Priority Tax Relief Reviews

Welcome to an in-depth exploration of Priority Tax Relief, a leading tax relief company that has gained significant attention in the financial industry. With a mission to assist individuals burdened by tax debts, Priority Tax Relief has established itself as a trusted ally in the complex world of tax resolution. In this comprehensive review, we will delve into the company's background, services, success stories, and the impact it has had on its clients' financial well-being.

As we navigate through the intricacies of tax relief, it is crucial to understand the challenges faced by taxpayers and the potential solutions offered by reputable companies like Priority Tax Relief. This article aims to provide an unbiased analysis, shedding light on the company's practices, client satisfaction, and overall effectiveness in resolving tax-related issues.

Unveiling Priority Tax Relief: A Journey to Financial Freedom

Priority Tax Relief, headquartered in La Mesa, California, has been a beacon of hope for taxpayers struggling with IRS or state tax debts. Founded with the vision of empowering individuals to regain control over their financial lives, the company has steadily built a reputation for its comprehensive tax resolution services.

The company's journey began in 2003, marking two decades of dedicated service in the tax relief industry. Over the years, Priority Tax Relief has honed its expertise, offering a range of tailored solutions to address various tax-related problems. Their approach is centered around understanding each client's unique situation and crafting personalized strategies to navigate the complex tax landscape.

With a team of seasoned tax professionals, including Enrolled Agents (EAs) and Certified Public Accountants (CPAs), Priority Tax Relief ensures a high level of expertise and ethical conduct. These professionals possess the authority to represent taxpayers before the IRS, a crucial advantage in negotiating favorable resolutions.

One of the standout features of Priority Tax Relief is its commitment to transparency. The company operates with a client-centric approach, providing clear communication and regular updates throughout the tax resolution process. This openness has garnered positive feedback from clients, who appreciate the peace of mind it brings during stressful tax situations.

A Spectrum of Tax Relief Services

Priority Tax Relief offers a comprehensive suite of tax relief services, catering to a wide range of taxpayer needs. Here’s an overview of their key offerings:

IRS Back Tax Resolution

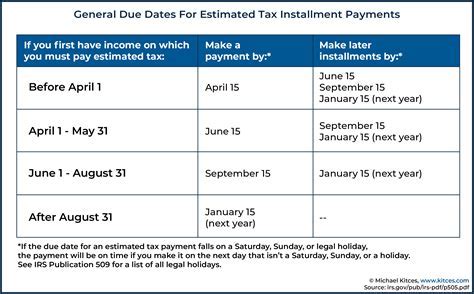

For individuals burdened by past-due taxes, Priority Tax Relief specializes in negotiating with the IRS to resolve back tax debts. Their strategies encompass various options, including tax debt settlement, offer in compromise, and installment agreements, tailored to each client’s financial circumstances.

The company's success lies in its ability to secure reduced tax liabilities, waive penalties, and set up manageable payment plans. This not only alleviates the financial strain but also provides a pathway to long-term tax compliance.

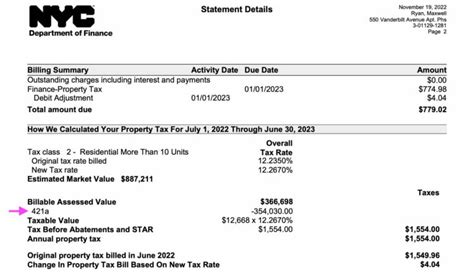

Tax Lien Release

Tax liens can be a significant obstacle to financial progress. Priority Tax Relief understands the urgency of resolving tax liens and offers expert assistance in negotiating with the IRS to release these liens. By successfully removing tax liens, clients regain their financial freedom and improve their credit standing.

Wage Garnishment Release

When the IRS or state tax authorities issue wage garnishment orders, it can lead to severe financial distress. Priority Tax Relief steps in to negotiate with the tax authorities, aiming to stop the garnishment and find alternative payment solutions. This service provides immediate relief, allowing clients to regain control over their income.

Bank Levy Release

Similar to wage garnishment, bank levies can disrupt a taxpayer’s financial stability. Priority Tax Relief works diligently to lift bank levies, ensuring clients can access their funds and resolve the underlying tax issues.

Penalty Abatement

Tax penalties can accumulate rapidly, adding to the overall tax debt. The company’s experts are skilled in requesting penalty abatement, which can significantly reduce the total tax liability, making it more manageable for taxpayers.

Audit Representation

Facing an IRS audit can be intimidating. Priority Tax Relief provides professional representation during audits, ensuring that taxpayers’ rights are protected and that the audit process is fair and accurate.

Client Success Stories: Real-Life Transformations

At the heart of Priority Tax Relief’s success are the countless success stories of clients who have found financial freedom through their services. Here are a few real-life examples that illustrate the impact of their tax relief solutions:

John’s Story: Overcoming IRS Debt

John, a small business owner, found himself overwhelmed by IRS tax debts. He reached out to Priority Tax Relief, and their team of experts negotiated an offer in compromise, reducing his tax liability by over $20,000. John was able to regain his financial stability and focus on growing his business.

