Chatham County Tax Records

Welcome to an in-depth exploration of the Chatham County Tax Records, a comprehensive guide that delves into the intricacies of this essential aspect of property ownership. In Chatham County, North Carolina, tax records are not merely administrative documents but hold significant importance for residents, property owners, and stakeholders alike. This article aims to provide a detailed insight into the world of Chatham County tax records, offering a clear understanding of the process, the information they contain, and their implications.

Understanding Chatham County Tax Records

Chatham County’s tax records serve as a vital resource, providing an extensive overview of property details, ownership information, and the corresponding tax assessments. These records are meticulously maintained by the county’s tax office, ensuring accurate and up-to-date information for various purposes, including property transactions, legal proceedings, and tax planning.

The importance of these records extends beyond their administrative role. They offer a transparent window into the financial obligations associated with property ownership, providing a clear understanding of the tax landscape for both current and prospective residents. Furthermore, they play a crucial role in ensuring fair and equitable taxation, as they detail the valuation process and the methodologies employed by the county's assessors.

Key Components of Chatham County Tax Records

Chatham County tax records encompass a wealth of information, each component serving a specific purpose and contributing to the overall transparency and efficiency of the tax system.

- Property Identification: Each record begins with a unique identifier, often a parcel number, which serves as a reference for the specific property. This identification system ensures accurate tracking and organization of records.

- Owner Information: Tax records include the names and contact details of property owners, providing a clear chain of ownership. This information is essential for legal and administrative processes, ensuring accurate communication and record-keeping.

- Property Characteristics: Detailed descriptions of the property, including its size, location, improvements (such as buildings, structures, or landscaping), and any unique features, are integral to the tax assessment process. These characteristics are carefully evaluated to determine the property's value.

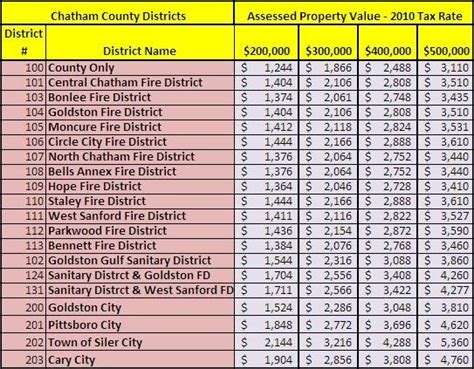

- Assessment Value: The heart of the tax record is the assessed value, which represents the property's worth for taxation purposes. This value is determined through a rigorous process, taking into account market trends, comparable sales, and other valuation methodologies. The assessment value forms the basis for calculating property taxes.

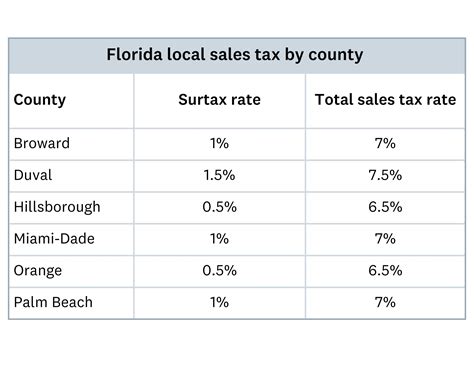

- Tax Rates and Calculations: Tax records outline the applicable tax rates, which vary based on the property's location and type. These rates are applied to the assessed value to determine the property's tax liability. The records also provide a breakdown of the calculated taxes, ensuring transparency in the process.

- Payment History: A record of tax payments made by the property owner is maintained, offering a historical perspective on the property's tax obligations. This information is crucial for understanding the property's financial history and ensuring compliance with tax regulations.

- Exemptions and Deductions: Tax records may also include details on any applicable exemptions or deductions, such as homestead exemptions or senior citizen discounts. These reductions in tax liability are an essential consideration for property owners and are carefully documented to ensure fairness and accuracy.

Accessing Chatham County Tax Records

Chatham County recognizes the importance of public access to tax records, understanding that transparency fosters trust and accountability. The county provides multiple avenues for residents and interested parties to access these records, ensuring convenience and ease of use.

Online Search Portal

The Chatham County Tax Office has developed an intuitive online search portal, accessible via the county’s official website. This platform allows users to search for tax records by entering the property’s address, parcel number, or owner’s name. The search results provide a comprehensive overview of the property’s tax details, including assessment values, tax rates, and payment history.

The online portal offers a user-friendly interface, ensuring that even those unfamiliar with tax terminology can navigate the system with ease. Additionally, the portal provides a secure environment, protecting sensitive information while facilitating access to the records.

