Washington Seattle Tax Rate

Welcome to the comprehensive guide on the tax rates in Seattle, Washington. In this expert-level journal-style article, we will delve into the intricacies of Seattle's tax system, providing you with a detailed understanding of the rates, their implications, and how they impact individuals and businesses in the city. Seattle's tax structure is a fascinating aspect of its economic landscape, offering unique insights into the city's fiscal policies and how they shape its growth and development.

Understanding Seattle’s Tax Landscape

Seattle, the vibrant hub of the Pacific Northwest, boasts a dynamic economy and a unique tax system. The city’s tax rates play a crucial role in funding public services, infrastructure, and initiatives that contribute to the well-being of its residents and businesses. Let’s explore the various tax categories and rates that make up Seattle’s fiscal landscape.

Income Tax Rates

One of the notable aspects of Seattle’s tax system is the absence of a state income tax. Washington is one of the few states in the US that does not impose a personal income tax on its residents. However, this does not mean that income is completely tax-free in Seattle. The city still collects revenue through other means, such as sales and property taxes, which we will discuss in detail.

Despite the lack of an income tax, Seattle has implemented a payroll tax on certain businesses. This tax, known as the Employee Hours Tax, applies to larger employers and is designed to support the city's budget and fund initiatives such as affordable housing and homelessness services. The tax rate for this varies depending on the number of employees and the company's gross payroll.

For individuals, the absence of an income tax means that their federal tax liability is their primary concern. However, it is important to note that Seattle's unique tax system does impact the overall tax burden for residents indirectly, as we will explore in subsequent sections.

Sales and Use Taxes

Seattle, like the rest of Washington state, imposes a sales and use tax on the sale of tangible personal property and certain services. This tax is collected by businesses and remitted to the state and local governments. The sales tax rate in Seattle consists of several components, including the state sales tax, local option taxes, and other special taxes.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

| City of Seattle Sales Tax | 1.75% |

| Local Option Tax (King County) | 0.5% |

| Special Taxes (e.g., Transit Tax) | Varies |

| Total Effective Sales Tax Rate | 9.0% (as of 2023) |

The sales tax rate in Seattle can vary depending on the type of product or service being purchased and the specific location within the city. For example, certain areas may have additional local option taxes or special assessments. It is essential for businesses and consumers to be aware of these variations to ensure compliance with tax regulations.

Property Taxes

Property taxes are a significant source of revenue for local governments in Seattle and Washington state. These taxes are levied on real estate, including land, buildings, and improvements, and are used to fund essential services such as schools, public safety, and infrastructure maintenance.

The property tax system in Seattle operates on a property-specific basis, meaning that the tax rate and valuation can vary significantly from one property to another. The tax rate is determined by the local taxing district and is applied to the assessed value of the property. This assessed value is typically based on the market value of the property as of a specific date, known as the assessment date.

The tax rate itself is expressed as a millage rate, which represents the amount of tax per $1,000 of assessed value. For example, a millage rate of 20 mills would result in a tax of $20 for every $1,000 of assessed value. These millage rates are set by local governments and can vary between different taxing districts within Seattle.

To illustrate, consider a hypothetical residential property in Seattle with an assessed value of $500,000. If the millage rate for that particular taxing district is 25 mills, the annual property tax for that property would be calculated as follows:

$500,000 (assessed value) x 0.025 (millage rate) = $12,500 (annual property tax)

It is important to note that property tax rates can change from year to year, as local governments may adjust their budgets and tax policies. Additionally, factors such as changes in property values, exemptions, and special assessments can impact the final tax bill for individual properties.

Business and Occupation Taxes

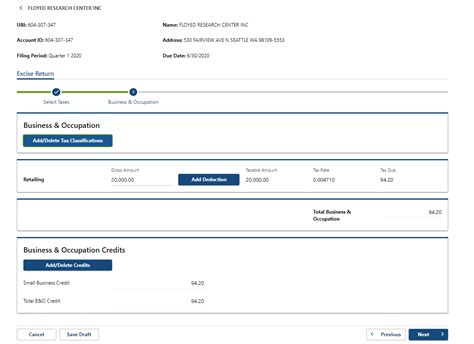

Seattle, like other cities in Washington, imposes a Business and Occupation (B&O) tax on businesses operating within its jurisdiction. This tax is based on the gross revenue generated by businesses and is designed to support the city’s budget and provide funding for essential services.

