Wake County Tax Bill Search

Welcome to our comprehensive guide on exploring the Wake County Tax Bill Search system. In this article, we delve into the intricacies of this essential service, shedding light on its functionality, benefits, and impact on property owners in Wake County. By the end of this exploration, you'll have a thorough understanding of how the Tax Bill Search works and its significance in the local real estate landscape.

Understanding the Wake County Tax Bill Search

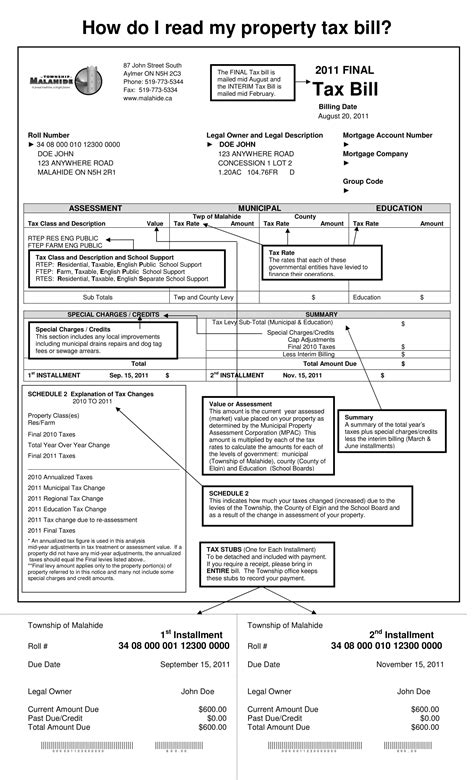

The Wake County Tax Bill Search is an online platform that provides residents and stakeholders with access to vital property tax information. It serves as a transparent and user-friendly interface, offering a wealth of data related to property taxes, assessments, and billing. This innovative tool has revolutionized the way property owners engage with their tax obligations, making the process more accessible and efficient.

The platform's primary objective is to empower property owners with knowledge and control over their tax-related matters. By leveraging the Tax Bill Search, individuals can easily retrieve detailed information about their property's tax status, including current and historical tax bills, assessment values, and payment due dates. This level of transparency fosters trust and enables homeowners to make informed decisions regarding their financial obligations.

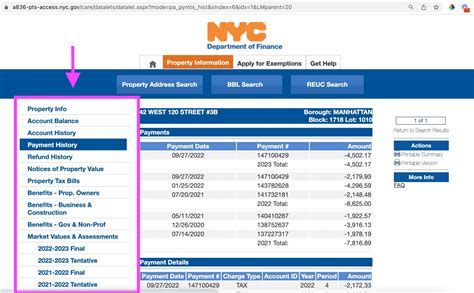

Moreover, the Wake County Tax Bill Search goes beyond basic tax information. It incorporates advanced features that enhance user experience and provide additional value. One notable feature is the ability to track tax bill payments and view payment histories. This ensures that property owners have a clear overview of their financial contributions and helps them stay organized and up-to-date with their tax responsibilities.

Key Features and Benefits

The Wake County Tax Bill Search offers a range of features that cater to the diverse needs of property owners and stakeholders. Let’s explore some of the key benefits that make this platform an indispensable tool:

- Quick and Accurate Information Retrieval: Users can access detailed tax information within seconds, eliminating the need for lengthy searches or manual data collection. This efficiency saves time and effort, allowing property owners to focus on other important tasks.

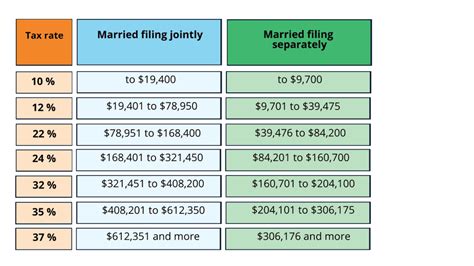

- Transparent Assessment Values: The platform provides transparent and up-to-date assessment values for each property. This transparency ensures that property owners have a clear understanding of their property's worth and how it contributes to their tax obligations.

- Payment Tracking and Due Date Reminders: With the Tax Bill Search, users can conveniently track their tax bill payments and receive timely reminders for upcoming due dates. This feature helps prevent late payments and associated penalties, ensuring a stress-free tax management experience.

- Historical Data Analysis: Access to historical tax bill data enables property owners to analyze trends, identify patterns, and make informed decisions regarding future tax planning. This long-term perspective empowers individuals to optimize their financial strategies and manage their property effectively.

- Secure and Reliable Data: The Wake County Tax Bill Search employs robust security measures to protect sensitive tax information. Users can trust that their data is handled with the utmost confidentiality and integrity, ensuring peace of mind when accessing their property's tax details.

