Pennsylvania Tax Forms

Pennsylvania tax forms are essential documents that residents and businesses in the state use to fulfill their tax obligations. These forms are crucial for reporting income, expenses, and other financial information to the Pennsylvania Department of Revenue. Accurate completion and timely submission of these forms are vital to ensure compliance with state tax laws and regulations.

Understanding the Pennsylvania Tax System

Pennsylvania’s tax system is designed to generate revenue for the state’s government, which is then utilized for various public services and infrastructure development. The state imposes taxes on income, sales, property, and certain business activities. Understanding the different tax forms and their purposes is crucial for individuals and businesses to navigate the tax landscape effectively.

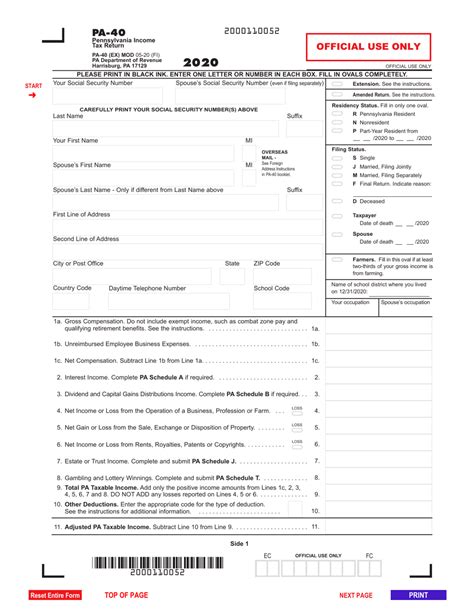

Individual Income Tax Forms

The most common tax form for individuals is the PA-40, which is the Pennsylvania Individual Income Tax Return. This form is used to report personal income, including wages, salaries, dividends, interest, and capital gains. Taxpayers must calculate their taxable income, apply relevant deductions and credits, and determine their tax liability using this form.

For individuals with more complex financial situations, such as multiple sources of income or business ownership, additional forms may be required. These include Schedule A for itemized deductions, Schedule C for reporting business income and expenses, and Schedule D for capital gains and losses.

| Form Name | Purpose |

|---|---|

| PA-40 | Primary income tax return for individuals |

| Schedule A | Itemized deductions for medical expenses, taxes, and charitable contributions |

| Schedule C | Reporting income and expenses for sole proprietors and small businesses |

| Schedule D | Reporting capital gains and losses from the sale of investments or assets |

Business and Corporate Tax Forms

Pennsylvania imposes taxes on businesses, including corporations, partnerships, and limited liability companies (LLCs). The specific tax forms and requirements vary based on the business structure and type of activity.

For example, corporations must file the PA-40ES form for estimated tax payments and the PA-100 for their annual corporate income tax return. Partnerships and LLCs, on the other hand, typically file the PA-40P form to report their business income and allocate it to the partners or members.

| Form Name | Business Structure |

|---|---|

| PA-40ES | Corporations (Estimated Tax Payments) |

| PA-100 | Corporations (Annual Income Tax Return) |

| PA-40P | Partnerships and LLCs (Business Income Reporting) |

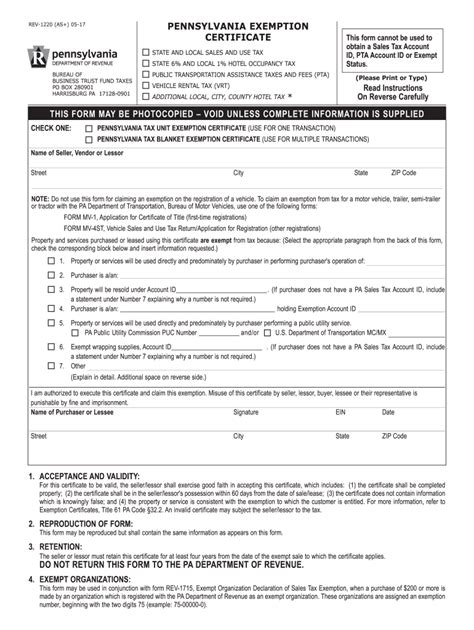

Sales and Use Tax Forms

Pennsylvania also collects sales tax on the sale of goods and certain services. Businesses that make taxable sales must register with the Department of Revenue and file Form REV-1127 to report and remit sales tax. Additionally, businesses may need to file Form REV-1128 for use tax, which applies to purchases made outside the state but used within Pennsylvania.

