Florida No Property Tax

Welcome to the sunshine state, where a unique tax system has sparked curiosity and debates. In Florida, the concept of no property tax is a significant feature, offering residents and investors a distinct financial landscape. This article delves into the intricacies of Florida's property tax laws, exploring the benefits, implications, and real-world applications of this intriguing policy.

Unraveling Florida’s Property Tax Landscape

Florida, known for its vibrant tourism and retirement communities, has crafted a property tax system that sets it apart from many other states. The absence of a direct property tax on real estate has become a defining characteristic, attracting attention and raising questions about its impact on the state’s economy and residents.

The Basics of Florida’s Property Tax Structure

While the term “no property tax” might sound like a complete exemption, Florida’s tax system operates on a more nuanced level. Here’s a breakdown of how it works:

- No Statewide Property Tax: Unlike many states, Florida does not impose a uniform property tax across all counties. This means there is no direct levy on property ownership at the state level.

- Local Assessments: Property taxes in Florida are primarily determined at the local level, with counties and municipalities having the authority to set their tax rates. This results in a diverse tax landscape across the state.

- Millage Rates: Local governments assess properties and determine a millage rate, which is a tax rate per $1,000 of assessed property value. This rate can vary significantly, leading to different tax burdens in different areas.

| County | Millage Rate (per $1,000) |

|---|---|

| Miami-Dade | 12.22 |

| Hillsborough | 10.84 |

| Palm Beach | 10.46 |

These millage rates are then applied to the assessed value of a property to calculate the annual tax liability. For instance, a property with an assessed value of $200,000 in Miami-Dade County would face a tax rate of 12.22 mills, resulting in an annual tax of $2,444.

Benefits and Implications for Residents

The absence of a statewide property tax in Florida has both positive and complex effects on residents. Here’s an in-depth look:

- Lower Overall Tax Burden: For homeowners, the lack of a state-level property tax can lead to significant savings. This is especially beneficial for those with high-value properties, as they avoid a uniform tax across the state.

- Varying Local Taxes: The decentralized tax system means that tax rates can differ significantly from one county to another. This can be advantageous for those who choose to live in areas with lower tax rates, resulting in substantial annual savings.

- Stability and Predictability: Florida’s property tax system is relatively stable, with consistent assessment practices. This provides predictability for homeowners, allowing them to budget effectively for their annual property taxes.

- Impact on Home Values: The absence of a statewide property tax can indirectly influence home values. In areas with lower tax rates, home prices might be more affordable, attracting buyers. However, in regions with higher taxes, property values might be suppressed.

Real-World Examples and Case Studies

To illustrate the impact of Florida’s property tax system, let’s examine a few scenarios:

- Homeowner Savings: Imagine a homeowner in Broward County with a property valued at 300,000. With a millage rate of 9.85, their annual property tax would be 2,955. This is significantly lower than the tax burden in many other states.

- Investor Strategies: Real estate investors can strategically purchase properties in counties with lower millage rates, maximizing their rental income or resale value. For instance, a property in rural Gilchrist County with a millage rate of 5.75 could be a more profitable investment choice.

- Retirement Communities: Florida’s reputation as a retirement haven is partly due to its tax structure. Retirees can enjoy their golden years without the burden of a high property tax, making the state an attractive option for those looking to downsize or relocate.

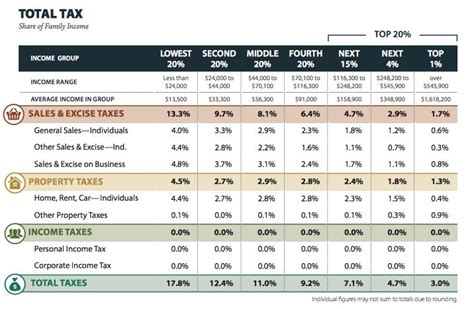

Comparative Analysis with Other States

Florida’s property tax system stands out when compared to other states. Here’s a brief overview of how it differs:

- Uniform vs. Decentralized: Unlike many states with uniform property tax rates, Florida’s decentralized system allows for local control and variation.

- Lower Overall Burden: On average, Florida’s property tax rates are lower than many other states, especially those with high-value real estate markets.

- Lack of State-Level Levy: The absence of a statewide property tax is a unique feature, providing a distinct advantage for homeowners and investors.

Future Implications and Considerations

As Florida’s population continues to grow, the property tax system will face evolving challenges and opportunities. Here are some key considerations:

- Infrastructure and Services: With varying tax rates, local governments must balance providing essential services and maintaining infrastructure. This can lead to innovative funding solutions or shifts in tax structures.

- Population Migration: The absence of a statewide property tax could influence migration patterns, with more individuals and businesses choosing to relocate to Florida for tax benefits.

- Policy Changes: As the state’s needs evolve, there might be discussions about revising the property tax system. This could include introducing a statewide tax or adjusting local assessment practices.

Conclusion: Navigating Florida’s Tax-Free Property Landscape

Florida’s “no property tax” policy is a unique feature that sets it apart in the real estate landscape. While it offers significant benefits, especially in terms of lower tax burdens, it also presents a complex and diverse tax environment. For those considering a move to Florida or investing in its real estate market, understanding this system is crucial. By navigating the local tax rates and assessment practices, individuals can make informed decisions that align with their financial goals and lifestyle preferences.

How do I calculate my property tax in Florida?

+To calculate your property tax in Florida, you need to know your property’s assessed value and the millage rate in your county. Multiply the assessed value by the millage rate (expressed as a decimal) to determine your annual tax. For example, if your property is valued at 250,000 and the millage rate is 10.5, your calculation would be: 250,000 x 0.0105 = $2,625.

Are there any exceptions to the “no property tax” rule in Florida?

+While there is no direct statewide property tax, Florida does impose taxes on tangible personal property and certain improvements. Additionally, local governments may levy additional taxes or fees, so it’s essential to check with your county’s tax assessor for a comprehensive understanding of your tax obligations.

How often are property taxes assessed in Florida?

+Property taxes in Florida are typically assessed annually. However, some counties may reassess properties more frequently, especially if there have been significant improvements or changes in the property’s value. It’s advisable to stay updated with your county’s assessment schedule.