The B&O tax rate varies depending on the type of business activity and can be classified into different categories, such as retail, wholesale, service, and manufacturing. Each category has its own tax rate, which can range from a few tenths of a percent to several percent of the business's gross income.

For example, a retail business in Seattle might be subject to a B&O tax rate of 0.471%, while a service business could face a rate of 1.5% of its gross income. These rates are set by the city and are subject to change based on budgetary needs and legislative decisions.

Businesses operating in multiple jurisdictions within Washington state may be required to file separate B&O tax returns for each location. It is crucial for businesses to understand their specific tax obligations and accurately report their revenue to avoid penalties and ensure compliance with tax regulations.

Other Taxes and Fees

In addition to the taxes mentioned above, Seattle imposes various other taxes and fees to support specific initiatives and services. These can include:

- Hotel/Motel Tax: A tax levied on lodging accommodations, often used to fund tourism promotion and related activities.

- Car Tab Fees: Vehicle registration fees, which can vary based on vehicle type and location.

- Utility Taxes: Taxes on utility services, such as electricity, water, and gas, which contribute to the city's revenue.

- Special Assessments: Additional fees or taxes imposed for specific improvements or services, such as street lighting or sewer maintenance.

These additional taxes and fees play a vital role in funding specific projects and maintaining the infrastructure and services that make Seattle a desirable place to live and do business.

The Impact of Seattle’s Tax Rates

Seattle’s tax rates have a significant impact on both individuals and businesses operating within the city. Understanding these impacts is crucial for making informed decisions and planning financial strategies.

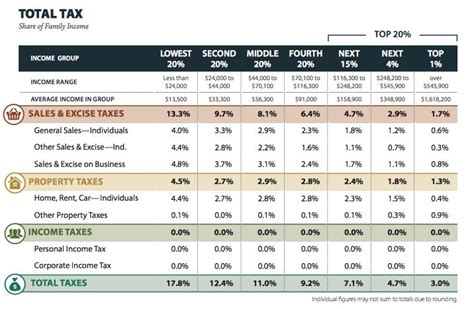

Impact on Individuals

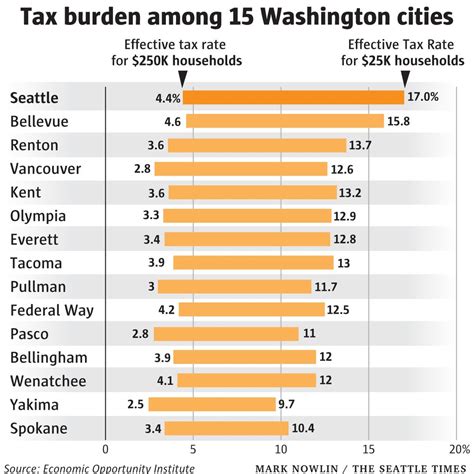

For individuals, the absence of a state income tax can be a significant advantage. It means that a larger portion of their income is available for savings, investments, or discretionary spending. However, it is important to consider the overall tax burden, including sales and property taxes, which can still be substantial.

The sales tax, in particular, can affect individuals' purchasing power and overall cost of living. Higher sales tax rates can result in increased prices for goods and services, impacting consumers' budgets. Additionally, property taxes can be a significant expense for homeowners, as they are based on the assessed value of their property.

Understanding the tax landscape is crucial for individuals when making financial decisions, such as purchasing a home, planning investments, or budgeting for daily expenses. It is essential to consider the impact of taxes on one's overall financial well-being.

Impact on Businesses

Businesses operating in Seattle face a unique set of tax obligations. The combination of sales, property, and business taxes can significantly impact their profitability and operational costs.

The sales tax, for instance, can affect businesses' pricing strategies and competitiveness. Higher sales tax rates can make it challenging for businesses to maintain their market share or expand their customer base. Additionally, the B&O tax, which is based on gross revenue, can be a substantial expense for businesses, especially those with high revenue streams.

Property taxes, on the other hand, can impact businesses' real estate decisions. The cost of property taxes can influence the choice of location, the size of the property, and the overall operational budget. Businesses must carefully consider these tax implications when making strategic decisions about their operations in Seattle.

Tax Incentives and Exemptions

While Seattle’s tax rates can be substantial, the city also offers various tax incentives and exemptions to encourage economic growth and support specific industries. These incentives can provide significant benefits to businesses and individuals, making Seattle an attractive location for investment and entrepreneurship.

