Commonwealth Of Virginia Sales Tax

The Commonwealth of Virginia, often referred to as simply Virginia, is a southeastern state in the United States known for its rich history, diverse landscapes, and thriving economy. When it comes to sales tax, Virginia has a comprehensive system in place to generate revenue for the state and local governments. This article delves into the intricacies of Virginia's sales tax, providing an in-depth analysis of its rates, exemptions, and the impact it has on businesses and consumers.

Understanding Virginia’s Sales Tax Structure

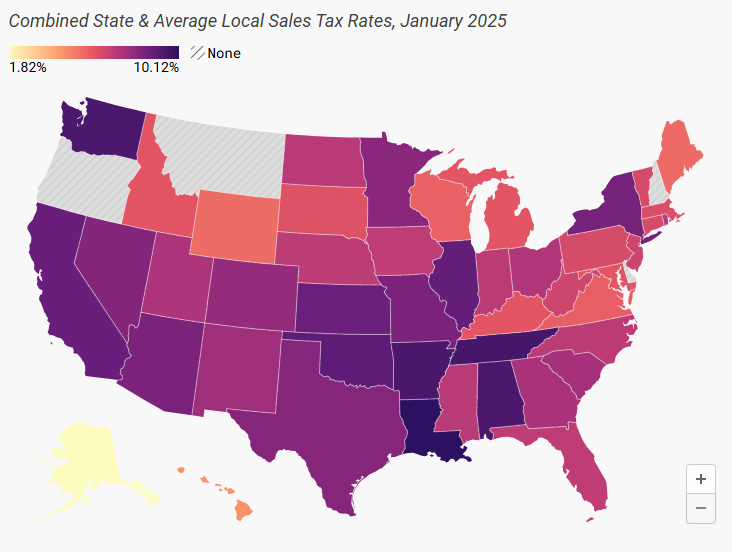

Virginia imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property, as well as certain services. The sales tax rate in Virginia consists of a state tax rate and an additional local tax rate, which varies depending on the jurisdiction. This unique structure allows local governments to raise revenue for their specific needs while contributing to the state’s overall tax revenue.

State Sales Tax Rate

The state sales tax rate in Virginia is a flat 4.3%, which is applicable statewide. This rate has been in effect since 1992 and has remained consistent, providing a stable tax environment for businesses and consumers.

Local Sales Tax Rates

In addition to the state sales tax, Virginia allows local jurisdictions to levy their own local sales and use taxes. These local tax rates can vary significantly across the state, ranging from 0% to 4%. The local sales tax rates are set by city or county governments and are often used to fund specific projects or initiatives within their communities.

| Local Jurisdiction | Local Sales Tax Rate |

|---|---|

| Arlington County | 0.5% |

| City of Alexandria | 2% |

| Fairfax County | 4% |

| City of Norfolk | 2% |

| Loudoun County | 1% |

| ... | ... |

The table above provides a glimpse of the diverse local sales tax rates across Virginia. It's important for businesses and consumers to be aware of these rates, as they can significantly impact the overall sales tax burden.

Sales Tax Exemptions in Virginia

While Virginia’s sales tax applies to a wide range of goods and services, there are certain categories that are exempt from taxation. Understanding these exemptions is crucial for both businesses and consumers to ensure compliance with the state’s tax laws.

Exempt Goods and Services

Virginia exempts several categories of goods and services from sales tax, including:

- Food and beverages intended for home consumption, excluding prepared foods and soft drinks.

- Prescription drugs and medical supplies.

- Clothing and footwear up to a certain value.

- Certain agricultural products.

- Educational materials and textbooks.

- Residential rents.

- Admission fees for certain cultural and entertainment events.

It's important to note that while these categories are exempt, there may be specific conditions or limitations attached to each exemption. For instance, the clothing and footwear exemption only applies to items below a certain price threshold.

