Nyc City Income Tax Rate

The New York City (NYC) income tax is a significant component of the city's revenue system, contributing to the funding of essential services and infrastructure. Understanding the NYC income tax rate is crucial for individuals and businesses operating within the city, as it impacts their financial planning and compliance obligations.

Overview of NYC Income Tax

The NYC income tax is a progressive tax system, meaning that the tax rate increases as income rises. This structure ensures that individuals and entities with higher earnings contribute a larger share of their income to the city’s revenue stream. The income tax is imposed on wages, salaries, commissions, bonuses, and other forms of compensation earned within the city limits.

NYC's income tax operates alongside the federal and state income tax systems. While federal and state tax rates are set by the Internal Revenue Service (IRS) and the New York State Department of Taxation and Finance, respectively, the city has its own tax authority, the New York City Department of Finance, which determines the city's tax rates and enforces compliance.

NYC Income Tax Rates for 2024

For the tax year 2024, the NYC income tax rates are as follows:

| Tax Rate | Income Bracket |

|---|---|

| 2.475% | Up to $12,600 |

| 3.725% | $12,601 to $24,999 |

| 4.445% | $25,000 to $50,000 |

| 5.077% | $50,001 to $75,000 |

| 5.884% | $75,001 to $100,000 |

| 6.426% | $100,001 to $200,000 |

| 6.823% | $200,001 to $500,000 |

| 6.85% | Over $500,000 |

These rates are applicable to residents and non-residents who earn income within the city limits. Non-residents may be subject to different withholding requirements, depending on the nature of their income and the duration of their stay in NYC.

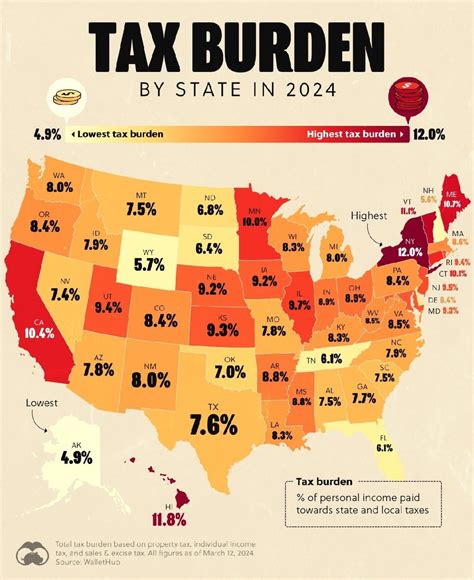

Comparison with Other Jurisdictions

When compared to other major cities and states, NYC’s income tax rates are generally higher. For instance, the city’s top tax rate of 6.85% is higher than the top rates in Los Angeles (9.3%), Chicago (3.75%), and Houston (1%). However, NYC’s rates are lower than those in some states, such as California (13.3%), which has the highest state income tax rate in the nation.

Taxable Income and Deductions

The taxable income for NYC residents includes all sources of income, such as wages, salaries, tips, commissions, dividends, interest, and capital gains. Non-residents are typically taxed on income earned within the city limits, which may include compensation for services rendered in NYC.

NYC offers several deductions and credits to reduce the taxable income and mitigate the tax burden. These include deductions for personal exemptions, standard deductions, and itemized deductions such as mortgage interest, property taxes, charitable contributions, and medical expenses. Additionally, residents may qualify for various tax credits, such as the New York City Earned Income Tax Credit, which provides a refundable credit to low- and moderate-income earners.

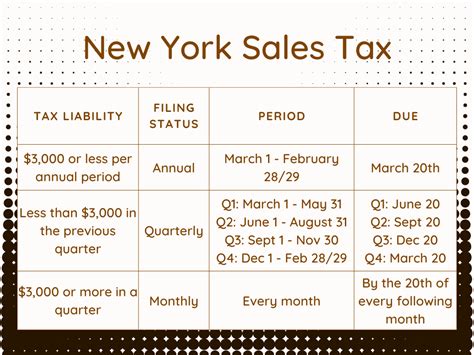

Filing and Payment Requirements

NYC residents and businesses must file their income tax returns annually. The due date for filing is typically aligned with the federal and state tax deadlines, which is usually April 15th of the following year. However, the city may offer extension options in certain circumstances.

