Crypto.com Tax Forms

As the world of cryptocurrencies continues to evolve and gain mainstream adoption, it becomes increasingly important for investors and enthusiasts to understand the tax implications associated with their crypto activities. Crypto.com, a leading cryptocurrency platform, provides users with the necessary tools and resources to navigate the complex world of crypto taxes. In this comprehensive guide, we will delve into the world of Crypto.com tax forms, exploring the various aspects of crypto taxation and offering valuable insights to help users comply with their tax obligations.

Understanding Crypto Taxation

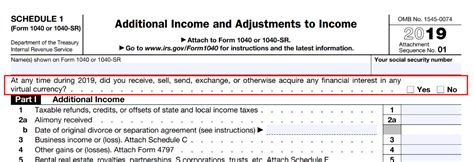

The taxation of cryptocurrencies is a relatively new and evolving area of law, and it varies greatly from country to country. In many jurisdictions, cryptocurrencies are treated as property or assets for tax purposes, similar to stocks or commodities. This means that any gains or losses realized through crypto transactions may be subject to capital gains tax or income tax.

Crypto.com recognizes the importance of tax compliance for its users and aims to simplify the process by providing a range of tax-related features and resources. By understanding the different types of crypto transactions and their tax implications, users can make informed decisions and ensure they meet their tax obligations accurately.

Types of Crypto Transactions and Tax Treatment

Crypto transactions can take various forms, each with its own tax considerations. Here are some common types of crypto transactions and their potential tax implications:

- Buying and Selling Cryptocurrencies: When users purchase cryptocurrencies on Crypto.com, they may incur capital gains tax if the cryptocurrencies are sold for a profit. The tax rate and applicable thresholds vary depending on the user's residence and local tax laws.

- Exchanging Cryptocurrencies: Crypto-to-crypto exchanges, such as trading Bitcoin for Ethereum, may also trigger tax consequences. These transactions are often considered a taxable event, and users should keep records of their trades to accurately calculate gains or losses.

- Receiving Cryptocurrency as Payment: If users accept cryptocurrencies as payment for goods or services, they may be subject to income tax. The fair market value of the cryptocurrency at the time of receipt is typically used to determine the income.

- Mining and Staking Rewards: Users who engage in crypto mining or staking activities may receive rewards in the form of cryptocurrencies. These rewards are generally considered taxable income and should be reported accordingly.

- Gifting and Inheritance: Transferring cryptocurrencies as gifts or through inheritance may have tax implications. Users should be aware of the applicable gift and estate tax laws in their jurisdiction.

Understanding the tax treatment of different crypto transactions is crucial for accurate reporting and compliance. Crypto.com provides educational resources and tools to help users navigate these complexities.

Crypto.com Tax Forms and Reporting

Crypto.com offers a range of tax forms and reporting features to assist users in meeting their tax obligations. These tools are designed to streamline the process and ensure accurate reporting of crypto-related income and gains.

Tax Reporting Tools

Crypto.com’s tax reporting tools are designed to simplify the often complex process of crypto tax reporting. These tools enable users to:

- Generate tax reports: Users can create comprehensive tax reports that summarize their crypto transactions and calculate gains or losses for a given period. These reports can be easily exported and shared with tax professionals.

- Track portfolio performance: Crypto.com's platform provides users with a detailed overview of their crypto portfolio, including historical prices and performance. This information is crucial for accurately calculating capital gains or losses.

- Set up tax alerts: Users can receive notifications and alerts to stay updated on important tax-related events, such as upcoming tax deadlines or changes in tax laws that may impact their crypto activities.

- Connect to tax software: Crypto.com integrates with popular tax software solutions, allowing users to seamlessly transfer their crypto transaction data to tax preparation platforms for further analysis and filing.

By leveraging these tax reporting tools, users can streamline their crypto tax reporting process and ensure compliance with local tax regulations.

