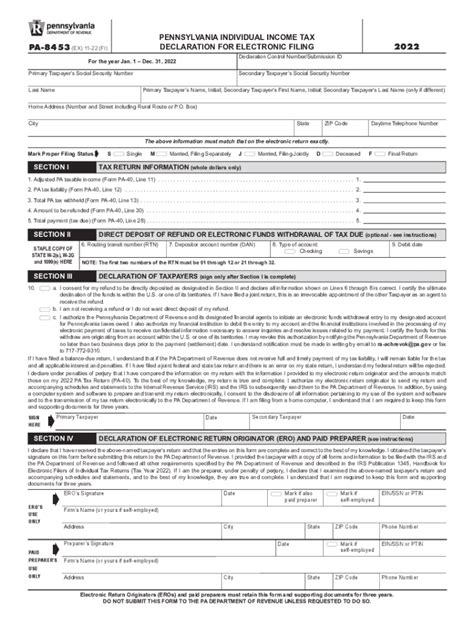

Pa State Tax Refund Status

The Pennsylvania Department of Revenue provides several methods for residents and taxpayers to check the status of their state tax refunds. This comprehensive guide will outline the various ways to access refund information, offering a step-by-step process and detailed explanations for each method. Additionally, we will provide insights into potential reasons for refund delays and offer tips to ensure a smoother refund experience.

Methods to Check PA State Tax Refund Status

The Pennsylvania Department of Revenue offers taxpayers multiple avenues to check the status of their state tax refunds. These methods are designed to be user-friendly and accessible, ensuring that taxpayers can obtain accurate and timely information about their refunds.

Online Refund Status Tool

The most convenient and widely used method is the online refund status tool provided by the Department of Revenue. This tool allows taxpayers to quickly and easily check the status of their refunds without having to wait on hold or visit a physical office. Here's how to use it:

-

Visit the Official Website: Go to the Pennsylvania Department of Revenue's refund status page. This is the official and secure website for checking your refund status.

-

Enter Your Information: On the page, you'll find a form requiring your Social Security Number, Refund Amount, and Refund Type (individual or business). Ensure you enter the exact details as they appear on your tax return.

-

Submit and Retrieve Status: After entering your details, click the Submit button. The tool will then display the status of your refund. It will indicate whether your refund has been processed, is in progress, or if there are any issues that need to be addressed.

The online tool provides a quick and efficient way to check your refund status, and it is updated regularly to reflect the latest information.

Telephone Inquiries

For those who prefer a more traditional method or encounter issues with the online tool, the Department of Revenue also offers a telephone inquiry service. Here's how to use it:

-

Call the Toll-Free Number: Dial 1-800-362-2050 to reach the Pennsylvania Department of Revenue's refund inquiry line. This number is toll-free and available for callers within the United States.

-

Follow the Automated Prompt: When connected, you'll hear an automated message. Follow the prompt to select the option for refund status inquiries.

-

Provide Your Information: The automated system will then prompt you to enter your Social Security Number and other identifying details using the telephone keypad. Ensure you enter the correct information to retrieve accurate status updates.

-

Listen to Your Refund Status: After providing the required information, the system will play a message indicating the status of your refund. It will inform you if your refund has been issued, is still in process, or if there are any issues with your return.

While the telephone inquiry service is useful, it may have longer wait times during peak periods, such as the tax filing season.

Written Inquiries

For those who prefer written communication or need to provide additional information, the Department of Revenue also accepts written inquiries regarding refund status. Here's how to do it:

-

Prepare a Written Request: Write a letter addressed to the Pennsylvania Department of Revenue with your name, address, Social Security Number, and a clear request for your refund status.

-

Include Relevant Details: In your letter, provide any additional information that might be relevant to your refund, such as the tax year in question, the date you filed your return, and any specific concerns or issues you have.