Navigating the Wake County Tax Bill Search

Now that we’ve explored the features and benefits, let’s dive into a step-by-step guide on how to navigate the Wake County Tax Bill Search effectively:

Step 1: Access the Platform

To begin, visit the official Wake County website and locate the Tax Bill Search portal. The link is typically easily accessible from the homepage, ensuring a seamless user experience. Once you’ve accessed the portal, you’ll be greeted with a user-friendly interface designed for simplicity and efficiency.

Step 2: Enter Property Details

On the search page, you’ll be prompted to enter specific details about the property you’re inquiring about. This typically includes the property address, owner’s name, or parcel number. The platform’s advanced search capabilities ensure accurate results, even with minimal input.

Step 3: Retrieve Tax Information

After providing the necessary details, the platform will generate a comprehensive report containing vital tax information. This report includes current tax bills, assessment values, and historical data. Users can easily navigate through the report, accessing the specific details they require.

Step 4: Payment and Due Date Management

The Wake County Tax Bill Search also provides a dedicated section for payment management. Here, users can view their payment history, track upcoming due dates, and access information on how to make payments. This centralized payment system simplifies the process and ensures timely contributions.

Step 5: Explore Additional Resources

Beyond tax bill retrieval and payment management, the platform offers a wealth of additional resources. These resources include tax-related forms, guidelines, and educational materials. Users can explore these resources to enhance their understanding of property taxes and optimize their financial strategies.

| Feature | Description |

|---|---|

| Tax Bill Search | Quickly retrieve current and historical tax bills for a specific property. |

| Assessment Values | Access transparent and up-to-date assessment values, ensuring understanding of property worth. |

| Payment Tracking | Conveniently track tax bill payments and receive reminders for upcoming due dates. |

| Historical Data Analysis | Analyze long-term tax bill trends and make informed financial decisions. |

| Secure Data Handling | Confidentially and securely manage sensitive tax information. |

Future Implications and Enhancements

As technology continues to advance, the Wake County Tax Bill Search is poised for further enhancements. The platform’s developers are committed to staying at the forefront of innovation, ensuring that the system remains user-friendly, efficient, and secure. Here’s a glimpse into some potential future developments:

Integration with Mobile Devices

With the increasing reliance on mobile technology, the development team is exploring ways to integrate the Tax Bill Search with mobile devices. This integration would allow users to access their tax information on the go, providing even greater convenience and accessibility.

Advanced Data Visualization

To enhance the user experience, the platform may incorporate advanced data visualization techniques. This could involve interactive charts, graphs, and maps that provide a more intuitive understanding of tax data, making it easier for users to analyze and interpret their property’s tax information.

Enhanced Security Measures

As cyber threats evolve, the Wake County Tax Bill Search will continue to implement robust security measures. This includes regular security audits, encryption protocols, and user authentication enhancements to safeguard sensitive tax data and protect user privacy.

Integration with Other County Services

The platform’s developers are exploring opportunities to integrate the Tax Bill Search with other county services. This integration would create a seamless experience for users, allowing them to access multiple county services from a single platform. This could include integration with property records, permitting, and other relevant services.

User Feedback and Continuous Improvement

The development team highly values user feedback and actively seeks input to enhance the platform. By listening to user experiences and suggestions, they can continuously improve the Tax Bill Search, ensuring it remains relevant, user-friendly, and responsive to the needs of the community.

Conclusion

The Wake County Tax Bill Search has revolutionized the way property owners engage with their tax obligations. By providing transparent, accessible, and efficient tax information, the platform empowers individuals to take control of their financial responsibilities. As the platform continues to evolve, it will remain a vital resource for property owners, ensuring a seamless and stress-free tax management experience.

How often is the Wake County Tax Bill Search updated with new information?

+The Wake County Tax Bill Search is updated on a regular basis to ensure that the information provided is accurate and up-to-date. Typically, updates are made annually, coinciding with the tax assessment cycle. However, in certain cases, such as changes in property ownership or significant reassessments, updates may be made more frequently to reflect the latest data.

Can I access historical tax bill data for multiple years using the platform?

+Absolutely! The Wake County Tax Bill Search provides access to historical tax bill data, allowing users to retrieve information for multiple years. This feature is particularly useful for analyzing long-term tax trends, comparing assessments, and planning future financial strategies. Users can easily navigate through the platform to access the specific historical data they require.

Is the Wake County Tax Bill Search accessible to all property owners, regardless of their technical expertise?

+Absolutely! The Wake County Tax Bill Search is designed with user-friendliness in mind, making it accessible to property owners with varying levels of technical expertise. The platform’s intuitive interface and straightforward search process ensure that even those unfamiliar with technology can easily retrieve the information they need. The development team prioritizes simplicity and ease of use to ensure a positive user experience for all.