Do Goverment Agencies Pay Taxes

In the intricate world of tax systems, one intriguing question arises: Do government agencies, entities tasked with upholding laws and policies, have tax obligations like regular citizens and businesses? The answer is nuanced and varies depending on the jurisdiction and the specific nature of the agency or government body.

Let's delve into the complex web of tax regulations surrounding government agencies and explore the various aspects that determine their tax liabilities.

The Complexity of Government Taxation

The taxation of government agencies is a multifaceted issue that requires a deep understanding of tax laws and the unique role of public entities in society. While private individuals and businesses are generally subject to various taxes, the treatment of government bodies is often more complex.

In many countries, government agencies are not considered tax-paying entities in the traditional sense. This is because governments create and enforce tax laws, and it would be unusual for them to impose taxes on themselves. However, this doesn't mean that government agencies are entirely exempt from all forms of taxation.

Tax Exemptions and Privileges

Government agencies often enjoy certain tax exemptions and privileges due to their public nature and the services they provide to society. These exemptions can vary widely and are typically outlined in the tax laws and regulations of a given jurisdiction.

Property Taxes

One common area where government agencies receive exemptions is property taxes. Government-owned properties, such as office buildings, land, and other assets, are often exempt from local property taxes. This exemption ensures that public funds are not used to pay taxes on government-owned assets.

| Government Entity | Property Tax Exemption |

|---|---|

| Federal Agencies | Exempt from state and local property taxes |

| State Agencies | Exempt from local property taxes, but may pay state-level taxes |

| Municipal Bodies | Often exempt from property taxes on their own facilities |

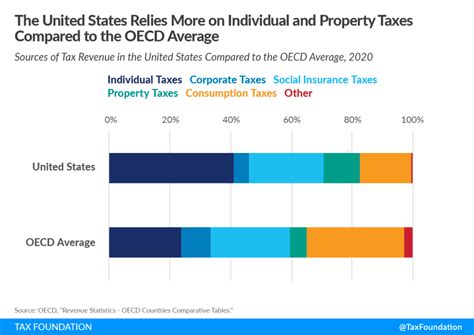

Income and Payroll Taxes

The treatment of income and payroll taxes for government employees is another complex aspect. While government agencies themselves may not pay income taxes, the employees of these agencies are generally subject to personal income tax obligations.

However, there are instances where certain government employees, such as those in specific roles or with unique tax status, may be exempt from certain income taxes. This is particularly true for diplomats and foreign service officers, who often enjoy tax privileges due to international agreements.

Sales and Consumption Taxes

When it comes to sales and consumption taxes, government agencies often have different obligations depending on the nature of their purchases. In many cases, government entities are exempt from paying sales tax on goods and services purchased for official use.

For instance, a government agency acquiring office supplies or equipment for official duties may not be subject to sales tax. However, if the agency engages in commercial activities or sells goods to the public, it may be required to collect and remit sales tax just like any other business.

Tax Obligations and Revenue Generation

While government agencies may enjoy certain tax exemptions, they are not entirely removed from the tax system. In fact, government bodies often have unique tax obligations and play a crucial role in revenue generation for the state.

Tax Collection and Administration

Government agencies, particularly tax authorities, are responsible for collecting and administering taxes on behalf of the state. This includes enforcing tax laws, conducting audits, and ensuring compliance with tax regulations.

For example, the Internal Revenue Service (IRS) in the United States is a government agency tasked with enforcing income tax laws and collecting taxes from individuals and businesses. Similarly, many countries have dedicated tax agencies that perform these functions.

Tax Policy and Reform

Government agencies also play a vital role in shaping tax policy and implementing tax reforms. Policy-making bodies within governments often propose and implement changes to the tax system, aiming to achieve various economic and social objectives.

These reforms can include adjustments to tax rates, the introduction of new taxes, or the elimination of certain tax exemptions. Government agencies, therefore, have a direct impact on the tax landscape and the financial well-being of citizens and businesses.

