Ohio Tax Refund Status

For Ohio residents, understanding the status of their tax refund is crucial, especially when navigating the complex tax system of the state. The Ohio Department of Taxation provides a comprehensive online platform for taxpayers to track their refund status, offering transparency and ease of access. This article aims to provide an in-depth guide on how to check your Ohio tax refund status, covering various methods and offering insights into the process.

Checking Your Ohio Tax Refund Status

The Ohio Department of Taxation offers several convenient ways for taxpayers to check the status of their refunds. Whether you prefer online portals, phone calls, or traditional mail, there's an option suited to your preference.

Online Refund Status Check

The most efficient and widely used method is the online refund status check. The Ohio Department of Taxation's website provides a user-friendly interface where taxpayers can enter their personal information to retrieve their refund status. Here's a step-by-step guide:

- Visit the Ohio Income Tax Refunds page on the official government website.

- Click on the "Check Your Ohio Income Tax Refund Status" link.

- You will be redirected to the Ohio Department of Taxation's eRefund Status Check page.

- Enter your Social Security Number, Refund Amount, and Zip Code. Ensure you enter the exact details as they appear on your tax return.

- Click the "Check Status" button. The system will retrieve your refund information, including the date it was issued and the method of payment.

- If your refund is pending, the system will display an estimated date for when you can expect to receive it. If there are any issues, you'll find information on the next steps you need to take.

The online refund status check is a quick and secure way to stay informed about your tax refund. It's accessible 24/7, ensuring you can check your refund status at your convenience.

Phone Inquiry

For those who prefer a more traditional approach, the Ohio Department of Taxation provides a dedicated phone line for refund status inquiries. Here's how to use this method:

- Call the Ohio Department of Taxation's Refund Hotline at (800) 282-1780 (toll-free within Ohio) or (614) 466-2249 (for callers outside Ohio).

- Follow the automated prompts to select the option for "Refund Status Inquiry".

- You will be asked to enter your Social Security Number and Refund Amount using the keypad on your phone.

- The system will provide you with your refund status, including any relevant dates and payment methods.

Keep in mind that phone lines may be busy during peak tax seasons, so patience may be required. Also, note that the automated system may not provide detailed information, so you may need to speak to a tax representative for further assistance.

Mail Inquiry

The traditional mail method is suitable for those who prefer a more old-school approach or have limited access to online services. Here's how to use this method:

- Write a letter addressed to the Ohio Department of Taxation, including your full name, address, and Social Security Number.

- In your letter, clearly state that you are inquiring about the status of your tax refund and provide the relevant tax year and the amount of the refund.

- Mail your letter to the following address: Ohio Department of Taxation, P.O. Box 182441, Columbus, OH 43218-2441.

- Allow sufficient time for a response, typically 2-3 weeks. The department will mail you a response with the details of your refund status.

While this method is reliable, it is the slowest, so plan accordingly if you need an urgent update on your refund status.

Understanding Your Ohio Tax Refund

Once you have checked your refund status, it's important to understand the various factors that can influence your tax refund. Ohio's tax system is unique, with several considerations that can impact the amount and timing of your refund.

Factors Affecting Your Refund

- Tax Filing Status: Your filing status (single, married filing jointly, head of household, etc.) can significantly impact your tax liability and, consequently, your refund.

- Income Level: Higher incomes may result in more tax liabilities, reducing the amount of your refund. However, certain deductions and credits can help offset this.

- Deductions and Credits: Ohio offers various deductions and credits, such as the Ohio School District Income Tax Credit and the Earned Income Tax Credit, which can reduce your tax liability and increase your refund.

- Withholding Amounts: If you had too much tax withheld from your paycheck, you may receive a larger refund. Conversely, if your withholdings were insufficient, you may owe taxes or receive a smaller refund.

- Filing Errors: Mistakes on your tax return can lead to delays in processing or even audits. Ensure you review your return carefully before submission.

Understanding these factors can help you estimate your refund and take appropriate measures to optimize your tax situation.

Refund Processing Times

The time it takes for your Ohio tax refund to be processed and issued can vary depending on several factors, including the method of filing and payment.

| Filing Method | Processing Time |

|---|---|

| E-filing with Direct Deposit | Approximately 7-14 days |

| Paper Filing with Direct Deposit | 4-6 weeks |

| Paper Filing with Check | 6-8 weeks |

These processing times are estimates and can be affected by various factors, including the accuracy of your return, the volume of tax returns being processed, and any issues with your refund, such as missing information or errors.

Common Issues and Solutions

While most tax refunds are processed smoothly, there can be instances of delays or errors. Understanding common issues and their solutions can help you navigate these situations effectively.

Refund Delays

If your refund is taking longer than expected, there could be several reasons. Here are some common causes of refund delays and their potential solutions:

- Missing or Incomplete Information: If your tax return is missing crucial information, such as your bank account details for direct deposit, it may be held up for further review. Solution: Ensure you provide complete and accurate information when filing your return.

- Errors or Discrepancies: Mistakes on your tax return, such as incorrect Social Security Numbers or math errors, can delay processing. Solution: Carefully review your return for errors before submitting. If you've already filed and discovered an error, amend your return as soon as possible.