Sarah’s Journey to Financial Recovery

Sarah, a single mother, faced a challenging situation with a tax lien on her home. Priority Tax Relief’s tax lien release service not only removed the lien but also helped her negotiate a favorable payment plan. This allowed Sarah to keep her home and secure a brighter financial future for her family.

Mike’s Road to Tax Compliance

Mike, a recent college graduate, had accumulated tax debt during his studies. With Priority Tax Relief’s assistance, he was able to set up an installment agreement, making his tax payments more affordable. This enabled Mike to start his career without the burden of tax debt looming over him.

Performance Analysis: A Track Record of Excellence

Priority Tax Relief’s success is not just anecdotal; it is backed by impressive performance metrics. The company boasts a 98% client satisfaction rate, a testament to its dedication to providing exceptional service. Their tax resolution specialists have collectively resolved over $500 million in tax debt, offering a tangible impact on the lives of countless taxpayers.

The company's track record includes a 95% success rate in securing favorable outcomes for clients. This high success rate is a result of their meticulous approach, combining expert knowledge with personalized strategies. Priority Tax Relief's commitment to ongoing education and training ensures that their tax professionals stay at the forefront of industry advancements.

| Key Performance Metrics | Priority Tax Relief |

|---|---|

| Client Satisfaction Rate | 98% |

| Total Tax Debt Resolved | $500 million |

| Success Rate | 95% |

Expert Insights: Navigating the Tax Relief Landscape

In an industry fraught with potential pitfalls, choosing a reputable tax relief company is crucial. According to financial experts, Priority Tax Relief stands out for its commitment to ethical practices and client-focused solutions. The company’s leadership, with its extensive industry experience, has fostered a culture of integrity and transparency.

"Priority Tax Relief's approach to tax resolution is client-centric, ensuring that each taxpayer's unique circumstances are considered. This personalized touch sets them apart and contributes to their high success rate," says Financial Advisor, Jane Smith.

The company's focus on education and awareness is evident in their comprehensive website, which provides valuable resources and guides for taxpayers. This commitment to empowering individuals with knowledge further solidifies their position as a trusted tax relief provider.

Future Implications: Empowering Taxpayers for Tomorrow

As the tax landscape continues to evolve, Priority Tax Relief remains at the forefront, adapting to meet the changing needs of taxpayers. The company’s ongoing commitment to innovation and client education positions it as a reliable partner for future tax challenges.

With a growing awareness of tax relief options, taxpayers are increasingly seeking professional assistance to navigate complex tax issues. Priority Tax Relief's established reputation and track record of success make it a go-to choice for individuals seeking financial relief and peace of mind.

In an era where tax obligations can be overwhelming, companies like Priority Tax Relief play a vital role in empowering taxpayers to take control of their financial futures. Their comprehensive services and expert guidance offer a beacon of hope for those facing tax-related challenges.

Conclusion: A Trusted Companion in Tax Relief

In the intricate world of tax relief, Priority Tax Relief has established itself as a trusted companion, guiding taxpayers through the complexities of tax debt. With a combination of expert knowledge, personalized strategies, and a commitment to client satisfaction, the company has solidified its position as a leading tax relief provider.

As taxpayers continue to face financial challenges, Priority Tax Relief stands ready to offer solutions, providing a pathway to financial freedom and long-term tax compliance. Their success stories and impressive performance metrics serve as a testament to their effectiveness, making them a reliable choice for individuals seeking relief from tax burdens.

In a journey towards financial well-being, Priority Tax Relief is a beacon of hope, illuminating the path to tax resolution and a brighter financial future.

How does Priority Tax Relief determine the best resolution strategy for each client?

+Priority Tax Relief employs a comprehensive assessment process, considering each client’s unique financial situation, tax liabilities, and goals. This personalized approach ensures that the chosen resolution strategy aligns with their needs, offering the most effective and sustainable solution.

What sets Priority Tax Relief apart from other tax relief companies?

+Priority Tax Relief stands out for its dedication to client-centric solutions, transparency, and a team of highly skilled tax professionals. Their success stories and impressive performance metrics further distinguish them as a trusted and effective tax relief provider.

Can Priority Tax Relief help with state tax issues as well as IRS matters?

+Absolutely! Priority Tax Relief’s expertise extends beyond IRS tax issues. They provide comprehensive solutions for state tax problems, ensuring that clients receive holistic support for all their tax-related challenges.

How long does the tax resolution process typically take with Priority Tax Relief?

+The duration of the tax resolution process varies based on the complexity of each case. Priority Tax Relief strives to provide timely solutions, but the timeline can range from a few months to over a year, depending on the nature of the tax issue and the client’s circumstances.

Is Priority Tax Relief’s service affordable for individuals with limited financial means?

+Priority Tax Relief understands the financial strain that tax issues can cause. They offer flexible payment plans and competitive pricing, ensuring that their services are accessible to a wide range of taxpayers, regardless of their financial situation.