New York State Tax Payments Online

Welcome to our comprehensive guide on New York State Tax Payments Online! In today's digital age, managing your tax obligations has become more convenient and efficient. New York State offers an online platform that allows taxpayers to handle various tax-related tasks, including payments, with ease. This article will delve into the features, benefits, and step-by-step process of utilizing this online system. Whether you're a business owner or an individual taxpayer, understanding this platform can streamline your tax management and save you valuable time.

Understanding the New York State Tax Payments Online Platform

The New York State Department of Taxation and Finance has developed an innovative online platform to cater to the diverse needs of taxpayers. This platform, accessible via the official website, provides a user-friendly interface that simplifies the process of paying taxes, submitting returns, and managing your tax accounts. With a secure and robust system, the online platform ensures the confidentiality and integrity of your financial information.

One of the key advantages of this online system is its accessibility. Taxpayers can access their accounts and perform various transactions from the comfort of their homes or offices, eliminating the need for physical visits to tax offices. This convenience is especially beneficial for busy individuals and businesses, allowing them to manage their tax obligations at their own pace.

Moreover, the platform offers a range of payment options to suit different preferences and requirements. Taxpayers can choose from electronic funds transfer (EFT), credit card payments, and even paper checks. The flexibility in payment methods ensures that individuals and businesses can select the most convenient and suitable option for their financial situations.

Key Features of the Online Payment Platform

- Secure Login and Account Management: Users can create secure accounts with unique usernames and passwords. The platform employs encryption protocols to protect sensitive data, ensuring a safe environment for managing tax-related information.

- Real-Time Transaction Tracking: Once logged in, taxpayers can view their account balances, recent transactions, and pending payments. This real-time tracking provides transparency and helps in financial planning.

- Efficient Payment Processing: The platform offers quick and efficient payment processing, reducing the time it takes for payments to be received and reflected in the taxpayer’s account. This timely processing can be crucial for meeting deadlines and avoiding penalties.

- Customizable Payment Schedules: For businesses with recurring tax obligations, the platform allows for the setup of automated payment schedules. This feature ensures that payments are made promptly and consistently, reducing the risk of late fees.

- Electronic Funds Transfer (EFT): EFT is a popular choice for taxpayers as it offers a direct and secure method of transferring funds from their bank accounts to the tax authority. This method eliminates the need for physical checks and provides a faster and more convenient payment process.

Step-by-Step Guide: Making Tax Payments Online

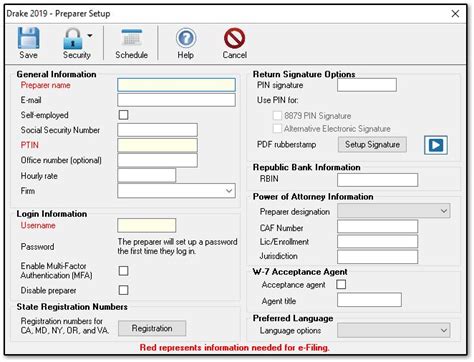

- Access the Platform: Begin by visiting the official New York State Department of Taxation and Finance website. The URL is https://www.tax.ny.gov. From the homepage, navigate to the “Online Services” section, where you’ll find the link to the tax payment portal.

- Register or Login: If you’re a new user, click on the “Register” button to create an account. Provide the required personal or business details, including your tax identification number. Existing users can simply log in with their credentials.

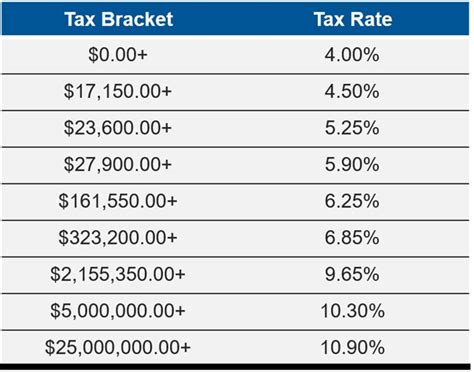

- Select Your Tax Type: Once logged in, you’ll be directed to your personalized dashboard. Here, select the type of tax you wish to pay, such as income tax, sales tax, or corporate tax. The platform will guide you through the specific steps for each tax type.

- Choose Your Payment Method: The platform offers a variety of payment options, including EFT, credit card, and check. Select the method that suits your preference and financial situation. Each option will have its own set of instructions.

- Enter Payment Details: Depending on the payment method chosen, you’ll be prompted to enter the necessary details. For EFT, provide your bank account information. For credit card payments, enter the card details, including the card number, expiration date, and CVV. For checks, you may need to provide the routing and account numbers.