-

Mail Your Letter: Send your written request to the following address: Pennsylvania Department of Revenue, Bureau of Individual Taxes, Refund Inquiries, PO Box 280946, Harrisburg, PA 17128-0946. Ensure you use proper postage and mailing methods.

While written inquiries may take longer to process, they are a useful option for those who prefer this method of communication.

Potential Reasons for Refund Delays

It's important to note that refund delays can occur for various reasons. Some common causes for refund delays include:

- Processing Time: The Department of Revenue processes refunds in batches, and it can take several weeks from the date of filing for your refund to be issued. This processing time is necessary to ensure the accuracy of the refund amount.

- Errors or Inconsistencies: If there are errors or inconsistencies in your tax return, such as missing information or incorrect calculations, it can delay the processing of your refund. The Department of Revenue may need to contact you to resolve these issues before issuing your refund.

- Additional Review: In some cases, the Department of Revenue may select returns for additional review or audit. This is a normal part of the tax process and is not necessarily indicative of a problem with your return. However, it can result in a delay in receiving your refund.

- Identity Verification: To protect against fraud, the Department of Revenue may require additional identity verification for certain refunds. This process can take additional time, but it is essential to ensure the security of your refund.

If you have concerns about the status of your refund or believe there may be an issue, it's important to reach out to the Department of Revenue using one of the methods outlined above. They can provide more detailed information about your specific situation and guide you through any necessary steps to resolve any issues.

Tips for a Smoother Refund Experience

To ensure a smoother refund experience, consider the following tips:

- File Electronically: Electronic filing is the fastest and most accurate way to file your tax return. It reduces the risk of errors and ensures a quicker turnaround time for your refund.

- Use Direct Deposit: Opt for direct deposit when filing your tax return. This method is faster and more secure than receiving a paper check, as it eliminates the risk of lost or stolen mail.

- Review Your Return: Before submitting your tax return, carefully review it for accuracy. Double-check your calculations, ensure all necessary information is included, and verify that your personal and financial details are correct.

- Keep Records: Maintain records of your tax returns and any supporting documentation. This will help you track your refund status and resolve any issues that may arise.

- Stay Informed: Keep up-to-date with the latest tax news and updates from the Pennsylvania Department of Revenue. They often provide important information and notifications about refund processing, potential delays, and any changes to tax laws or regulations.

By following these tips and staying informed, you can navigate the refund process more efficiently and ensure a smoother experience.

Conclusion

Checking the status of your PA state tax refund is a straightforward process, thanks to the various methods provided by the Pennsylvania Department of Revenue. Whether you prefer online tools, telephone inquiries, or written communication, there's an option suited to your needs. Remember to allow for processing time and be aware of potential delays due to errors, additional reviews, or identity verification. By staying informed and following the tips outlined above, you can ensure a smoother refund experience and receive your refund promptly.

What is the estimated processing time for PA state tax refunds?

+The estimated processing time for PA state tax refunds can vary. During peak periods, such as the tax filing season, it may take several weeks from the date of filing for your refund to be issued. However, the Department of Revenue aims to process refunds as quickly and efficiently as possible.

How can I track the progress of my refund if it’s taking longer than expected?

+If your refund is taking longer than expected, you can track its progress using the online refund status tool or by contacting the Department of Revenue through telephone or written inquiries. They can provide specific information about your refund and guide you through any necessary steps to resolve potential issues.

What should I do if I think there’s an error with my refund amount or status?

+If you suspect an error with your refund amount or status, contact the Department of Revenue immediately. They can assist you in resolving any issues and ensure that your refund is processed accurately. Provide them with as much detail as possible about your concern, including any supporting documentation.

Can I change my refund method (from check to direct deposit) after filing my return?

+Changing your refund method after filing your return is generally not possible. It’s important to choose your preferred refund method (check or direct deposit) when filing your tax return. However, if there are extenuating circumstances, you may be able to request a change. Contact the Department of Revenue for guidance on this matter.