- Identity Verification: In some cases, the tax department may require additional identity verification to ensure the security of your refund. Solution: Respond promptly to any requests for verification and provide the required documents.

- Audit: In rare cases, your tax return may be selected for an audit, which can delay your refund. Solution: Cooperate with the tax department and provide the necessary documentation to resolve the audit as quickly as possible.

Refund Errors

Errors can occur during the refund process, leading to incorrect refund amounts or issues with the method of payment. Here are some common refund errors and how to address them:

- Incorrect Refund Amount: If you believe your refund amount is incorrect, compare it to your tax calculations and check for any deductions or credits that may have been overlooked. Solution: If you find an error, contact the Ohio Department of Taxation to request a refund adjustment.

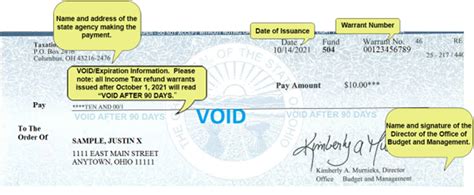

- Direct Deposit Errors: If your direct deposit refund is returned due to incorrect bank account information, the tax department may issue a paper check instead. Solution: Ensure your bank account information is accurate when filing your return. If you receive a paper check, deposit it promptly to avoid potential fees.

- Check Mailing Errors: Occasionally, paper checks may be lost or delayed in the mail. Solution: Wait a reasonable amount of time (usually 2-3 weeks) before contacting the tax department to request a replacement check. Provide them with your refund information and mailing address to facilitate the process.

Staying Informed and Preparing for Next Steps

Checking your Ohio tax refund status is just one part of the tax process. To ensure a smooth experience, it's important to stay informed about the latest tax updates and plan for your next steps.

Staying Informed

The Ohio Department of Taxation regularly updates its website with important tax information and announcements. Staying informed about these updates can help you make timely decisions and avoid potential issues. Here are some resources to stay updated:

- Ohio Department of Taxation Website: Visit the official website regularly for the latest news, tax forms, and guidelines. Ohio Income Tax is a great starting point.

- Email Updates: Sign up for email updates from the tax department to receive notifications about important tax deadlines, changes in regulations, and other relevant information.

- Social Media: Follow the Ohio Department of Taxation on social media platforms like Twitter and Facebook for quick updates and tax tips.

Preparing for Next Steps

Once you've received your tax refund, it's important to plan how you'll use it wisely. Here are some ideas for making the most of your refund:

- Pay Off Debt: Consider using your refund to pay off high-interest debt, such as credit cards or personal loans. This can help improve your financial health and reduce future interest payments.

- Build an Emergency Fund: If you don't have an emergency fund, use your refund to start one. Aim to save enough to cover at least 3-6 months of living expenses to provide a financial safety net.

- Invest in Your Future: Invest your refund in stocks, bonds, or other financial instruments to grow your wealth over time. Consult a financial advisor to determine the best investment strategy for your goals.

- Home Improvements: Use your refund for home repairs or renovations, which can increase the value of your property and provide a more comfortable living environment.

- Education Savings: If you have children or are planning for your own education, consider putting your refund into a 529 college savings plan or other education savings accounts.

Remember, the key to making the most of your tax refund is to plan ahead and use it wisely. With proper financial management, your tax refund can contribute to a more secure and comfortable future.

Conclusion

Checking your Ohio tax refund status is a straightforward process, thanks to the various methods provided by the Ohio Department of Taxation. Whether you prefer online tools, phone inquiries, or traditional mail, you can easily stay informed about your refund. Understanding the factors that affect your refund, common issues, and potential delays can help you navigate the tax process more smoothly. By staying informed and planning your next steps wisely, you can make the most of your tax refund and work towards your financial goals.

How long does it take to receive my Ohio tax refund after filing electronically with direct deposit?

+

You can typically expect to receive your Ohio tax refund within 7-14 days after filing electronically with direct deposit. However, it’s important to note that processing times may vary based on the accuracy and completeness of your tax return, as well as the volume of tax returns being processed.

What should I do if I haven’t received my Ohio tax refund within the estimated timeframe?

+

If you haven’t received your Ohio tax refund within the estimated timeframe, it’s recommended to first check the status of your refund online or by phone to see if there are any processing delays or issues. If the status indicates a problem, you may need to contact the Ohio Department of Taxation for further assistance. Ensure you have your tax return information and any relevant documentation ready when contacting them.

Can I check the status of my Ohio tax refund if I filed my return on paper?

+

Yes, you can check the status of your Ohio tax refund even if you filed your return on paper. The Ohio Department of Taxation provides online and phone options for refund status inquiries. When checking the status, ensure you have your Social Security Number, the amount of your expected refund, and your mailing address ready.

What if I notice an error in my Ohio tax refund amount or payment method?

+

If you notice an error in your Ohio tax refund amount or payment method, you should contact the Ohio Department of Taxation as soon as possible. They will guide you on the steps to take to rectify the error. It’s important to provide accurate and complete information when contacting them to ensure a swift resolution.