Case Studies: Tax Treatment of Government Agencies

To illustrate the varying tax obligations of government agencies, let’s explore a few real-world examples from different countries.

United States

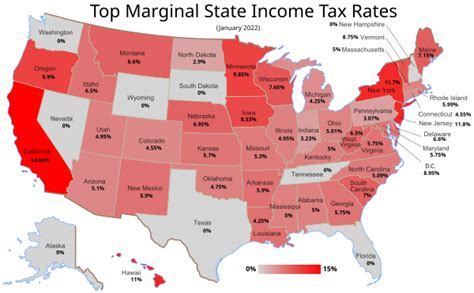

In the United States, federal government agencies are generally exempt from state and local taxes, including property, sales, and income taxes. This exemption is rooted in the concept of sovereign immunity, which protects the federal government from being taxed by state or local authorities.

However, this exemption does not apply to federal employees, who are subject to personal income tax obligations like any other citizen. Additionally, federal agencies that engage in commercial activities, such as the Postal Service, may be subject to certain taxes.

United Kingdom

In the UK, government departments and agencies are generally exempt from most taxes, including income tax, National Insurance contributions, and value-added tax (VAT) on their purchases. This exemption extends to local government bodies as well.

However, government agencies in the UK are not entirely exempt from all taxes. For instance, they may be subject to stamp duty land tax (SDLT) when acquiring property and corporation tax if they operate as a company.

Canada

In Canada, federal and provincial government agencies are exempt from most taxes, including income tax, sales tax, and property tax. This exemption is granted under the Canadian Constitution and is intended to ensure that government funds are not used to pay taxes.

However, like in other countries, government employees in Canada are subject to personal income tax obligations. Additionally, certain government entities, such as Crown corporations, may be subject to specific tax regulations depending on their commercial activities.

The Impact on Fiscal Policy and Budgeting

The tax obligations (or lack thereof) of government agencies have significant implications for fiscal policy and government budgeting.

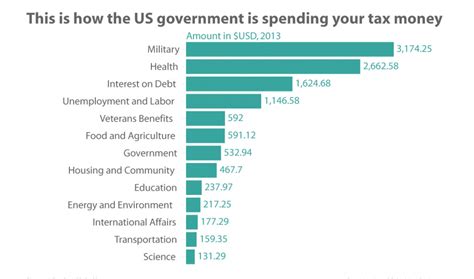

Revenue Generation

By exempting government agencies from certain taxes, governments forego potential revenue streams. This can impact the overall fiscal health of the state and require alternative sources of revenue to fund public services and infrastructure.

On the other hand, by collecting taxes from citizens and businesses, government agencies contribute to the overall tax base, allowing for the provision of essential services and the implementation of social programs.

Budgetary Constraints

The tax exemptions enjoyed by government agencies can also lead to budgetary constraints. Without tax revenue, government bodies may face limitations in funding their operations and achieving their mandated objectives.

As a result, governments often need to carefully manage their finances, allocate resources efficiently, and explore alternative funding mechanisms to ensure the smooth functioning of public entities.

Conclusion

The taxation of government agencies is a complex and multifaceted issue that varies across jurisdictions. While government bodies often enjoy certain tax exemptions and privileges, they are not entirely exempt from all forms of taxation.

From property tax exemptions to the role of government agencies in tax collection and policy-making, the tax landscape for public entities is intricate and shaped by a variety of factors. Understanding these nuances is essential for a comprehensive grasp of tax systems and their impact on society.

Are all government agencies exempt from taxes?

+No, the tax obligations of government agencies vary widely. While many enjoy exemptions, certain agencies may be subject to specific taxes depending on their activities and jurisdiction.

Do government employees pay taxes?

+Yes, government employees are generally subject to personal income tax obligations, just like any other citizen. However, there may be exceptions for certain roles or international agreements.

How do government agencies contribute to the tax system?

+Government agencies contribute to the tax system through tax collection and administration. They enforce tax laws, conduct audits, and ensure compliance, playing a crucial role in revenue generation for the state.