- Review and Confirm: Before finalizing the payment, carefully review the details, including the amount, tax type, and payment method. Ensure that all information is accurate to avoid errors. Once satisfied, confirm the payment.

- Receive Confirmation: After successful payment processing, you’ll receive a confirmation message or email. This confirmation serves as a record of your transaction and can be used for future reference or as proof of payment.

- Save and Print Receipt: It is advisable to save and/or print the payment receipt for your records. This receipt contains important details such as the transaction ID, date, and time, which can be useful for accounting purposes or in case of any disputes.

Benefits of Online Tax Payments

- Convenience and Flexibility: The online platform allows taxpayers to make payments at any time, from anywhere with an internet connection. This flexibility eliminates the need for physical visits to tax offices, saving time and effort.

- Secure and Confidential: The platform utilizes advanced security measures to protect taxpayer information. Encryption protocols ensure that sensitive data, such as financial details and tax information, remains secure during online transactions.

- Efficient Payment Processing: Online payments are processed quickly, often in real-time. This efficiency ensures that payments are promptly received and reflected in the taxpayer’s account, reducing the risk of late payments and associated penalties.

- Cost-Effective: The online payment platform eliminates the need for physical checks and postage, reducing costs for taxpayers. Additionally, the platform often offers incentives or discounts for online payments, making it a cost-effective choice.

- Easy Record-Keeping: The platform maintains a detailed record of all transactions, providing taxpayers with an organized and accessible history of their payments. This feature simplifies record-keeping and makes it easier to track tax obligations.

Future Implications and Developments

The New York State Tax Payments Online platform is continuously evolving to meet the changing needs of taxpayers. As technology advances, the platform is expected to incorporate new features and enhancements to further streamline the tax payment process.

One potential development is the integration of blockchain technology, which could enhance security and transparency. Blockchain's decentralized nature could provide an added layer of protection for sensitive financial data, ensuring its integrity and confidentiality. Additionally, smart contracts could automate certain tax processes, reducing the potential for errors and improving efficiency.

Another area of focus is the platform's mobile accessibility. With the increasing reliance on smartphones and tablets, a mobile-optimized version of the platform could offer taxpayers even greater convenience. Mobile apps could provide real-time updates, push notifications for payment due dates, and a more user-friendly interface, making tax management even more accessible.

Furthermore, the platform could explore partnerships with financial institutions and payment gateways to expand the range of payment options. This could include the integration of digital wallets, such as Apple Pay or PayPal, providing taxpayers with a wider choice of secure and convenient payment methods.

The future of New York State's online tax payment platform holds exciting possibilities. By leveraging technological advancements and staying responsive to taxpayer needs, the platform can continue to enhance the tax payment experience, making it more efficient, secure, and user-friendly.

| Payment Method | Fees | Processing Time |

|---|---|---|

| Electronic Funds Transfer (EFT) | No fees | Real-time |

| Credit Card | Varies (typically 2.5% of the transaction amount) | Instant |

| Paper Check | No fees | 3-5 business days |

FAQs

Can I make partial payments online for my tax obligations?

+

Yes, the New York State Tax Payments Online platform allows taxpayers to make partial payments. This feature is particularly useful for taxpayers who may not have the full amount due at the time of payment. By making partial payments, you can manage your tax obligations more flexibly and avoid any potential late payment penalties.

Are there any fees associated with online tax payments in New York State?

+

The fees for online tax payments in New York State vary depending on the payment method chosen. Electronic Funds Transfer (EFT) and paper checks typically have no additional fees. However, credit card payments may incur a processing fee, which is usually a percentage of the transaction amount. It’s important to check the specific fee structure for each payment method before finalizing your transaction.

Can I schedule recurring payments for my taxes online?

+

Absolutely! The New York State Tax Payments Online platform offers the convenience of scheduling recurring payments. This feature is ideal for businesses and individuals with regular tax obligations. By setting up automated payments, you can ensure that your taxes are paid on time without the need for manual reminders or interventions. This not only saves time but also reduces the risk of late payments and associated penalties.

Is my financial information secure when making online tax payments in New York State?

+

Yes, the New York State Tax Payments Online platform prioritizes the security of taxpayer information. The platform utilizes advanced encryption technologies to protect sensitive data during online transactions. Additionally, the Department of Taxation and Finance regularly updates its security measures to comply with industry standards and best practices. Rest assured, your financial information is safe and confidential when using the online payment platform.

What happens if I encounter technical issues while making an online tax payment?

+

In the event of technical issues or errors during the online payment process, it’s important to remain calm and follow a few simple steps. First, check your internet connection and ensure that you’re using a compatible web browser. If the issue persists, contact the New York State Department of Taxation and Finance’s technical support team. They can provide guidance and assistance to resolve any technical problems you may encounter.