Property Tax Phone Number

Property tax is a fundamental component of the revenue system for local governments, including municipalities, counties, and school districts. It plays a crucial role in funding public services, infrastructure, and education within a community. For homeowners and property owners, understanding property tax assessments, payment schedules, and potential exemptions is essential for financial planning and maintaining good standing with local authorities.

Unraveling the Complexity of Property Tax

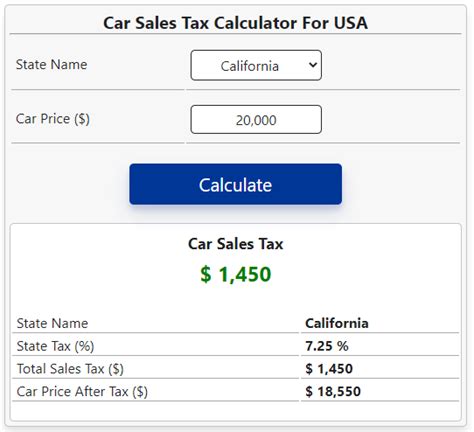

Property tax, often referred to as real estate tax or ad valorem tax, is a levy imposed on the value of real property, typically assessed annually. The tax is calculated based on the assessed value of the property, which takes into account various factors such as the property’s size, location, improvements, and market conditions.

Each jurisdiction has its own unique assessment process, tax rates, and billing cycles. These factors contribute to the complexity of property tax, making it a challenge for property owners to navigate without guidance.

As a property owner, having access to accurate information and support is crucial for managing your property tax obligations effectively. This is where the Property Tax Phone Number comes into play, serving as a vital resource for homeowners seeking clarity and assistance.

The Role of the Property Tax Phone Number

The Property Tax Phone Number is a dedicated hotline established by local government agencies or tax authorities to provide direct assistance to property owners. This hotline serves as a central point of contact for all matters related to property tax, offering personalized guidance and support.

When you call the Property Tax Phone Number, you can expect to speak with knowledgeable representatives who are well-versed in the intricacies of local property tax laws and procedures. They are trained to address a wide range of inquiries, from basic questions about assessment values and payment due dates to more complex issues such as tax exemptions, appeals, and special assessment programs.

By utilizing the Property Tax Phone Number, you can benefit from the following services:

- Tax Assessment Information: Obtain detailed information about your property's assessed value, including the methodology used for assessment and any changes made over time.

- Payment Options and Due Dates: Receive guidance on payment methods, due dates, and any available installment plans to ensure timely and convenient tax payments.

- Exemption and Credit Programs: Learn about potential tax exemptions or credits for which you may be eligible, such as homestead exemptions, senior citizen discounts, or veteran benefits.

- Appeals and Grievance Processes: Understand the steps involved in challenging your property tax assessment if you believe it is inaccurate or unfair. Get guidance on preparing and filing an appeal.

- Special Assessments and Taxes: Gain clarity on any special assessments or additional taxes, such as those for improvements, bonds, or community services, that may be levied on your property.

- Tax Lien and Foreclosure Assistance: Receive support if you are facing tax lien issues or are at risk of foreclosure due to delinquent property taxes. Get information on payment plans and resources to avoid these consequences.

Maximizing the Benefits of the Property Tax Phone Number

To make the most of your interaction with the Property Tax Phone Number, it is advisable to have certain key information readily available before making the call.

Here are some essential details to have on hand:

- Property Address: Ensure you have the exact street address and zip code of the property for which you are seeking information. This ensures that the tax assessor can locate your property accurately.

- Assessment Notice or Tax Bill: If you have received an assessment notice or tax bill, keep it nearby. This provides the representative with valuable information about your property's assessment and tax status.

- Property Records: Gather any relevant documents or records pertaining to your property, such as deeds, titles, or previous tax assessments. These can be useful for verifying information and addressing specific concerns.

- Personal Identification: Have a form of identification ready, such as your driver's license or social security number, to verify your identity and ensure the security of your information.

By being prepared with these details, you can streamline the process and receive accurate, tailored assistance from the Property Tax Phone Number representatives.

Online Resources and Alternative Methods

In addition to the Property Tax Phone Number, many local government agencies and tax authorities provide online resources and alternative methods for property owners to access information and support.

These resources may include:

- Official Websites: Local government websites often feature dedicated sections for property tax information, including assessment data, tax rates, payment options, and important deadlines. These websites may also provide access to online payment portals and forms for filing appeals or requesting exemptions.

- Email and Live Chat Support: Some tax authorities offer email and live chat services as additional channels for communication. These methods can be convenient for quick inquiries or for those who prefer written communication.

- Social Media Platforms: Many government agencies have embraced social media as a means of communication. You may find valuable updates, announcements, and even direct messaging options on platforms like Twitter, Facebook, or Instagram.

- Public Meetings and Workshops: Attend public meetings or workshops organized by your local government or tax authority. These events provide opportunities to interact directly with officials, ask questions, and gain insights into property tax matters.

While these online resources and alternative methods offer convenience and accessibility, the Property Tax Phone Number remains a valuable resource for personalized guidance and immediate assistance.

The Impact of Property Tax on Your Community

Property tax is not merely a financial obligation; it is an essential contribution to the well-being and development of your community. The revenue generated from property taxes funds critical services and infrastructure that directly impact your daily life.

