Lakewood Income Tax

Welcome to our in-depth exploration of the Lakewood Income Tax, a crucial aspect of financial management for residents and businesses within the vibrant city of Lakewood, Ohio. This comprehensive guide aims to provide an expert understanding of the income tax landscape in Lakewood, offering valuable insights and practical information to navigate this essential financial obligation.

Understanding the Lakewood Income Tax System

The city of Lakewood, nestled in Cuyahoga County, Ohio, boasts a robust economic ecosystem, making it an ideal setting for businesses and individuals to thrive. At the heart of this financial landscape is the Lakewood Income Tax, a system designed to contribute to the city’s prosperity while offering a fair and efficient approach to taxation.

Lakewood's income tax system operates under the principles of progressivity and equity, ensuring that individuals and businesses with higher earnings contribute proportionally more to the city's revenue stream. This approach not only fosters a sense of fairness but also aligns with the city's commitment to sustainable economic growth.

For residents and businesses, understanding the nuances of the Lakewood Income Tax is essential for effective financial planning and compliance. Let's delve into the key aspects that define this tax system.

Tax Rates and Structure

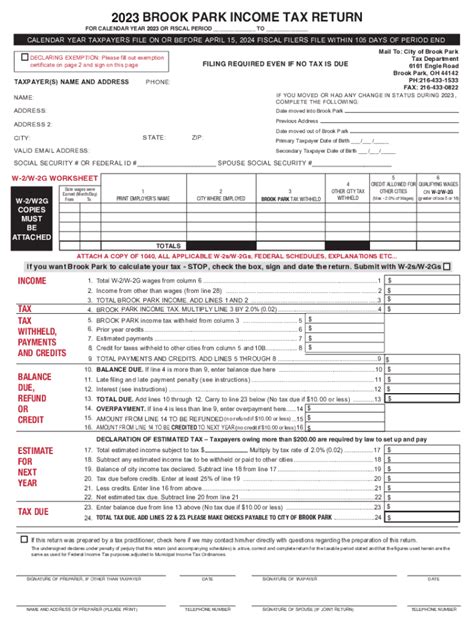

The Lakewood Income Tax is structured with a flat rate system, ensuring simplicity and transparency. Currently, the tax rate stands at 2% for residents and businesses, which is applied to earned income within the city limits. This rate is competitive within the region, offering a balanced approach to taxation without placing an excessive burden on taxpayers.

| Tax Type | Rate |

|---|---|

| Resident Income Tax | 2% |

| Non-Resident Income Tax | 2% |

| Business Income Tax | 2% |

However, it's important to note that the tax rate is subject to periodic review by the city council to align with economic trends and ensure the city's fiscal health. Any changes in the tax rate are typically announced well in advance, allowing taxpayers to adjust their financial strategies accordingly.

Taxable Income and Exemptions

The Lakewood Income Tax applies to a wide range of earned income, including wages, salaries, commissions, bonuses, and other forms of compensation. This comprehensive approach ensures that all income sources are fairly taxed, contributing to the city’s overall revenue.

However, the tax system also recognizes certain exemptions to provide relief to specific income types. For instance, income derived from certain government bonds and pensions is often exempt from taxation, allowing retirees and investors to enjoy a reduced tax burden. Additionally, certain types of disability income and unemployment benefits may also be exempt, offering financial relief during challenging times.

Tax Filing and Payment

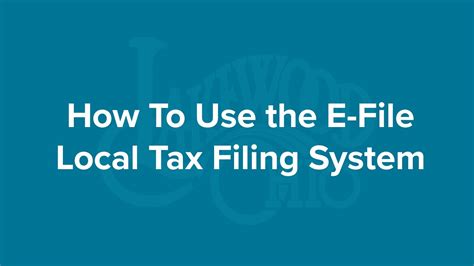

Lakewood’s income tax system is designed with taxpayer convenience in mind, offering electronic filing options for both individuals and businesses. The Lakewood Tax Department provides an online platform where taxpayers can register, file their returns, and make payments securely. This digital approach not only streamlines the tax filing process but also reduces the risk of errors and delays.

For businesses, the tax department offers quarterly estimated payments, allowing for a more manageable approach to tax obligations. This system ensures that businesses can plan their finances effectively, making regular payments throughout the year instead of facing a significant tax burden at the end of the fiscal period.

Moreover, the Lakewood Tax Department provides taxpayer assistance through dedicated helplines and online resources. This support system ensures that taxpayers can receive guidance and clarification on complex tax matters, fostering a culture of transparency and cooperation.

Benefits and Impact of the Lakewood Income Tax

The Lakewood Income Tax plays a pivotal role in shaping the city’s economic landscape, offering a range of benefits that contribute to the overall well-being of residents and businesses.

