State Of Michigan Income Tax Refund

The Michigan income tax refund process is an essential aspect of the state's tax system, offering financial relief to residents and businesses. In this comprehensive guide, we will delve into the intricacies of Michigan's income tax refunds, exploring the eligibility criteria, calculation methods, and timelines. By understanding the state's tax refund landscape, individuals and businesses can navigate the process efficiently and ensure they receive the refunds they are entitled to.

Understanding Michigan’s Income Tax Refunds

Michigan, like many other states, operates a progressive income tax system, meaning that taxpayers pay a higher tax rate as their income increases. The state’s income tax refund policy aims to provide a financial boost to those who have overpaid their taxes during the tax year. This refund system not only ensures fairness but also acts as a financial incentive for taxpayers to stay compliant with their tax obligations.

Eligibility for Income Tax Refunds

Not all taxpayers in Michigan are eligible for income tax refunds. The eligibility criteria are primarily based on the taxpayer’s income level, tax deductions, and credits claimed. Generally, individuals who have paid more in taxes than their actual liability are entitled to a refund. This includes taxpayers who have excess withholdings from their paychecks or those who have made estimated tax payments exceeding their tax liability.

Businesses operating in Michigan may also be eligible for income tax refunds, particularly if they have overpaid their corporate income taxes. The eligibility for business refunds is determined by the nature of the business, its tax obligations, and the specific tax credits and deductions it can claim.

Calculating Income Tax Refunds

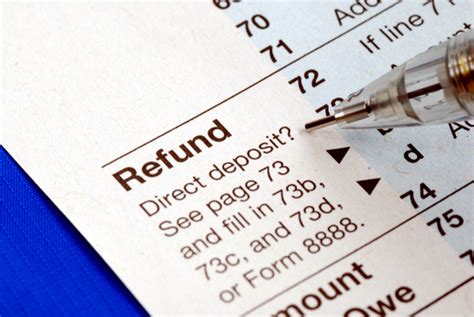

The calculation of Michigan income tax refunds involves a straightforward process. Taxpayers can use the state’s official tax forms and guidelines to determine their eligibility and calculate the exact amount they are owed. The refund amount is typically the difference between the total tax paid and the actual tax liability, taking into account any applicable deductions, credits, and exemptions.

For individuals, the calculation often involves comparing their total income, tax withholdings, and estimated tax payments with their actual tax liability for the year. Businesses, on the other hand, must consider their business income, expenses, and tax obligations to determine their refund eligibility.

| Calculation Factors | Description |

|---|---|

| Total Income | All sources of income, including wages, investments, and business profits. |

| Tax Withholdings | Amounts deducted from paychecks or estimated tax payments made during the year. |

| Deductions and Credits | Various deductions and tax credits, such as the standard deduction, itemized deductions, and tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit. |

| Actual Tax Liability | The amount of tax owed based on Michigan's tax rates and the taxpayer's specific circumstances. |

Timelines and Deadlines for Income Tax Refunds

Understanding the timelines for Michigan income tax refunds is crucial for taxpayers. The state aims to process refunds as quickly as possible, typically within a few weeks of receiving the tax return. However, several factors can influence the speed of refund processing, including the method of filing (paper or electronic), the complexity of the return, and the accuracy of the information provided.

To ensure timely refunds, Michigan taxpayers are encouraged to file their tax returns as early as possible, especially if they are expecting a refund. The state's tax authorities often prioritize the processing of refunds during the early filing season, making it advantageous for taxpayers to be among the first to submit their returns.

Here is a breakdown of the key timelines and deadlines for Michigan income tax refunds:

- Filing Deadline: Taxpayers must file their Michigan income tax returns by April 15th of each year. This deadline aligns with the federal tax filing deadline.

- Refund Processing Time: The Michigan Department of Treasury aims to process refunds within 21 days of receiving the return. However, complex returns or those with errors may take longer.

- Refund Payment Methods: Michigan offers various refund payment methods, including direct deposit, check, or a refund credit towards the following year's taxes. Taxpayers can choose their preferred method when filing their return.

- Late Filing and Refunds: Taxpayers who miss the filing deadline may still be eligible for a refund, but they should be aware of potential penalties and interest charges. It's crucial to file as soon as possible to avoid additional fees.

Maximizing Your Michigan Income Tax Refund

While the income tax refund process is straightforward, there are strategies taxpayers can employ to maximize their refunds. Here are some tips and insights to consider:

Utilize Tax Deductions and Credits

Michigan offers a range of tax deductions and credits that can significantly reduce your tax liability. Some key deductions and credits to consider include:

- Standard Deduction: All taxpayers can claim a standard deduction based on their filing status. This reduces the amount of taxable income, resulting in a lower tax liability.