Sales Tax Holidays

Virginia also offers sales tax holidays, during which certain types of purchases are exempt from sales tax. These holidays are typically held at strategic times of the year, such as back-to-school season or hurricane preparedness periods. During these periods, consumers can save on essential items like school supplies, clothing, and emergency preparedness gear.

For example, Virginia's Back-to-School Sales Tax Holiday is held annually, usually for a few days in August. During this holiday, clothing and footwear items priced under a certain limit are exempt from sales tax, providing a significant savings opportunity for families preparing for the new school year.

Impact on Businesses and Consumers

Virginia’s sales tax system has a profound impact on both businesses and consumers within the state. For businesses, the sales tax structure influences their pricing strategies, tax compliance requirements, and overall financial planning.

Business Considerations

Businesses operating in Virginia must navigate the state’s sales tax laws to ensure they are collecting and remitting taxes correctly. This includes registering for a sales tax permit, calculating and collecting the appropriate tax rates, and filing regular tax returns. Failure to comply with these obligations can result in penalties and interest charges.

Moreover, businesses must consider the impact of varying local sales tax rates when pricing their goods and services. To maintain competitiveness, some businesses may choose to absorb the additional local tax, while others may pass it on to the consumer. This decision can significantly affect a business's profitability and customer perception.

Consumer Perspective

For consumers, Virginia’s sales tax structure means understanding the total cost of their purchases, including the applicable tax rates. While the state tax rate is consistent, the addition of local tax rates can make price comparisons between jurisdictions more complex. This is especially true for online shoppers, who may not always be aware of the local tax rates applicable to their purchases.

However, Virginia's sales tax exemptions and holidays provide opportunities for consumers to save money. By being aware of these exemptions and planning their purchases accordingly, consumers can minimize their tax burden and maximize their purchasing power.

Future Implications and Trends

Virginia’s sales tax system is dynamic and subject to ongoing changes and trends. As the state’s economy evolves, so too does the tax landscape, influencing revenue generation and economic development.

Economic Impact and Revenue Generation

Sales tax is a significant source of revenue for the Commonwealth of Virginia, contributing to the state’s overall budget. In recent years, the state has seen a steady increase in sales tax revenue, with a growing population and a robust economy playing a key role. This revenue is vital for funding essential services, infrastructure development, and public programs.

Potential Changes and Challenges

While Virginia’s sales tax system is generally stable, there are ongoing discussions and potential changes on the horizon. Some proposed changes include modifying the sales tax rate structure, expanding the list of exempt items, or implementing new tax incentives to attract businesses and promote economic growth.

Additionally, the rise of e-commerce and online shopping presents unique challenges for sales tax collection. Virginia, like many other states, is exploring ways to effectively tax online sales and ensure fair competition between brick-and-mortar and online retailers. This includes considering the implementation of marketplace facilitator laws and remote seller regulations.

Conclusion

Virginia’s sales tax system is a complex yet vital component of the state’s economy. It provides a stable revenue stream for the state and local governments, while also impacting the pricing strategies of businesses and the purchasing decisions of consumers. As Virginia continues to thrive and adapt to economic changes, its sales tax system will play a crucial role in shaping the state’s financial landscape.

How often do sales tax rates change in Virginia?

+Sales tax rates in Virginia are generally stable, with the state tax rate remaining consistent since 1992. However, local tax rates can change more frequently, as they are set by individual city or county governments. It’s essential for businesses and consumers to stay updated on these changes to ensure compliance.

Are there any special sales tax rates for specific industries or products in Virginia?

+Virginia does not have specific sales tax rates for individual industries or products. However, certain items like food, clothing, and prescription drugs are exempt from sales tax under specific conditions. It’s important to consult the Virginia Department of Taxation for detailed information on these exemptions.

How does Virginia ensure compliance with sales tax laws, especially with online sales?

+Virginia has implemented various measures to ensure compliance with sales tax laws, including registering businesses for sales tax permits, conducting audits, and imposing penalties for non-compliance. With regards to online sales, the state is exploring marketplace facilitator laws and remote seller regulations to improve tax collection from online retailers.