Aiken County Taxes

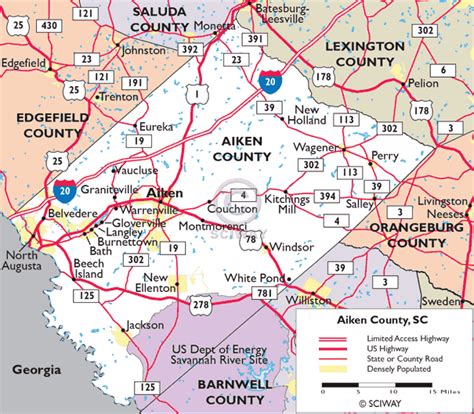

Welcome to a comprehensive guide on Aiken County Taxes, designed to provide you with an in-depth understanding of the tax landscape in this region. Aiken County, located in South Carolina, boasts a vibrant community and a unique tax system that affects residents, businesses, and investors alike. This article aims to demystify the intricacies of Aiken County's tax structure, offering valuable insights and expert advice.

Understanding Aiken County’s Tax System

Aiken County operates under a robust tax framework, encompassing various tax types and regulations. The county’s tax system is crucial for funding essential services, infrastructure development, and maintaining the local economy. Here’s an overview of the key tax categories and their significance:

Property Taxes

Property taxes are a significant revenue source for Aiken County. The county assesses the value of real estate properties, including residential homes, commercial establishments, and land, to determine the tax liability. Property taxes fund critical services such as education, public safety, and infrastructure maintenance. Aiken County utilizes a millage rate system, where the tax rate is expressed in mills (one-tenth of a cent) per dollar of assessed property value. The millage rate is set annually by the county’s governing body, taking into account the budget requirements and the need to maintain a balanced tax structure.

For instance, if the millage rate is set at 100 mills, a property with an assessed value of $200,000 would have a property tax bill of $2,000. Aiken County offers various tax exemptions and relief programs to eligible homeowners, including homestead exemptions and veterans' exemptions. These exemptions help reduce the tax burden for specific categories of taxpayers, ensuring fairness and providing support to vulnerable communities.

| Tax Type | Description |

|---|---|

| Residential Property Tax | Taxes on homes and residential properties, with potential exemptions for homeowners. |

| Commercial Property Tax | Taxes on businesses and commercial establishments, supporting economic development. |

| Land Tax | Taxes on undeveloped land, contributing to the county's overall revenue. |

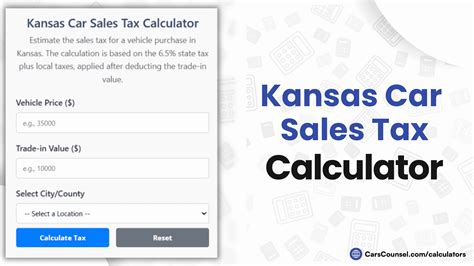

Sales and Use Taxes

Sales and use taxes are another vital component of Aiken County’s tax system. These taxes are imposed on the sale of goods and services within the county, as well as on the use or consumption of certain items. The revenue generated from these taxes is essential for funding public projects, such as road improvements, recreational facilities, and cultural initiatives.

Aiken County's sales tax rate is comprised of a state-mandated rate and a local rate, with the total rate varying slightly across the county due to additional municipal taxes. The sales tax is applied to most retail transactions, including purchases made online or through catalogs if the seller has a physical presence in the county. It's important for businesses to understand the sales tax requirements and ensure compliance to avoid penalties.

Use taxes, on the other hand, are levied on the storage, use, or consumption of tangible personal property in Aiken County. This tax applies when items are purchased from out-of-state vendors or through online retailers and are brought into the county for use. Use taxes ensure that all transactions are taxed fairly, regardless of where the purchase was made.

Business Taxes and Licenses

Aiken County encourages economic growth and entrepreneurship by offering a supportive business environment. The county collects business taxes and licenses to fund services that benefit the business community, such as business development programs, infrastructure improvements, and regulatory compliance initiatives.

Businesses operating within Aiken County are required to obtain specific licenses and permits, depending on their industry and nature of operations. These licenses ensure compliance with local regulations and help the county maintain a safe and thriving business ecosystem. Common business licenses include:

- Occupational licenses for professionals such as contractors, lawyers, and healthcare providers.

- Sales tax permits for businesses engaged in retail sales.

- Business licenses for general operations, which may have additional requirements based on the business type.

