Which Turbo Tax Do I Need

TurboTax is a popular tax preparation software that offers a range of products to cater to different tax situations and complexities. Choosing the right TurboTax product can ensure you have the necessary tools to accurately and efficiently file your taxes. This guide will help you determine which TurboTax option aligns with your specific needs.

Understanding TurboTax Products

TurboTax offers several products designed for various tax scenarios. These products are categorized based on the complexity of tax returns and the features they offer. Here’s an overview of the primary TurboTax products:

- TurboTax Free Edition: Ideal for simple tax returns, such as those with W-2 income, limited deductions, and no investment income. It's a no-cost option for basic tax filing.

- TurboTax Deluxe: Suited for taxpayers with more complex deductions and credits, including those with investment income, rental property income, or charitable donations. It provides additional guidance and tools for maximizing deductions.

- TurboTax Premier: Designed for investors and homeowners. It includes features to handle capital gains and losses, rental property income, and deductions for mortgage interest and property taxes.

- TurboTax Self-Employed: Specifically tailored for the unique tax needs of sole proprietors, independent contractors, and business owners. It helps manage business income, expenses, and self-employment taxes.

- TurboTax Business: A separate product for businesses, including partnerships, LLCs, and S-Corps. It assists with business tax forms and schedules.

Assessing Your Tax Situation

To determine which TurboTax product is right for you, it’s essential to evaluate your tax situation. Consider the following factors:

Income Sources

Determine whether you have a single source of income (such as a job) or multiple sources. If you have investment income, rental property income, or self-employment income, you may require a more advanced TurboTax product.

Deductions and Credits

Review your potential deductions and credits. Do you have significant charitable donations, medical expenses, or education-related expenses? Are you eligible for the Child Tax Credit or other tax credits? The more deductions and credits you have, the more complex your tax return may be.

Business Ownership

If you own a business, whether as a sole proprietor or as part of a partnership or corporation, you’ll need a TurboTax product that can handle business-related tax forms and schedules.

Rental Properties

If you own rental properties, you’ll need a product that can handle rental income and expenses, such as TurboTax Premier or Self-Employed.

Investment Income

If you have investment income from stocks, bonds, or mutual funds, you’ll need a product that can accurately report capital gains and losses, such as TurboTax Premier.

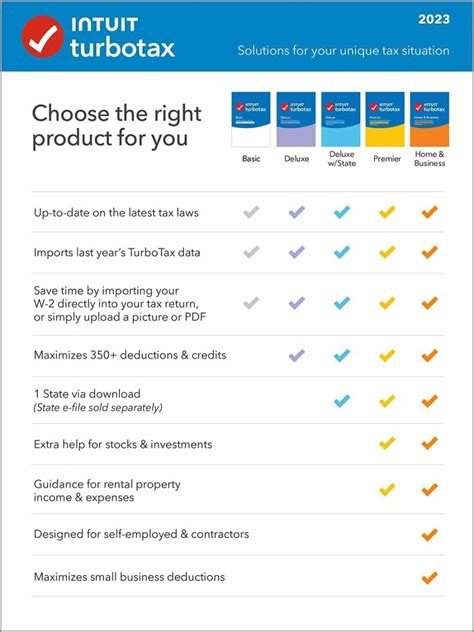

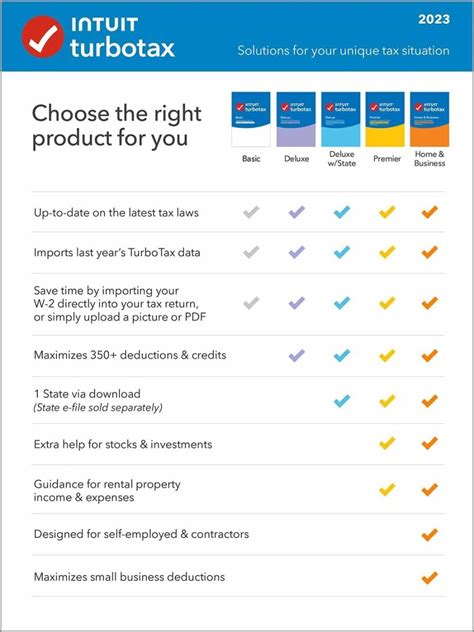

Comparing TurboTax Products

Here’s a comparison of key features across different TurboTax products:

