What Is Fpi In Income Tax

FPI, or Foreign Portfolio Investment, is a crucial concept in the realm of income tax and international finance. It plays a significant role in the global financial landscape and has a direct impact on the economies of nations around the world. This comprehensive guide will delve into the intricacies of FPI, shedding light on its definition, its role in income tax, and its broader implications.

Understanding FPI: A Global Perspective

FPI refers to the movement of financial assets, typically stocks, bonds, and other securities, between countries by investors seeking higher returns or diversification. Unlike Foreign Direct Investment (FDI), which involves direct ownership and control of a business, FPI is a more passive form of investment, where investors buy and sell financial instruments on international markets.

This type of investment has gained prominence in recent decades as global financial markets have become increasingly interconnected. Investors, ranging from institutional funds to individual traders, now have access to a vast array of international investment opportunities, leading to a surge in FPI activity.

The Mechanics of FPI

When an investor from one country purchases financial assets in another country, it is considered an inflow of FPI for the recipient country. Conversely, when an investor sells these assets, it results in an outflow of FPI. These transactions are typically conducted through stock exchanges, bond markets, and other financial institutions.

For instance, consider an American investor who purchases shares in a British technology company listed on the London Stock Exchange. This transaction represents an inflow of FPI for the United Kingdom, as the investor is injecting capital into the British economy. Similarly, if a Japanese investor decides to sell their holdings in an American tech firm, it would result in an outflow of FPI from the United States.

| Country | FPI Inflows | FPI Outflows |

|---|---|---|

| United States | $450 billion | $300 billion |

| China | $200 billion | $150 billion |

| United Kingdom | $180 billion | $120 billion |

The table above illustrates hypothetical FPI inflows and outflows for three major economies. Such data is crucial for understanding the financial health and investment attractiveness of these countries.

The Role of FPI in Income Tax

FPI has a complex relationship with income tax systems around the world. While it provides opportunities for global investors to diversify their portfolios and potentially increase returns, it also presents unique challenges for tax authorities in managing cross-border financial flows.

Taxation of FPI Income

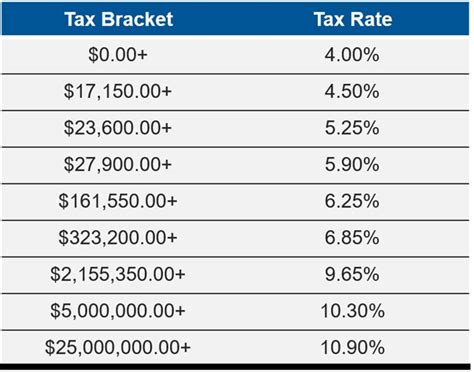

The income generated from FPI, such as dividends, interest, and capital gains, is subject to taxation in most jurisdictions. Tax authorities often treat FPI income differently from domestic income, implementing specific rules and regulations to govern these transactions.

For instance, many countries have withholding tax systems in place for FPI income. This means that the entity making the payment (e.g., a company paying dividends) withholds a certain percentage of the payment as tax and remits it to the tax authority. The rate of withholding tax can vary depending on the type of income and the tax treaty between the two countries involved.

Furthermore, FPI income may be taxed differently based on the residency status of the investor. Non-residents may be subject to different tax rates or have to comply with specific tax reporting requirements.

Tax Treaties and Double Taxation

To mitigate the risk of double taxation, where an investor’s income is taxed by both the source country and the investor’s home country, many countries enter into tax treaties with one another. These treaties establish rules for how income is taxed and ensure that investors are not unduly burdened by overlapping tax obligations.

For example, the United States has a tax treaty with Canada that specifies the tax rates and rules for various types of income, including dividends, interest, and capital gains. This treaty helps ensure that U.S. investors in Canadian securities are not double-taxed and vice versa.

The Impact of FPI on Economies

FPI can have significant effects on the economies of both the investing and recipient countries. It can influence exchange rates, impact the availability of credit, and affect the overall financial stability of a nation.

Benefits of FPI

Inflows of FPI can bring numerous advantages to a country’s economy. They can provide a source of capital for businesses, support economic growth, and stimulate job creation. Additionally, FPI can enhance a country’s financial market infrastructure and increase its attractiveness to domestic and foreign investors.

For instance, consider a developing country with a growing technology sector. FPI inflows into this sector can provide much-needed capital for startups and established firms, allowing them to expand, innovate, and create employment opportunities. This, in turn, can boost the country's economic growth and improve its global competitiveness.

Risks and Challenges

However, FPI also comes with risks. Sudden outflows of FPI can lead to financial crises, currency devaluations, and economic downturns. This was evident during the Asian Financial Crisis of the late 1990s, where rapid outflows of FPI contributed to the collapse of several Asian economies.

Moreover, FPI can sometimes lead to speculation and volatile financial markets. Investors may engage in short-term trading strategies, which can exacerbate market volatility and make it difficult for long-term investors to navigate the market.

The Future of FPI

As global financial markets continue to evolve, FPI is expected to remain a significant factor in international finance. The increasing integration of financial markets, coupled with advancements in technology and communication, will likely lead to even greater FPI activity.

However, the management of FPI will also become more complex. Tax authorities and financial regulators will need to adapt to the changing landscape, implementing innovative solutions to ensure fair taxation, mitigate risks, and promote financial stability.

Emerging Trends in FPI

- Increased Focus on Sustainability: Investors are increasingly considering environmental, social, and governance (ESG) factors when making investment decisions. This trend is expected to influence FPI flows, with investors seeking sustainable and responsible investment opportunities.

- Digital Assets and Blockchain: The rise of digital assets and blockchain technology has opened up new avenues for FPI. Cryptocurrencies and tokenized assets are gaining traction, offering investors new avenues for international investment.

- Regulatory Changes: Many countries are reevaluating their tax systems and financial regulations to adapt to the changing nature of FPI. This includes initiatives to streamline tax reporting, enhance transparency, and combat tax evasion.

In conclusion, FPI is a dynamic and influential aspect of global finance. Its impact on income tax systems, economies, and financial markets is profound. As the world continues to globalize, understanding FPI and its implications will be crucial for investors, policymakers, and financial professionals alike.

How does FPI differ from FDI?

+FPI and FDI are both forms of international investment, but they differ in terms of the nature of the investment and the level of involvement. FPI involves the purchase and sale of financial assets, such as stocks and bonds, by investors seeking returns. In contrast, FDI involves direct investment in a business or entity, often resulting in ownership and control. FDI is typically a more long-term and committed form of investment compared to FPI.

What are the tax implications of FPI for investors?

+The tax implications of FPI can vary widely depending on the investor’s residence, the source of the income, and the tax treaties in place. Investors may be subject to withholding taxes on dividends and interest, and they may need to report and pay taxes on capital gains. It’s crucial for investors to understand their tax obligations and seek professional advice to ensure compliance.

How do countries benefit from FPI inflows?

+FPI inflows can provide countries with access to much-needed capital for economic growth and development. They can support businesses, stimulate job creation, and enhance financial market infrastructure. Additionally, FPI can signal confidence in a country’s economy, attracting further investment and fostering economic stability.