Ventura Ca Sales Tax

Ventura, a charming coastal city in Southern California, is known for its picturesque beaches, vibrant downtown, and laid-back lifestyle. However, when it comes to financial matters, understanding the sales tax rates is crucial for both residents and businesses alike. The sales tax in Ventura, like in many other cities, is a significant source of revenue for the local government and plays a vital role in funding public services and infrastructure development.

Understanding Ventura’s Sales Tax Structure

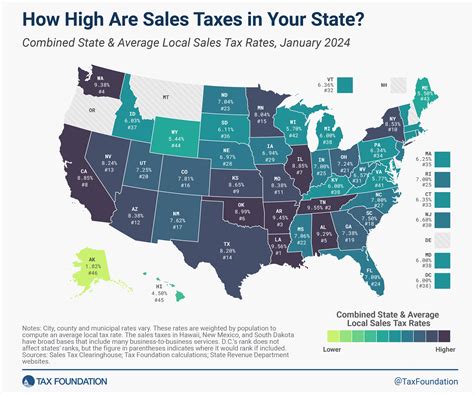

The sales tax in Ventura, California, is a combination of state, county, and city taxes, each with its own rate. This unique structure ensures that a portion of the revenue generated from sales goes towards state-wide initiatives, while also providing funding for local projects and services. As of my last update in January 2023, the sales tax rates in Ventura were as follows:

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Ventura County | 0.75% |

| Ventura City | 1.00% |

| Total Sales Tax in Ventura | 9.00% |

The state sales tax rate in California is set at 7.25%, which is a standard rate across the state. This rate applies to most tangible personal property and some services. However, it's important to note that certain jurisdictions, like Ventura County, have additional taxes to support specific initiatives.

Ventura County Sales Tax

Ventura County, in an effort to enhance public safety and transportation, imposes an additional 0.75% sales tax. This tax, known as the Public Safety and Transportation Investment Act, was approved by voters in 2016 and aims to improve roads, bridges, and law enforcement services. The revenue generated from this tax is strictly allocated to these critical areas, ensuring that the community’s needs are met.

Ventura City Sales Tax

The city of Ventura also has its own sales tax rate, which stands at 1.00%. This tax is vital for funding various city projects and maintaining the city’s infrastructure. The revenue collected from this tax is used for essential services such as street maintenance, park improvements, and community development initiatives.

Impact of Sales Tax on Local Businesses and Residents

The sales tax in Ventura affects both businesses and residents in various ways. For businesses, especially those in the retail sector, the tax rate can influence pricing strategies and overall profitability. Businesses must carefully consider these tax rates when setting their prices to remain competitive and attract customers.

Residents, on the other hand, feel the impact of sales tax directly when making purchases. The 9.00% sales tax in Ventura means that a significant portion of the purchase price goes towards these taxes. However, it's important to remember that this tax contributes to the overall well-being of the community by funding essential services and infrastructure projects.

Strategies for Businesses

To navigate the sales tax landscape effectively, businesses in Ventura can employ several strategies. First, they can educate themselves about the tax rates and how they are applied to different goods and services. This knowledge can help businesses make informed decisions about pricing and promotions.

Additionally, businesses can explore tax exemption options for certain purchases. For example, businesses engaged in manufacturing or reselling goods may qualify for exemptions on the sales tax paid on certain purchases. Consulting with a tax professional can provide valuable insights into these opportunities.

Tips for Residents

For residents, understanding the sales tax can help with budgeting and financial planning. It’s important to consider the tax when comparing prices, especially for larger purchases. Shopping around and comparing prices from different retailers can sometimes lead to savings, even with the sales tax taken into account.

Additionally, residents should be aware of tax-free holidays or special promotions that may offer opportunities to save on certain items. These events, often organized by the state or local government, can provide significant savings and help stretch household budgets.

Future Implications and Considerations

As with any tax structure, the sales tax rates in Ventura are subject to change. The local government may propose adjustments to these rates to address budget shortfalls or to fund specific initiatives. It’s essential for both businesses and residents to stay informed about any potential changes and how they might impact their financial planning.

Furthermore, the sales tax structure in Ventura, like many other cities, faces ongoing debates and discussions. Some argue for simplifying the tax structure, while others advocate for targeted taxes to support specific community needs. Engaging in these discussions and understanding the potential impacts can help shape the future of sales tax policies in Ventura.

Potential Changes and Their Impact

If the sales tax rates were to change, it could have significant effects on the local economy. For instance, a decrease in the sales tax rate could stimulate consumer spending, as goods and services become more affordable. Conversely, an increase in the tax rate could lead to a shift in consumer behavior, potentially impacting local businesses.

Additionally, changes in the sales tax structure could influence the way businesses operate. For example, if certain goods or services were exempted from sales tax, it could encourage businesses to specialize in those areas, leading to a shift in the local economy.

How do sales tax rates impact online purchases in Ventura?

+

Online purchases in Ventura are also subject to sales tax. The same rates apply to online transactions as they do to in-store purchases. This means that when you buy goods online from a Ventura-based retailer, you will pay the combined state, county, and city sales tax rate. However, if the online retailer is not based in Ventura, they may not collect the city’s sales tax, resulting in a slightly lower overall tax rate for the purchase.

Are there any sales tax holidays in Ventura or California?

+

Yes, California, including Ventura, does have sales tax holidays. These are designated periods when certain types of goods, often back-to-school items or energy-efficient appliances, are exempt from sales tax. These holidays are typically announced by the state government and provide an opportunity for residents to save on essential purchases. It’s important to stay updated on these events to take advantage of the savings.

How do businesses handle sales tax collection and remittance in Ventura?

+

Businesses in Ventura are responsible for collecting and remitting the appropriate sales tax to the California Department of Tax and Fee Administration. This process involves registering with the department, collecting the tax at the point of sale, and then submitting the collected taxes periodically. The frequency of remittance can vary based on the business’s sales volume and other factors. It’s crucial for businesses to stay compliant with these requirements to avoid penalties.