United States Tax Refund Tourist

The concept of tax refunds for tourists in the United States can be a bit complex, especially for those who are not familiar with the country's tax system. However, understanding the process and eligibility can provide an excellent opportunity for visitors to reclaim a portion of their expenses while exploring the USA. This comprehensive guide will delve into the world of tax refunds for tourists, offering a detailed breakdown of the process, requirements, and potential benefits.

Understanding Tax Refunds for Tourists in the USA

When it comes to tax refunds, the United States offers a unique system that can be advantageous for international visitors. The idea behind tax refunds is to allow non-residents to reclaim the taxes they have paid on certain purchases during their stay in the country. This refund system, known as the VAT (Value Added Tax) refund or Sales Tax refund, is a great way for tourists to get some money back and make their travel experience more financially rewarding.

The United States Internal Revenue Service (IRS) is the governing body that oversees tax matters, including tax refunds for tourists. The IRS has specific guidelines and procedures in place to ensure a fair and efficient refund process for eligible individuals.

Who is Eligible for a Tax Refund as a Tourist in the USA?

Eligibility for a tax refund as a tourist in the USA is primarily determined by the visitor's residency status and the nature of their purchases. Here are the key criteria:

- Residency Status: To be eligible, you must be a non-resident alien for tax purposes. This means you do not have a permanent residence or a green card in the United States. Temporary visitors, such as tourists, students, and business travelers, are typically considered non-residents.

- Purchase Requirements: The items you purchase must meet specific criteria. Generally, eligible purchases include tangible personal property, such as clothing, electronics, souvenirs, and other goods bought for personal use. Services, real estate, and certain exempt items are usually not eligible for tax refunds.

- Minimum Purchase Amount: Most states and retailers have a minimum purchase amount required to qualify for a tax refund. This amount can vary, but it typically ranges from $50 to $200 or more. Ensure you check the specific requirements for the state you are shopping in.

- Timing: You must make your purchases during a single visit to the USA and intend to leave the country within a short period, usually within a few months. This ensures that you are not establishing a tax residency in the United States.

It's important to note that not all states in the USA offer tax refunds to tourists. As of my last update, the following states provide tax refund programs for non-residents:

| State | Tax Refund Program |

|---|---|

| Alaska | Permanent Fund Dividend |

| California | Sales Tax Refund |

| Delaware | Sales Tax Exemption |

| Florida | Sales Tax Refund |

| Hawaii | Excise Tax Refund |

| Louisiana | Sales Tax Refund |

| Minnesota | Sales Tax Refund |

| Montana | Use Tax Exemption |

| New Hampshire | Sales Tax Exemption |

| New Jersey | Sales Tax Refund |

| New York | Sales Tax Refund |

| Rhode Island | Sales Tax Refund |

| South Carolina | Sales Tax Refund |

| Tennessee | Sales Tax Refund |

| Texas | Sales Tax Refund |

| Vermont | Sales Tax Exemption |

| Wyoming | Sales Tax Refund |

It's crucial to check the specific requirements and regulations for each state you plan to visit, as they may have unique rules and processes.

The Process of Applying for a Tax Refund as a Tourist

Applying for a tax refund as a tourist in the USA involves several steps, which can vary slightly depending on the state and the retailer. Here is a general overview of the process:

- Shop at Eligible Retailers: Start by making your purchases at retailers that participate in the tax refund program. These retailers often display signs or logos indicating their participation, such as "Tax-Free Shopping" or "Tax Refund Available."

