Partnership Tax Return

In the world of business and finance, understanding the intricacies of tax obligations is crucial for any partnership. A partnership tax return is a complex yet essential aspect that ensures compliance with tax laws and facilitates smooth financial operations. This article delves into the specifics of partnership tax returns, offering an in-depth analysis for professionals seeking expert guidance.

Understanding Partnership Tax Returns

A partnership tax return is a vital document that outlines the financial activities and tax obligations of a business partnership. It serves as a comprehensive report, providing a detailed breakdown of the partnership’s income, expenses, deductions, and other relevant financial data. This return is crucial for maintaining transparency and ensuring that the partnership adheres to tax regulations.

Partnerships, unlike sole proprietorships or corporations, have unique tax considerations. While each partner is considered self-employed and responsible for their own taxes, the partnership itself is also subject to specific tax regulations. This dual tax obligation makes partnership tax returns a complex yet critical process.

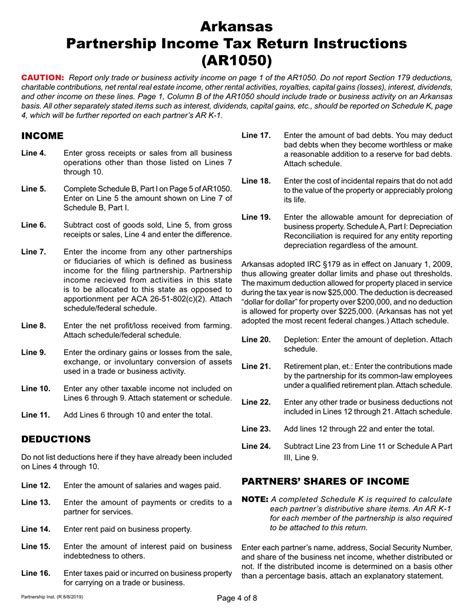

Key Components of a Partnership Tax Return

The partnership tax return is a comprehensive document, including various components that reflect the financial health and tax obligations of the partnership. Here are some key elements:

- Partnership Income and Losses: This section details the partnership's revenue and any associated losses. It involves calculating the net income, which is the total income minus allowable expenses.

- Partner's Share of Income and Deductions: Each partner's share of the partnership's income, deductions, and credits is specified. This information is crucial for partners to report on their individual tax returns.

- Expenses and Deductions: The return outlines all allowable expenses, including operational costs, employee salaries, and other deductions that can reduce the partnership's taxable income.

- Partnership Tax Liability: This section calculates the partnership's tax liability, considering income, deductions, and applicable tax rates. The partnership is responsible for paying this tax liability to the relevant tax authority.

- Schedules and Attachments: Depending on the partnership's activities and income sources, additional schedules and attachments may be required. These could include depreciation schedules, cost of goods sold calculations, or other specialized forms.

| Component | Description |

|---|---|

| Partnership Income | Total revenue from business activities |

| Partner's Share | Breakdown of each partner's income and deductions |

| Expenses | Operational costs and allowable deductions |

| Tax Liability | Calculated tax owed by the partnership |

Preparing and Filing Partnership Tax Returns

The process of preparing and filing a partnership tax return involves several critical steps to ensure accuracy and compliance. Here’s a detailed guide:

Step 1: Gather Financial Records

Start by collecting all relevant financial records for the partnership. This includes income statements, bank statements, invoices, receipts, and any other documentation related to the partnership’s financial activities. Ensure that all records are organized and easily accessible.

Step 2: Determine Tax Year and Due Date

Identify the tax year for which the return is being prepared. Partnerships typically follow a calendar year (January 1 to December 31) for tax purposes. However, some partnerships may opt for a fiscal year, which can be any 12-month period ending on the last day of any month except December. Determine the due date for filing, which is typically March 15th for partnerships.

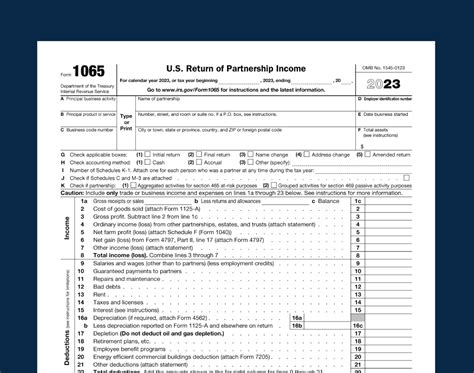

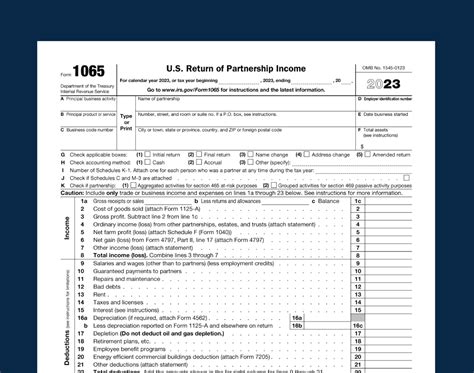

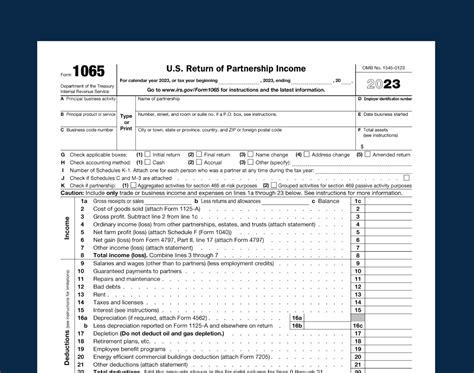

Step 3: Choose the Right Form

Partnerships use Form 1065, U.S. Return of Partnership Income, to report their income, deductions, and credits. This form is comprehensive and may require additional schedules and attachments based on the partnership’s specific activities.

