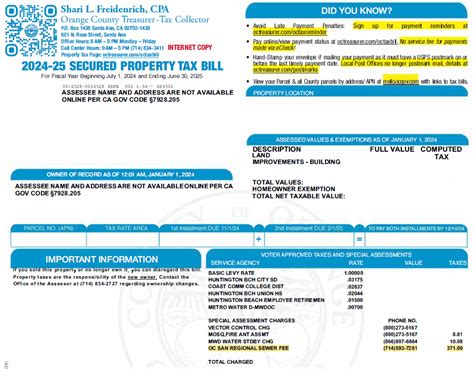

State Of Alabama Tax Return

The State of Alabama's tax system plays a crucial role in the economic landscape of the state, impacting individuals, businesses, and the overall fiscal health of the region. Understanding the intricacies of Alabama's tax return process is essential for taxpayers, especially given the state's unique tax structure and recent legislative changes. In this comprehensive guide, we delve into the specifics of filing tax returns in Alabama, offering a detailed analysis of the process, key considerations, and potential benefits.

Navigating Alabama’s Tax Landscape

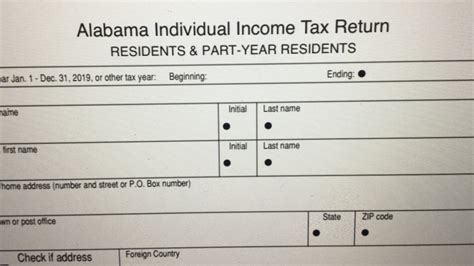

Alabama operates under a combined reporting system for income taxes, which means that individuals and businesses can utilize the same tax forms and instructions for both state and federal tax returns. This streamlined approach simplifies the process for taxpayers, especially those who are new to the state or have complex financial situations.

The state's tax year follows the federal fiscal year, which runs from January 1st to December 31st. Alabama residents and businesses must file their tax returns within this timeframe, ensuring compliance with both state and federal regulations. The Alabama Department of Revenue provides detailed guidelines and resources to assist taxpayers in navigating this process efficiently.

Key Features of Alabama’s Tax System

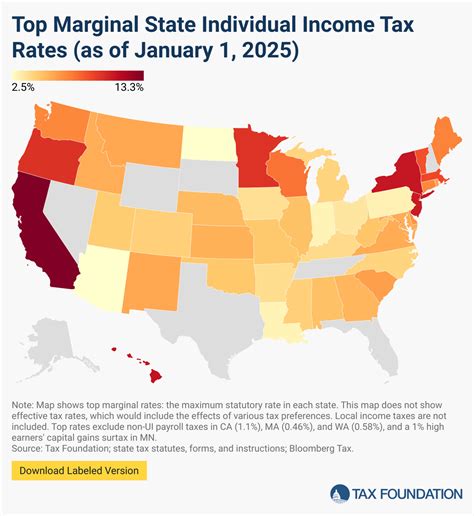

Alabama’s tax system is characterized by several unique features that set it apart from other states. Firstly, the state imposes a 2% income tax rate on all individuals, regardless of their income level. This flat tax rate is applied to all taxable income, including wages, salaries, and investment earnings. While this structure may seem straightforward, it is important to note that Alabama offers various deductions and credits that can reduce the overall tax liability.

Secondly, Alabama has a progressive tax system for corporations. The corporate income tax rate varies depending on the amount of taxable income. For corporations with taxable income of $100,000 or less, the tax rate is 6.5%. However, as the income increases, the tax rate progressively increases as well. For example, corporations with taxable income between $100,001 and $250,000 face a tax rate of 6.75%, and so on, up to a maximum tax rate of 7.25% for income exceeding $500,000.

| Taxable Income Range | Corporate Income Tax Rate |

|---|---|

| Up to $100,000 | 6.5% |

| $100,001 - $250,000 | 6.75% |

| $250,001 - $500,000 | 7% |

| Over $500,000 | 7.25% |

Alabama also offers several tax incentives and credits to encourage economic development and investment within the state. These incentives can significantly reduce the tax burden for businesses operating in specific industries or regions. For instance, the Alabama Jobs Act provides tax credits for companies creating new jobs in the state, with the potential for significant savings over multiple years.

