Virginia State Tax Status

Welcome to this comprehensive guide on the Virginia State Tax Status, an essential topic for individuals and businesses alike. Virginia, known as the "Old Dominion State," has a unique tax landscape that can be both intriguing and complex. In this article, we will delve into the intricacies of Virginia's tax system, providing you with valuable insights and a deep understanding of the state's tax policies and their implications.

Understanding Virginia’s Tax Landscape

Virginia, with its rich history and diverse economy, has developed a tax system that aims to support its residents and businesses while also generating revenue for essential state services. The state’s tax structure is multifaceted, encompassing various taxes such as income tax, sales tax, property tax, and more. Let’s explore each of these tax categories in detail.

Income Tax: A Progressive Approach

Virginia operates a progressive income tax system, meaning that higher income earners pay a higher percentage of their income in taxes. This approach aims to maintain fairness and provide an equitable tax burden. The state offers five income tax brackets, each with its own tax rate, ranging from 2% to 5.75%. For the tax year 2023, these brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 to 3,000</td> <td>2%</td> </tr> <tr> <td>3,001 to 5,000</td> <td>3%</td> </tr> <tr> <td>5,001 to 17,000</td> <td>5%</td> </tr> <tr> <td>17,001 to 100,000</td> <td>5.75%</td> </tr> <tr> <td>Over 100,000 | 5.75% |

Virginia's income tax system also offers various deductions and credits to reduce the tax burden on individuals and families. Some notable deductions include the standard deduction, which varies based on filing status, and the personal exemption deduction, which provides a tax break for each dependent claimed.

Sales and Use Tax: A Revenue Generator

Virginia imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. The state’s sales tax rate is currently set at 4.3%, while localities have the authority to levy an additional sales tax of up to 1%. This results in a combined sales tax rate that varies across the state. For example, in the city of Richmond, the total sales tax rate is 6% (4.3% state tax + 1.7% local tax). The use tax, on the other hand, applies to purchases made outside Virginia but used within the state, ensuring that all transactions are taxed equally.

Certain items are exempt from sales tax in Virginia, including most groceries, prescription drugs, and non-prepared food items. Additionally, the state offers a sales tax holiday during specific periods, providing tax-free shopping for certain categories of goods, such as school supplies and clothing.

Property Tax: Localized Assessment

Property tax in Virginia is primarily a local tax, with rates and assessment methods varying across cities and counties. Local governments have the authority to set their own tax rates, typically expressed as cents per $100 of assessed value. The assessed value of a property is determined by local assessors, who consider factors such as the property’s location, condition, and recent sales of similar properties.

Virginia offers several property tax relief programs to assist certain groups, such as the elderly, disabled veterans, and low-income homeowners. These programs can provide reduced tax rates or exemptions, making property ownership more affordable.

Other Taxes: A Comprehensive System

In addition to the taxes mentioned above, Virginia has a range of other tax categories, each designed to target specific activities or industries. These include:

- Meals Tax: Imposed on the sale of prepared food and beverages, with rates varying by locality.

- Lodging Tax: Applied to the rental of hotel rooms and similar accommodations.

- Business Taxes: Virginia has a corporate income tax and various business license taxes, ensuring that businesses contribute to the state’s revenue.

- Estate and Inheritance Taxes: While Virginia has repealed its estate tax, it still imposes an inheritance tax on certain transfers of property.

Tax Compliance and Filing

Navigating Virginia’s tax system requires a careful understanding of the state’s requirements and deadlines. Individual taxpayers typically file their state income tax returns by May 1 following the tax year. Businesses, on the other hand, have varied filing deadlines depending on their entity type and tax obligations.