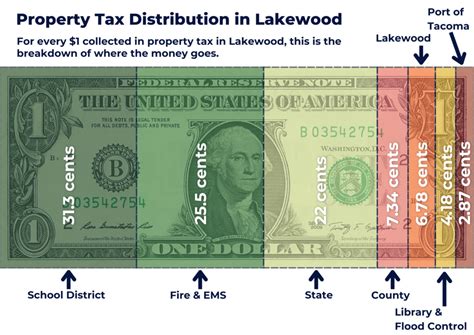

Funding Essential Services

Revenue generated from the income tax is a critical source of funding for the city’s essential services. This includes education, with a significant portion of tax revenue allocated to support the Lakewood City School District, ensuring a high-quality learning environment for students. Additionally, the tax revenue supports public safety initiatives, such as police and fire department operations, enhancing the overall safety and security of the community.

Furthermore, the income tax funds infrastructure development and maintenance, ensuring that Lakewood's roads, parks, and public spaces remain well-maintained and accessible. This investment in infrastructure not only improves the quality of life for residents but also enhances the city's appeal to businesses and visitors.

Economic Stimulus and Growth

The progressive nature of the Lakewood Income Tax system encourages economic growth by attracting new businesses and investors. The competitive tax rate, combined with a stable and well-managed tax system, creates a favorable environment for entrepreneurship and business expansion. This, in turn, leads to job creation, boosting the local economy and providing opportunities for residents.

Moreover, the tax revenue generated supports small business development through various initiatives and incentives. The city's commitment to fostering a thriving business community extends to offering resources and support for startups and established businesses, further contributing to economic growth.

Community Initiatives and Development

Beyond its economic impact, the Lakewood Income Tax contributes to a range of community initiatives and development projects. This includes arts and culture programs, which enhance the city’s cultural landscape and attract visitors. The tax revenue also supports recreational facilities and events, providing opportunities for residents to engage in healthy and social activities.

Furthermore, the income tax plays a crucial role in community development projects, such as neighborhood revitalization and affordable housing initiatives. By reinvesting tax revenue into these projects, Lakewood ensures that its residents have access to safe, vibrant, and inclusive communities.

Navigating the Lakewood Income Tax: Practical Tips

Now that we’ve explored the fundamentals of the Lakewood Income Tax, let’s delve into some practical tips and strategies to help residents and businesses navigate this tax system with ease and efficiency.

Tax Planning and Preparation

Effective tax planning is essential to ensuring compliance and optimizing your tax obligations. Here are some key considerations:

- Stay Informed: Keep up-to-date with the latest tax rates, deadlines, and any changes in tax laws or regulations. The Lakewood Tax Department provides regular updates and resources to keep taxpayers informed.

- Utilize Tax Software: Take advantage of user-friendly tax software that can streamline the tax preparation process. These tools can help you organize your financial data, calculate your tax liability, and file your returns accurately.

- Seek Professional Advice: If you have complex financial circumstances or business operations, consider consulting a tax professional. They can provide tailored advice and ensure you're taking advantage of all available tax benefits and deductions.

Maximizing Tax Benefits

The Lakewood Income Tax system offers a range of benefits and deductions to reduce your tax burden. Here’s how you can maximize these opportunities:

- Claim Exemptions: Review the list of income types that are exempt from taxation, such as certain government bonds and pensions. Ensure you claim these exemptions when filing your tax returns to reduce your taxable income.

- Business Deductions: If you operate a business, be sure to take advantage of allowable business deductions. This can include expenses for office space, equipment, supplies, and other operational costs. Properly documenting and categorizing these expenses can significantly reduce your tax liability.

- Education Deductions: If you're a student or have dependent students, you may be eligible for education-related deductions or credits. These can help offset the cost of tuition, books, and other educational expenses, providing a significant tax benefit.

Staying Compliant and Avoiding Penalties

Maintaining tax compliance is crucial to avoid penalties and legal issues. Here are some key practices to follow:

- Timely Filing: Ensure you file your tax returns by the specified deadlines. Late filing can result in penalties and interest charges, adding unnecessary costs to your tax obligations.

- Accurate Reporting: Accuracy is paramount in tax reporting. Ensure all income and deductions are correctly documented and reported. Inaccurate reporting can lead to audits and potential legal consequences.

- Keep Records: Maintain organized records of your financial transactions, receipts, and tax-related documents. This not only facilitates the tax preparation process but also provides evidence in case of an audit.

Exploring Tax-Efficient Strategies

Implementing tax-efficient strategies can help you optimize your financial position and reduce your overall tax burden. Consider the following approaches:

- Retirement Planning: Contribute to tax-advantaged retirement accounts, such as IRAs or 401(k)s. These accounts offer tax benefits, including deductions for contributions and tax-deferred growth, which can significantly reduce your taxable income.

