Nys Taxes Login

Welcome to our comprehensive guide on navigating the New York State (NYS) Taxes Login process. Filing taxes can be a daunting task, but with the right information and resources, it becomes a more manageable and efficient process. In this article, we will delve into the intricacies of accessing your NYS tax account, providing you with a step-by-step guide and valuable insights to ensure a seamless experience.

Understanding the NYS Taxes Login Process

The NYS Taxes Login is the gateway to your personal tax account, allowing you to file returns, make payments, and manage various tax-related matters. This secure online platform provides taxpayers with a convenient and efficient way to fulfill their tax obligations. Whether you're a resident, a business owner, or a tax professional, understanding how to navigate this system is essential for a smooth tax filing journey.

Getting Started: Creating Your NYS Taxes Login Account

Before diving into the login process, it's crucial to have a clear understanding of the prerequisites and requirements for creating an account. Here's a step-by-step guide to get you started:

- Visit the NYS Taxes Website: Begin by accessing the official New York State Department of Taxation and Finance website. This is your primary source for all tax-related information and services.

- Locate the Login Portal: Navigate to the login section, typically found in the top right corner of the homepage. Look for options like "Register" or "Create an Account."

- Gather Necessary Information: To create an account, you'll need specific details, including your full name, date of birth, Social Security Number (SSN), and an email address. Ensure you have these details readily available.

- Choose a Secure Password: Select a unique and strong password that meets the website's requirements. A combination of letters, numbers, and special characters is recommended for enhanced security.

- Complete the Registration Form: Fill out the registration form accurately and completely. Provide your personal details, select security questions, and agree to the terms and conditions.

- Verify Your Identity: Depending on the security measures in place, you may be required to verify your identity through a secure code sent to your email or phone.

- Confirm Registration: Once your identity is verified, you'll receive a confirmation email or a notification within your account, indicating that your registration was successful.

By following these steps, you'll be well on your way to establishing a secure and accessible NYS Taxes Login account. Let's now explore the process of accessing your account and the features it offers.

Logging In and Exploring Your NYS Taxes Account

Now that you have successfully created your account, it's time to log in and familiarize yourself with the platform. Here's a guide to help you navigate your NYS Taxes Account:

- Access the Login Portal: Return to the NYS Taxes website and locate the login section. Enter your username (usually your email address) and the password you created during registration.

- Secure Login: Ensure you're logging in from a secure network to protect your sensitive information. Avoid public Wi-Fi for added security.

- Two-Factor Authentication (Optional): For enhanced security, consider enabling two-factor authentication. This adds an extra layer of protection by requiring a code sent to your phone or email during login.

- Dashboard Overview: Upon successful login, you'll be directed to your dashboard. This is your central hub, providing an overview of your tax-related activities, deadlines, and important notifications.

- Explore Account Features: Take some time to explore the various sections of your account. These may include filing returns, making payments, viewing tax history, accessing forms and publications, and managing personal information.

- Filing Returns: Depending on your tax situation, you can file individual income tax returns, business tax returns, or other specialized forms. The platform will guide you through the filing process, ensuring a seamless experience.

- Payment Options: If you have tax liabilities, you can make payments through various methods, including credit/debit cards, electronic funds transfer, or check/money order. The platform provides clear instructions for each payment option.

- Viewing Tax History: Access your past tax returns, payments, and correspondence to stay organized and informed about your tax obligations.

- Help and Support: The NYS Taxes website offers extensive help and support resources. You can find answers to common questions, access tutorials, and connect with customer support for personalized assistance.

By exploring these features and familiarizing yourself with the platform, you'll gain confidence in managing your tax affairs effectively. Let's now delve into some advanced topics and best practices to ensure a successful and stress-free tax filing experience.

Advanced Topics and Best Practices

Maximizing the potential of your NYS Taxes Login account involves more than just basic navigation. Here, we'll discuss some advanced topics and best practices to enhance your tax filing journey.

Utilizing NYS Taxes Login for Business Owners

For business owners, the NYS Taxes Login platform offers a range of features specifically tailored to your needs. Here's how you can make the most of it:

- Registering Your Business: If you haven't already, use the platform to register your business with the state. This ensures compliance and provides access to essential business-related tax forms and resources.

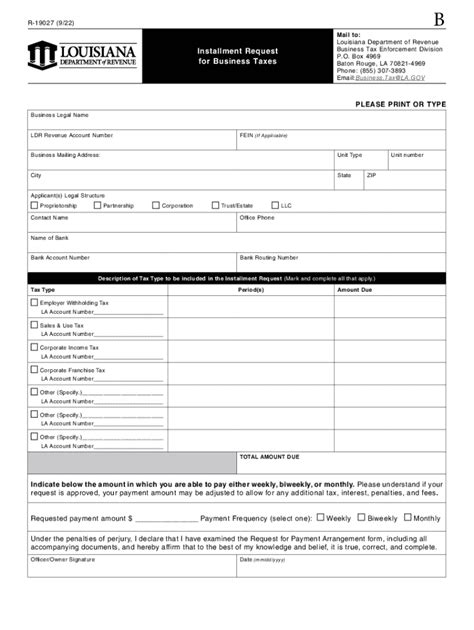

- Filing Business Tax Returns: Whether you're a sole proprietor, partnership, or corporation, you can file your business tax returns online. The platform provides guidance and forms specific to your business structure.