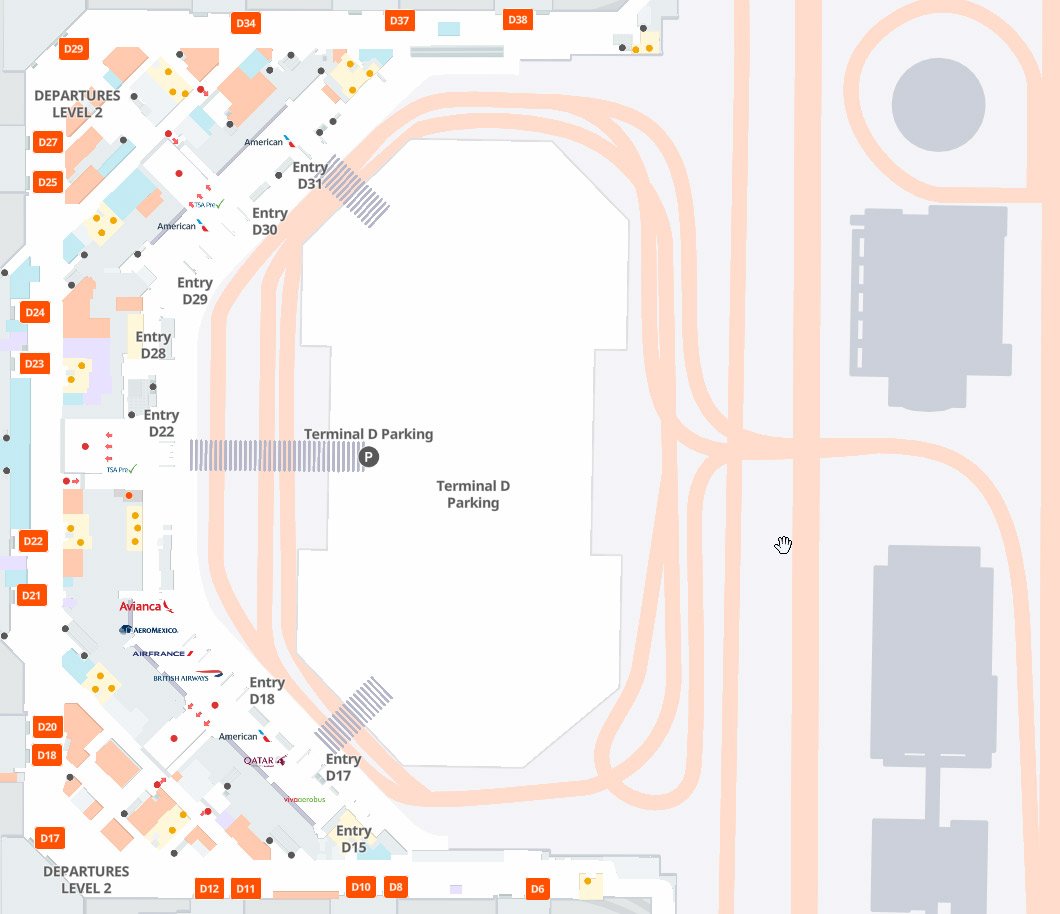

Virginia offers both online and paper filing options for tax returns. The Virginia Department of Taxation provides an online filing system, known as eTax, which allows individuals and businesses to submit their returns electronically. This system offers convenience and efficiency, especially for those with straightforward tax situations.

Tax Relief and Assistance

Virginia recognizes the importance of providing support to taxpayers facing financial difficulties. The state offers various tax relief programs and assistance options, including payment plans, penalty waivers, and extended filing deadlines. Additionally, the Virginia Tax Relief Commission works to provide recommendations for tax policy changes, ensuring that the system remains fair and accessible.

Economic Impact and Future Outlook

Virginia’s tax system plays a crucial role in shaping the state’s economy and its overall fiscal health. The revenue generated from taxes funds essential services such as education, healthcare, infrastructure development, and public safety. A well-structured tax system can encourage economic growth, attract businesses, and support the state’s residents.

Looking ahead, Virginia's tax landscape is likely to evolve in response to changing economic conditions and policy priorities. The state may consider tax reforms to enhance fairness, simplify compliance, and adapt to the needs of a modern economy. For instance, discussions around tax incentives for renewable energy or technology-focused industries could shape the future of Virginia's tax policies.

Frequently Asked Questions

What is the current sales tax rate in Virginia?

+The state sales tax rate in Virginia is 4.3%, but local governments can add an additional tax of up to 1%, resulting in varying total sales tax rates across the state.

Are there any tax deductions available for homeowners in Virginia?

+Yes, Virginia offers several property tax relief programs, including the Landowner’s Tax Relief Program and the Disabled Veterans Exemption, which provide reduced tax rates or exemptions for eligible homeowners.

When is the deadline for filing Virginia state income tax returns for individuals?

+The deadline for individuals to file their Virginia state income tax returns is typically May 1 following the tax year. However, this deadline may be extended in certain circumstances.

Does Virginia have an estate tax?

+No, Virginia has repealed its estate tax. However, the state still imposes an inheritance tax on certain transfers of property.

How can I stay updated on Virginia’s tax changes and reforms?

+You can stay informed by regularly checking the Virginia Department of Taxation’s website, subscribing to their email updates, or following trusted tax news sources that cover Virginia-specific tax developments.