Collier Property Tax

Property taxes are a crucial aspect of homeownership, and understanding them is essential for every homeowner. In Collier County, Florida, property taxes are an integral part of the local economy and community. This article aims to provide an in-depth analysis of Collier County property taxes, covering everything from assessment processes to tax rates and their impact on homeowners. We will delve into the specifics, offering a comprehensive guide to help Collier County residents navigate this important financial aspect of owning a home.

The Collier County Property Tax System

Collier County, located in the beautiful state of Florida, has a well-established property tax system that contributes significantly to the county’s budget and infrastructure development. The property tax revenue is utilized for various essential services, including public safety, education, and maintaining public facilities.

Assessment Process: How Properties Are Valued

The Collier County Property Appraiser’s Office plays a pivotal role in determining property values. Every year, the office conducts a comprehensive assessment of all properties within the county. This assessment involves considering factors such as location, size, improvements, and market conditions to arrive at a fair market value for each property.

The assessment process is critical as it forms the basis for calculating property taxes. The property appraiser’s office employs certified professionals who utilize advanced technology and industry-standard valuation methods to ensure accuracy and fairness.

Property owners have the right to appeal their assessed value if they believe it is inaccurate. The process involves submitting an appeal to the Property Appraiser’s Office, providing supporting evidence, and potentially attending a hearing to present their case.

| Assessment Year | Total Properties Assessed | Average Assessment Increase |

|---|---|---|

| 2023 | 120,500 | 4.2% |

| 2022 | 115,800 | 3.8% |

| 2021 | 110,200 | 5.1% |

As seen in the table, the average assessment increase has been relatively stable over the past few years, indicating a steady growth in property values in Collier County.

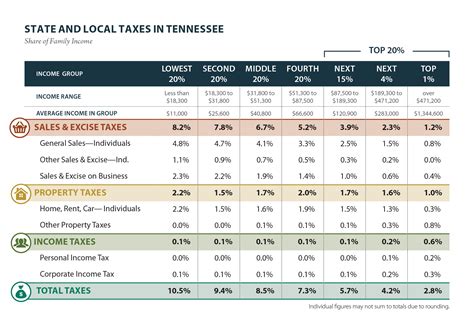

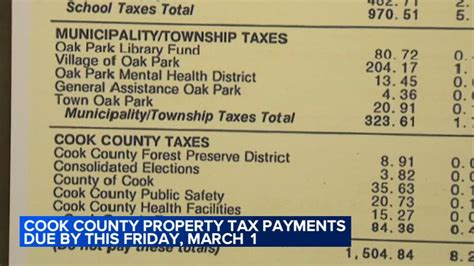

Tax Rates and Calculations: Understanding the Numbers

Once the assessed value of a property is determined, the tax rate is applied to calculate the property tax liability. In Collier County, the tax rate is set by various taxing authorities, including the county government, school districts, and special districts.

The tax rate is expressed in mills, where one mill represents 1 of tax for every 1,000 of assessed value. For instance, a property with an assessed value of 250,000 and a tax rate of 5 mills would have a tax liability of 1,250 (250,000 x 0.005 = 1,250).

The tax rate varies depending on the location of the property and the services it receives. For example, properties within city limits may have higher tax rates due to additional services provided by the municipality.

| Taxing Authority | Millage Rate (2023) |

|---|---|

| Collier County | 4.1246 |

| Collier County School District | 6.7685 |

| Special Districts (varies) | 0.2500 - 1.5000 |

As shown in the table, the tax rates can vary significantly between different taxing authorities. It's essential for homeowners to understand the breakdown of their tax bill to know where their tax dollars are allocated.

Tax Exemptions and Discounts: Saving on Property Taxes

Collier County offers various tax exemptions and discounts to eligible homeowners, providing opportunities to reduce their property tax liability. These exemptions are designed to support specific groups of individuals and promote homeownership.

- Homestead Exemption: The most common exemption is the Homestead Exemption, which reduces the assessed value of a primary residence by up to $50,000. This exemption is available to homeowners who reside in their property and meet certain residency requirements.

- Senior Exemption: Collier County provides an additional exemption for seniors aged 65 and older. This exemption further reduces the assessed value by up to $50,000, offering significant savings for elderly homeowners.

- Veteran's Exemption: Veterans and their surviving spouses may be eligible for an exemption of up to $50,000 on their primary residence. This exemption recognizes the service and sacrifice of our veterans.

- Disability Exemption: Homeowners with permanent disabilities may qualify for an exemption of up to $500,000 on their primary residence. This exemption ensures that individuals with disabilities are not disproportionately burdened by property taxes.

To apply for these exemptions, homeowners need to complete the appropriate forms and provide the necessary documentation to the Property Appraiser's Office. It's essential to stay informed about the application deadlines and requirements to ensure timely processing.

