Tax Collector Greenville Sc

The Tax Collector's office in Greenville, South Carolina, plays a crucial role in the local government's revenue collection and plays a significant role in the economic life of the city. This office ensures that the citizens of Greenville contribute their fair share to the development and maintenance of the city's infrastructure, services, and programs. This article will delve into the operations, responsibilities, and impact of the Tax Collector's office in Greenville, SC, shedding light on its inner workings and its importance to the community.

Understanding the Role of the Tax Collector in Greenville, SC

The Tax Collector’s office in Greenville is a vital part of the city’s government, tasked with the critical responsibility of collecting taxes and fees to support the city’s operations and development. The office is headed by the Tax Collector, who is appointed by the city council and serves as a key financial officer for the city.

The Tax Collector's office is responsible for a wide range of duties, including but not limited to:

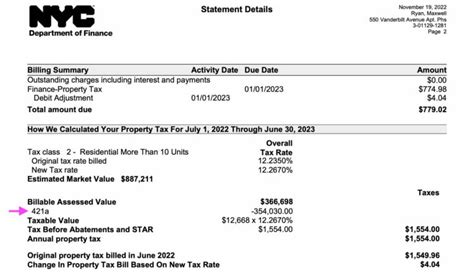

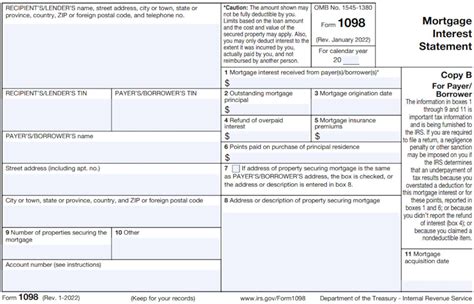

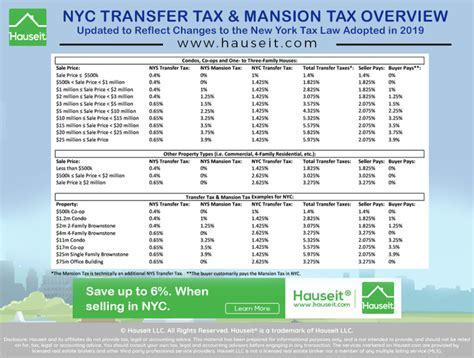

- Property Tax Collection: The primary function of the Tax Collector's office is to collect property taxes from residential and commercial property owners within Greenville. These taxes are a significant source of revenue for the city, contributing to the maintenance and improvement of local infrastructure, such as roads, schools, and public facilities.

- Vehicle Registration and Fees: The office also handles vehicle registration and related fees. This includes issuing vehicle registration certificates, collecting registration fees, and processing title transfers. Vehicle-related revenue is essential for funding transportation infrastructure and public safety initiatives.

- Business Tax Collection: Businesses operating within Greenville are required to pay various taxes and fees. The Tax Collector's office ensures these obligations are met, contributing to the city's economic development and providing resources for business support services.

- Special Assessments: In certain circumstances, the city may levy special assessments on property owners to fund specific projects or improvements. The Tax Collector's office manages the collection of these assessments, ensuring that the projects are financed adequately.

- Fee Collection: The office collects various fees, such as license fees, permit fees, and utility fees, which are essential for the day-to-day operations of the city government and the provision of public services.

The Tax Collector's office operates with a strong commitment to transparency, accountability, and customer service. It strives to provide clear and concise information to taxpayers, offering various payment options and assistance to ensure compliance with tax obligations.

The Tax Collector’s Impact on Greenville’s Economy

The Tax Collector’s office plays a pivotal role in Greenville’s economic landscape. The revenue generated through the collection of taxes and fees is reinvested into the community, driving economic growth and development.

For instance, property taxes collected by the Tax Collector's office are used to fund vital services and infrastructure projects. This includes maintaining and improving the city's roads, bridges, and public transportation systems, which are essential for facilitating economic activity and improving the quality of life for residents and businesses alike.

Moreover, the business taxes collected by the Tax Collector's office contribute to the city's business support programs, such as small business grants, startup incubators, and economic development initiatives. These programs foster entrepreneurship and business growth, creating job opportunities and stimulating the local economy.

The Tax Collector's office also works closely with the city's planning and development departments to ensure that the city's tax policies align with its economic development goals. This collaboration helps attract new businesses and industries to Greenville, further boosting the city's economic vitality.

Efficient Tax Collection Processes

The Tax Collector’s office in Greenville is renowned for its efficient and streamlined tax collection processes. The office utilizes modern technology and digital systems to manage tax records, calculate tax liabilities, and process payments.

