Aarp Tax Aid

Every year, millions of individuals navigate the complex world of tax preparation, often seeking assistance to ensure accuracy and compliance with tax laws. One trusted resource that has been aiding taxpayers for decades is the AARP Foundation Tax-Aide program.

In this comprehensive guide, we will delve into the depths of the AARP Tax-Aide program, exploring its history, services, impact, and future outlook. With a rich legacy of volunteerism and a commitment to helping taxpayers, especially those with low to moderate income, the AARP Tax-Aide program stands as a pillar of support during tax season. Join us as we uncover the stories, statistics, and strategies that make this program a vital resource for millions of Americans.

A Legacy of Tax Assistance: The AARP Tax-Aide Program

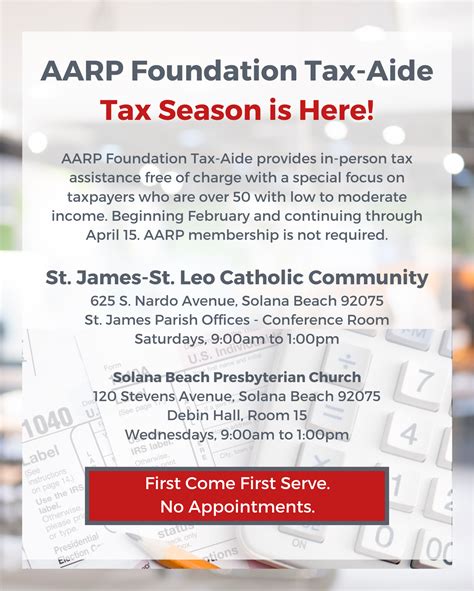

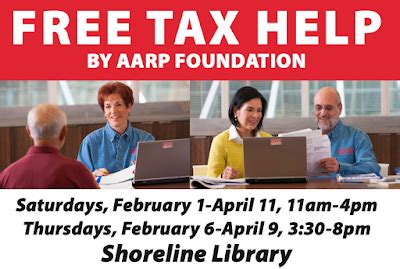

The AARP Tax-Aide program is a national initiative that provides free tax preparation assistance to millions of Americans, particularly those aged 50 and above. Founded in the 1960s, this program has grown into one of the largest volunteer-run tax preparation services in the United States, offering a helping hand to those who need it most.

The program's origins can be traced back to a simple idea: to empower individuals to navigate the complexities of tax laws and ensure they receive the refunds and credits they are entitled to. Over the decades, the AARP Tax-Aide program has evolved, leveraging technology and an extensive network of dedicated volunteers to provide efficient and accurate tax preparation services.

A Volunteer-Powered Force

At the heart of the AARP Tax-Aide program lies a dedicated army of volunteers. These individuals, often retired professionals with a background in accounting, finance, or tax preparation, donate their time and expertise to help their communities. With rigorous training and a deep understanding of tax laws, these volunteers ensure that taxpayers receive the highest level of service.

The volunteer network is extensive, with over 30,000 volunteers across the United States. These volunteers not only assist with tax preparation but also provide valuable education and guidance, ensuring that taxpayers understand their financial obligations and rights.

| Volunteer Demographics | Statistics |

|---|---|

| Average Volunteer Age | 65 years |

| Years of Service | 5–10 years on average |

| Total Volunteers in 2023 | 32,500 |

Eligible Taxpayers: Who Benefits from AARP Tax-Aide?

The AARP Tax-Aide program caters to a diverse range of taxpayers, but its primary focus is on those aged 50 and above. This demographic often faces unique financial challenges and may require additional support during tax season. However, the program’s services are not limited to seniors alone.

Individuals with low to moderate income, regardless of age, can also benefit from AARP Tax-Aide. The program assists taxpayers with various financial situations, including those with simple tax returns, complex investments, or unique life circumstances such as retirement or disability.

Moreover, AARP Tax-Aide extends its reach to military families, offering specialized assistance for those serving in the armed forces. This inclusive approach ensures that a wide range of taxpayers can access the support they need to navigate the tax landscape successfully.

Services Offered: More Than Just Tax Preparation

The AARP Tax-Aide program goes beyond basic tax preparation. Volunteers are trained to handle a wide array of tax-related tasks, ensuring that taxpayers receive comprehensive assistance.