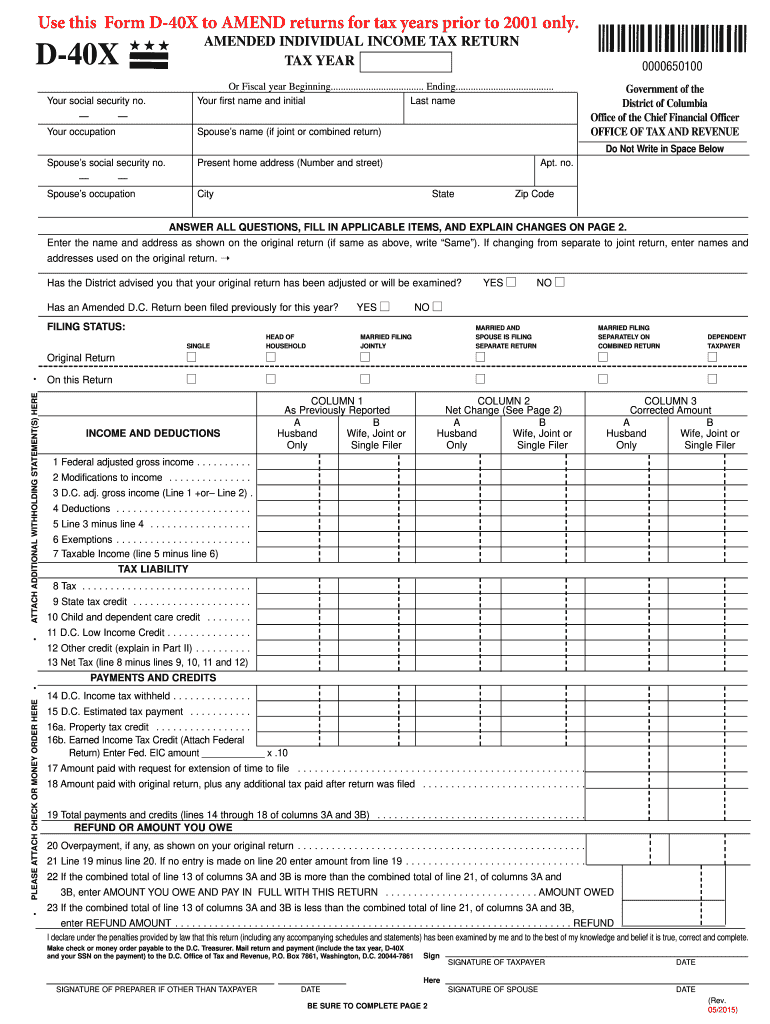

- Request a Tax Refund Form: At the time of purchase, ask the retailer for a tax refund form or a receipt that includes the necessary details for your refund claim. Ensure that the form or receipt includes your name, the date of purchase, a description of the items, and the total amount spent.

- Complete the Form: Fill out the tax refund form accurately and provide all the required information, including your passport details and the method of refund you prefer (e.g., bank transfer, credit card, or check). Double-check the form for accuracy before submission.

- Submit the Form: You can submit the form to the retailer or directly to the state tax authority, depending on the state's refund process. Some states require you to submit the form in person at specific locations, while others allow online submissions.

- Wait for Processing: The processing time for tax refunds can vary. It typically takes a few weeks to a couple of months, depending on the state and the volume of refund claims. Keep track of your submission and follow up if necessary.

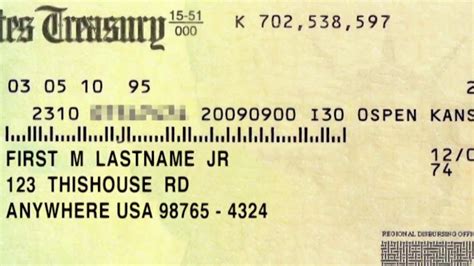

- Receive Your Refund: Once your refund is processed and approved, you will receive the refund amount through your preferred method of payment. It's important to note that there may be fees associated with the refund process, which can vary depending on the state and the refund service provider.

Remember, it's always a good idea to plan your purchases and understand the refund process before you start shopping. This way, you can ensure a smooth and successful tax refund experience during your travels in the USA.

Maximizing Your Tax Refund: Tips and Strategies

To make the most of your tax refund as a tourist in the USA, consider the following tips and strategies:

- Research Before You Shop: Familiarize yourself with the tax refund programs and requirements of the states you plan to visit. Check the minimum purchase amounts, eligible items, and any specific documentation you may need. This will help you plan your shopping efficiently.

