Wyoming State Sales Tax

In the vast and captivating state of Wyoming, nestled amidst breathtaking landscapes and a vibrant culture, understanding the intricacies of the Wyoming State Sales Tax is essential for both residents and businesses alike. This article delves into the specifics of this tax system, providing a comprehensive guide to its structure, rates, and implications.

Unraveling the Wyoming Sales Tax Landscape

Wyoming’s sales tax system stands as a cornerstone of its revenue generation strategy, contributing significantly to the state’s fiscal health. The Wyoming Department of Revenue, with its dedicated approach, ensures the effective administration and collection of sales taxes, thereby supporting vital public services and infrastructure development.

At its core, the Wyoming State Sales Tax is a consumption tax levied on the sale of tangible personal property and certain services within the state's borders. This tax is applied at various stages of the supply chain, from manufacturers to retailers, and ultimately, to the end consumer.

Tax Rates and Exemptions: A Detailed Breakdown

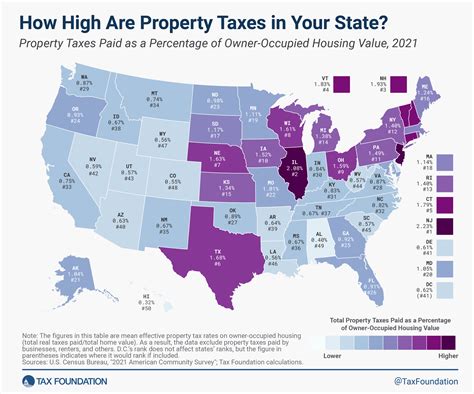

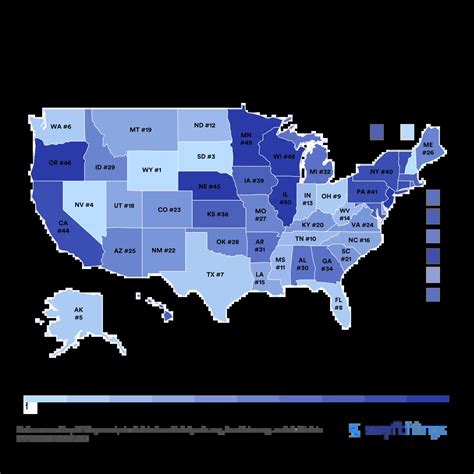

Wyoming’s sales tax structure is characterized by a uniform statewide rate, which simplifies tax compliance for businesses and consumers. As of 2023, the statewide sales tax rate stands at 4%, one of the lowest in the nation. This base rate applies uniformly across all counties and municipalities within Wyoming.

However, the state's sales tax system also allows for local option taxes, enabling counties and municipalities to levy additional taxes to fund specific projects or initiatives. These local option taxes, when added to the statewide rate, can result in combined sales tax rates ranging from 4% to 6%, depending on the location.

| County/Municipality | Additional Local Option Tax | Total Sales Tax Rate |

|---|---|---|

| Laramie County | 2% | 6% |

| Albany County | 1.5% | 5.5% |

| Campbell County | 1% | 5% |

Despite the simplicity of the statewide rate, Wyoming's sales tax system offers a range of exemptions and exclusions that can significantly impact tax liabilities. Some notable exemptions include:

- Food for home consumption

- Prescription and non-prescription drugs

- Most clothing and footwear

- Certain agricultural and livestock products

- Services such as legal, medical, and financial advice

It's crucial to note that while these exemptions provide relief for specific goods and services, they also highlight the complexity of Wyoming's sales tax system, especially for businesses operating across multiple jurisdictions.

Registration and Compliance: A Guide for Businesses

For businesses operating in Wyoming, understanding the registration and compliance requirements is paramount. The Wyoming Department of Revenue mandates that businesses collect and remit sales tax if they have a physical presence in the state, engage in economic nexus, or make remote sales into the state.