Filing Requirements and Deadlines

Understanding the filing requirements and deadlines is crucial for Alabama taxpayers to ensure timely and accurate submissions. The Alabama Department of Revenue provides clear guidelines on who is required to file tax returns and the associated deadlines.

Who Must File

All Alabama residents with taxable income exceeding the standard deduction are required to file a state income tax return. Additionally, non-residents with income sourced from Alabama activities, such as business operations or investments, must also file a return. The state’s tax laws are applicable to individuals, partnerships, corporations, trusts, and estates.

Businesses, regardless of their legal structure, are subject to Alabama's tax laws if they have a physical presence in the state or engage in business activities within Alabama borders. This includes, but is not limited to, sales transactions, employment of Alabama residents, and ownership of real estate.

Filing Deadlines

The standard deadline for filing Alabama tax returns is April 15th, aligning with the federal tax filing deadline. However, it is important to note that certain situations may warrant an extension. For instance, if a taxpayer is unable to meet the April 15th deadline due to extenuating circumstances, they can request an automatic six-month extension by filing Form 4868. This extension provides additional time to file the return but does not extend the deadline for paying any taxes due.

It is crucial for taxpayers to be aware of these deadlines and plan accordingly to avoid penalties and interest charges. Late filing and late payment penalties can significantly impact the overall tax liability, so staying informed and proactive is essential.

The Filing Process: Step-by-Step

Filing a tax return in Alabama can be a straightforward process with the right guidance and preparation. Here is a step-by-step guide to assist taxpayers in navigating the process efficiently:

Step 1: Gather Your Documents

Before beginning the filing process, it is essential to gather all necessary documents. This includes W-2 forms for wages and salaries, 1099 forms for miscellaneous income, and any other relevant tax documents. Additionally, taxpayers should collect records of deductions, credits, and expenses they plan to claim. Having all the required information organized will streamline the filing process.

Step 2: Choose Your Filing Method

Alabama taxpayers have several options for filing their tax returns. The traditional method involves completing and submitting paper forms to the Alabama Department of Revenue. However, with advancements in technology, the state now offers convenient online filing options through its official website. Taxpayers can also utilize tax preparation software or seek the assistance of tax professionals to ensure accuracy and efficiency.

Step 3: Calculate Your Tax Liability

The next step is to calculate your tax liability. This involves determining your taxable income, applying the appropriate tax rate, and considering any deductions or credits you are eligible for. Alabama’s tax forms and instructions provide clear guidelines on how to calculate your tax liability accurately. It is crucial to double-check your calculations to avoid errors that could lead to penalties or audits.

Step 4: Pay Your Taxes

Once you have calculated your tax liability, it is important to pay any taxes owed by the deadline. Alabama offers various payment methods, including electronic funds transfer, credit card payments, and check or money order payments. Ensure that you select a payment method that aligns with your financial preferences and provides a secure transaction.

Step 5: Review and Submit Your Return

Before submitting your tax return, carefully review all the information you have provided. Ensure that all personal and financial details are accurate and that you have included all relevant schedules and forms. Once you are satisfied with the accuracy of your return, you can submit it to the Alabama Department of Revenue. If you are filing online, you will receive immediate confirmation of receipt.

Tax Planning and Optimization Strategies

Effective tax planning can help Alabama taxpayers minimize their tax liability and maximize their financial benefits. Here are some strategies to consider when navigating the state’s tax landscape:

Utilize Deductions and Credits

Alabama offers various deductions and credits that can significantly reduce your tax burden. These include deductions for medical and dental expenses, charitable contributions, and state and local taxes paid. Additionally, Alabama residents may be eligible for credits such as the Child and Dependent Care Credit, the Alabama State Earned Income Tax Credit, and the Alabama Taxpayer Refund. Understanding and claiming these deductions and credits can lead to substantial savings.

Take Advantage of Tax Incentives

As mentioned earlier, Alabama provides several tax incentives and credits to promote economic development and investment. These incentives can be particularly beneficial for businesses looking to expand or relocate within the state. Taxpayers should consult with tax professionals or the Alabama Department of Revenue to explore these opportunities and determine their eligibility.