Aiken County also offers incentives and tax breaks for businesses that create jobs, invest in the community, or operate in specific industries. These incentives aim to attract new businesses and support existing ones, fostering a vibrant and competitive business landscape.

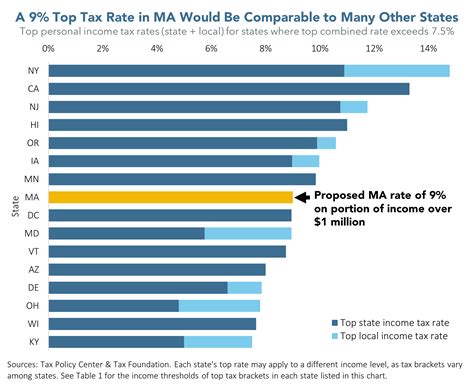

Personal Income Taxes

Personal income taxes are an essential part of Aiken County’s revenue stream. Residents of the county are subject to both state and federal income taxes, with the county collecting a portion of the state income tax. The county utilizes this revenue to fund essential services, including education, healthcare, and social welfare programs.

Aiken County's income tax system is progressive, meaning that higher income earners pay a larger percentage of their income in taxes. This approach ensures that the tax burden is distributed fairly across different income levels. The county also offers tax credits and deductions to eligible residents, providing relief for specific expenses such as childcare, education, and healthcare.

Tax Payment Options and Deadlines

Aiken County provides taxpayers with various options for paying their taxes, ensuring convenience and accessibility. Here are the primary methods of tax payment:

- Online Payments: Taxpayers can pay their property taxes, business taxes, and other applicable taxes online through the Aiken County website. This method is secure, efficient, and allows for real-time payment tracking.

- Mail-In Payments: Taxpayers can mail their tax payments to the Aiken County Treasurer's Office. This option is suitable for those who prefer traditional methods and allows for the inclusion of remittance advice for accurate processing.

- In-Person Payments: Aiken County offers in-person payment options at designated locations, including the Treasurer's Office and certain satellite offices. This method is ideal for those who prefer face-to-face interactions and allows for immediate confirmation of payment.

- Automatic Payment Plans: Aiken County provides automatic payment plans for property taxes, allowing taxpayers to have their tax payments automatically deducted from their bank accounts on specific dates. This option ensures timely payments and avoids late fees.

It's crucial for taxpayers to adhere to the established tax deadlines to avoid penalties and interest charges. Aiken County typically sends out tax notices with clear instructions and due dates. Late payments may result in additional fees, so it's advisable to stay informed and plan accordingly.

Tax Exemptions and Relief Programs

Aiken County recognizes the importance of providing tax relief to certain segments of the population. The county offers a range of exemptions and relief programs to ease the tax burden for eligible individuals and organizations. Here are some notable tax relief initiatives:

Homestead Exemptions

Aiken County provides homestead exemptions for eligible homeowners, reducing the taxable value of their primary residence. This exemption aims to provide financial relief to homeowners, especially those on fixed incomes. To qualify for the homestead exemption, homeowners must meet specific residency and income criteria.

Veterans’ Exemptions

The county shows its appreciation for veterans by offering property tax exemptions. Eligible veterans can apply for reduced property taxes, providing much-needed financial support. The exemption amount varies based on the veteran’s disability status and length of service.

Senior Citizen Exemptions

Aiken County extends tax relief to senior citizens by offering property tax exemptions based on age and income. This initiative ensures that senior citizens can continue to afford their homes and maintain their quality of life. The exemption amount is determined by the county’s assessment board, taking into account the taxpayer’s circumstances.

Agricultural Exemptions

The county promotes agricultural activities by offering exemptions for farmland and agricultural equipment. This encourages farming as a vital economic activity and helps preserve the rural character of Aiken County. To qualify for these exemptions, landowners must meet specific criteria regarding the use and value of their land.

The Impact of Aiken County Taxes on the Local Economy

Aiken County’s tax system plays a pivotal role in shaping the local economy. The revenue generated from taxes funds essential services, infrastructure development, and community initiatives, creating a positive feedback loop that benefits residents and businesses alike. Here’s a deeper look at the economic impact of Aiken County’s tax structure:

Funding for Essential Services

Tax revenue is the primary source of funding for critical services in Aiken County. These services include education, public safety, healthcare, and social welfare programs. By investing in these areas, the county ensures that its residents have access to quality public services, promoting a healthy and productive community.