Step 4: Calculate Income and Expenses

Accurately calculate the partnership’s income and expenses. This involves totaling all revenue streams, such as sales, services provided, and any other sources of income. Deduct allowable expenses, including operating costs, salaries, rent, and other deductions, to determine the net income.

Step 5: Allocate Partner’s Share

Allocate the partnership’s income, deductions, and credits to each partner based on their ownership percentage or agreed-upon distribution. This information is crucial for partners to report on their individual tax returns.

Step 6: Calculate Tax Liability

Determine the partnership’s tax liability by applying the appropriate tax rates to the net income. Partnerships are generally taxed at the entity level, meaning they pay taxes on their income. However, this does not relieve partners from their individual tax obligations.

Step 7: Prepare and File the Return

Complete Form 1065 and any required schedules or attachments. Ensure that all information is accurate and complete. File the return with the Internal Revenue Service (IRS) by the due date, typically March 15th. Partnerships may request an extension if needed, but this only extends the filing deadline, not the payment deadline.

Partnership Tax Obligations and Responsibilities

Partnerships have specific tax obligations and responsibilities that are distinct from those of other business entities. Understanding these obligations is crucial for ensuring compliance and avoiding potential penalties.

Tax Payments

Partnerships are responsible for paying taxes on their income. The partnership itself is a taxable entity, and the tax liability is calculated based on the partnership’s net income. However, partnerships do not pay income tax directly. Instead, the tax liability is passed through to the partners, who report their share of the partnership’s income and pay taxes on it individually.

Partner’s Tax Obligations

Each partner in a partnership is considered self-employed and is responsible for their own tax obligations. This includes paying income tax on their share of the partnership’s income, as well as self-employment tax, which covers Social Security and Medicare taxes. Partners must report their share of the partnership’s income, deductions, and credits on their individual tax returns.

Estimated Tax Payments

Partners are required to make estimated tax payments throughout the year to cover their tax liability. These payments are made quarterly and are based on the partner’s expected income and tax obligations. Failure to make timely estimated tax payments can result in penalties and interest.

Filing Requirements

Partnerships must file Form 1065 annually, even if the partnership has no income or losses to report. The due date for filing is typically March 15th, but partnerships can request an extension until September 15th. However, the extension only applies to the filing deadline, not the payment deadline.

The Importance of Professional Guidance

Partnership tax returns can be complex, especially for partnerships with multiple partners, complex financial structures, or specialized industries. Engaging the services of a certified public accountant (CPA) or tax advisor can provide valuable expertise and ensure compliance with tax laws.

A professional tax advisor can help partnerships navigate the complexities of tax regulations, maximize deductions and credits, and minimize tax liabilities. They can also provide guidance on partnership agreements, tax planning strategies, and ensure that the partnership's tax obligations are met accurately and on time.

Conclusion

Partnership tax returns are a critical aspect of running a successful business partnership. Understanding the process, obligations, and responsibilities associated with these returns is essential for compliance and financial health. By following the steps outlined in this article and seeking professional guidance when needed, partnerships can ensure smooth tax operations and focus on their core business activities.

FAQ

Can a partnership deduct expenses related to starting the business, such as legal fees and permits?

+Yes, partnerships can deduct expenses related to starting the business, including legal fees, permits, and other startup costs. These expenses are typically treated as organizational expenses and can be deducted over a period of 180 months (15 years) using a specific deduction method.

Are partnerships required to pay employment taxes for their partners?

+No, partnerships are not required to pay employment taxes for their partners. Partners are considered self-employed and are responsible for their own employment taxes, including Social Security and Medicare taxes. However, partnerships must still comply with employment tax regulations for any employees they may have.

Can a partnership carry forward losses from one tax year to another?

+Yes, partnerships can carry forward losses from one tax year to another. This is known as a net operating loss (NOL). The partnership can use the NOL to offset future profits and reduce its tax liability. The carryover period and specific rules may vary depending on the jurisdiction and tax laws.

Do partnerships need to report every transaction on their tax return?

+No, partnerships do not need to report every transaction on their tax return. Instead, they report the net income or loss for the tax year, which is the result of all transactions and adjustments. However, partnerships must maintain accurate records and documentation to support the information reported on their tax return.

Can a partnership claim tax credits?

+Yes, partnerships can claim tax credits, just like other business entities. Tax credits can reduce the partnership’s tax liability and are often available for specific activities or investments, such as research and development, renewable energy, or hiring certain types of employees. It’s important to review the eligibility criteria and requirements for each credit.