Navigating the Tax Preparation Process

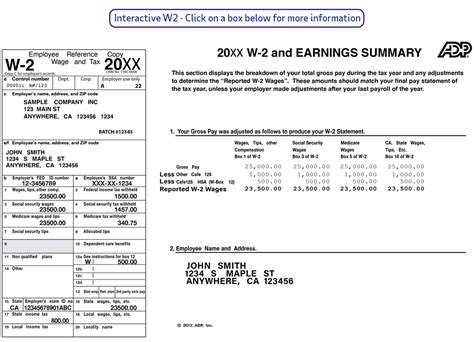

Completing tax forms accurately can be complex, especially for those unfamiliar with the process or with unique financial situations. Here are some tips to navigate the tax preparation journey:

- Gather all necessary documents: Collect W-2 forms, 1099 forms, expense records, and any other relevant financial documents before starting.

- Understand your filing status: Determine whether you qualify as a single filer, married filing jointly, head of household, or another status, as this affects your tax liability.

- Calculate deductions and credits: Research and calculate any applicable deductions and credits to reduce your taxable income.

- Seek professional help: If you’re unsure about any aspect of the process, consider consulting a tax professional or using tax preparation software to ensure accuracy.

Online Filing and Payment Options

Pennsylvania offers convenient online filing and payment options for taxpayers. The Department of Revenue’s website provides an e-filing platform where individuals and businesses can submit their tax forms securely. This platform also allows for electronic payments, making the process more efficient and reducing the risk of errors.

Deadlines and Penalties

It’s crucial to be aware of the tax filing deadlines to avoid penalties and interest. For individual income tax returns, the deadline is typically April 15th, but it may be extended to a later date in certain circumstances. Business tax return deadlines vary based on the entity type.

Failing to file tax returns or pay taxes on time can result in significant penalties and interest charges. It’s essential to stay informed about the latest tax laws and regulations to ensure compliance and avoid any unnecessary financial burdens.

Staying Informed and Avoiding Common Mistakes

Tax laws and regulations can change frequently, so staying updated is crucial. The Pennsylvania Department of Revenue’s website provides valuable resources, including tax guides, forms, and publications, to help taxpayers understand their obligations. Additionally, subscribing to tax newsletters or following reputable tax blogs can keep you informed about the latest developments.

Some common mistakes to avoid when dealing with Pennsylvania tax forms include:

- Forgetting to sign and date your tax return

- Entering incorrect personal information or Social Security numbers

- Miscalculating income, deductions, or tax liability

- Failing to report all sources of income

- Missing important deadlines

Seeking Assistance

If you're facing complex tax situations or have questions about specific forms, don't hesitate to seek professional assistance. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide expert guidance and ensure your tax obligations are met accurately and efficiently.

Pennsylvania Tax Resources and Support

The Pennsylvania Department of Revenue offers a range of resources to assist taxpayers. These include:

- Taxpayer Service Center: A dedicated helpline for taxpayers to seek assistance with general tax inquiries.

- Online Taxpayer Account Management: A secure platform for taxpayers to manage their accounts, view tax records, and make payments online.

- Taxpayer Assistance Offices: Physical locations where taxpayers can receive in-person assistance and guidance.

Where can I find the latest Pennsylvania tax forms and instructions?

+You can access the latest tax forms and instructions on the Pennsylvania Department of Revenue’s website. The website provides a comprehensive list of forms, along with detailed instructions for completion.

What if I miss the tax filing deadline? Are there any extensions available?

+Missing the tax filing deadline can result in penalties and interest. However, you can request an extension by filing Form PA-4868. This extension provides additional time to file your return but does not extend the deadline for paying any taxes owed.

How can I stay updated on Pennsylvania tax law changes?

+To stay informed about tax law changes, you can subscribe to the Department of Revenue’s email updates and follow their official social media channels. Additionally, tax professionals and reputable tax websites often provide timely updates on tax law modifications.

Are there any tax credits or deductions available for specific situations in Pennsylvania?

+Yes, Pennsylvania offers various tax credits and deductions. These include the Property Tax/Rent Rebate Program for eligible homeowners and renters, the Retirement Income Tax Exclusion for retirees, and the School Income Tax Relief (SITR) Credit for certain taxpayers. It’s essential to research and understand the eligibility criteria for these credits.