- Managing Employee Taxes: If you have employees, you can use the platform to manage payroll taxes, withholdings, and other employment-related tax obligations.

- Accessing Business Resources: Explore the resources section for business owners, which offers valuable information on tax incentives, credits, and industry-specific guidance.

Tax Planning and Strategies

Effective tax planning can help minimize your tax liabilities and maximize your refunds. Consider the following strategies:

- Understanding Tax Credits and Deductions: Familiarize yourself with the various tax credits and deductions available to individuals and businesses. These can significantly impact your tax obligations.

- Maximizing Tax Refunds: Review your tax withholdings throughout the year to ensure you're not overpaying. Adjustments can be made to optimize your refund or minimize tax liabilities.

- Stay Informed on Tax Updates: The tax landscape is subject to changes and updates. Stay informed about new laws, regulations, and incentives that may affect your tax situation.

Security and Privacy Considerations

Protecting your sensitive tax information is of utmost importance. Here are some security best practices to keep in mind:

- Strong Password Management: Use unique and complex passwords for your NYS Taxes Login account. Consider using a password manager to generate and store secure passwords.

- Two-Factor Authentication: Enable two-factor authentication for an added layer of security. This ensures that even if your password is compromised, your account remains secure.

- Secure Browsing: Always access your NYS Taxes account from a secure network. Avoid public Wi-Fi for sensitive transactions.

- Regularly Update Your Security Settings: Stay updated with the latest security measures offered by the NYS Taxes platform. Enable any new security features to enhance protection.

By implementing these advanced topics and best practices, you can navigate the NYS Taxes Login platform with confidence and ensure a secure and efficient tax filing experience.

Future Implications and Updates

The world of taxes is constantly evolving, and staying informed about upcoming changes and updates is crucial. Here's a glimpse into the future of the NYS Taxes Login platform and its potential impact on taxpayers.

Digital Transformation and Technological Advancements

The NYS Taxes platform is committed to embracing digital transformation and leveraging technological advancements to enhance the user experience. Here are some potential developments to look forward to:

- Enhanced Mobile Accessibility: Expect improved mobile accessibility, allowing taxpayers to manage their tax affairs seamlessly from their smartphones or tablets.

- AI-Powered Assistance: Artificial Intelligence (AI) may be integrated into the platform to provide personalized assistance, offering tailored recommendations and guidance based on individual tax situations.

- Blockchain Integration: Blockchain technology could be explored to enhance security and streamline tax processes, ensuring transparency and efficiency.

Policy Changes and Tax Reform

Tax policies and reforms are subject to change at both the state and federal levels. Stay informed about any upcoming changes that may impact your tax obligations. Here are some potential areas to watch:

- Tax Rate Adjustments: Keep an eye on any proposed changes to tax rates, which could affect your tax liabilities.

- New Tax Credits and Deductions: Be aware of any newly introduced tax credits or deductions that may benefit you or your business.

- Simplification of Tax Forms: Efforts to simplify tax forms and processes could make filing taxes more straightforward and less time-consuming.

Community Engagement and Tax Education

The NYS Taxes platform recognizes the importance of community engagement and tax education. Expect continued efforts to enhance taxpayer education and provide resources to simplify complex tax concepts. Some initiatives may include:

- Online Tax Workshops: Virtual workshops and webinars could be offered to provide in-depth guidance on specific tax topics.

- Tax Education Campaigns: Campaign initiatives may be launched to raise awareness about tax obligations and the importance of timely filing.

- Community Outreach Programs: The platform may partner with community organizations to reach underserved populations and provide tax assistance.

By staying informed about these future implications and actively engaging with the NYS Taxes platform, you can adapt to changes and continue to navigate the tax landscape with confidence.

Conclusion

Navigating the NYS Taxes Login process is an essential skill for taxpayers in New York State. By understanding the prerequisites, creating a secure account, and exploring the platform's features, you can efficiently manage your tax obligations. This comprehensive guide has provided you with the tools and insights needed to make the most of your NYS Taxes Login experience.

Remember, effective tax planning, security measures, and staying informed about updates are key to a successful tax filing journey. Embrace the digital transformation and leverage the resources available to simplify your tax affairs. With the right approach and a proactive mindset, you can navigate the complex world of taxes with confidence and peace of mind.

Frequently Asked Questions

How often should I update my security settings on the NYS Taxes Login platform?

+It is recommended to review and update your security settings annually or whenever there are significant changes to your personal information or security preferences. Stay vigilant and ensure your account remains secure by regularly assessing and updating your security measures.

Can I access my NYS Taxes account from a mobile device?

+Absolutely! The NYS Taxes platform is optimized for mobile accessibility, allowing you to manage your tax affairs on the go. Simply visit the NYS Taxes website on your mobile browser or download the official mobile app (if available) to access your account securely.

What should I do if I forget my NYS Taxes Login password?

+If you forget your password, don’t panic! The NYS Taxes platform offers a password recovery process. Simply click on the “Forgot Password” link on the login page, and follow the instructions to reset your password securely. Ensure you have access to the email address associated with your account for verification purposes.

Are there any upcoming changes to tax rates in New York State?

+Stay informed about any potential changes to tax rates by regularly checking the official NYS Taxes website or following reputable news sources. While specific rate changes cannot be predicted, being aware of any proposed or enacted changes will help you plan your tax strategy accordingly.