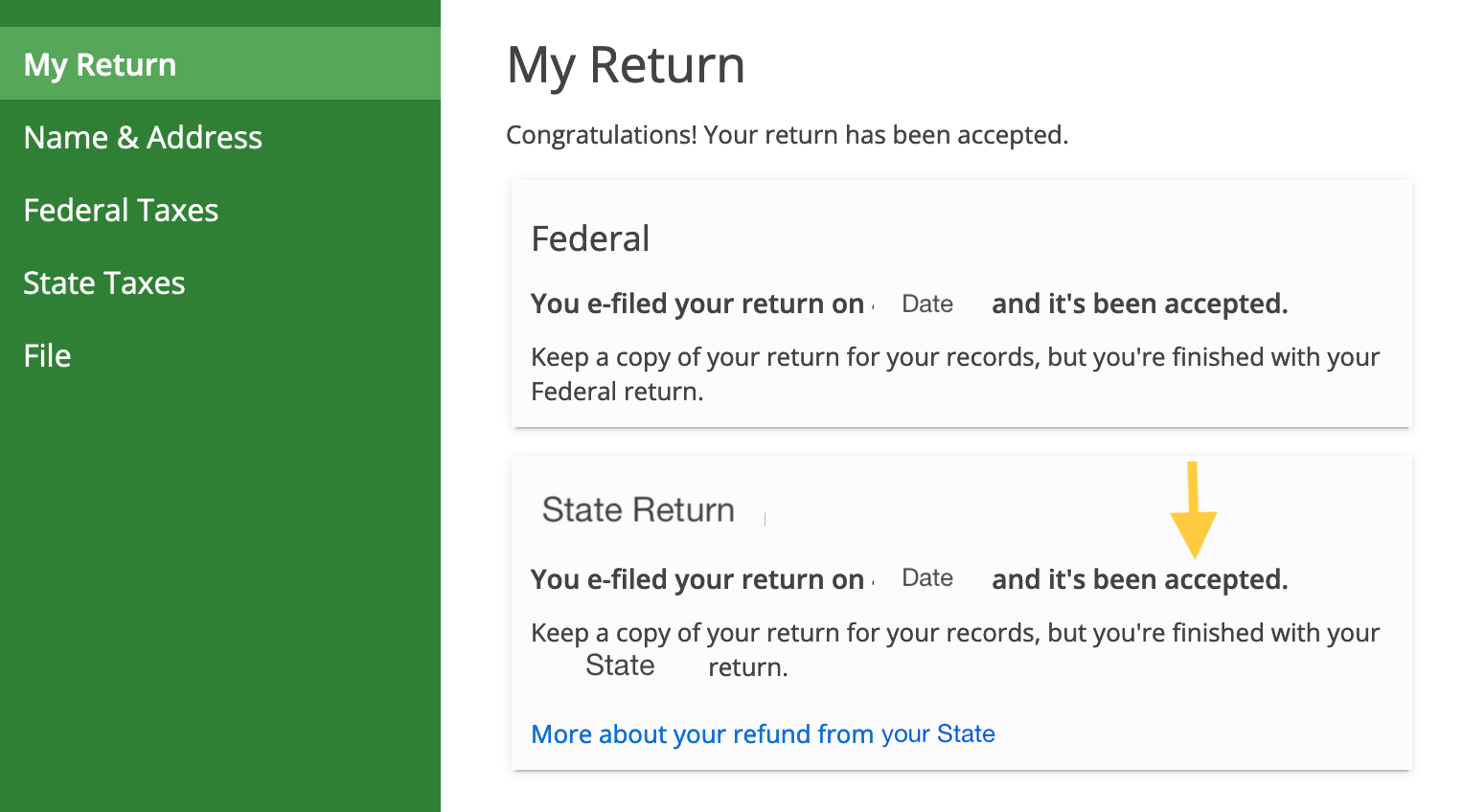

- Tax Return Preparation: Volunteers help taxpayers complete and file their federal and state tax returns, ensuring accuracy and compliance with tax laws.

- E-filing Services: The program utilizes electronic filing to streamline the process, providing efficient and secure submission of tax returns.

- Credit and Refund Maximization: Volunteers assist taxpayers in claiming all eligible credits and refunds, including the Earned Income Tax Credit (EITC) and Child Tax Credit.

- Specialized Support: AARP Tax-Aide offers tailored assistance for seniors, military families, and individuals with disabilities, ensuring their unique needs are addressed.

- Education and Guidance: Volunteers provide educational resources and workshops to empower taxpayers with the knowledge to make informed financial decisions.

Impact and Outreach: Changing Lives Through Tax Assistance

The AARP Tax-Aide program has made a significant impact on the lives of millions of Americans over the years. Through its dedicated volunteer force and comprehensive services, the program has achieved remarkable outcomes.

Tax Returns Filed: A Growing Success

Each year, the AARP Tax-Aide program files an impressive number of tax returns. In 2022 alone, volunteers prepared and filed over 1.8 million tax returns, an increase of 10% from the previous year. This growth demonstrates the program’s expanding reach and its ability to meet the growing demand for tax assistance.

