax Dodgers

The issue of tax evasion and the notorious "tax dodgers" has long been a controversial topic, capturing the attention of governments, economists, and the general public alike. Tax dodging, often associated with complex financial maneuvers and secretive offshore activities, poses a significant challenge to global tax systems and societal fairness. This article delves into the world of tax evasion, shedding light on the methods employed, the impact on economies, and the ongoing efforts to combat this pervasive issue.

The Dark Art of Tax Evasion

Tax evasion, an illegal practice, involves individuals, corporations, or entities intentionally manipulating financial records, utilizing loopholes, or engaging in deceitful activities to reduce their tax obligations below the legally required amount. It is a complex phenomenon that manifests in various forms, each with its own set of strategies and consequences.

The Mechanics of Tax Dodging

At its core, tax evasion thrives on exploiting gaps in tax laws and regulations. Tax dodgers employ a range of strategies, including:

- Offshore Accounts and Shell Companies: One of the most notorious methods involves setting up offshore accounts or shell companies in jurisdictions with lenient tax laws. These entities often serve as conduits to divert income and assets, effectively hiding them from domestic tax authorities.

- Transfer Pricing: Multinational corporations often engage in transfer pricing, manipulating the prices charged between different parts of their global operations. This strategy can artificially reduce profits in high-tax countries while inflating them in low-tax jurisdictions.

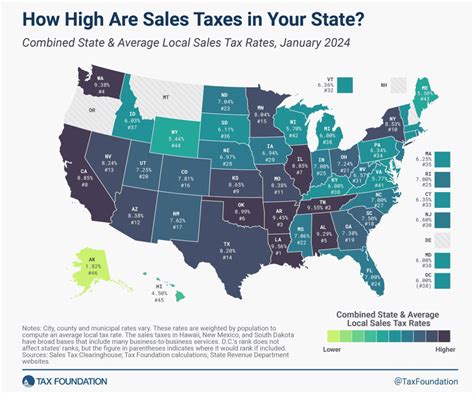

- Tax Havens: Tax havens, typically small countries or territories with favorable tax regimes, attract individuals and corporations seeking to minimize their tax liabilities. These jurisdictions often have strict secrecy laws, making it challenging for tax authorities to track and audit financial activities.

- False Invoices and Fraudulent Records: Some individuals and businesses create false invoices or manipulate financial records to overstate expenses or understate income, thereby reducing their taxable income.

- Abuse of Tax Incentives: While tax incentives are designed to encourage certain economic activities, some taxpayers abuse these incentives, claiming deductions or credits to which they are not entitled.

The complexity of modern tax systems, coupled with the increasing globalization of the economy, has created a fertile ground for tax evasion tactics. The sheer number of jurisdictions, each with its unique tax laws, provides ample opportunities for tax planners to exploit differences and optimize tax liabilities.

| Tax Evasion Strategy | Description |

|---|---|

| Offshore Accounts | Utilizing banks or financial institutions in tax havens to conceal assets and income. |

| Shell Companies | Creating empty corporate entities to hide ownership and divert profits. |

| Transfer Mispricing | Manipulating prices between related entities to shift profits to low-tax jurisdictions. |

| Tax Treaty Shopping | Abusing double tax treaties to reduce or eliminate taxes on cross-border transactions. |

| Aggressive Tax Planning | Pushing the boundaries of tax laws to minimize tax liabilities, often involving complex structures. |

Impact on Societies and Economies

The consequences of tax evasion extend far beyond the boundaries of financial accounting. When individuals or entities successfully evade taxes, they create an uneven playing field, undermining the integrity of the tax system and eroding public trust. The societal impact of tax evasion is profound and multifaceted.

Economic Inequality and Fairness

Tax evasion contributes to economic inequality by allowing those with the means and knowledge to access complex tax avoidance strategies, while those without such resources bear a disproportionate tax burden. This imbalance can exacerbate wealth disparities and hinder social mobility.

Furthermore, tax evasion undermines the principle of fairness. When some taxpayers evade their obligations, the tax burden shifts to those who comply, leading to higher tax rates and a perception of injustice. This can erode public confidence in the tax system and discourage voluntary compliance.

Government Revenue Loss

One of the most direct impacts of tax evasion is the loss of revenue for governments. Tax revenues fund essential public services such as healthcare, education, infrastructure, and social safety nets. When tax evasion reduces these revenues, governments face challenges in providing adequate services and maintaining fiscal stability.

| Country | Estimated Annual Tax Loss (in Billions) |

|---|---|

| United States | $400–$600 |

| United Kingdom | $50–$70 |

| Germany | $50–$75 |

| France | $30–$50 |

| Australia | $10–$20 |

The table above provides a glimpse into the estimated annual tax losses for a few major economies due to tax evasion. These figures represent a significant portion of their respective tax revenues, highlighting the magnitude of the problem.

Undermining Social Welfare

Tax evasion not only affects government finances but also impacts the delivery of social welfare programs. Many governments rely on tax revenues to fund initiatives aimed at reducing poverty, providing healthcare, and supporting vulnerable populations. When tax evasion reduces these revenues, it becomes challenging to maintain and expand social welfare programs, potentially leaving those in need without adequate support.