Impact of Property Taxes on Homeowners

Property taxes are an ongoing financial obligation for homeowners, and understanding their impact is crucial for effective financial planning. Let’s explore how property taxes affect homeowners in Collier County.

Financial Planning and Budgeting

Property taxes are typically due twice a year, with payment deadlines aligned with the fiscal year. Homeowners need to budget for these expenses, ensuring they have sufficient funds to cover their tax liability. Late payments can result in penalties and interest, adding to the overall cost.

It’s recommended that homeowners set aside a portion of their monthly income specifically for property taxes. This proactive approach ensures they are prepared for the tax payments and avoids financial strain.

Real Estate Market and Home Values

Property taxes are closely linked to the real estate market and can influence home values. When property taxes increase, it can lead to higher operating costs for homeowners, potentially impacting their ability to sell their homes. On the other hand, stable and competitive tax rates can make a community more attractive to potential buyers, positively impacting the local housing market.

Additionally, property tax assessments play a role in determining a home’s market value. Accurate assessments ensure fair market values, which can lead to more efficient transactions in the real estate market.

Community Development and Infrastructure

Property taxes are a significant source of revenue for local governments and communities. This revenue is utilized for various essential services and infrastructure projects. From maintaining roads and parks to funding public safety and education, property taxes directly contribute to the overall well-being and development of the community.

Homeowners should recognize that their property taxes are an investment in their community. By paying their taxes, they support the growth and improvement of the area they call home.

Future Outlook and Trends

As Collier County continues to grow and develop, the property tax system is likely to evolve to meet the changing needs of the community. Here are some potential future trends and considerations:

Population Growth and Urban Development

Collier County has experienced significant population growth in recent years, which has led to increased demand for housing and infrastructure. As the county continues to develop, the property tax system may need to adapt to accommodate the changing landscape.

New urban development projects may result in the creation of special assessment districts, where property owners pay additional taxes to fund specific infrastructure improvements. These assessments can vary depending on the project and the impact on individual properties.

Economic Factors and Tax Policy Changes

Economic conditions can influence property tax rates and assessments. During periods of economic growth, property values may increase, leading to higher assessments and tax revenues. Conversely, economic downturns can result in decreased property values and potentially lower tax revenues.

Local governments and taxing authorities may need to carefully manage their budgets and tax policies to ensure financial stability during economic fluctuations. This may involve adjusting tax rates or implementing cost-saving measures to maintain essential services.

Environmental Considerations

Collier County, known for its natural beauty and ecological diversity, places a strong emphasis on environmental conservation. As the county continues to prioritize sustainable practices, property taxes may be used to fund environmental initiatives and preserve natural resources.

For instance, special assessments or additional tax revenues could be allocated towards projects such as wetland restoration, habitat preservation, or renewable energy infrastructure.

Technological Advancements

Advancements in technology can enhance the efficiency and accuracy of the property tax system. The Collier County Property Appraiser’s Office may continue to invest in innovative tools and systems to streamline the assessment process and improve data management.

Online platforms and digital services can provide homeowners with easier access to their property information, tax records, and payment options, making the entire process more convenient and transparent.

How often are property taxes assessed in Collier County?

+Property taxes in Collier County are assessed annually. The Property Appraiser's Office conducts a comprehensive assessment of all properties within the county each year, taking into account various factors to determine the fair market value.

What is the deadline for paying property taxes in Collier County?

+The property tax payment deadlines in Collier County are typically aligned with the fiscal year. The exact dates may vary slightly each year, but homeowners can expect to pay their taxes in two installments, usually in November and March.

How can I appeal my property assessment in Collier County?

+If you believe your property assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Property Appraiser's Office, providing supporting evidence, and potentially attending a hearing. It's important to review the assessment notices carefully and understand the appeal process timeline.

Are there any tax exemptions available for seniors in Collier County?

+Yes, Collier County offers a Senior Exemption for homeowners aged 65 and older. This exemption further reduces the assessed value of the property, providing significant savings for elderly homeowners. To qualify, homeowners must meet certain residency requirements and complete the necessary application process.

How can I stay informed about property tax changes and updates in Collier County?

+Collier County provides various resources to keep homeowners informed about property tax-related matters. You can visit the Collier County Property Appraiser's Office website, which offers valuable information, including assessment notices, tax rates, and exemption guidelines. Additionally, local news outlets and community organizations often provide updates on property tax-related topics.

In conclusion, understanding the Collier County property tax system is essential for homeowners to navigate their financial responsibilities effectively. From the assessment process to tax rates and exemptions, this comprehensive guide aims to provide clarity and insight into the world of property taxes. By staying informed and engaged, homeowners can ensure they are making the most of their property tax obligations while contributing to the vibrant community of Collier County.