Taxpayers can access their tax information and make payments online through the Tax Collector's website. This digital platform offers a user-friendly interface, allowing taxpayers to view their tax bills, pay online using credit cards or e-checks, and even set up automatic payment plans. The online system also provides real-time updates on tax balances and payment statuses, ensuring transparency and convenience for taxpayers.

In addition to online services, the Tax Collector's office also maintains a physical presence with dedicated customer service centers located across the city. These centers provide in-person assistance to taxpayers, offering guidance on tax obligations, payment options, and resolving any queries or concerns.

The office also conducts regular outreach programs and educational initiatives to ensure taxpayers understand their obligations and the importance of timely tax payments. These efforts contribute to a culture of tax compliance and help maintain a positive relationship between the Tax Collector's office and the community.

| Service | Description |

|---|---|

| Online Tax Payment | Secure online platform for tax payments, including credit card and e-check options. |

| Automatic Payment Plans | Set up automatic payments to ensure timely tax payments without the hassle of manual transactions. |

| Taxpayer Assistance | In-person assistance at customer service centers for tax-related queries and concerns. |

| Outreach Programs | Community events and educational initiatives to promote tax compliance and awareness. |

Exploring the Tax Collector’s Office Structure

The Tax Collector’s office in Greenville, SC, is organized into several key departments, each with specialized functions, to ensure efficient and effective tax collection and administration. Understanding the structure of this office provides insight into how it operates and serves the community.

Property Tax Department

The Property Tax Department is a cornerstone of the Tax Collector’s office. This department is responsible for assessing and collecting property taxes, which are a significant source of revenue for the city. Here’s a breakdown of their key functions:

- Assessment: The department evaluates the value of properties within Greenville, taking into account factors like location, size, and improvements. This assessment determines the property tax liability for each owner.

- Tax Roll Preparation: Based on the assessments, the Property Tax Department prepares the tax roll, which is a comprehensive list of all taxable properties and their respective tax liabilities.

- Tax Bill Issuance: Once the tax roll is finalized, the department issues tax bills to property owners, detailing the amount owed and the due date.

- Collection: The department oversees the collection of property taxes, providing various payment options to taxpayers. They also work with taxpayers who may have difficulties paying their taxes, offering payment plans or other solutions.

Vehicle Registration and Licensing Department

The Vehicle Registration and Licensing Department is responsible for registering vehicles, issuing license plates and registration certificates, and collecting related fees. Their duties include:

- Vehicle Registration: This department processes vehicle registration applications, ensuring that all necessary information is provided and that the vehicle meets the required standards.

- Title Transfers: They handle the transfer of vehicle titles when ownership changes, ensuring proper documentation and fee collection.

- License Plate Issuance: The department issues license plates to registered vehicles, ensuring compliance with state regulations.

- Fee Collection: They collect various fees associated with vehicle registration, including registration fees, title transfer fees, and license plate fees.

Business Tax Department

The Business Tax Department is tasked with collecting taxes and fees from businesses operating within Greenville. Their responsibilities include:

- Business License Issuance: This department issues business licenses to companies operating within the city, ensuring compliance with local regulations and fee collection.

- Business Tax Assessment: They assess the tax liability of businesses based on their revenue, profits, or other applicable factors.

- Tax Bill Issuance and Collection: The department issues tax bills to businesses and oversees the collection of these taxes, providing various payment options and assistance when needed.

- Business Support: The Business Tax Department also provides guidance and support to businesses regarding their tax obligations, helping them understand and comply with the city's tax regulations.

Special Assessments and Fees Department

The Special Assessments and Fees Department handles the collection of special assessments and various fees levied by the city. These assessments and fees are typically used to fund specific projects or services.

- Special Assessments: This department manages the collection of special assessments, which are levied on property owners to fund improvements or projects that benefit the community, such as road repairs or infrastructure enhancements.

- Fee Collection: They also collect various fees, including license fees, permit fees, and utility fees, which are essential for funding the city's operations and services.

By understanding the structure and functions of each department within the Tax Collector's office, we can appreciate the complexity and importance of their work in ensuring the financial stability and prosperity of Greenville, SC.

Future Trends and Innovations in Tax Collection

The Tax Collector’s office in Greenville, SC, is committed to staying ahead of the curve in terms of technological advancements and innovative practices. By embracing these trends, the office aims to enhance its efficiency, improve taxpayer experience, and ensure the continued financial health of the city.

Digital Transformation and Online Services

The Tax Collector’s office is actively pursuing digital transformation to provide more accessible and convenient services to taxpayers. This includes:

- Enhanced Online Payment Platforms: The office is investing in upgrading its online payment systems to offer a seamless and secure experience. This will include additional payment methods, improved user interfaces, and real-time transaction updates.

