Sales Tax For Cars In Tn

Welcome to an in-depth exploration of the sales tax landscape for cars in the state of Tennessee. In this comprehensive guide, we will delve into the intricate details of Tennessee's sales tax policies, shedding light on the various aspects that impact car buyers and sellers alike. From understanding the tax rates to exploring the specific regulations, we aim to provide you with a clear and informative overview of this important topic.

Understanding Tennessee’s Sales Tax Structure

Tennessee, like many other states, imposes a sales tax on the purchase of vehicles. This tax is a crucial revenue source for the state, contributing to the funding of various public services and infrastructure projects. The sales tax for cars in Tennessee is not a uniform rate across the state; instead, it is comprised of a combination of state and local taxes, which can vary depending on the county and city where the vehicle is purchased.

The state sales tax in Tennessee is set at a rate of 7% for most goods, including vehicles. However, it is important to note that this is not the only tax applicable to car purchases. Local governments, such as counties and municipalities, have the authority to impose additional taxes, which can significantly impact the overall sales tax rate.

County-Level Sales Tax Variations

Tennessee’s counties have the power to levy their own sales taxes, which are added to the state’s base rate. These county-level taxes can range from 0.25% to 2.75%, depending on the specific county. For instance, Davidson County, which includes Nashville, has a local sales tax of 2.25%, bringing the total sales tax rate for car purchases to 9.25% in that area.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Davidson | 2.25% | 9.25% |

| Shelby | 2.50% | 9.50% |

| Knox | 1.75% | 8.75% |

| Hamilton | 1.50% | 8.50% |

| Rutherford | 2.75% | 9.75% |

These variations in local sales tax rates can have a significant impact on the final cost of a vehicle purchase. It is crucial for buyers to be aware of these differences, especially when considering purchases across county lines.

The Role of Municipalities

In addition to county-level taxes, municipalities in Tennessee also have the authority to impose their own sales taxes. These municipal taxes are typically lower than county taxes, ranging from 0.5% to 1.5%. However, they can further add to the overall sales tax burden for car buyers.

For instance, the city of Memphis, located in Shelby County, has a municipal sales tax of 1%. When combined with the county and state taxes, the total sales tax rate for car purchases in Memphis is 9.5%. This demonstrates how the cumulative effect of state, county, and municipal taxes can result in a higher overall tax rate.

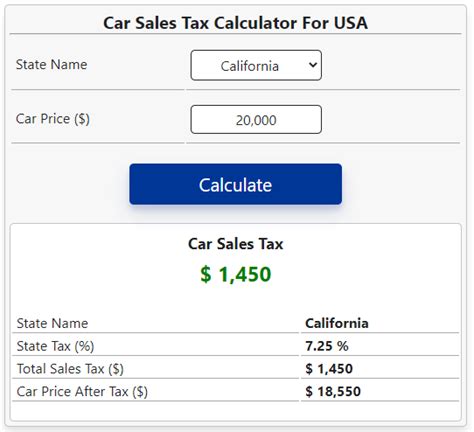

Calculating Sales Tax: A Step-by-Step Guide

Understanding the sales tax structure is just the first step. To truly grasp the financial implications, it is crucial to know how to calculate the sales tax for a car purchase in Tennessee. Here’s a step-by-step guide to help you navigate this process:

- Determine the Base Price: Start by identifying the base price of the vehicle you wish to purchase. This is the manufacturer's suggested retail price (MSRP) or the negotiated price if you are buying from a private seller.

- Calculate the State Sales Tax: Multiply the base price by the state sales tax rate of 7%. This will give you the state tax amount.

- Find the County Sales Tax Rate: Research the county where the vehicle will be purchased. Refer to the table above or official county websites to find the specific county sales tax rate.

- Calculate the County Sales Tax: Multiply the base price by the county sales tax rate. This will provide you with the county tax amount.

- Determine the Municipal Tax (if applicable): If the vehicle is being purchased in a municipality that levies its own sales tax, find the municipal tax rate and multiply it by the base price.