- Combine Your Purchases: If you are visiting multiple states that offer tax refunds, consider making larger purchases at the end of your trip. This way, you can combine your receipts and potentially reach the minimum purchase amount more easily.

- Keep Original Receipts: Always keep your original receipts safe and organized. You may need them for the refund application or in case of any discrepancies. Scan or take photos of your receipts for backup, especially if you plan to submit them online.

- Understand Refund Policies: Different retailers and states may have varying refund policies. Some may offer instant refunds at the point of sale, while others may require a separate refund process. Understand the policies to ensure a hassle-free experience.

- Consider a Tax Refund Service: If you find the tax refund process complex or time-consuming, you can opt for a tax refund service. These services can handle the paperwork and submission process on your behalf for a fee. It's a convenient option, especially if you are short on time.

- Stay Informed About Changes: Tax refund programs and regulations can change over time. Keep yourself updated with the latest information from official sources to avoid any surprises or missed opportunities.

By following these tips and staying organized, you can maximize your tax refund and make your travel budget stretch further.

Potential Benefits and Considerations

Tax refunds for tourists in the USA offer several benefits, including:

- Financial Savings: Tax refunds can provide a significant boost to your travel budget. By reclaiming a portion of the taxes paid on your purchases, you can save money and allocate it to other aspects of your trip, such as accommodation, dining, or activities.

- Enhanced Shopping Experience: The tax refund process encourages tourists to shop more freely and enjoy a more tailored shopping experience. It allows you to explore a wider range of products and brands, knowing that you can potentially recover a portion of your expenses.

- Support for Local Economies: Tax refunds can stimulate local economies by encouraging international visitors to spend more. This benefits local businesses and helps sustain the tourism industry in the USA.

However, it's essential to consider a few key points:

- Fees and Charges: There may be fees associated with the tax refund process, such as administration fees or exchange rate charges. These fees can vary, so it's crucial to understand them before proceeding with your refund claim.

- Time and Effort: The tax refund process requires time and effort, especially if you are visiting multiple states or making multiple purchases. Ensure you have the necessary time and resources to dedicate to the process.

- Eligibility and Compliance: Always ensure you meet the eligibility criteria and comply with the tax refund regulations. Failure to do so may result in delays or denial of your refund claim.

Overall, tax refunds for tourists in the USA present an excellent opportunity to reclaim a portion of your travel expenses. By understanding the process, staying organized, and following the guidelines, you can make the most of your shopping experience and maximize your refund potential.

Frequently Asked Questions

Can I get a tax refund for services rendered during my trip to the USA, such as hotel stays or restaurant meals?

+No, tax refunds in the USA are typically only available for tangible personal property purchases. Services, such as hotel stays, restaurant meals, and entertainment, are generally not eligible for tax refunds.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any restrictions on the types of items I can purchase for a tax refund?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are specific restrictions on the types of items eligible for tax refunds. Generally, items must be tangible personal property intended for personal use. Items such as food, alcohol, and certain exempt goods may not qualify. It's best to check the specific guidelines for the state you are shopping in.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I apply for a tax refund if I'm a US resident with a green card?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, tax refunds are primarily intended for non-resident aliens. If you are a US resident with a green card, you are considered a tax resident and are not eligible for tax refunds on your purchases.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long does it typically take to receive a tax refund after submitting the necessary paperwork?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The processing time for tax refunds can vary depending on the state and the volume of refund claims. It can range from a few weeks to several months. It's best to check with the specific state tax authority or refund service provider for an estimated timeline.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I apply for a tax refund if I'm a student studying in the USA but not a permanent resident?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, if you are a non-resident alien student, you may be eligible for tax refunds on your purchases. However, it's important to understand the specific requirements for students, as they may vary slightly from tourist refunds. Check with your school's international student office or the state tax authority for more information.</p>

</div>

</div>

</div>