Public Records Request

For those seeking more in-depth information or requiring official copies of tax records, Chatham County offers a public records request process. This process involves submitting a formal request, either online or in person, detailing the specific records required. The county’s tax office reviews the request and provides the requested documents within a reasonable timeframe.

The public records request process is particularly useful for individuals or organizations conducting research, legal proceedings, or due diligence. It ensures that all relevant information is obtained and that the records are treated with the confidentiality and professionalism they deserve.

Implications and Applications

Chatham County tax records have far-reaching implications and applications, influencing various aspects of property ownership and the local community.

Real Estate Transactions

For prospective buyers, sellers, and real estate professionals, tax records are an invaluable resource. They provide a comprehensive understanding of a property’s value, tax obligations, and historical performance. This information is crucial for making informed decisions, negotiating prices, and ensuring a fair and transparent transaction process.

Tax records also assist in identifying potential investment opportunities, as they offer insights into the financial health and stability of a property. Real estate investors can analyze trends, assess risks, and make strategic decisions based on the data provided in these records.

Community Planning and Development

From a community perspective, tax records play a pivotal role in shaping the county’s development and planning strategies. They provide a snapshot of the county’s economic landscape, highlighting areas of growth, stability, and potential challenges. This information is instrumental in formulating policies, allocating resources, and making informed decisions about infrastructure, zoning, and public services.

Additionally, tax records contribute to the overall financial health of the county. The revenue generated from property taxes supports essential services, such as education, public safety, and infrastructure maintenance. Transparent and accurate tax records ensure that the county's resources are allocated efficiently and fairly, benefiting the entire community.

Future Trends and Innovations

As technology advances and data becomes increasingly crucial, Chatham County is committed to staying at the forefront of tax record management. The county recognizes the potential for innovation and is exploring ways to enhance the accessibility, efficiency, and security of its tax record system.

Digital Transformation

The county is investing in digital infrastructure to streamline the tax record process. This includes the development of advanced search algorithms, improved data storage systems, and secure online platforms. By embracing digital transformation, Chatham County aims to provide faster, more efficient access to tax records while ensuring data integrity and security.

Data Analytics and Insights

Chatham County is leveraging data analytics to gain deeper insights from its tax records. By analyzing patterns, trends, and correlations, the county can identify areas for improvement, detect anomalies, and make data-driven decisions. This approach enhances the accuracy and fairness of the tax assessment process, ensuring that property owners receive equitable treatment.

Community Engagement and Transparency

Transparency remains a cornerstone of Chatham County’s tax record management philosophy. The county actively engages with residents, holding public forums, workshops, and educational sessions to demystify the tax process and encourage open dialogue. By fostering a culture of transparency and understanding, the county strengthens its relationship with the community and builds trust.

Conclusion

Chatham County Tax Records are more than just administrative documents; they are a vital component of the county’s economic and social fabric. This comprehensive guide has shed light on the significance, content, and accessibility of these records, offering a deeper understanding of their role in property ownership and community development.

As Chatham County continues to innovate and improve its tax record management, the future looks promising. With a focus on transparency, efficiency, and community engagement, the county ensures that its tax records remain a trusted and valuable resource for years to come.

How often are tax records updated in Chatham County?

+Tax records in Chatham County are typically updated annually. The county conducts a reassessment process to determine the property’s current market value and adjust the assessment accordingly. This ensures that the tax records reflect the most recent property values and tax obligations.

Can I dispute my property’s assessment value in Chatham County?

+Yes, property owners have the right to appeal their assessment value if they believe it is inaccurate or unfair. Chatham County provides a formal appeals process, allowing owners to present their case and provide evidence to support their claim. It is essential to follow the prescribed procedures and timelines for a successful appeal.

Are there any exemptions or discounts available for property taxes in Chatham County?

+Chatham County offers several exemptions and discounts to eligible property owners. These include homestead exemptions, senior citizen discounts, and exemptions for certain agricultural or conservation properties. It is advisable to consult with the county’s tax office or a tax professional to understand the specific requirements and eligibility criteria for these exemptions.

How can I stay informed about changes to tax rates or policies in Chatham County?

+Chatham County provides various avenues for staying informed about tax-related matters. The county’s official website often features updates and announcements regarding tax rates, policies, and any proposed changes. Additionally, subscribing to the county’s newsletter or following their social media accounts can provide timely notifications and important updates.