Bellevue Sales Tax

In the vibrant city of Bellevue, nestled in the heart of Washington state, the topic of sales tax is a matter of great interest and importance for both residents and businesses alike. With a thriving economy and a diverse range of retail and commercial activities, understanding the nuances of sales tax in Bellevue is essential for making informed financial decisions. This comprehensive guide delves into the intricacies of Bellevue's sales tax landscape, shedding light on its structure, implications, and potential benefits.

Unraveling the Bellevue Sales Tax: A Comprehensive Guide

Bellevue, a bustling city known for its technological advancements and vibrant business ecosystem, imposes a sales tax that contributes significantly to its revenue stream. This tax, while necessary for the city's growth and development, can impact the financial plans of both consumers and businesses operating within its boundaries. Let's embark on a detailed exploration of how sales tax operates in Bellevue, shedding light on its complexities and providing valuable insights for those navigating its economic landscape.

The Sales Tax Structure in Bellevue

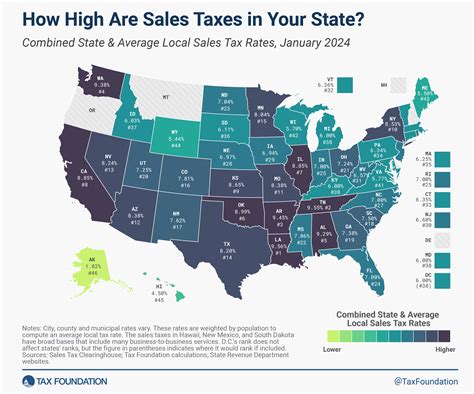

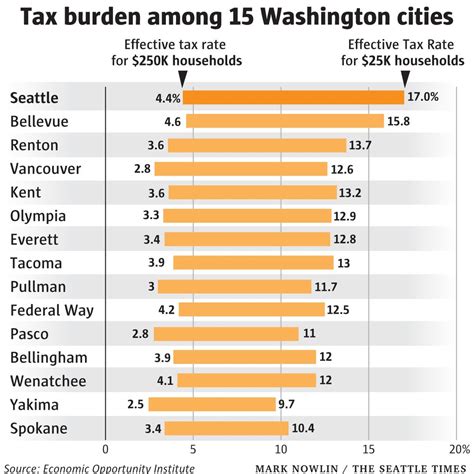

The sales tax system in Bellevue is a meticulously designed framework that comprises multiple layers of taxation. At its core, Bellevue imposes a base sales tax rate of 6.5%, which is applicable to a wide range of goods and services. This base rate serves as the foundation upon which additional taxes are layered, creating a comprehensive tax structure.

In addition to the base rate, Bellevue introduces local taxes that are specific to the city. These local taxes are designed to address the unique needs and priorities of the community, such as funding local infrastructure projects, supporting public services, and fostering economic development initiatives. The local tax rate in Bellevue currently stands at 1.8%, bringing the combined sales tax rate to a total of 8.3%.

| Sales Tax Category | Tax Rate |

|---|---|

| Base Sales Tax | 6.5% |

| Local Tax | 1.8% |

| Combined Sales Tax Rate | 8.3% |

It is worth noting that the sales tax structure in Bellevue extends beyond the city limits. The state of Washington also imposes its own sales tax, adding another layer to the overall tax landscape. The state sales tax rate in Washington is currently set at 6.5%, bringing the total sales tax rate for Bellevue residents and businesses to a significant 14.8%.

Sales Tax Exemptions and Special Considerations

While the sales tax structure in Bellevue may appear straightforward, it is essential to explore the exemptions and special considerations that exist within this framework. Understanding these nuances can help businesses and consumers navigate the tax landscape more effectively and potentially reduce their tax liability.

One notable exemption within the Bellevue sales tax system is the food exemption. Unlike many other jurisdictions, Bellevue does not impose sales tax on the purchase of unprepared food items. This exemption provides a significant relief for residents, as it means that groceries and staple food items are not subject to the city's sales tax. However, it is important to note that this exemption only applies to food that is intended for consumption at home and does not extend to restaurant meals or prepared food items.

In addition to the food exemption, Bellevue offers special tax rates for certain types of businesses and transactions. For example, businesses engaged in manufacturing may be eligible for a reduced sales tax rate on the purchase of certain raw materials and equipment. This incentive is designed to promote economic growth and encourage investment in the manufacturing sector within the city.

Furthermore, Bellevue recognizes the importance of charitable organizations and non-profit entities in the community. As such, these organizations may be eligible for sales tax exemptions on certain purchases made in the course of their operations. This exemption helps reduce the financial burden on these organizations, allowing them to allocate more resources towards their mission and serve the community more effectively.

It is crucial for businesses and consumers alike to stay informed about these exemptions and special considerations. By understanding the nuances of the Bellevue sales tax system, individuals and organizations can optimize their financial strategies and ensure compliance with the relevant tax regulations.

