Mortgage Tax Form

The Mortgage Tax Form is a crucial document that plays a vital role in the real estate and mortgage industry, impacting both buyers and lenders. It serves as a legal instrument to assess and collect taxes on mortgage transactions, ensuring that governments can generate revenue from one of the most significant financial decisions individuals make in their lifetimes. This article aims to delve into the intricacies of the Mortgage Tax Form, its purpose, implications, and its impact on the real estate market.

Understanding the Mortgage Tax Form

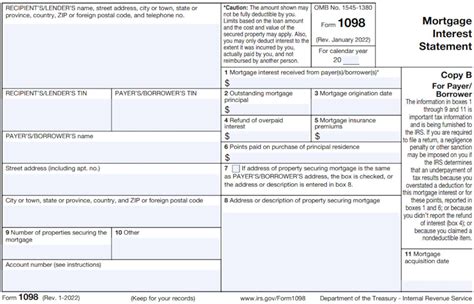

The Mortgage Tax Form, often referred to as the Real Estate Transfer Tax Form or simply the Transfer Tax Form, is a legal document required in many jurisdictions when a property is purchased or refinanced using a mortgage. It is a critical component of the settlement process, as it details the financial aspects of the transaction, including the mortgage amount, interest rates, and any applicable taxes.

This form is designed to calculate and record the transfer taxes owed to the state or local government, ensuring that the appropriate tax authorities receive their due share. The tax rates can vary significantly based on location and the type of property being purchased. For instance, some areas may have a flat tax rate applied to the total mortgage amount, while others may assess a percentage-based tax on the property's value.

Key Components of the Mortgage Tax Form

The Mortgage Tax Form contains several critical sections that capture the essential details of the transaction:

- Property Information: This section provides an overview of the property being purchased, including its address, legal description, and fair market value. It ensures that the tax is calculated accurately based on the property's worth.

- Borrower and Lender Details: The form captures the personal information of both the borrower (the individual purchasing the property) and the lender (the financial institution providing the mortgage). This includes names, addresses, and contact details, ensuring transparency and accountability.

- Mortgage Terms: A comprehensive breakdown of the mortgage agreement is provided, including the loan amount, interest rate, term length, and any associated fees. This information is vital for calculating the applicable transfer taxes.

- Tax Calculation: This section is where the magic happens. It involves a complex calculation that considers the property's value, the mortgage amount, and the applicable tax rates to determine the total transfer tax owed. The tax is typically a one-time fee paid by the borrower as part of the settlement costs.

- Signatures and Acknowledgements: The form requires signatures from both the borrower and the lender, signifying their agreement to the terms outlined. Additionally, a notary public may be required to witness and validate the signatures, adding an extra layer of security and legality.

The Mortgage Tax Form is a highly regulated document, and its accuracy is paramount to avoid legal complications and financial penalties. It is typically prepared by the title company or settlement agent handling the transaction, who are experts in navigating the complex web of local tax laws and regulations.

Impact on the Real Estate Market

The Mortgage Tax Form and the transfer taxes it entails have a significant impact on the real estate market, influencing both buyers and sellers. Here’s a closer look at its implications:

Buyer Perspective

For buyers, the Mortgage Tax Form adds an additional cost to their purchase, often coming as a surprise if they are unaware of its existence. Transfer taxes can range from a few hundred dollars for a modest home to several thousand dollars for high-value properties. These taxes are typically included in the closing costs, so buyers need to factor them into their budget when planning for their home purchase.

Furthermore, the transfer tax can influence a buyer's decision-making process. In highly competitive markets where properties sell quickly, the transfer tax may become a negotiating point. Buyers might opt to reduce their offer price to compensate for the transfer tax, especially if they anticipate a competitive bidding situation.

Seller Perspective

From a seller’s standpoint, the Mortgage Tax Form and the associated transfer taxes can impact the final sale price of their property. While the seller doesn’t directly pay the transfer tax, it is typically built into the overall sale price. This means that the seller might need to adjust their asking price to account for the tax, ensuring the property remains competitive in the market.

In some cases, sellers might even consider offering to pay the transfer tax as an incentive to buyers, especially if they are motivated to sell quickly. This strategy can make their property more attractive to potential buyers, increasing the chances of a successful sale.

Market Dynamics

The existence of transfer taxes and the Mortgage Tax Form can influence market dynamics in various ways. In areas with high transfer taxes, buyers may be more hesitant to enter the market, especially first-time homebuyers. This can lead to a slower market and potentially impact property values.

On the other hand, in regions with more favorable tax rates, the market might experience a boost in activity. Buyers are more likely to be active, and sellers may benefit from increased demand. This can lead to a more vibrant and competitive market, with properties selling faster and potentially at higher prices.

Future Implications and Trends

The Mortgage Tax Form and transfer taxes are integral components of the real estate ecosystem, and their impact is likely to persist. However, several trends and developments are worth noting for the future:

Digitalization of the Process

As the real estate industry embraces technology, the process of completing and submitting the Mortgage Tax Form is likely to become more digital. Online platforms and digital signatures can streamline the process, making it more efficient and convenient for all parties involved. This shift can reduce errors and ensure a faster settlement process.

Variable Tax Rates

Transfer tax rates are subject to change based on local government decisions. While some areas may opt to increase taxes to boost revenue, others might reduce rates to stimulate market activity. Keeping an eye on these changes is crucial for both buyers and sellers, as it can significantly impact their financial strategies.

Alternative Tax Structures

Some jurisdictions are exploring alternative tax structures, such as stamp duties or land transfer taxes, which can be more favorable to certain types of transactions. These alternative structures can impact the overall cost of purchasing a property and may influence buyer and seller decisions.

| Property Type | Transfer Tax Rate (%) |

|---|---|

| Residential Property | 0.5 |

| Commercial Property | 1.0 |

| Vacant Land | 0.75 |

Conclusion

The Mortgage Tax Form is a critical document that ensures governments receive their share of revenue from real estate transactions. Its impact on the real estate market is profound, influencing buyer and seller behavior, as well as market dynamics. Understanding the intricacies of this form and its associated taxes is vital for anyone involved in the real estate industry, whether as a professional or a buyer/seller.

How often does the Mortgage Tax Form need to be filed?

+The Mortgage Tax Form is typically filed once during the settlement process when the property is purchased or refinanced. It is a one-time requirement unless there are significant changes to the mortgage terms or the property is sold again.

Can transfer taxes be negotiated between buyers and sellers?

+Transfer taxes are set by local governments and cannot be directly negotiated between buyers and sellers. However, as mentioned earlier, buyers may adjust their offer price to account for the transfer tax, which can indirectly influence the final sale price.

Are there any exemptions or discounts for transfer taxes?

+Exemptions and discounts for transfer taxes vary by jurisdiction. Some areas may offer reduced rates for first-time homebuyers or certain types of properties. It’s essential to research local laws and consult with a real estate professional to understand any potential exemptions.