Colorado Tax Refund Status

The Colorado Tax Refund Status is a topic of interest for many residents and individuals who have filed tax returns in the state. Understanding the status of your tax refund and the processes involved can help alleviate concerns and provide clarity on when to expect your refund. This article aims to provide a comprehensive guide, offering insights into the various aspects of the Colorado tax refund system, including the online tools, the typical timeline, and strategies to ensure a smooth and timely refund process.

Unraveling the Colorado Tax Refund Process

The process of obtaining a tax refund in Colorado involves several steps, each with its own timeline and requirements. By breaking down these steps, individuals can better navigate the system and anticipate the status of their refunds.

Step 1: Filing Your Colorado Tax Return

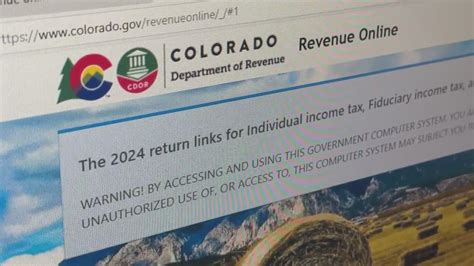

The journey towards receiving a tax refund begins with the accurate and timely filing of your Colorado tax return. The Colorado Department of Revenue provides various methods for filing, including online options through their official website. It’s important to ensure that all necessary forms and supporting documents are included to avoid delays.

| Filing Method | Description |

|---|---|

| Online Filing | The most common method, offering convenience and a faster refund process. Colorado's online filing system, Colorado eFile, allows taxpayers to file their state returns electronically. |

| Paper Filing | An option for those who prefer a more traditional approach. Taxpayers can download and print forms from the Department of Revenue's website or request them by mail. |

Once your tax return is filed, the next step is to understand the status and progress of your refund.

Step 2: Checking Your Refund Status

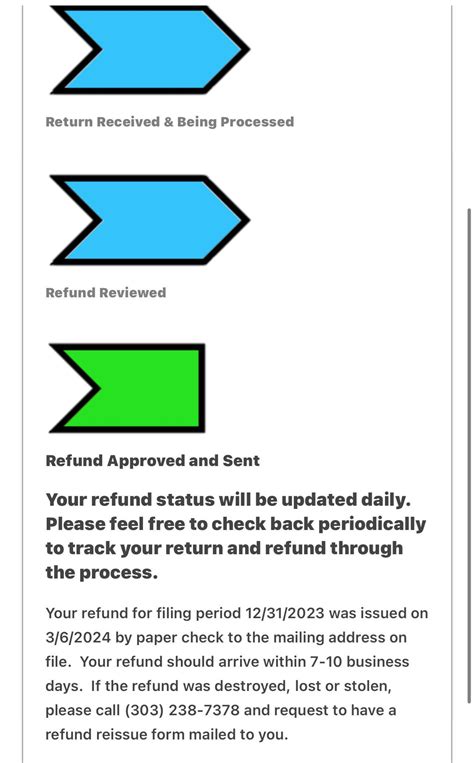

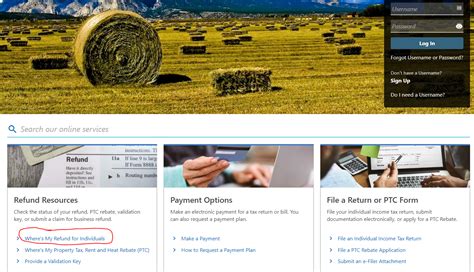

The Colorado Department of Revenue offers several tools to help taxpayers check the status of their tax refunds. These tools provide real-time updates, allowing individuals to track the progress of their refunds and receive notifications when their refunds are issued.

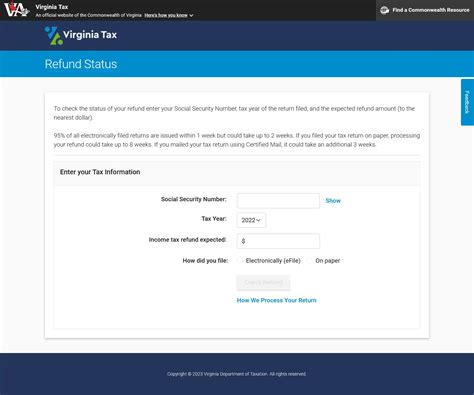

- Online Refund Status Tool: Accessible through the Colorado Department of Revenue's website, this tool requires taxpayers to input their Social Security Number, date of birth, and the amount of their expected refund. It provides an instant update on the status of their refund.