- Sum Up the Taxes: Add up the state, county, and municipal tax amounts to find the total sales tax liability for the vehicle purchase.

- Calculate the Final Price: Add the total sales tax amount to the base price to determine the final price of the vehicle, inclusive of all applicable taxes.

By following this systematic approach, you can accurately estimate the sales tax you will owe when purchasing a car in Tennessee. It is always a good idea to double-check these calculations with a trusted tax professional or by using reliable online sales tax calculators to ensure accuracy.

Exemptions and Special Cases

While the standard sales tax rates apply to most car purchases in Tennessee, there are certain exemptions and special cases to be aware of. These can significantly impact the tax liability for specific types of vehicles or under certain circumstances.

Vehicle Exemptions

Tennessee offers exemptions from sales tax for certain types of vehicles. These exemptions can provide substantial savings for eligible buyers. Here are some notable vehicle exemptions:

- Disabled Veteran Vehicles: Tennessee law provides a sales tax exemption for vehicles purchased by disabled veterans. To qualify, the veteran must have a service-connected disability rated at 100% by the Veterans Administration.

- Electric Vehicles (EVs): There is a temporary sales tax exemption for the purchase of new electric vehicles. This exemption is set to expire on December 31, 2024, after which the standard sales tax rates will apply to EV purchases.

- Hybrid Vehicles: Hybrid vehicles are eligible for a reduced sales tax rate of 2.75% for the state tax portion. This reduced rate does not apply to the local and municipal taxes, so the overall tax rate may still vary depending on the county and municipality.

Special Circumstances

In addition to vehicle exemptions, there are certain special circumstances that can impact the sales tax liability for car purchases in Tennessee. These include:

- Trade-Ins: When trading in a vehicle, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This can result in a lower tax liability if the trade-in value is substantial.

- Out-of-State Purchases: If you purchase a vehicle from another state and register it in Tennessee, you may be subject to a use tax. The use tax is designed to ensure that vehicles purchased out of state are taxed at a rate comparable to the sales tax in Tennessee.

- Lease-to-Own Agreements: For lease-to-own agreements, the sales tax is typically calculated on the total lease amount rather than the purchase price. This can result in a higher tax liability compared to a traditional purchase.

Understanding these exemptions and special circumstances is crucial for making informed financial decisions when purchasing a vehicle in Tennessee. It is always recommended to consult with a tax professional or refer to official state guidelines to ensure compliance with the latest tax regulations.

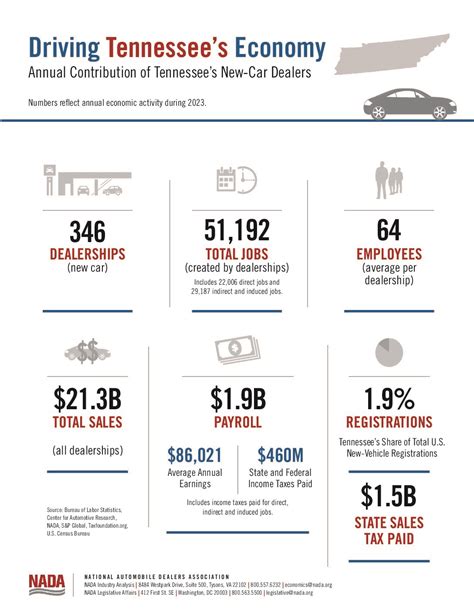

Sales Tax and the Tennessee Economy

The sales tax on car purchases plays a significant role in Tennessee’s economy. It is a vital source of revenue for the state, counties, and municipalities, funding essential public services and infrastructure projects. The tax revenue generated from car sales contributes to the overall economic health and development of the state.

Revenue Distribution

The sales tax collected from car purchases is distributed among various levels of government in Tennessee. The state government receives the majority of the revenue, which is then allocated to various departments and programs. Local governments, including counties and municipalities, also benefit from the sales tax, using the funds to support local services and infrastructure.