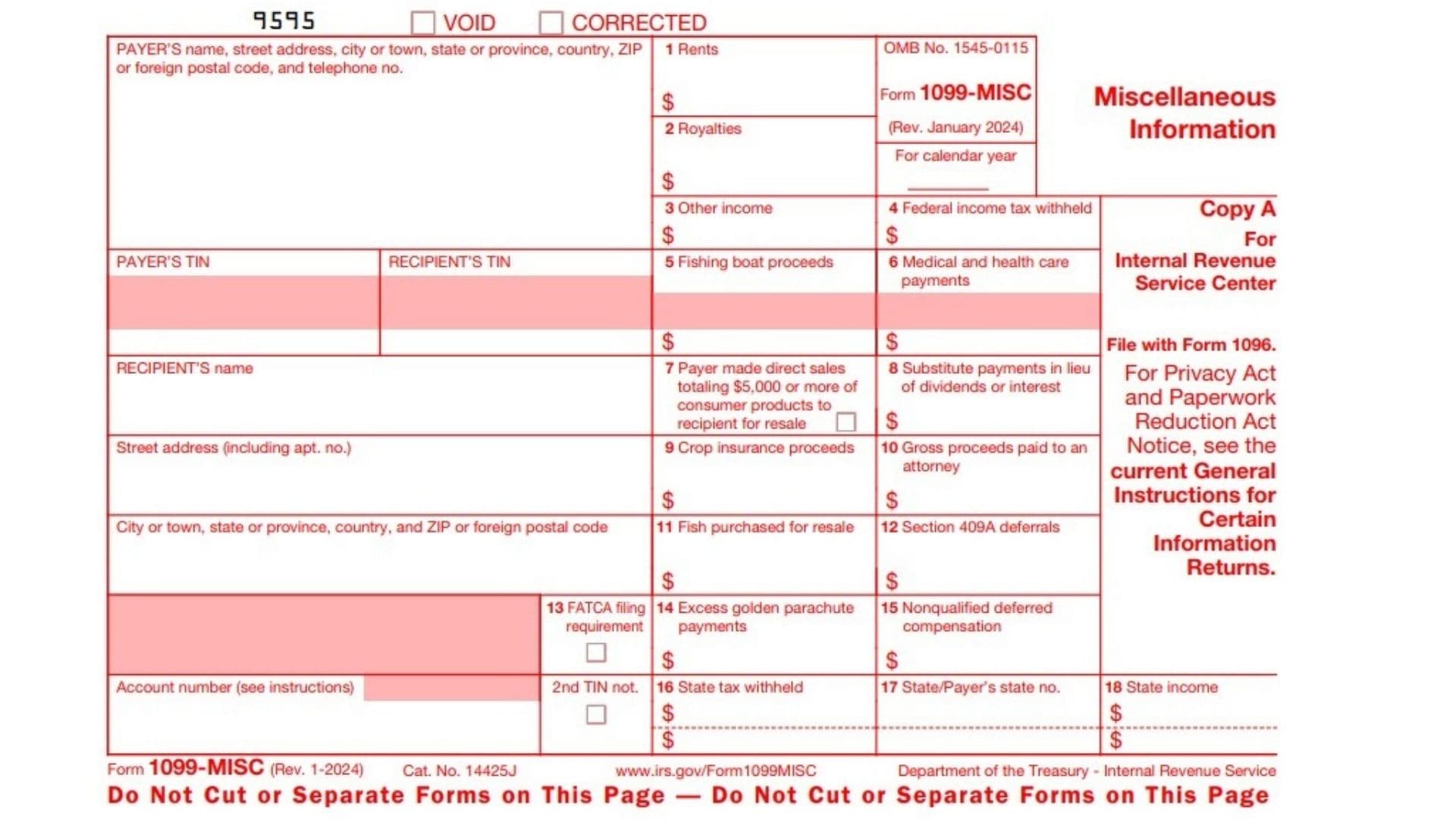

Tax Forms and Documentation

Crypto.com provides users with the necessary tax forms and documentation to support their crypto tax reporting. These forms include:

- 1099-K Forms: Crypto.com issues 1099-K forms to users who have engaged in certain crypto transactions, such as selling cryptocurrencies for fiat currency. These forms report the total proceeds from these transactions and are used for tax reporting purposes.

- Tax Reports: In addition to 1099-K forms, Crypto.com generates comprehensive tax reports that detail users' crypto transactions, including purchases, sales, exchanges, and other relevant activities. These reports provide a clear overview of users' crypto-related income and gains.

- Transaction History: Users can access their detailed transaction history on Crypto.com's platform. This information is crucial for verifying and reconciling crypto transactions with tax reports.

It's important for users to carefully review and understand the information provided in these tax forms and reports to ensure accurate tax reporting.

Best Practices for Crypto Tax Compliance

Navigating the world of crypto taxes can be challenging, but by following some best practices, users can ensure compliance and minimize the risk of errors or penalties.

Keep Accurate Records

Maintaining accurate records of all crypto transactions is essential for tax compliance. Users should track the date, amount, and value of each transaction, including purchases, sales, exchanges, and any other relevant activities. Crypto.com’s platform provides tools to help users keep detailed records of their crypto activities.