- Telephone Refund Hotline: For those who prefer a more traditional approach, the Department of Revenue operates a toll-free hotline. Taxpayers can call this number and follow the automated prompts to receive information about their refund status.

- Refund Status Updates by Email: Subscribing to email updates is another convenient way to stay informed. Taxpayers can receive notifications directly to their inbox, alerting them when their refund has been processed and issued.

These tools ensure that taxpayers can actively monitor the progress of their refunds and address any potential delays or issues promptly.

Step 3: Understanding the Refund Timeline

The timeline for receiving a Colorado tax refund varies depending on the method of filing and the complexity of the return. On average, taxpayers can expect to receive their refunds within 21 business days after their return is accepted. However, it’s important to note that this timeline is an estimate and may be influenced by several factors.

| Filing Method | Average Refund Timeline |

|---|---|

| Online Filing | Refunds are typically issued within 21 business days, with some taxpayers receiving their refunds even sooner. |

| Paper Filing | The processing time for paper returns is slightly longer, with refunds usually issued within 30 to 45 days after the return is received. |

It's worth mentioning that the Colorado Department of Revenue processes refunds in the order they are received, and taxpayers may experience slight variations in the timeline based on the volume of returns being processed.

Step 4: Resolving Refund Delays and Issues

In some cases, taxpayers may encounter delays or issues with their tax refunds. These situations can arise due to various reasons, including errors in the tax return, missing information, or identity verification concerns.

- Error Corrections: If an error is identified during the processing of your tax return, the Department of Revenue will send a notice outlining the issue. It's crucial to address these errors promptly to avoid further delays. Taxpayers can correct errors online or by mail, following the instructions provided in the notice.

- Missing Information: Incomplete returns can also lead to delays. If additional information is required, the Department of Revenue will contact the taxpayer directly. Responding promptly to these requests is essential to expedite the refund process.

- Identity Verification: To protect against fraud, the Department of Revenue may implement additional security measures, including identity verification. This process may involve providing further documentation or completing additional forms. Complying with these measures is necessary to receive your refund.

By staying proactive and addressing any issues promptly, taxpayers can minimize delays and ensure a smoother refund process.

Maximizing Your Colorado Tax Refund

While understanding the refund process is crucial, taxpayers can also take proactive steps to maximize their tax refunds. By exploring tax credits and deductions, individuals can potentially reduce their tax liability and increase their refund amount.

Tax Credits and Deductions

Colorado offers a range of tax credits and deductions that can benefit taxpayers. These incentives are designed to support various sectors and promote economic growth within the state. By claiming these credits and deductions, taxpayers can potentially reduce their tax burden and increase their refund.

- State Tax Credits: Colorado provides several tax credits, including the Child and Dependent Care Credit, the Working Family Credit, and the Military Family Relief Credit. These credits can offset a portion of your tax liability, providing financial relief to eligible taxpayers.

- Deductions for Residents: Residents of Colorado can benefit from various deductions, such as the Standard Deduction and the Medical and Dental Expenses Deduction. These deductions reduce the taxable income, resulting in a lower tax liability and a potentially larger refund.

- Business Tax Incentives: Colorado offers tax incentives for businesses operating within the state. These incentives can take the form of tax credits, deductions, or reduced tax rates, encouraging business growth and job creation. By taking advantage of these incentives, businesses can not only reduce their tax burden but also contribute to the state's economy.

