Maryland Car Sales Tax

When purchasing a vehicle in Maryland, understanding the intricacies of the sales tax system is crucial. The Maryland Car Sales Tax is a vital component of the state's revenue generation, and it can significantly impact the overall cost of buying a new or used car. In this comprehensive guide, we will delve into the specifics of the Maryland Car Sales Tax, providing you with all the information you need to navigate this process with ease.

Understanding the Maryland Car Sales Tax

The Maryland Car Sales Tax is a tax levied on the purchase price of vehicles, whether they are new or used. This tax is a crucial source of revenue for the state, contributing to various public services and infrastructure development. It is important to note that the sales tax in Maryland varies depending on the jurisdiction where the vehicle is purchased and registered.

Maryland's unique tax structure is based on a combination of state and local taxes, with each county and municipality imposing its own additional tax rates. This means that the total sales tax you pay on a vehicle can vary significantly depending on your location. Understanding these variations is essential to make informed financial decisions when buying a car.

State Sales Tax

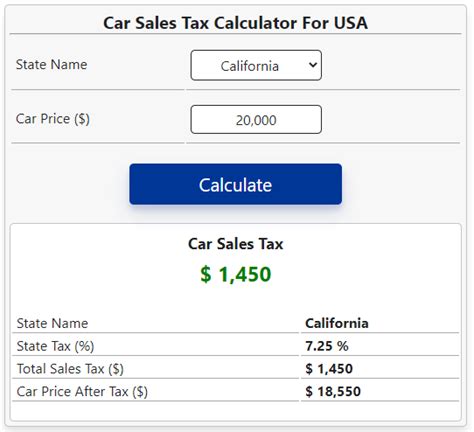

At the state level, Maryland imposes a standard sales tax rate of 6% on vehicle purchases. This rate is consistent across the state and applies to both new and used cars, as well as other tangible personal property. The state sales tax is a significant component of the overall tax burden, providing a substantial revenue stream for Maryland's government.

Local Sales Tax

In addition to the state sales tax, Maryland's counties and municipalities have the authority to impose their own local sales taxes. These local taxes can vary widely, ranging from 0% to 4.5%, depending on the jurisdiction. This means that the total sales tax rate on a vehicle purchase can range from 6% to 10.5%, creating a significant difference in the overall cost of buying a car.

| County/Municipality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Baltimore City | 1.5% | 7.5% |

| Montgomery County | 3% | 9% |

| Prince George's County | 1% | 7% |

| Anne Arundel County | 4.5% | 10.5% |

| Howard County | 3% | 9% |

| ... | ... | ... |

The table above provides a glimpse into the local sales tax rates in some of Maryland's counties and municipalities. It is important to research the specific tax rates in your area to get an accurate understanding of the total sales tax you will incur when purchasing a vehicle.

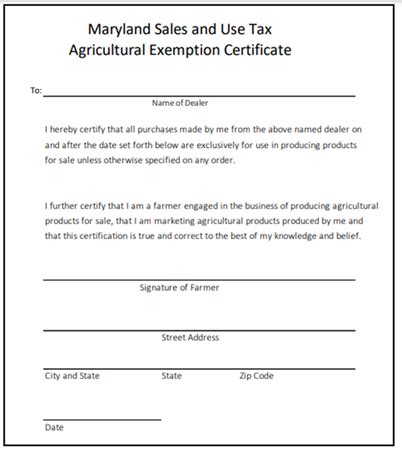

Exemptions and Special Considerations

While the Maryland Car Sales Tax is generally applicable to all vehicle purchases, there are certain exemptions and special considerations that you should be aware of. These exemptions can help reduce the overall tax burden and provide relief in specific situations.

Trade-In Allowances

When trading in your old vehicle as part of a new purchase, Maryland offers a trade-in allowance that can reduce the sales tax you owe. The trade-in allowance is calculated based on the value of the vehicle being traded in and can significantly lower the taxable amount of the new vehicle purchase. This incentive encourages vehicle turnover and provides a financial benefit to those who choose to trade in their older cars.

Military Personnel and Veterans

Maryland recognizes the service of its military personnel and veterans by offering tax exemptions on vehicle purchases. Active-duty military members and veterans who meet certain criteria may be eligible for a partial or full exemption from the state sales tax. This exemption is a token of appreciation for their service and can provide significant savings when buying a car in Maryland.

Disabled Individuals

Maryland also extends tax relief to individuals with disabilities. Qualified disabled individuals may be exempt from paying sales tax on certain vehicle modifications and adaptive equipment. This exemption ensures that those with disabilities have equal access to necessary vehicle adaptations without the added financial burden of sales tax.