Taxpayers can choose from various methods to pay their NYC income taxes, including direct deposit, credit card, debit card, and electronic funds transfer. The city also accepts checks and money orders by mail. It's essential to ensure timely payment to avoid penalties and interest, which can significantly increase the overall tax liability.

Tax Compliance and Enforcement

The New York City Department of Finance is responsible for enforcing tax compliance and collecting the city’s income tax revenue. The department employs a range of strategies to ensure compliance, including audits, investigations, and enforcement actions. Non-compliance can lead to significant penalties, interest charges, and even legal action.

To promote voluntary compliance, the department offers various resources and assistance to taxpayers, such as online filing and payment systems, tax guides, and customer service support. Additionally, the department conducts outreach and education campaigns to inform taxpayers about their rights and responsibilities.

Common Tax Issues and Audits

Some common issues that may trigger an audit by the New York City Department of Finance include significant changes in income, inconsistent reporting, and failure to report all sources of income. Audits can be time-consuming and costly, so it’s crucial for taxpayers to maintain accurate records and seek professional guidance when needed.

In the event of an audit, taxpayers have the right to representation, either by themselves or through a tax professional. The audit process typically involves a review of tax returns, supporting documentation, and an interview with the taxpayer or their representative. It's important to respond promptly to audit notices and provide all requested information to facilitate a timely resolution.

Future Outlook and Tax Reform

The NYC income tax system is subject to ongoing review and potential reforms. As the city’s economic landscape evolves, the tax structure may need adjustments to maintain fairness and competitiveness. The city government and tax authorities regularly assess the tax code to identify areas for improvement and ensure that the tax system supports the city’s financial stability and economic growth.

Proposed reforms may include adjustments to tax rates, brackets, and deductions to align with changing economic conditions and demographic shifts. Additionally, the city may explore new tax policies or incentives to attract and retain businesses and high-income earners, while also ensuring a fair tax burden for all residents.

The Impact of Economic Changes

Economic downturns or recessions can significantly impact the city’s tax revenue. During such periods, income tax collections may decline as individuals and businesses face financial challenges. The city may need to implement budget adjustments or seek alternative revenue sources to maintain essential services and infrastructure projects.

Conversely, economic growth and prosperity can lead to increased tax revenue, enabling the city to invest in critical areas such as education, healthcare, infrastructure, and public safety. The NYC income tax system plays a vital role in supporting these initiatives and ensuring the city's long-term financial sustainability.

Conclusion

Understanding the NYC income tax rate is essential for individuals and businesses operating within the city. The progressive tax system ensures that those with higher incomes contribute a larger share, while deductions and credits provide relief to low- and moderate-income earners. Compliance with tax laws is crucial to avoid penalties and legal issues.

As NYC continues to evolve and adapt to economic changes, the income tax system will likely undergo reforms to maintain its effectiveness and fairness. Taxpayers can stay informed about changes through official channels and seek professional advice to ensure compliance and optimize their tax strategies.

Are there any special tax rates for certain industries or professions in NYC?

+No, NYC’s income tax rates are not specific to industries or professions. The tax rates apply universally to all income sources within the city limits.

Can I claim deductions for commuting expenses in NYC?

+Commuting expenses are generally not deductible for federal or NYC income tax purposes. However, if your primary workplace is located outside NYC and you work in the city occasionally, you may be able to deduct certain expenses related to that temporary workplace.

How does NYC’s income tax rate compare to other major cities worldwide?

+NYC’s income tax rates are relatively high compared to some major cities like London, Paris, and Tokyo, which have either flat or lower tax rates. However, the rates are lower than in cities like Sydney and Singapore, which have higher top marginal tax rates.