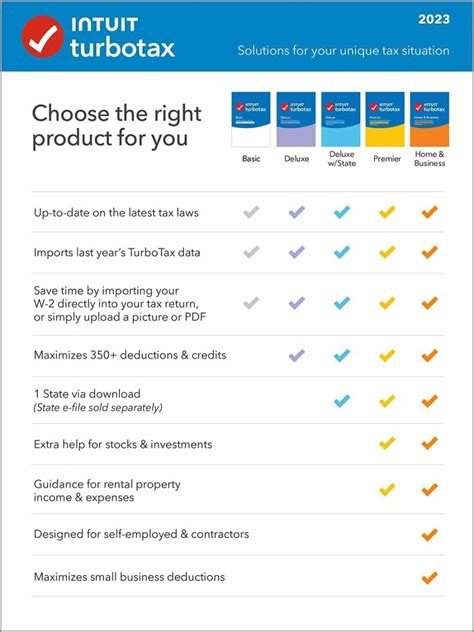

It's important to consult with a tax professional or utilize reputable tax preparation software to ensure that you're maximizing your tax credits and deductions. By claiming all eligible credits and deductions, taxpayers can optimize their tax refunds and potentially receive a larger return.

Strategic Tax Planning

In addition to claiming tax credits and deductions, strategic tax planning can further enhance your tax refund. By carefully managing your finances and exploring tax-efficient strategies, you can potentially reduce your tax liability and increase your refund.

- Retirement Account Contributions: Contributing to retirement accounts, such as a 401(k) or IRA, can provide tax benefits. These contributions are often tax-deductible, reducing your taxable income and potentially lowering your tax liability. Additionally, the growth within these accounts is typically tax-deferred, further enhancing the tax advantages.

- Educational Expenses: If you or your dependents are pursuing higher education, you may be eligible for tax deductions or credits related to educational expenses. These can include tuition fees, books, and other qualified educational expenses. By claiming these deductions or credits, you can reduce your taxable income and potentially increase your refund.

- Energy-Efficient Home Improvements: Colorado offers tax credits for energy-efficient home improvements. By investing in energy-saving upgrades, such as solar panels or energy-efficient appliances, you can not only reduce your energy costs but also qualify for tax credits. These credits can offset a portion of the cost of these improvements, providing a financial incentive for making environmentally conscious choices.

Working with a tax professional or utilizing tax planning tools can help you identify strategies that align with your financial goals and maximize your tax refund. By implementing these strategies, you can potentially reduce your tax liability and receive a larger refund.

Conclusion: Navigating the Colorado Tax Refund Landscape

Understanding the Colorado tax refund process and taking proactive steps to maximize your refund can significantly impact your financial situation. By staying informed about the refund timeline, utilizing the available tools to track your refund status, and exploring tax credits and deductions, you can ensure a smooth and beneficial refund experience.

Additionally, strategic tax planning can further enhance your refund, allowing you to potentially reduce your tax liability and increase your return. By leveraging the resources and incentives offered by the state, you can make the most of your tax refund and plan for a more financially secure future.

Remember, staying organized, keeping accurate records, and seeking professional advice when needed are key to a successful tax refund journey. With the right approach and knowledge, you can navigate the Colorado tax refund landscape with confidence and optimize your financial outcomes.

How do I check the status of my Colorado tax refund online?

+

To check the status of your Colorado tax refund online, you can use the Colorado Department of Revenue’s online refund status tool. This tool requires your Social Security Number, date of birth, and the amount of your expected refund. It provides an instant update on the status of your refund.

What is the average processing time for a Colorado tax refund?

+

The average processing time for a Colorado tax refund is typically around 21 business days for online filings and 30 to 45 days for paper filings. However, it’s important to note that this timeline can vary based on the volume of returns being processed.

What should I do if my Colorado tax refund is delayed or I receive an error message?

+

If your Colorado tax refund is delayed or you receive an error message, it’s important to address the issue promptly. Check your tax return for errors or missing information. If needed, contact the Colorado Department of Revenue’s Taxpayer Service Division for assistance. They can provide guidance on resolving errors and processing your refund.

Are there any tax credits or deductions I can claim to increase my Colorado tax refund?

+

Yes, Colorado offers various tax credits and deductions that can help increase your tax refund. These include the Child and Dependent Care Credit, the Working Family Credit, and deductions for medical and dental expenses, among others. It’s beneficial to explore these options and consult a tax professional to maximize your refund.

Can I receive my Colorado tax refund via direct deposit?

+

Yes, you can opt for direct deposit when filing your Colorado tax return. This option is available for both online and paper filings. By providing your banking information, you can receive your refund directly into your account, typically within the estimated processing time.