Calculating the Maryland Car Sales Tax

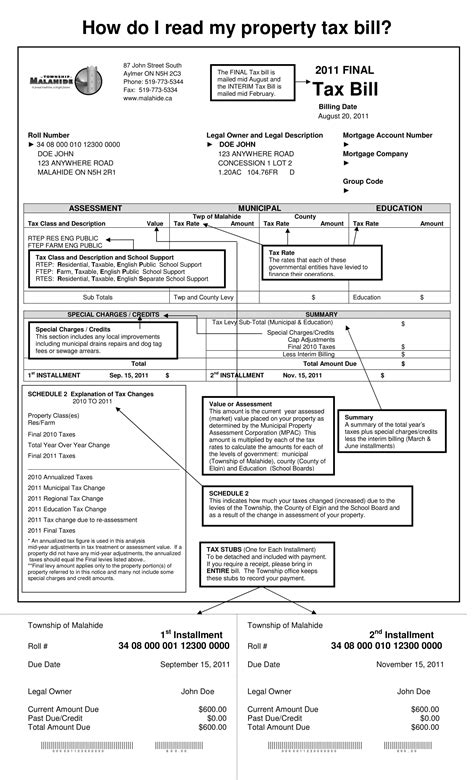

Calculating the exact amount of sales tax you will owe on a vehicle purchase in Maryland involves a few simple steps. Here's a breakdown of the process:

- Determine the purchase price of the vehicle, including any additional fees and charges.

- Find the applicable sales tax rate for your specific location. This includes both the state sales tax rate (6%) and the local sales tax rate (varies by county/municipality).

- Multiply the purchase price by the total sales tax rate to calculate the sales tax amount.

- Add any applicable trade-in allowances or exemptions to reduce the taxable amount.

- Ensure you have all the necessary documentation and information to support any exemptions or allowances claimed.

It is important to note that the sales tax is typically paid at the time of vehicle registration, and the funds are distributed to the appropriate state and local governments. Accurate calculation and timely payment of the sales tax are essential to avoid any legal complications or penalties.

Tips for Managing Car Sales Tax in Maryland

Navigating the Maryland Car Sales Tax system can be simplified with a few strategic approaches. Here are some tips to help you manage the sales tax process effectively:

- Research Local Tax Rates: Before finalizing your vehicle purchase, take the time to research the sales tax rates in different counties and municipalities. This can help you identify the most favorable location for purchasing your vehicle, potentially saving you hundreds or even thousands of dollars.

- Utilize Trade-In Allowances: If you're trading in your old vehicle, be sure to take advantage of the trade-in allowance. This can significantly reduce the taxable amount of your new vehicle purchase, making it a smart financial move.

- Explore Exemptions: If you're a military member, veteran, or have a disability, investigate the available tax exemptions. These exemptions can provide substantial savings and are a well-deserved benefit for those who qualify.

- Consult a Tax Professional: If you have complex financial circumstances or are unsure about the tax implications of your vehicle purchase, consider consulting a tax professional. They can provide expert advice and ensure you are taking advantage of all available tax benefits.

Future Implications and Trends

The Maryland Car Sales Tax landscape is subject to ongoing changes and developments. While it is challenging to predict the exact future of the sales tax system, certain trends and factors may influence its trajectory.

Economic Impact

The sales tax revenue generated from vehicle purchases plays a significant role in Maryland's economy. As the state's economy continues to evolve, the demand for vehicles and the associated sales tax revenue may experience fluctuations. Monitoring economic trends and consumer behavior can provide insights into the potential impact on the sales tax system.

Political Considerations

The political landscape in Maryland can influence the future of the sales tax system. Changes in government policies, tax reform initiatives, and budgetary considerations may lead to alterations in the sales tax rates or the introduction of new exemptions. Staying informed about political developments can help anticipate potential changes and their implications.

Environmental Initiatives

With a growing focus on environmental sustainability, Maryland may explore initiatives to promote the adoption of electric vehicles (EVs) and other eco-friendly transportation options. Incentives and tax benefits for EV purchases could become more prevalent, encouraging consumers to make environmentally conscious choices. Understanding these initiatives can provide insight into potential tax advantages in the future.

Conclusion

The Maryland Car Sales Tax is a complex yet essential aspect of vehicle purchasing in the state. By understanding the state and local tax rates, exploring available exemptions, and employing strategic approaches, you can navigate the sales tax system effectively. Staying informed about economic, political, and environmental developments can further enhance your ability to make informed financial decisions when buying a car in Maryland.

As you embark on your vehicle-buying journey, remember that knowledge is power. With a comprehensive understanding of the Maryland Car Sales Tax, you can make confident choices and potentially save significantly on your next car purchase.

How often do sales tax rates change in Maryland?

+Sales tax rates in Maryland can change periodically, typically as part of legislative actions or budgetary decisions. While it is difficult to predict exact timing, staying informed about local government initiatives can provide insights into potential changes.

Are there any online resources to help calculate the Maryland Car Sales Tax?

+Yes, there are several online calculators and tools available that can assist in estimating the Maryland Car Sales Tax. These resources often consider factors such as vehicle price, location, and applicable tax rates. Using these tools can provide a quick estimate before finalizing your purchase.

Can I negotiate the sales tax on my vehicle purchase?

+The sales tax is a mandatory charge determined by the state and local governments, so it is not typically negotiable. However, you can negotiate the vehicle price, which indirectly affects the sales tax amount. Additionally, exploring different locations with varying tax rates can provide an effective way to reduce the overall cost.

What documentation is required to claim tax exemptions for military personnel or veterans?

+To claim tax exemptions as a military member or veteran, you will need to provide valid military identification or documentation proving your status. Additionally, you may need to meet certain residency or service-related criteria. It is advisable to consult the Maryland Comptroller’s Office for specific requirements.