- Itemized Deductions: If your expenses exceed the standard deduction, you may benefit from itemizing your deductions. This includes expenses such as medical costs, charitable contributions, and state and local taxes.

- Earned Income Tax Credit (EITC): The EITC is a valuable credit for low- to moderate-income workers and families. It can provide a significant refund, especially for those with qualifying children.

- Child and Dependent Care Credit: If you pay for childcare or dependent care services, you may be eligible for this credit, which can offset a portion of those expenses.

- Education Credits: Michigan offers credits for higher education expenses, such as the Michigan Tuition Grant and the American Opportunity Tax Credit.

Optimize Your Tax Withholdings

To ensure you receive a refund, it’s crucial to optimize your tax withholdings throughout the year. If you have multiple jobs or income sources, consider adjusting your withholding allowances to prevent overpaying taxes. You can use the W-4 form provided by your employer to make these adjustments.

Take Advantage of Michigan’s Tax Credits

Michigan provides several state-specific tax credits that can further reduce your tax liability. Some notable credits include:

- Homestead Property Tax Credit: This credit helps offset property taxes for homeowners. It is automatically calculated and applied to your tax refund or deduction.

- Senior Citizens and Disabled Veterans Property Tax Exemption: Qualified senior citizens and disabled veterans may be exempt from paying property taxes on their primary residence.

- Renewable Energy Tax Credit: If you have invested in renewable energy sources, such as solar panels or wind turbines, you may be eligible for this credit.

Seek Professional Assistance

For complex tax situations or if you’re unsure about maximizing your refund, consider seeking professional tax preparation assistance. Tax professionals can help you navigate the intricacies of Michigan’s tax system, ensuring you claim all eligible deductions and credits. They can also provide guidance on tax planning strategies to optimize your financial situation.

Future Implications and Changes

Michigan’s tax landscape is subject to changes and updates, which can impact the income tax refund process. It’s essential to stay informed about any upcoming tax law changes or reforms that may affect your refund eligibility or calculation.

In recent years, Michigan has made efforts to simplify its tax system and improve refund processing efficiency. The state has implemented electronic filing options, allowing taxpayers to file their returns online and receive faster refunds. Additionally, Michigan has enhanced its tax credit programs to provide more financial relief to eligible taxpayers.

Looking ahead, the state may continue to explore ways to further streamline the tax refund process, making it more accessible and efficient for taxpayers. Additionally, changes in tax rates or deductions could impact the size of refunds in the future.

Conclusion

Michigan’s income tax refund process offers a financial opportunity for taxpayers who have overpaid their taxes. By understanding the eligibility criteria, calculation methods, and timelines, individuals and businesses can navigate the process effectively and ensure they receive their rightful refunds. With careful planning, taxpayers can maximize their refunds by utilizing deductions, credits, and tax planning strategies. Staying informed about any changes to Michigan’s tax laws will also help taxpayers adapt to new refund scenarios.

Frequently Asked Questions

What is the average income tax refund in Michigan?

+

The average income tax refund in Michigan varies from year to year and depends on several factors, including the taxpayer’s income level, deductions, and credits claimed. In recent years, the average refund has ranged from 1,000 to 2,000.

How long does it take to receive a Michigan income tax refund?

+

Michigan aims to process income tax refunds within 21 days of receiving the return. However, complex returns or those with errors may take longer. Electronic filing and direct deposit can expedite the process, typically resulting in refunds within a few weeks.

Can I check the status of my Michigan income tax refund online?

+

Yes, you can check the status of your Michigan income tax refund online through the Michigan Department of Treasury’s website. You will need to provide your Social Security Number, date of birth, and refund amount to access your refund status.

What should I do if my Michigan income tax refund is delayed or incorrect?

+

If your Michigan income tax refund is delayed or you believe it is incorrect, you should contact the Michigan Department of Treasury’s Refund Hotline at 1-800-272-9829. They can provide guidance and assist with resolving any refund issues.

Are there any penalties for late filing or underpayment of taxes in Michigan?

+

Yes, Michigan imposes penalties for late filing and underpayment of taxes. Late filing penalties can range from 5% to 25% of the unpaid tax, depending on the severity of the delay. Underpayment penalties may also apply if you owe additional taxes beyond your estimated payments or withholdings.