The program's success is further highlighted by the number of taxpayers it has served over the years. Since its inception, AARP Tax-Aide has prepared and filed over 50 million tax returns, a testament to its longevity and reliability.

| Tax Returns Filed | Statistics |

|---|---|

| 2022 Tax Season | 1,850,000 |

| Cumulative Returns Filed | 50,000,000 |

Maximizing Refunds and Credits: Financial Empowerment

One of the key strengths of the AARP Tax-Aide program is its ability to help taxpayers maximize their refunds and claim eligible credits. In 2022, the program assisted taxpayers in claiming over 1.3 billion in refunds and credits, an average of 710 per taxpayer.

This financial empowerment is particularly significant for low-income taxpayers, who often rely on tax refunds to cover essential expenses or to invest in their future. By ensuring that taxpayers receive their full entitlements, the AARP Tax-Aide program plays a vital role in improving financial stability and reducing economic disparities.

| Refund and Credit Maximization | Statistics |

|---|---|

| Total Refunds and Credits Claimed (2022) | $1,300,000,000 |

| Average Refund/Credit per Taxpayer | $710 |

Community Outreach and Education

Beyond tax preparation, the AARP Tax-Aide program actively engages in community outreach and education initiatives. Volunteers organize workshops, seminars, and informational sessions to raise awareness about tax laws, financial planning, and the importance of accurate tax filing.

These educational efforts have a lasting impact, empowering taxpayers to take control of their financial futures. By fostering financial literacy, the program contributes to the overall economic well-being of communities, especially those with limited access to financial resources and expertise.

Future Outlook: Expanding Horizons and Digital Innovation

As the AARP Tax-Aide program looks toward the future, it embraces new opportunities and challenges. With the rapid advancement of technology, the program is exploring innovative ways to enhance its services and reach a wider audience.

Embracing Digital Solutions

To meet the evolving needs of taxpayers, the AARP Tax-Aide program is investing in digital solutions. Online platforms and mobile apps are being developed to provide taxpayers with convenient access to tax preparation resources and assistance.

These digital tools will not only streamline the tax preparation process but also ensure that taxpayers can receive support regardless of their physical location. The program aims to bridge the digital divide, ensuring that all taxpayers, including those in rural or underserved areas, can benefit from its services.

Expanding Volunteer Base and Training

The AARP Tax-Aide program recognizes the importance of a diverse and skilled volunteer base. Efforts are underway to attract a younger demographic of volunteers, ensuring a continuous pipeline of dedicated individuals to serve taxpayers.

Additionally, the program is enhancing its training curriculum to stay abreast of evolving tax laws and technological advancements. By investing in volunteer development, the AARP Tax-Aide program ensures that its services remain relevant and effective in a rapidly changing tax landscape.

Partnerships and Collaborations

To amplify its impact, the AARP Tax-Aide program is actively seeking partnerships with community organizations, financial institutions, and government agencies. These collaborations aim to expand the program’s reach, especially in underserved communities, and provide a more holistic approach to financial empowerment.

By working together, these partnerships can address the unique financial challenges faced by different demographic groups, ensuring that the AARP Tax-Aide program remains a vital resource for all taxpayers.

Conclusion: A Lifeline for Taxpayers

The AARP Tax-Aide program stands as a beacon of support for millions of taxpayers, especially those in vulnerable financial situations. Through its dedicated volunteers, comprehensive services, and community engagement, the program has made a profound impact on the lives of Americans across the nation.

As tax laws continue to evolve and technology reshapes the way we interact with financial services, the AARP Tax-Aide program remains committed to adapting and innovating. By embracing digital solutions, expanding its volunteer base, and forging new partnerships, the program ensures that it will continue to provide vital assistance to taxpayers for years to come.

For those in need of tax preparation assistance, the AARP Tax-Aide program offers a helping hand, empowering individuals to navigate the complexities of tax laws and secure their financial well-being. With its rich history and unwavering commitment to serving others, the program stands as a testament to the power of volunteerism and community support.

How can I become a volunteer for the AARP Tax-Aide program?

+Volunteering for the AARP Tax-Aide program is a rewarding experience. To become a volunteer, you can visit the AARP website or contact your local AARP chapter. Volunteers typically need to complete a training program and pass a certification exam to ensure they are equipped to provide accurate tax assistance.

What are the eligibility criteria for receiving AARP Tax-Aide services?

+AARP Tax-Aide services are primarily aimed at individuals aged 50 and above. However, the program also assists low- to moderate-income taxpayers, regardless of age. Military families and individuals with disabilities are also eligible for specialized support.

How can I locate my nearest AARP Tax-Aide site?

+You can find your nearest AARP Tax-Aide site by visiting the official AARP website. Simply enter your zip code or city, and the website will provide you with a list of nearby locations and their contact information. You can then reach out to schedule an appointment.

Are there any fees associated with AARP Tax-Aide services?

+No, AARP Tax-Aide services are provided free of charge. The program is funded through donations and grants, ensuring that taxpayers can access high-quality tax preparation assistance without financial barriers.