These funds are allocated to:

- Education: Property taxes are a primary source of funding for public schools, ensuring that students have access to quality education and resources.

- Public Safety: Police, fire, and emergency services are supported by property tax revenue, ensuring the safety and security of your community.

- Infrastructure and Utilities: Property taxes contribute to the maintenance and improvement of roads, bridges, water and sewer systems, and other essential public works.

- Community Services: From libraries and parks to social services and cultural programs, property taxes play a vital role in enhancing the quality of life within your community.

- Economic Development: Property tax revenue can be utilized to attract businesses, create jobs, and stimulate economic growth, benefiting the entire community.

By understanding the impact of your property tax contributions, you can appreciate the importance of fulfilling your tax obligations and engaging with local government initiatives.

Tips for Effective Property Tax Management

To ensure a smooth and stress-free experience with your property tax obligations, consider the following tips:

- Stay Informed: Keep yourself updated on property tax laws, assessment processes, and important deadlines. Regularly check official websites and subscribe to newsletters or alerts to receive timely information.

- Understand Your Assessment: Review your property tax assessment carefully. If you have questions or concerns about the assessed value, reach out to the Property Tax Phone Number or your local tax assessor's office for clarification.

- Explore Exemptions and Credits: Research potential tax exemptions or credits for which you may be eligible. These can significantly reduce your tax liability and should be explored to maximize your savings.

- Consider Payment Options: Explore the various payment methods and schedules offered by your local government. Many jurisdictions provide options such as online payments, automatic withdrawals, or installment plans to accommodate different financial situations.

- Stay Organized: Maintain a dedicated file or digital folder for all your property tax-related documents, including assessment notices, tax bills, payment receipts, and correspondence. This ensures easy access to important information when needed.

- Seek Professional Advice: If you have complex tax situations or are unsure about certain aspects of property tax, consider consulting a tax professional or accountant. They can provide personalized advice and ensure you are taking advantage of all available benefits and deductions.

The Future of Property Tax: Technological Advancements

As technology continues to evolve, the field of property tax assessment and management is also experiencing significant advancements. These innovations aim to enhance efficiency, accuracy, and transparency in the property tax system.

Here are some notable technological developments shaping the future of property tax:

- Automated Valuation Models (AVMs): AVMs utilize advanced algorithms and machine learning to estimate property values based on a variety of data points, including recent sales, property characteristics, and market trends. These models can provide quick and accurate assessments, reducing the reliance on manual valuation methods.

- Geospatial Technologies: Geospatial technologies, such as Geographic Information Systems (GIS), enable tax assessors to create detailed maps and analyze spatial data related to properties. This technology facilitates more precise assessments, especially for unique or irregularly shaped properties.

- Blockchain Technology: Blockchain, the technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize property tax records and transactions. It can provide a secure and transparent platform for storing and transferring property ownership data, ensuring the integrity of records and simplifying the assessment process.

- Artificial Intelligence (AI) and Data Analytics: AI and data analytics tools are being used to analyze vast amounts of property data, identify patterns, and predict property values. These technologies can assist tax assessors in making more informed decisions and improving the accuracy of assessments.

- Online Platforms and Digital Services: Many local governments are investing in online platforms and digital services to streamline property tax processes. These platforms enable property owners to access assessment data, pay taxes online, and interact with tax authorities digitally, enhancing convenience and efficiency.

While these technological advancements offer significant benefits, it is essential to maintain a balance between innovation and human expertise. Skilled tax assessors and professionals will continue to play a crucial role in ensuring fair and accurate assessments, especially in complex cases or when new technologies require human oversight.

Conclusion

Property tax is a vital component of local governance, funding essential services and contributing to the development of your community. By understanding your property tax obligations and utilizing resources like the Property Tax Phone Number, you can navigate the complexities of property tax with confidence and ensure a positive impact on your community.

Stay informed, engage with your local government, and leverage the available resources to make property tax management a seamless part of your financial planning.

What if I have difficulty paying my property taxes on time?

+If you are facing financial challenges and anticipate difficulty in paying your property taxes on time, it is important to take proactive steps. Contact your local tax authority or reach out to the Property Tax Phone Number for guidance. They can provide information on potential payment plans, deferral programs, or other options to help you manage your tax obligations. Early communication is key to avoiding penalties and maintaining a positive relationship with your tax authority.

How often are property tax assessments conducted, and can I appeal them?

+The frequency of property tax assessments varies depending on your jurisdiction. Some areas conduct assessments annually, while others may do so every few years. If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal the assessment. The process typically involves submitting an appeal application and providing supporting evidence. It is advisable to consult with the Property Tax Phone Number or your local tax assessor’s office for guidance on the appeal process and any deadlines.

Are there any tax exemptions or credits available for specific situations, such as being a senior citizen or a veteran?

+Yes, many jurisdictions offer tax exemptions or credits to eligible individuals or properties. These may include homestead exemptions, senior citizen discounts, veteran benefits, or credits for certain improvements or energy-efficient upgrades. It is worth exploring these options to reduce your tax liability. The Property Tax Phone Number or your local tax assessor’s office can provide information on the specific exemptions and credits available in your area and guide you through the application process.