Consider Tax-Advantaged Retirement Plans

Alabama residents can benefit from tax-advantaged retirement plans, such as 401(k)s and IRAs. Contributions to these plans are often tax-deductible, and earnings grow tax-free until withdrawal. This can significantly reduce your taxable income and provide long-term financial benefits. It is important to consult with a financial advisor to understand the best retirement planning strategies for your specific situation.

Stay Informed on Legislative Changes

Alabama’s tax laws are subject to change, and staying informed on legislative updates is crucial for effective tax planning. The state’s tax landscape may evolve due to new policies, economic developments, or budget considerations. Taxpayers should regularly review official government sources, such as the Alabama Department of Revenue’s website, to stay updated on any changes that may impact their tax obligations.

The Future of Alabama’s Tax System

Alabama’s tax system is constantly evolving to meet the changing needs of its residents and businesses. As the state’s economy grows and adapts to new challenges, the tax landscape is likely to undergo further transformations. Here are some potential future implications and considerations:

Digital Transformation

The rise of digital technologies and online platforms has revolutionized the way taxpayers interact with tax authorities. Alabama is likely to continue investing in digital infrastructure to enhance the efficiency and accessibility of its tax filing processes. This may include further improvements to online filing systems, mobile applications, and electronic payment options, making it even more convenient for taxpayers to meet their obligations.

Tax Policy Reform

Alabama’s tax policies are subject to ongoing discussions and potential reforms. As the state’s economic priorities shift and new legislative initiatives are introduced, the tax system may undergo changes to align with these evolving needs. Taxpayers should stay informed on any proposed reforms, as they may impact the way they file their returns and the overall tax burden they face.

Economic Development Initiatives

Alabama’s tax incentives and credits play a crucial role in attracting businesses and fostering economic growth. As the state continues to prioritize economic development, it is likely that these incentives will be expanded and refined to meet the changing needs of businesses. Taxpayers should stay tuned to any updates or expansions of these incentives, as they can provide significant financial benefits.

International Tax Considerations

With globalization and increasing international business operations, Alabama taxpayers may face unique challenges when it comes to international tax considerations. As the state’s economy becomes more interconnected with the global market, tax authorities may need to adapt their policies to address issues such as transfer pricing, cross-border transactions, and double taxation. Taxpayers with international operations should stay informed on these developments to ensure compliance.

Conclusion

Navigating Alabama’s tax return process requires a thorough understanding of the state’s unique tax system and its evolving landscape. By familiarizing themselves with the key features, filing requirements, and optimization strategies, taxpayers can ensure compliance, minimize their tax burden, and maximize their financial benefits. As Alabama continues to adapt and innovate its tax policies, staying informed and proactive will be essential for individuals and businesses alike.

How can I find out if I am eligible for any tax credits or deductions in Alabama?

+To determine your eligibility for tax credits and deductions, you can refer to the Alabama Department of Revenue’s website, which provides comprehensive guidelines and resources. Additionally, consulting with a tax professional can help you navigate the specific requirements and maximize your benefits.

Are there any resources available to help me calculate my tax liability accurately?

+Yes, the Alabama Department of Revenue offers online tax calculators and interactive tools to assist taxpayers in estimating their tax liability. These resources provide a convenient way to understand your potential tax obligations before filing.

What should I do if I owe taxes but cannot afford to pay the full amount by the deadline?

+If you are unable to pay your taxes in full by the deadline, you should contact the Alabama Department of Revenue as soon as possible. They may be able to offer payment plans or other options to help you manage your tax obligations. It is important to communicate your situation and explore available solutions.

Can I file my Alabama tax return electronically?

+Yes, Alabama offers electronic filing options through its official website. This method is convenient, secure, and provides immediate confirmation of receipt. Additionally, many tax preparation software programs offer the option to e-file Alabama tax returns.

Are there any tax preparation resources available for individuals with low incomes or limited financial means?

+Alabama provides tax preparation assistance programs for low-income individuals and those with limited financial resources. These programs offer free tax preparation services and can help ensure accurate filing. You can find more information on these programs through the Alabama Department of Revenue’s website or by contacting local community organizations.