For instance, property taxes contribute significantly to the funding of the Aiken County School District, enabling the district to provide high-quality education to students. Similarly, sales and use taxes support the development of recreational facilities, making Aiken County an attractive place to live and work.

Infrastructure Development

Aiken County’s tax revenue is instrumental in funding infrastructure projects that enhance the quality of life for residents and businesses. These projects include road improvements, bridge repairs, water and sewer system upgrades, and the development of public transportation networks. Well-maintained infrastructure attracts businesses and fosters economic growth, creating a positive cycle of investment and development.

Community Initiatives and Economic Development

Beyond funding essential services and infrastructure, Aiken County’s tax revenue is also directed towards community initiatives and economic development programs. These initiatives aim to improve the overall well-being of the community and attract new businesses and investments.

For example, the county may utilize tax revenue to support local arts and culture, promoting Aiken County as a vibrant cultural hub. Additionally, tax incentives and grants can be offered to businesses that create jobs, invest in renewable energy, or operate in strategic industries, further strengthening the local economy.

Navigating the Tax Landscape: Expert Tips

Understanding and managing your tax obligations can be complex, especially when dealing with a diverse tax system like Aiken County’s. Here are some expert tips to help you navigate the tax landscape effectively:

Stay Informed

Keep yourself updated on the latest tax regulations, deadlines, and changes in Aiken County’s tax system. Subscribe to official notifications, follow the county’s tax department on social media, and attend community meetings or workshops to stay informed. Being aware of tax updates can help you plan your finances and avoid surprises.

Utilize Tax Relief Programs

Take advantage of the various tax relief programs offered by Aiken County. If you’re a homeowner, consider applying for homestead or senior citizen exemptions. Veterans should explore the veterans’ exemptions available to them. These programs can significantly reduce your tax burden and provide much-needed financial relief.

Seek Professional Advice

If you have complex tax situations or are unsure about your tax obligations, consider seeking advice from a qualified tax professional. A tax advisor can help you navigate the intricacies of Aiken County’s tax system, ensure compliance, and identify potential tax-saving opportunities.

Plan Your Payments

Aiken County offers various payment options, including online payments, mail-in payments, and in-person payments. Choose the method that suits your preferences and needs. Consider setting up automatic payment plans to ensure timely payments and avoid late fees. Planning your payments can help you manage your cash flow effectively.

Stay Organized

Maintain a well-organized record-keeping system for your tax-related documents. Keep track of tax notices, payment receipts, and any correspondence with the Aiken County tax authorities. Proper record-keeping can simplify the tax preparation process and provide evidence in case of audits or inquiries.

Conclusion

Aiken County’s tax system is a vital component of the local economy, funding essential services, infrastructure development, and community initiatives. By understanding the different tax categories, exemptions, and payment options, taxpayers can navigate the tax landscape effectively and contribute to the county’s prosperity. Remember to stay informed, utilize tax relief programs, and seek professional advice when needed. Together, we can ensure a fair and sustainable tax system that benefits all members of the Aiken County community.

How do I estimate my property taxes in Aiken County?

+To estimate your property taxes in Aiken County, you can use the county’s online tax estimator tool. This tool considers factors such as your property’s assessed value, location, and any applicable exemptions. It provides a rough estimate of your tax liability, helping you plan your finances accordingly.

Are there any tax breaks for green initiatives in Aiken County?

+Yes, Aiken County offers tax incentives for green initiatives. The county promotes renewable energy and sustainable practices by providing tax credits and exemptions for eligible businesses and homeowners. These incentives encourage the adoption of eco-friendly technologies and practices, contributing to a greener community.

How can I apply for a business license in Aiken County?

+To apply for a business license in Aiken County, you can visit the county’s Business Licensing Office or their official website. The process typically involves filling out an application form, providing relevant business information, and paying the applicable fees. The county’s staff will guide you through the requirements specific to your business type.

What happens if I miss the tax payment deadline in Aiken County?

+If you miss the tax payment deadline in Aiken County, you may be subject to late fees and interest charges. It’s important to stay informed about the payment deadlines and plan your payments accordingly. The county’s tax office can provide guidance on late payment options and potential penalty waivers in specific circumstances.

Are there any tax incentives for starting a business in Aiken County?

+Aiken County offers a range of tax incentives to attract and support new businesses. These incentives may include tax credits, reduced tax rates, or grants for job creation and economic development. The county’s economic development office can provide detailed information on the available incentives and the eligibility criteria.