Combating Tax Dodgers: Strategies and Innovations

Recognizing the detrimental effects of tax evasion, governments, international organizations, and tax authorities have implemented a range of strategies and innovations to combat this pervasive issue. The battle against tax dodgers is multifaceted, involving legal, technological, and collaborative approaches.

Strengthening Tax Laws and Enforcement

One of the primary strategies in the fight against tax evasion is to strengthen tax laws and improve enforcement mechanisms. Governments are increasingly adopting measures to close loopholes, enhance transparency, and impose stricter penalties for tax evasion.

For instance, the General Anti-Avoidance Rule (GAAR) in many jurisdictions empowers tax authorities to challenge aggressive tax planning strategies that lack commercial substance. Additionally, countries are collaborating to harmonize tax laws and reduce opportunities for tax evasion through initiatives like the Base Erosion and Profit Shifting (BEPS) project led by the Organisation for Economic Co-operation and Development (OECD).

Information Exchange and Transparency

International cooperation plays a pivotal role in combating tax evasion. Countries are increasingly exchanging tax information and adopting transparency measures to curb illicit financial flows. The Automatic Exchange of Information (AEOI) framework, for example, allows jurisdictions to automatically share financial account information with each other, making it more difficult for taxpayers to hide assets offshore.

Furthermore, initiatives like the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) in the United States aim to enhance transparency and information sharing between tax authorities, reducing the anonymity associated with offshore accounts.

Technological Innovations

The digital age has brought about new challenges and opportunities in the fight against tax evasion. Tax authorities are leveraging technology to enhance their capabilities and stay ahead of evolving evasion tactics.

- Data Analytics: Advanced data analytics and machine learning algorithms are being employed to identify patterns and anomalies in financial data, helping tax authorities detect potential cases of tax evasion.

- Blockchain Technology: Blockchain, known for its transparency and security, is being explored as a tool to improve the traceability of financial transactions, making it more difficult to conceal assets or manipulate records.

- Artificial Intelligence (AI): AI-powered systems can analyze vast amounts of data, including social media activity and news reports, to identify potential tax evasion cases and prioritize audits.

Whistleblower Programs

Whistleblower programs have emerged as a powerful tool in the fight against tax evasion. These programs incentivize individuals with knowledge of tax evasion activities to come forward and provide information to tax authorities. Many countries now offer financial rewards and protection to whistleblowers, encouraging them to expose illicit practices.

Whistleblower programs have led to significant tax recoveries and the exposure of complex evasion schemes, demonstrating their effectiveness in combating tax dodgers.

Public Awareness and Education

Raising public awareness about the consequences of tax evasion and promoting a culture of voluntary compliance is essential. Tax authorities and advocacy groups are actively engaging in educational campaigns to highlight the importance of paying taxes and the societal benefits that result from honest tax contributions.

Conclusion

The world of tax evasion is complex and multifaceted, encompassing a wide range of strategies and tactics. From offshore accounts to aggressive tax planning, tax dodgers exploit the intricacies of tax systems to minimize their obligations. However, the impact of their actions extends far beyond mere financial losses, affecting societal fairness, economic inequality, and the delivery of essential public services.

Combating tax evasion requires a multi-pronged approach, involving strengthened laws, international cooperation, technological innovations, and public awareness. While the battle against tax dodgers is challenging, the efforts of governments, tax authorities, and the public are making a difference. By working together, we can create a more equitable and transparent tax system, ensuring that everyone contributes their fair share and that the benefits of taxation are shared by all.

Frequently Asked Questions

What are the potential consequences of tax evasion for individuals and corporations?

+Tax evasion can lead to severe legal and financial consequences. Individuals and corporations found guilty of tax evasion may face fines, penalties, and even imprisonment. Additionally, they may be subject to civil lawsuits and have their assets seized or frozen. The reputation damage and loss of public trust can also have long-lasting effects on businesses and individuals.

<div class="faq-item">

<div class="faq-question">

<h3>How do tax havens and offshore accounts facilitate tax evasion?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Tax havens offer lenient tax regimes and strict bank secrecy laws, making it attractive for individuals and corporations to set up offshore accounts. These accounts allow taxpayers to hide their assets and income from domestic tax authorities, reducing their tax liabilities. The anonymity and lack of transparency associated with offshore accounts make it challenging for tax authorities to trace and audit financial activities.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the role of international organizations in combating tax evasion?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>International organizations play a crucial role in coordinating global efforts to combat tax evasion. Bodies like the OECD and the United Nations (UN) facilitate international cooperation, promote information exchange, and develop standards and guidelines to address tax evasion. They also provide a platform for countries to share best practices and collaborate on tax policy reforms.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can individuals and businesses ensure tax compliance and avoid evasion charges?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To ensure tax compliance, individuals and businesses should stay informed about tax laws and regulations. It is essential to maintain accurate financial records, declare all income and assets, and seek professional advice when navigating complex tax matters. Avoiding aggressive tax planning strategies and maintaining transparency can help individuals and businesses steer clear of evasion charges.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the future prospects for combating tax evasion?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The future of combating tax evasion looks promising, with continued efforts to enhance international cooperation, strengthen tax laws, and leverage technology. The increasing adoption of transparency measures, such as country-by-country reporting and beneficial ownership registries, will make it more difficult for tax evaders to conceal their activities. Additionally, the development of blockchain-based solutions and AI-powered analytics will further empower tax authorities in their fight against tax evasion.</p>

</div>

</div>

</div>