- Digital Tax Filing and Recordkeeping: The office is exploring ways to digitize tax records and filings, making it easier for taxpayers to manage their tax obligations and for the office to maintain accurate records. This could involve the implementation of blockchain technology for secure and transparent recordkeeping.

- Mobile Apps: The development of mobile applications is on the horizon, allowing taxpayers to access their tax information, make payments, and receive updates on the go.

Data Analytics and Tax Compliance

The Tax Collector’s office recognizes the power of data analytics in improving tax compliance and identifying potential fraud. By leveraging advanced analytics tools, the office can:

- Detect Non-Compliance: Data analytics can help identify patterns and anomalies in tax filings, enabling the office to detect potential cases of non-compliance or fraud. This proactive approach ensures fair and equitable tax collection.

- Optimize Tax Collection Strategies: Analyzing historical data can help the office optimize its collection strategies, targeting specific taxpayer groups or industries to improve collection rates and efficiency.

- Personalized Taxpayer Assistance: Data-driven insights can also be used to provide personalized assistance to taxpayers, offering tailored solutions to their unique circumstances and needs.

Community Engagement and Outreach

While technology plays a significant role in modernizing tax collection, the Tax Collector’s office in Greenville also recognizes the importance of human connection and community engagement. To this end, the office is focused on:

- Community Education Initiatives: The office plans to expand its educational programs, offering workshops and seminars to help taxpayers better understand their tax obligations and the importance of timely payments. These initiatives aim to foster a culture of tax compliance and financial literacy.

- Taxpayer Assistance Centers: In addition to online services, the office will continue to maintain physical taxpayer assistance centers. These centers provide personalized assistance to those who prefer in-person interactions, ensuring that all taxpayers receive the support they need.

- Community Partnerships: Collaborating with local community organizations and businesses, the Tax Collector's office can reach a wider audience and provide valuable tax-related information and support to residents and businesses.

By combining technological advancements with a commitment to community engagement, the Tax Collector's office in Greenville, SC, is poised to deliver efficient, transparent, and taxpayer-centric services. These efforts will not only improve the taxpayer experience but also contribute to the financial stability and growth of the city.

What are the office hours of the Tax Collector’s office in Greenville, SC?

+

The Tax Collector’s office in Greenville, SC, is typically open from 8:30 AM to 5:00 PM, Monday through Friday. However, it’s advisable to check their official website or contact them directly for the most up-to-date information, as hours may vary due to special events or holidays.

How can I pay my taxes to the Tax Collector’s office in Greenville?

+

The Tax Collector’s office in Greenville offers a variety of payment options. You can pay online through their secure website using a credit card or e-check. Alternatively, you can visit one of their customer service centers and make a payment in person using cash, check, or money order. They also accept payments by mail if you prefer to send a check or money order.

What happens if I miss the tax payment deadline in Greenville, SC?

+

If you miss the tax payment deadline, you may be subject to late fees and penalties. It’s important to note that the Tax Collector’s office in Greenville, SC, may offer payment plans or other arrangements to help taxpayers who are facing financial difficulties. It’s best to contact them directly to discuss your options and avoid further penalties.

How can I obtain a tax receipt from the Tax Collector’s office in Greenville, SC?

+

You can obtain a tax receipt from the Tax Collector’s office in Greenville, SC, by logging into your online account (if you have one) and downloading the receipt. Alternatively, you can request a receipt by mail or visit one of their customer service centers and request a printed receipt in person. It’s a good idea to keep these records for your personal financial records and tax filings.

Does the Tax Collector’s office in Greenville, SC, offer any tax incentives or exemptions?

+

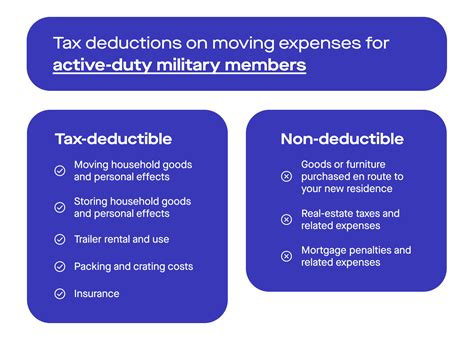

Yes, the Tax Collector’s office in Greenville, SC, does offer certain tax incentives and exemptions. These may include homestead exemptions for primary residences, military exemptions, and exemptions for senior citizens or individuals with disabilities. It’s important to check with the office directly to determine your eligibility for any of these incentives or exemptions.