The economic nexus threshold in Wyoming is set at $100,000 in annual sales, meaning businesses exceeding this threshold must register for a sales tax permit and begin collecting and remitting sales tax. This threshold, while relatively high compared to other states, provides a degree of flexibility for small businesses.

Businesses can register for a Wyoming Sales Tax Permit through the Department of Revenue's online portal. The registration process typically involves providing basic business information, such as the business's legal name, physical address, and contact details. Once registered, businesses are issued a unique permit number, which they must display on all sales tax documents and records.

Compliance with sales tax obligations involves collecting the appropriate tax rate from customers, maintaining accurate sales records, and filing timely tax returns. Wyoming's sales tax returns are due monthly, quarterly, or annually, depending on the business's sales volume and registration status.

To facilitate compliance, the Wyoming Department of Revenue offers a range of resources, including online filing and payment systems, detailed tax guides, and dedicated customer support services. These resources aim to simplify the tax compliance process and ensure businesses can fulfill their obligations efficiently.

The Impact on Consumers: Understanding the Real Cost

For consumers in Wyoming, the impact of the state sales tax is a critical consideration when making purchasing decisions. While the statewide sales tax rate is relatively low, the addition of local option taxes can significantly increase the overall cost of goods and services, especially in certain counties.

Consider the example of a consumer purchasing a new laptop in Laramie County, which has a combined sales tax rate of 6%. For a laptop priced at $1,000, the sales tax alone would amount to $60, bringing the total cost to $1,060. This highlights the importance of understanding local tax rates when budgeting for significant purchases.

Moreover, Wyoming's sales tax system, with its various exemptions, can lead to price disparities for similar goods and services across the state. For instance, the exemption for food for home consumption means that groceries are tax-free, providing a significant savings for families and individuals.

Consumers can also benefit from tax-free events organized by the state, such as the annual "Sales Tax Holiday," during which specific items, often back-to-school supplies, are exempt from sales tax for a limited period. These events provide an opportunity for consumers to save on essential items, contributing to the state's economy and supporting local businesses.

Wyoming Sales Tax: A Forward-Looking Perspective

As Wyoming continues to evolve, so too does its sales tax system. The state’s commitment to a stable and predictable tax environment, coupled with its dedication to supporting local communities, positions Wyoming as an attractive destination for businesses and residents alike.

Looking ahead, the potential for tax reform remains an ongoing discussion. While Wyoming's current sales tax structure serves its purposes, the state may consider adjustments to keep pace with economic trends and ensure the continued viability of its revenue generation strategies.

In the realm of sales tax, Wyoming's approach showcases a balance between simplicity and flexibility. The state's low, uniform tax rate, coupled with its allowance for local option taxes, provides a robust foundation for economic growth while also offering local communities the autonomy to fund their unique initiatives.

For businesses and consumers alike, understanding Wyoming's sales tax landscape is a key to making informed decisions and ensuring compliance with the state's tax obligations. As the state continues to thrive, its sales tax system will undoubtedly remain a vital component of its economic success.

What is the purpose of Wyoming’s sales tax?

+

Wyoming’s sales tax is a primary source of revenue for the state, funding essential public services and infrastructure development. It ensures that businesses and consumers contribute to the state’s fiscal health, supporting the overall well-being of Wyoming’s residents.

Are there any online resources for businesses to understand their sales tax obligations in Wyoming?

+

Yes, the Wyoming Department of Revenue provides an extensive online resource center with detailed guides, FAQs, and interactive tools to help businesses understand their sales tax obligations. These resources are available on the department’s official website.

How often do businesses need to file sales tax returns in Wyoming?

+

The frequency of sales tax return filing in Wyoming depends on the business’s sales volume and registration status. Monthly, quarterly, or annual filing is required, with the specific timing determined by the Department of Revenue based on the business’s sales tax liability.

Are there any plans for sales tax reform in Wyoming?

+

As of my last update in January 2023, there were no significant plans for sales tax reform in Wyoming. However, the state’s tax policies are subject to ongoing review, and any future changes will be influenced by economic trends, budgetary needs, and public feedback.