Understand Local Tax Laws

Crypto tax laws vary significantly from country to country and even within different jurisdictions. Users should familiarize themselves with the specific tax regulations applicable to their residence. Crypto.com provides educational resources and guidance to help users understand the tax landscape in their region.

Seek Professional Advice

Crypto taxation can be complex, and it’s advisable for users to consult with tax professionals who have expertise in cryptocurrencies. Tax advisors can provide personalized guidance based on individual circumstances and ensure compliance with local tax laws.

Utilize Crypto Tax Software

Crypto tax software can be a valuable tool for users to automate their tax reporting and calculation processes. These software solutions integrate with crypto exchanges and wallets, providing accurate transaction data and generating tax reports. Crypto.com’s integration with popular tax software further enhances the accuracy and efficiency of tax reporting.

Future of Crypto Taxation

As the cryptocurrency industry continues to mature, tax regulations are likely to evolve and become more comprehensive. Governments and tax authorities worldwide are increasingly recognizing the importance of regulating and taxing cryptocurrencies.

Regulatory Developments

Many countries are actively working on developing specific guidelines and regulations for cryptocurrencies. These regulations aim to provide clarity on tax obligations, anti-money laundering measures, and consumer protection. Crypto.com stays updated on these regulatory developments and adapts its platform and tax reporting tools accordingly.

Increased Tax Enforcement

Tax authorities are becoming more proactive in enforcing crypto tax compliance. This includes enhanced data sharing agreements between governments and crypto exchanges, as well as increased audits and investigations into crypto-related tax evasion. Users should expect more scrutiny and a higher level of tax enforcement in the coming years.

Crypto Tax Automation

To simplify the tax reporting process for users, Crypto.com continues to enhance its tax reporting tools and features. The platform aims to provide automated tax reporting solutions that integrate seamlessly with users’ crypto activities, ensuring accurate and timely tax compliance.

Conclusion

Crypto.com’s commitment to providing users with comprehensive tax reporting tools and resources demonstrates its dedication to supporting the growing crypto community. By understanding the tax implications of crypto transactions and leveraging Crypto.com’s tax forms and reporting features, users can confidently navigate the complex world of crypto taxation and ensure compliance with local tax laws.

As the crypto space continues to evolve, Crypto.com remains at the forefront, ensuring that its users have the necessary tools to thrive in this exciting and dynamic industry.

FAQ

How do I access my Crypto.com tax forms and reports?

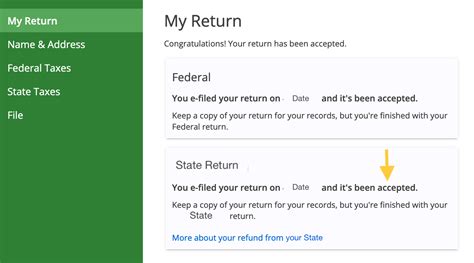

+To access your Crypto.com tax forms and reports, log in to your Crypto.com account and navigate to the “Tax Center” section. Here, you’ll find a comprehensive overview of your crypto-related tax information, including 1099-K forms and tax reports for the current and previous tax years.

What information do I need to provide for accurate tax reporting on Crypto.com?

+To ensure accurate tax reporting, it’s essential to provide complete and accurate information about your crypto transactions. This includes the date, amount, and value of each transaction, as well as any relevant fees or commissions associated with the transaction. Crypto.com’s platform provides tools to help you track and record this information.

Can I connect my Crypto.com account to tax software for easier tax reporting?

+Yes, Crypto.com integrates with popular tax software solutions, allowing you to seamlessly transfer your crypto transaction data to tax preparation platforms. This integration simplifies the process of importing your crypto activities into tax software, making it easier to generate tax reports and file your taxes.

Are there any tax advantages or deductions available for crypto investors?

+The availability of tax advantages and deductions for crypto investors varies depending on the jurisdiction. Some countries offer tax incentives or deductions for certain crypto-related activities, such as mining or staking. It’s important to consult with a tax professional to understand the specific tax benefits available in your region.

What should I do if I have questions or need further assistance with crypto tax reporting on Crypto.com?

+Crypto.com provides extensive support and resources to assist users with their crypto tax reporting. If you have questions or need further assistance, you can reach out to Crypto.com’s customer support team through the platform’s support channels. They can provide guidance and help you navigate any tax-related issues you may encounter.