Impact of Sales Tax on Local Businesses and Consumers

The sales tax structure in Bellevue has a profound impact on both local businesses and consumers. For businesses, the sales tax rate directly influences their pricing strategies and profitability. With a combined sales tax rate of 14.8%, businesses must carefully consider the impact on their bottom line and find ways to manage their financial obligations while remaining competitive in the market.

For consumers, the sales tax rate can influence their purchasing decisions and overall financial planning. The added tax burden may encourage consumers to shop around for the best deals or explore alternative purchasing options, such as online retailers or neighboring jurisdictions with lower tax rates. Understanding the sales tax landscape is crucial for consumers to make informed choices and manage their budgets effectively.

To mitigate the potential negative impacts of a high sales tax rate, Bellevue has implemented various initiatives to support local businesses and promote economic growth. These initiatives include tax incentives for small businesses, streamlined tax filing processes, and targeted marketing campaigns to encourage consumer spending within the city. By fostering a business-friendly environment, Bellevue aims to strike a balance between generating revenue through sales tax and supporting the growth and success of local enterprises.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Bellevue. The city takes sales tax compliance seriously and has implemented measures to enforce the collection and remittance of sales tax. Businesses operating within Bellevue are required to obtain a business license and register with the Department of Revenue to report and pay their sales tax obligations.

To facilitate compliance, the Department of Revenue provides resources and guidance to businesses, helping them understand their sales tax responsibilities. This includes providing tax registration forms, offering educational materials, and conducting outreach programs to ensure businesses are aware of their obligations. By providing support and resources, the city aims to create a fair and transparent tax system that promotes compliance and minimizes the risk of non-compliance penalties.

In addition to educational initiatives, Bellevue also conducts regular audits and inspections to ensure businesses are accurately collecting and remitting sales tax. These audits serve as a deterrent against tax evasion and help maintain a level playing field for all businesses operating within the city. By enforcing sales tax compliance, Bellevue aims to protect its revenue stream and ensure a fair and equitable tax system for all residents and businesses.

Future Outlook and Potential Changes

As Bellevue continues to evolve and adapt to changing economic landscapes, the sales tax structure may also undergo modifications. The city's leadership and policymakers are constantly evaluating the effectiveness of the current tax system and exploring potential reforms to enhance its efficiency and fairness.

One potential area of reform is the consideration of a simplified tax structure. While the current system provides targeted incentives and exemptions, it can also be complex and challenging for businesses to navigate. Simplifying the tax structure could make it more accessible and understandable for businesses, reducing the administrative burden and streamlining the tax filing process.

Additionally, Bellevue may explore the possibility of introducing new tax incentives or adjusting existing ones to promote specific economic goals. For instance, the city could offer enhanced tax incentives for businesses that create job opportunities or invest in environmentally sustainable practices. By aligning the tax system with its strategic priorities, Bellevue can encourage economic growth and development in targeted sectors.

Furthermore, the ongoing digital transformation and the rise of e-commerce present new challenges and opportunities for sales tax collection. Bellevue may need to adapt its tax policies to address the unique nature of online transactions and ensure that sales tax is collected fairly and effectively in the digital realm. This could involve collaborating with online platforms and developing innovative solutions to capture tax revenue from online sales.

How often are sales tax rates updated in Bellevue?

+Sales tax rates in Bellevue are subject to periodic updates and revisions. The city's leadership and the Department of Revenue regularly review the tax structure to ensure it aligns with the city's economic goals and revenue needs. While the frequency of updates can vary, significant changes are typically announced in advance to provide businesses and consumers with sufficient time to adjust their financial plans.

Are there any plans to reduce the sales tax rate in Bellevue?

+Reducing the sales tax rate is a complex decision that involves careful consideration of the city's financial needs and the potential impact on revenue generation. While there may be discussions and proposals for tax reforms, any significant changes to the sales tax rate would require careful evaluation and consensus among policymakers and community stakeholders.

How can businesses stay informed about sales tax changes in Bellevue?

+Businesses operating in Bellevue can stay informed about sales tax changes by regularly monitoring the city's official websites and subscribing to relevant newsletters or alerts. The Department of Revenue often provides updates and announcements regarding tax policy changes, ensuring that businesses have access to the latest information. Additionally, businesses can reach out to the Department of Revenue directly for clarifications or to stay updated on any upcoming changes.

In conclusion, understanding the sales tax landscape in Bellevue is crucial for both businesses and consumers navigating the city’s vibrant economy. The comprehensive sales tax structure, with its base and local taxes, contributes significantly to the city’s revenue stream and supports essential public services. While the sales tax rate may impact financial decisions, the city’s initiatives and exemptions provide opportunities for businesses and consumers to optimize their strategies and manage their obligations effectively. As Bellevue continues to evolve, the sales tax system will likely undergo reforms to adapt to changing economic dynamics and promote sustainable growth.