Pay Property Tax Nyc

Paying property taxes in New York City is an essential task for homeowners and property owners alike. Understanding the process and the various methods available can simplify what might otherwise seem like a daunting task. This comprehensive guide will walk you through the steps to pay your property taxes in NYC, ensuring a seamless and efficient experience.

Understanding Property Taxes in NYC

In New York City, property taxes are a crucial source of revenue for the local government, contributing to the maintenance and development of various public services and infrastructure. These taxes are assessed on both residential and commercial properties, and the amount owed is based on the property's assessed value.

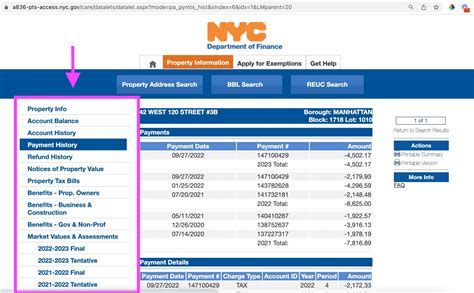

The Department of Finance (DOF) is responsible for managing property taxes in NYC. They determine the assessed value of properties, send out tax bills, and provide various payment options to property owners. It's important for homeowners and property owners to stay informed about their tax obligations and the due dates to avoid any penalties.

Assessed Value and Tax Rates

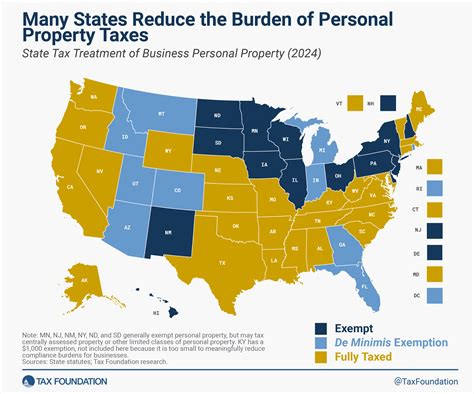

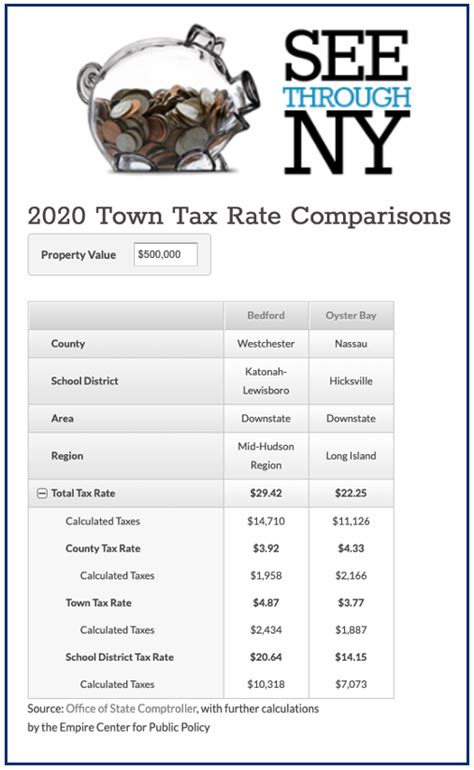

The assessed value of a property is determined by the DOF through regular assessments. This value is then multiplied by the applicable tax rate, which can vary depending on the property's location and type. For instance, commercial properties often have different tax rates compared to residential properties.

The tax rate is typically expressed as a percentage and is subject to change annually. It's essential to stay updated on the current tax rate to accurately calculate the amount owed.

Tax Bills and Due Dates

Property owners in NYC receive tax bills from the DOF, outlining the assessed value of their property, the applicable tax rate, and the total amount due. These bills are typically sent out twice a year, with due dates falling in January and July. However, it's crucial to verify the specific due dates as they can vary slightly based on the property's location and assessment cycle.

Failing to pay property taxes on time can result in penalties and interest charges, which can quickly accumulate. It's therefore advisable to plan and budget for these expenses to ensure timely payments.

Methods to Pay Property Taxes in NYC

The NYC Department of Finance offers a range of convenient payment methods to cater to different preferences and circumstances. Here's an overview of the primary ways to pay your property taxes:

Online Payment

The most popular and convenient method is to pay your property taxes online through the DOF's official website. This method allows you to make payments using a credit card, debit card, or electronic check (eCheck). It's a secure and efficient process, and you'll receive immediate confirmation of your payment.