The distribution of sales tax revenue allows for a more equitable sharing of financial responsibilities and ensures that local needs are met. It also provides an incentive for local governments to attract businesses and residents, as a higher tax base can lead to increased revenue and improved services.

Impact on Car Dealerships and Consumers

Car dealerships in Tennessee play a crucial role in the state’s economy, generating jobs and contributing to economic growth. The sales tax collected from car purchases provides a significant portion of their revenue, allowing them to invest in their businesses, expand operations, and offer a wider range of services to consumers.

For consumers, the sales tax on car purchases can be a significant expense. However, it is important to recognize that this tax supports the infrastructure and services that benefit the community as a whole. Additionally, car buyers have the opportunity to explore tax-saving strategies, such as taking advantage of exemptions or special circumstances, to reduce their overall tax liability.

Future Implications and Tax Reform

The sales tax landscape for cars in Tennessee is subject to ongoing evaluation and potential reform. As the state’s economy and tax policies evolve, there may be changes to the tax rates, exemptions, and overall structure. It is crucial for car buyers, sellers, and industry professionals to stay informed about any proposed or enacted tax reforms to ensure compliance and take advantage of any new opportunities.

Potential Tax Reforms

Some potential areas of tax reform that could impact car sales in Tennessee include:

- Uniform Tax Rate: One proposed reform is the implementation of a uniform sales tax rate across the state, eliminating the variations in county and municipal taxes. This could simplify the tax structure and make it more consistent for car buyers.

- Revenue Allocation: There may be discussions about adjusting the distribution of sales tax revenue among different levels of government. This could impact the funds available for local services and infrastructure projects.

- Alternative Tax Structures: Tennessee may explore alternative tax structures, such as a value-added tax (VAT) or a flat tax, which could have implications for car sales and the overall tax burden.

While these potential reforms are speculative, they highlight the dynamic nature of tax policies and the ongoing efforts to improve the tax system in Tennessee. It is essential for stakeholders to engage in these discussions and provide input to ensure that any reforms are beneficial for the state's economy and its residents.

Conclusion: Navigating Tennessee’s Sales Tax Landscape

Tennessee’s sales tax structure for cars is a complex interplay of state, county, and municipal taxes. Understanding this landscape is crucial for car buyers and sellers to make informed decisions and comply with tax regulations. By knowing the specific tax rates and exemptions, individuals can accurately calculate their tax liability and explore potential tax-saving strategies.

The sales tax on car purchases is an essential component of Tennessee's economy, providing revenue for public services and infrastructure. While it may be a significant expense for consumers, it is important to recognize the broader impact of these taxes on the state's overall economic health and development.

As the tax landscape continues to evolve, staying informed about potential reforms and changes is crucial. By staying engaged and proactive, individuals can navigate Tennessee's sales tax system with confidence and contribute to the state's economic growth and prosperity.

How often are sales tax rates updated in Tennessee?

+

Sales tax rates in Tennessee are typically updated annually, usually effective from July 1st of each year. However, local governments may adjust their sales tax rates at different times, so it’s important to stay informed about any changes in your specific county or municipality.

Are there any online resources to help calculate sales tax for car purchases in Tennessee?

+

Yes, there are several online sales tax calculators available that can assist in estimating the sales tax for car purchases in Tennessee. These calculators take into account the state, county, and municipal tax rates, making it easier to get an accurate estimate. However, it’s always a good idea to verify the calculations with official sources or a tax professional.

Can I claim a refund for overpaid sales tax on my car purchase in Tennessee?

+

Yes, if you believe you have overpaid sales tax on your car purchase in Tennessee, you can file a refund claim with the Tennessee Department of Revenue. The process involves completing the necessary forms and providing supporting documentation. It’s important to carefully review the requirements and guidelines for filing a refund claim to ensure a successful outcome.

Are there any upcoming changes to the sales tax structure for cars in Tennessee that I should be aware of?

+

As of my last update in January 2024, there are no announced major changes to the sales tax structure for cars in Tennessee. However, it’s always recommended to stay informed about any proposed or enacted tax reforms by regularly checking official government websites or consulting with tax professionals.