Pcmc Property Tax

Welcome to an in-depth exploration of the PCMC (Pimpri Chinchwad Municipal Corporation) Property Tax system, an essential aspect of property ownership in the Pimpri Chinchwad area of Pune, India. This guide aims to provide a comprehensive understanding of the property tax landscape, covering everything from tax calculations to payment methods, and the various incentives and benefits available to homeowners and businesses.

Understanding PCMC Property Tax

The PCMC Property Tax is a crucial revenue source for the Pimpri Chinchwad Municipal Corporation, contributing to the development and maintenance of the city’s infrastructure, including roads, parks, and civic amenities. Property owners have a legal obligation to pay this tax annually, and timely payments ensure the continued growth and improvement of the city.

Tax Calculation Methodology

The PCMC employs a systematic approach to calculate property taxes, taking into account various factors such as:

- The property’s location, as different zones within Pimpri Chinchwad have varying tax rates.

- Property type, whether residential, commercial, or industrial, as each category has distinct tax implications.

- The built-up area of the property, which is the total area covered by the structure, including walls and columns.

- Usage type, considering whether the property is owner-occupied, rented, or vacant.

- The age of the property, with older properties often subject to lower tax rates.

- Any amenities or facilities within the property, such as a swimming pool or gym, which can impact the tax calculation.

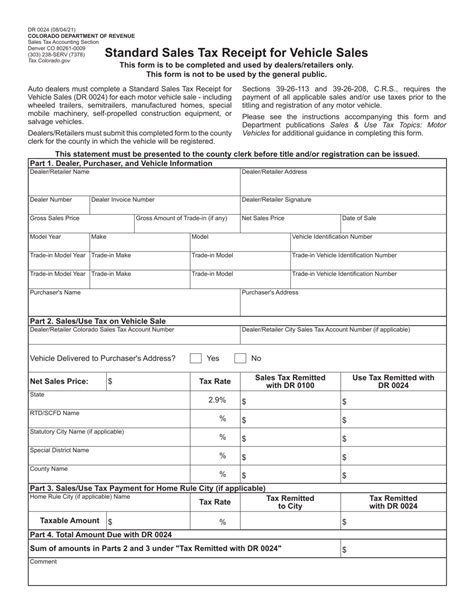

The PCMC utilizes a unit area value system for tax assessment, where each zone is assigned a unit rate per square foot, which is then multiplied by the property's built-up area to arrive at the annual tax liability. This system ensures fairness and transparency in tax calculation.

| Zone | Unit Rate (per sq. ft.) |

|---|---|

| Residential | ₹5.50 to ₹21.50 |

| Commercial | ₹25.00 to ₹55.00 |

| Industrial | ₹15.00 to ₹25.00 |

For instance, a residential property with a built-up area of 1500 sq. ft. located in Zone A would have a unit rate of ₹5.50. The annual tax liability for this property would be calculated as: 1500 sq. ft. x ₹5.50 = ₹8,250.

Tax Payment Options and Due Dates

The PCMC provides a range of convenient payment methods for property taxes, including:

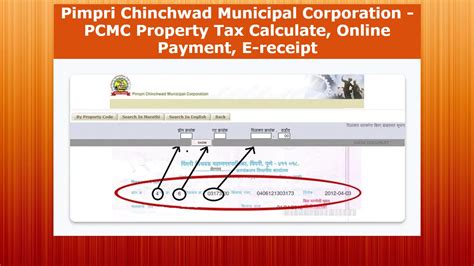

- Online payment through the PCMC website, which accepts major credit and debit cards.

- Cash or cheque payments at the PCMC office or designated collection centers.

- NEFT/RTGS transfers to the PCMC’s designated bank account.

- Payment through authorized third-party collection agents, who may accept cash, cheques, or digital payments.

Property owners are encouraged to pay their taxes before the due date to avoid late fees and penalties. The PCMC typically issues tax notices in the first quarter of the financial year, with a 30-day grace period before penalties are applied.

| Due Date | Grace Period | Late Fee |

|---|---|---|

| April 15th | May 15th | 1% of the tax amount per month |

Benefits and Incentives for Property Owners

The PCMC recognizes the importance of encouraging timely tax payments and rewarding responsible property owners. As such, it offers a range of benefits and incentives, including:

Early Payment Discounts

Property owners who pay their taxes before the due date are eligible for a 2% discount on their tax liability. This incentive promotes early payment and reduces the PCMC’s administrative burden.

Senior Citizen Concessions

Senior citizens aged 60 and above who own residential properties are entitled to a 10% reduction in their tax liability. This concession is aimed at supporting the city’s elderly population and encouraging them to remain in their own homes.

Online Payment Bonuses

To promote digital transactions and reduce administrative costs, the PCMC offers a 1% bonus to property owners who pay their taxes online. This incentive not only benefits property owners but also contributes to the city’s overall digital transformation.

Property Upkeep and Maintenance Grants

The PCMC understands the challenges of maintaining properties, especially for low-income homeowners. As such, it provides grants for property repairs and maintenance, which can be claimed against tax liabilities. This initiative not only helps homeowners but also contributes to the overall improvement of the city’s property landscape.

Challenges and Future Outlook

While the PCMC Property Tax system is well-structured and offers a range of benefits, there are challenges that the corporation and property owners face.

Challenges

One of the primary challenges is the undervaluation of properties, especially in rapidly developing areas. This can lead to lower tax revenues for the PCMC, impacting its ability to fund essential civic services and infrastructure development.

Another challenge is the lack of awareness among some property owners about their tax obligations and the benefits available to them. This can lead to late payments, non-compliance, and increased administrative costs for the PCMC.

Future Outlook

Looking ahead, the PCMC aims to address these challenges through a series of initiatives. These include:

- Implementing a more accurate property valuation system to ensure fair and transparent tax assessments.

- Enhancing public awareness campaigns to educate property owners about their tax obligations and the benefits of timely payments.

- Expanding the digital payment infrastructure to make tax payments more convenient and secure, and to reduce administrative overheads.

- Introducing incentives for energy-efficient and eco-friendly properties, encouraging property owners to adopt sustainable practices.

By addressing these challenges and implementing these initiatives, the PCMC aims to create a more efficient and equitable property tax system, contributing to the continued growth and development of Pimpri Chinchwad.

How can I estimate my property tax liability before receiving the official notice from PCMC?

+You can use the PCMC’s online property tax calculator, available on their website. Simply input your property’s details, including its location, type, and built-up area, and the calculator will provide an estimate of your annual tax liability.

Are there any tax benefits for homeowners who install renewable energy systems on their properties?

+Yes, the PCMC offers a 10% reduction in tax liability for properties with installed renewable energy systems, such as solar panels. This incentive promotes the adoption of clean energy and reduces the carbon footprint of the city.

Can I pay my property tax in installments instead of a lump sum?

+Unfortunately, the PCMC does not currently offer an installment payment option. However, you can explore payment plans with authorized collection agents or financial institutions to manage your tax liability more flexibly.