To make an online payment, you'll need your property's unique BORIS (Building Owner Reference Information System) number, which can be found on your tax bill. Follow these steps:

- Visit the DOF's Online Payment Portal.

- Enter your BORIS number and the amount you wish to pay.

- Choose your preferred payment method (credit card, debit card, or eCheck) and provide the necessary details.

- Review the payment summary and confirm the transaction.

- You'll receive an email confirmation with your payment details.

Online payments are processed instantly, ensuring a quick and hassle-free experience.

Telephone Payment

If you prefer not to make an online payment, you can also pay your property taxes over the phone. The DOF provides a dedicated telephone payment system, which allows you to make payments using your credit or debit card.

To make a telephone payment, follow these steps:

- Call the DOF's Telephone Payment Line at 1-888-NYC-TAXES (1-888-692-8297) from within the United States, or 1-917-333-8877 if you're calling from outside the US.

- Follow the automated prompts to enter your BORIS number and the amount you wish to pay.

- Provide your credit or debit card details when prompted.

- Confirm the transaction details and complete the payment.

- You'll receive a confirmation number for your records.

Telephone payments are processed securely and provide an alternative to online payment methods.

In-Person Payment

For those who prefer a more traditional approach, the DOF offers in-person payment options at designated locations. You can visit these locations to pay your property taxes using cash, check, money order, or credit/debit card.

To make an in-person payment, you'll need to bring your tax bill and the exact amount due. Here are the steps:

- Locate the nearest DOF Customer Service Center or Payment Processing Center using the DOF Location Finder.

- Visit the chosen location during their operating hours.

- Present your tax bill and the payment method of your choice.

- Receive a receipt as proof of payment.

It's important to note that some locations may have specific hours or days for accepting cash payments, so it's advisable to check beforehand.

Other Payment Methods

In addition to the above methods, the DOF offers other payment options to cater to different needs:

- Electronic Funds Transfer (EFT): This method allows you to set up automatic payments from your bank account. You'll need to complete an EFT Enrollment Form and submit it to the DOF.

- Mobile Payment Apps: You can also use mobile payment apps like Zelle or Venmo to send payments to the DOF's official account.

- Mail-In Payment: If you prefer to mail your payment, you can send a check or money order along with your tax bill to the address provided on the bill.

Frequently Asked Questions (FAQs)

Can I pay my property taxes in installments?

+Yes, the DOF offers a Property Tax Installment Payment Program (PTIP) for eligible homeowners. This program allows you to spread your tax payments over 10 months, making it more manageable. To enroll, you must meet certain income and property value requirements. Visit the PTIP Program page for more details.

What happens if I miss a property tax payment deadline?

+If you miss a payment deadline, you may be subject to late fees and interest charges. The DOF sends out penalty notices, and it's important to address any missed payments promptly to avoid further penalties. You can make a late payment using any of the methods mentioned earlier.

How can I dispute my property's assessed value or tax rate?

+If you believe your property's assessed value or tax rate is incorrect, you have the right to file a tax grievance. The DOF provides a Property Tax Grievance Guide with detailed instructions on how to file a grievance. It's important to gather supporting evidence and submit your grievance within the specified timeframe.

Are there any tax exemptions or discounts available for property owners in NYC?

+Yes, NYC offers various tax exemption programs to eligible property owners. These programs include the Senior Citizen Rent and Property Tax Exemption, Veterans' Exemption, and Star (Basic STAR) Exemption for homeowners. Visit the DOF Tax Exemptions page for more information on eligibility and how to apply.

Can I pay my property taxes using a credit card without incurring additional fees?

+Yes, the DOF does not charge additional fees for credit card payments made online or over the phone. However, please note that some third-party payment processors may charge a convenience fee for credit card transactions. To avoid these fees, consider using a debit card or eCheck instead.

Paying property taxes in NYC is a crucial responsibility for property owners. By understanding the process, due dates, and various payment methods, you can ensure timely and accurate payments. Whether you choose to pay online, over the phone, in person, or through other methods, the DOF provides a range of options to cater to different preferences. Stay informed, plan ahead, and take advantage of the available resources to navigate the property tax process seamlessly.