| Product | Features | Suitable For |

|---|---|---|

| Free Edition | Simple tax return with W-2 income, basic deductions, and no investment income. | Taxpayers with straightforward tax situations and limited deductions. |

| Deluxe | Includes features for deductions and credits, such as mortgage interest, education expenses, and charitable donations. | Taxpayers with moderate complexities, including some investment income or rental property income. |

| Premier | Designed for investors and homeowners with capital gains and losses, rental property income, and deductions for mortgage interest and property taxes. | Investors, homeowners, and taxpayers with significant investment or rental property income. |

| Self-Employed | Tailored for sole proprietors, independent contractors, and business owners. Manages business income, expenses, and self-employment taxes. | Sole proprietors, independent contractors, and business owners with self-employment income. |

| Business | For partnerships, LLCs, and S-Corps. Assists with business tax forms and schedules. | Businesses with complex tax needs, including partnerships and corporations. |

Additional Considerations

When choosing a TurboTax product, also consider the following:

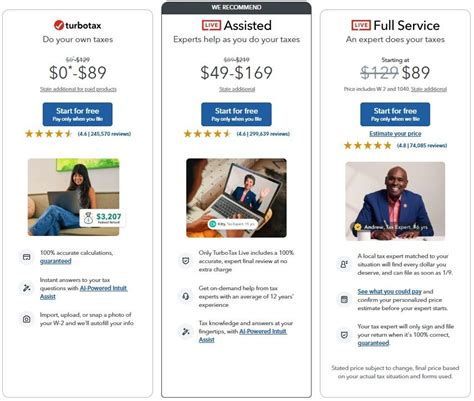

- Pricing: Each TurboTax product has a different price point. While some products are free, others may require a one-time fee or a subscription.

- Ease of Use: TurboTax is known for its user-friendly interface, but certain products may offer more guidance and support for complex tax situations.

- Support: TurboTax provides customer support for all its products, but some products may offer additional support options, such as live tax advice or audit support.

Conclusion

Selecting the right TurboTax product ensures you have the necessary tools to navigate your tax situation effectively. By evaluating your income sources, deductions, and tax complexities, you can choose a product that aligns with your needs. Whether you’re a homeowner, investor, business owner, or have a simple tax return, TurboTax offers a range of products to suit your unique circumstances.

Can I upgrade my TurboTax product during the filing process?

+

Yes, TurboTax allows you to upgrade your product at any time during the filing process. If you realize that your tax situation is more complex than you initially thought, you can switch to a higher-tier product to access additional features and guidance.

Is TurboTax Premier necessary for all investors?

+

No, not all investors need TurboTax Premier. If you have a straightforward investment portfolio with limited transactions, the Deluxe edition may suffice. However, if you have multiple investment accounts, complex transactions, or substantial capital gains, Premier would be a better fit.

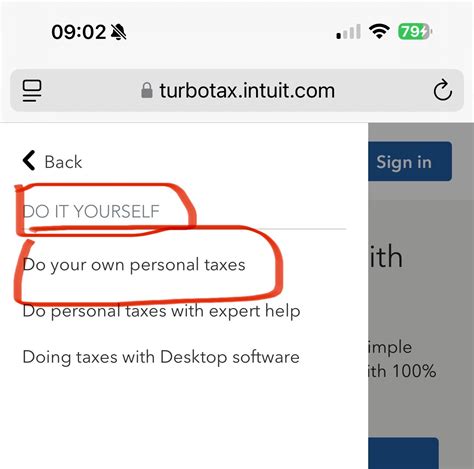

What if I’m not sure which product to choose?

+

TurboTax provides a helpful Product Selector Tool on their website. This tool asks a series of questions about your tax situation and recommends the most suitable product for you.