- Business Structure: If you're starting a business, carefully consider the legal structure that best aligns with your tax objectives. Different business structures offer varying tax advantages, so consult with a professional to determine the most tax-efficient option for your specific circumstances.

- Investment Strategies: Explore tax-efficient investment strategies, such as tax-loss harvesting or utilizing tax-advantaged investment vehicles. These strategies can help you minimize capital gains taxes and maximize the after-tax returns on your investments.

Future Outlook and Potential Changes

As with any tax system, the Lakewood Income Tax is subject to potential changes and adjustments to align with economic trends and community needs. Here’s a glimpse into the future of this tax system and some potential developments to consider:

Economic Trends and Tax Rates

The city of Lakewood closely monitors economic trends and fiscal health to ensure the tax system remains sustainable and fair. As the economic landscape evolves, the city council may consider adjustments to the tax rate to maintain a balanced approach to taxation. For instance, during periods of economic growth, the tax rate may be adjusted downward to provide relief to taxpayers, while in times of economic downturn, a slight increase in the tax rate could help stabilize the city’s revenue stream.

Community Feedback and Reforms

Lakewood values community input and feedback on its tax system. As such, the city regularly engages with residents and businesses to gather insights and address concerns. This collaborative approach ensures that the tax system remains responsive to the needs and challenges faced by the community. Based on this feedback, the city may implement reforms to enhance fairness, simplify the tax filing process, or introduce new tax incentives to support specific community initiatives.

Digital Transformation and Tax Administration

In line with technological advancements, the Lakewood Tax Department is committed to digital transformation. This includes further enhancing the online tax filing platform, integrating new technologies for improved tax administration, and exploring blockchain-based solutions for secure and transparent tax transactions. These digital initiatives aim to streamline the tax filing process, reduce administrative burdens, and provide taxpayers with a more efficient and user-friendly experience.

Intergovernmental Collaboration

The city of Lakewood actively collaborates with neighboring municipalities and county authorities to align tax policies and initiatives. This intergovernmental cooperation can lead to the harmonization of tax rates and regulations, making it easier for businesses operating across multiple jurisdictions to comply with tax obligations. Additionally, collaborative efforts can result in the development of regional incentives and programs to attract investment and support economic growth in the greater Cuyahoga County area.

Sustainable Development and Tax Incentives

Lakewood is committed to sustainable development and environmental stewardship. As such, the city may introduce tax incentives to encourage environmentally friendly practices and investments. This could include tax credits for businesses adopting green technologies, incentives for residents to invest in energy-efficient home improvements, or support for community initiatives focused on sustainability and resilience.

Conclusion: Embracing the Lakewood Income Tax System

The Lakewood Income Tax is more than just a financial obligation; it’s a vital component of the city’s vibrant ecosystem, contributing to its economic growth, community development, and overall prosperity. By understanding the nuances of this tax system and actively participating in its efficient management, residents and businesses can thrive within Lakewood’s dynamic economic landscape.

From funding essential services to stimulating economic growth and supporting community initiatives, the Lakewood Income Tax plays a pivotal role in shaping the city's future. As we've explored in this comprehensive guide, effective tax planning, compliance, and strategic financial management can help individuals and businesses optimize their tax obligations and contribute to the city's continued success.

As Lakewood continues to evolve, its income tax system will adapt to meet the changing needs of its residents and businesses. By staying informed, engaging with the community, and embracing technological advancements, the city can ensure a sustainable and equitable tax environment that fosters economic prosperity and enhances the quality of life for all.

How often should I file my Lakewood Income Tax returns?

+

Lakewood Income Tax returns should be filed annually by the specified deadline, which is typically aligned with federal and state tax filing dates. However, businesses may be required to make quarterly estimated payments to ensure compliance and avoid penalties.

Are there any resources available to assist with tax filing and compliance in Lakewood?

+

Yes, the Lakewood Tax Department provides a wealth of resources, including online guides, tutorials, and helplines. Additionally, tax professionals and accountants can offer personalized assistance and guidance to ensure accurate tax filing and compliance.

What are the consequences of not paying or underpaying my Lakewood Income Tax?

+

Failure to pay or underpaying your Lakewood Income Tax can result in penalties, interest charges, and potential legal consequences. It’s crucial to stay compliant to avoid these issues and maintain a positive financial standing in the community.

Are there any tax incentives or deductions available for residents or businesses in Lakewood?

+

Yes, the Lakewood Income Tax system offers a range of tax incentives and deductions. These can include exemptions for certain types of income, business deductions for operational expenses, and education-related deductions or credits. It’s important to explore these opportunities to optimize your tax position.

How can I stay updated on changes or developments related to the Lakewood Income Tax system?

+

The Lakewood Tax Department provides regular updates and announcements on its website and through official communications. Additionally, subscribing to local news sources and following relevant social media channels can help you stay informed about tax-related developments in the city.