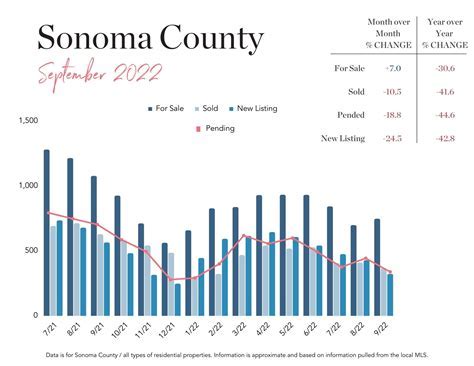

Sonoma County Property Taxes

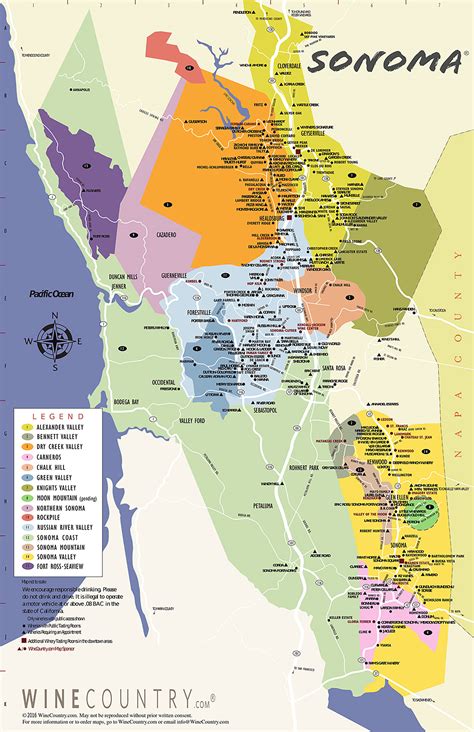

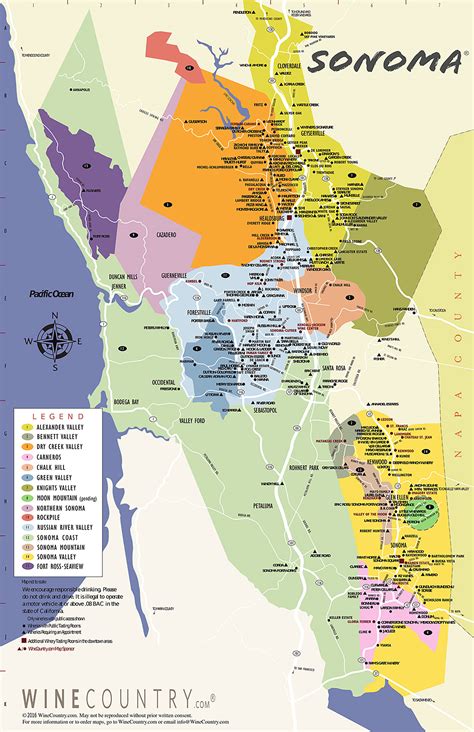

In the vibrant and picturesque Sonoma County, nestled in the heart of Northern California's wine country, property taxes play a significant role in the local economy and community dynamics. With its diverse landscape ranging from rolling vineyards to lush coastal areas, Sonoma County offers a unique blend of natural beauty and thriving businesses. As residents and property owners navigate the complex world of property taxes, understanding the ins and outs of the local tax system is essential. This article aims to provide an in-depth analysis of Sonoma County property taxes, shedding light on the processes, rates, and factors that influence this vital aspect of county finances.

Unraveling the Sonoma County Property Tax System

Sonoma County’s property tax system operates under the principles outlined in California’s Proposition 13, a landmark initiative passed in 1978. This proposition introduced significant changes to the state’s property tax assessment and collection processes, impacting both homeowners and commercial property owners alike. Under Proposition 13, property taxes are assessed based on the property’s purchase price or its assessed value as of the date of purchase, whichever is higher.

The assessed value of a property is typically determined by the Sonoma County Assessor's Office, which considers various factors such as market value, location, and improvements made to the property. Once the assessed value is established, it serves as the basis for calculating the property tax liability. However, it's important to note that Sonoma County, like many other California counties, utilizes a split-roll tax system, which means that certain types of properties, such as commercial and industrial properties, may be subject to different assessment and tax rules.

Understanding Property Tax Rates

The property tax rate in Sonoma County, as in other California counties, consists of two primary components: the base rate and any applicable voter-approved parcel taxes. The base rate, as mandated by Proposition 13, is set at 1% of the assessed value of the property. This base rate funds essential services provided by the county, including law enforcement, fire protection, and infrastructure maintenance.

In addition to the base rate, Sonoma County residents may also be subject to various parcel taxes, which are approved by local voters to support specific community services or projects. These parcel taxes can vary widely, depending on the specific needs and priorities of the community. For instance, a parcel tax might be dedicated to funding local schools, parks, or emergency services.

To illustrate the impact of these taxes, consider the following example: a homeowner in Sonoma County with a property assessed at $500,000 would pay a base property tax of $5,000 (1% of the assessed value). If there are additional parcel taxes in their district, say a 0.25% tax for local schools, the total property tax liability would increase to $5,125 ($5,000 base tax + $125 school parcel tax). It's important for property owners to stay informed about the parcel taxes applicable to their specific area, as these can significantly impact their overall tax burden.

| Tax Component | Rate | Explanation |

|---|---|---|

| Base Property Tax | 1% of Assessed Value | Mandated by Proposition 13, this funds essential county services. |

| Parcel Taxes | Varies by District | Voter-approved taxes supporting specific community services or projects. |

The Role of Property Assessments

Property assessments are a crucial aspect of the Sonoma County property tax system, as they determine the value upon which taxes are calculated. The Sonoma County Assessor’s Office conducts these assessments, considering various factors such as:

- Market Value: The current market value of similar properties in the area is a key consideration. This helps ensure that properties are assessed fairly and in line with their true market worth.