For example, Seattle offers a Business Tax Incentive Program, which provides tax relief to businesses that meet certain criteria, such as job creation or investment in specific industries. This program aims to promote economic development and support businesses that contribute to the city's growth.

Additionally, Seattle has implemented tax exemptions for certain sectors, such as renewable energy and affordable housing. These exemptions can significantly reduce the tax burden for businesses and individuals involved in these sectors, making it more feasible to pursue sustainable and affordable initiatives.

It is important for businesses and individuals to stay informed about these tax incentives and exemptions, as they can provide substantial savings and support for specific endeavors.

Future Implications and Considerations

As Seattle continues to evolve and adapt to changing economic and social landscapes, its tax rates and policies will likely undergo further modifications. Understanding the potential future implications of these tax structures is crucial for both individuals and businesses.

Economic Growth and Development

Seattle’s tax rates play a vital role in funding public services and infrastructure, which are essential for the city’s economic growth and development. The revenue generated from taxes supports initiatives such as education, transportation, and public safety, all of which contribute to a thriving business environment and a high quality of life for residents.

However, as the city's economy evolves, so too will the tax landscape. Changes in the business climate, population growth, and technological advancements may necessitate adjustments to tax rates and policies. For example, the rise of e-commerce and remote work could impact sales tax collections and require new strategies for taxation.

It is essential for policymakers and businesses to stay vigilant and adapt to these changes to ensure that Seattle remains a competitive and attractive hub for investment and innovation.

Social Equity and Sustainability

Seattle’s tax system also has implications for social equity and sustainability. The revenue generated from taxes is often used to address social issues and promote environmental initiatives.

For instance, tax revenue can be allocated to support affordable housing programs, which aim to address the city's housing affordability crisis. Additionally, taxes can fund initiatives related to climate change mitigation, such as investments in renewable energy and sustainable transportation infrastructure.

As Seattle strives to become a more equitable and sustainable city, its tax policies will likely continue to evolve to support these goals. This may include further tax incentives for environmentally friendly practices or initiatives aimed at reducing income inequality.

Tax Policy Reforms

Seattle’s tax system is subject to ongoing discussions and potential reforms. As the city’s needs and priorities change, there may be proposals for tax policy reforms to address emerging challenges or to optimize revenue collection.

For example, there have been debates about implementing a state income tax, which could provide a more stable and predictable revenue stream for the city and state. While such a reform would significantly impact individuals and businesses, it could also address funding gaps and provide greater financial stability.

Staying informed about potential tax policy reforms is crucial for individuals and businesses to anticipate and plan for changes that may impact their financial strategies and decision-making processes.

Conclusion

Seattle’s tax rates are a complex and dynamic aspect of its economic landscape. Understanding these rates and their implications is essential for individuals and businesses to make informed financial decisions and contribute to the city’s growth and development.

As Seattle continues to evolve, its tax system will adapt to meet the changing needs of its residents and businesses. By staying informed and engaged, individuals and businesses can actively participate in shaping the city's fiscal policies and ensuring a sustainable and prosperous future for all.

How does Seattle’s lack of state income tax impact residents’ tax burden overall?

+While Seattle’s absence of a state income tax may seem advantageous, it is important to consider the overall tax burden. Residents still pay sales and property taxes, which can be substantial. Additionally, the payroll tax for larger employers can indirectly impact individuals’ employment opportunities and wages.

What are the potential advantages of implementing a state income tax in Seattle?

+A state income tax could provide a more stable and equitable revenue stream for the city and state. It could reduce the reliance on volatile sales and property taxes, offering a more predictable funding source for essential services and initiatives.

How can businesses minimize their tax burden in Seattle?

+Businesses can explore tax incentives and exemptions offered by Seattle. These programs can provide substantial savings and support for specific industries and initiatives. Additionally, careful financial planning and compliance with tax regulations can help minimize tax obligations.

What is the role of property taxes in Seattle’s tax system?

+Property taxes are a significant source of revenue for Seattle and are used to fund essential services such as schools, public safety, and infrastructure. The property tax system is property-specific, with rates and valuations varying based on location and assessed value.

How can individuals and businesses stay informed about Seattle’s tax policies and reforms?

+Individuals and businesses can stay informed by regularly reviewing official tax publications and websites, such as those provided by the City of Seattle and the Washington State Department of Revenue. Additionally, consulting with tax professionals can provide valuable insights and guidance.