- Location: The location of the property can significantly impact its value. For instance, properties located in desirable neighborhoods or with access to amenities like schools or parks may have higher assessments.

- Improvements: Any improvements made to the property, such as additions, renovations, or upgrades, can increase its assessed value. These improvements are taken into account during the assessment process.

- Economic Factors: The local economy and real estate market conditions can influence property values. For example, during times of economic prosperity, property values may rise, leading to higher assessments.

Property Tax Relief Programs

Sonoma County recognizes the potential financial burden that property taxes can impose on certain groups, and as such, offers several tax relief programs to eligible residents. These programs aim to provide assistance to homeowners who may be struggling to meet their tax obligations due to age, disability, or economic hardship.

One notable program is the Homeowner's Property Tax Exemption, which provides a partial or full exemption from property taxes for qualifying homeowners who meet specific criteria. This exemption can significantly reduce the tax burden for eligible individuals, making homeownership more affordable and sustainable.

Additionally, Sonoma County offers the Disabled Veterans' Property Tax Exemption, which provides a property tax exemption for qualifying disabled veterans. This exemption not only recognizes the service and sacrifice of veterans but also helps alleviate the financial strain that property taxes can impose on those with disabilities.

For homeowners who are 62 years of age or older, the Senior Citizen's Property Tax Postponement program allows them to defer their property tax payments until a later date, such as when the property is sold or the homeowner passes away. This program provides much-needed financial relief for seniors, allowing them to maintain their standard of living without the immediate burden of property taxes.

The Impact of Natural Disasters

Sonoma County, known for its natural beauty, is not immune to the devastating impacts of natural disasters, particularly wildfires. In recent years, the county has faced significant challenges due to wildfires that have ravaged communities and destroyed countless homes. These disasters not only have an immediate impact on residents but also have long-term financial implications, including the potential for increased property taxes.

In the aftermath of a natural disaster, the Sonoma County Assessor's Office works diligently to assess the damage and adjust property values accordingly. This process is critical in ensuring that property owners are not overtaxed based on pre-disaster values. The office may declare a disaster relief period, during which assessments are frozen or adjusted to reflect the current value of the property, taking into account the damage sustained.

For homeowners who have experienced significant property damage, there may be tax implications. However, Sonoma County offers various assistance programs and tax relief measures to help residents navigate this challenging time. These programs can include property tax abatements, deferments, or exemptions, providing much-needed financial support to those rebuilding their lives and homes.

Online Resources and Payment Options

Sonoma County recognizes the importance of providing convenient and accessible services to its residents, especially when it comes to property taxes. To facilitate this, the county offers an array of online resources and payment options, making it easier for property owners to manage their tax obligations.

The Sonoma County Tax Collector's Office maintains a user-friendly website where residents can access their property tax information, view their assessment notices, and even pay their taxes online. This online platform provides a secure and efficient way to manage tax payments, eliminating the need for physical visits to the tax office.

In addition to online payment options, Sonoma County also accepts property tax payments through various methods, including credit cards, checks, and money orders. This flexibility ensures that property owners can choose the payment method that best suits their preferences and financial situation.

The Future of Sonoma County Property Taxes

As Sonoma County continues to evolve and adapt to changing economic and social landscapes, the property tax system is likely to undergo further refinements and adjustments. The county’s commitment to fairness, transparency, and community well-being will remain at the forefront of these changes.

One area of potential focus is the ongoing debate surrounding the split-roll tax system. While this system ensures that commercial and industrial properties contribute proportionally to the county's tax base, there have been calls for reform to make the system more equitable. Advocates for reform argue that commercial properties should be assessed and taxed similarly to residential properties, leveling the playing field and potentially generating additional revenue for essential community services.

Additionally, Sonoma County may explore innovative strategies to enhance its tax collection processes, such as implementing modern technologies and streamlining payment options. By embracing digital transformation, the county can improve efficiency, reduce administrative burdens, and provide an even more user-friendly experience for property owners.

As the county navigates these potential changes, it will be crucial to maintain open lines of communication with residents and property owners. Transparency and engagement will be key in ensuring that any reforms or adjustments are well-received and understood by the community.

What is the timeline for Sonoma County property tax payments?

+Property taxes in Sonoma County are due in two installments. The first installment is typically due on November 1st, while the second installment is due on February 1st of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Are there any penalties for late property tax payments in Sonoma County?

+Yes, Sonoma County imposes penalties for late property tax payments. If the first installment is not paid by December 10th, a 10% penalty is applied. Similarly, if the second installment is not paid by April 10th, another 10% penalty is added. It’s important to note that penalties continue to accrue until the taxes are paid in full.

How can I appeal my property assessment in Sonoma County?

+If you believe your property assessment is inaccurate or unfair, you have the right to appeal. The process involves submitting an application to the Sonoma County Assessment Appeals Board. It’s important to carefully review the assessment notice and gather relevant evidence to support your case. The appeals board will review your application and make a determination based on the evidence provided.