Nyc Tax Bills

Understanding New York City property taxes is crucial for homeowners, investors, and businesses alike. In a city as diverse and dynamic as NYC, tax bills can vary significantly depending on various factors. This comprehensive guide aims to demystify NYC tax bills, offering an in-depth analysis of how they work, what influences them, and how to navigate this essential aspect of property ownership.

The Basics of NYC Tax Bills

NYC property taxes are a significant source of revenue for the city, funding various services and infrastructure projects. The tax system is complex, but understanding its fundamentals is essential for effective financial planning.

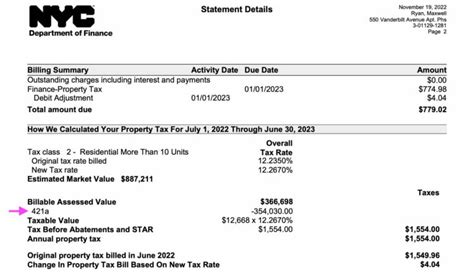

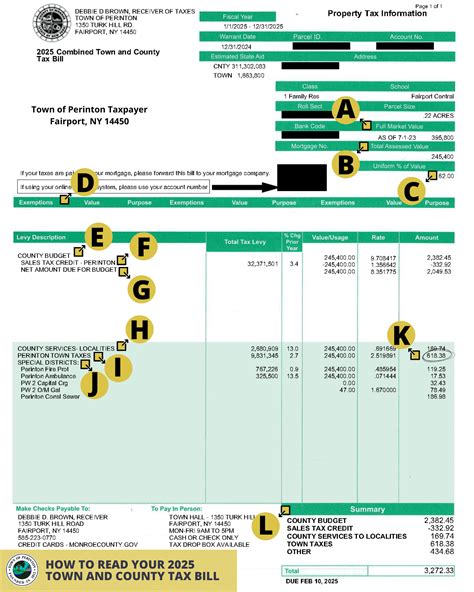

Property taxes in NYC are based on the assessed value of a property. The Department of Finance assesses properties every few years, determining their market value. This assessed value is then multiplied by the tax rate, which varies based on the property's location and usage.

The resulting amount is the taxable value, which forms the basis for the tax bill. This bill is typically sent out twice a year, and property owners are required to pay it by specific due dates. Failure to pay on time can result in penalties and interest charges.

Key Components of NYC Tax Bills

- Assessed Value: As mentioned, this is the value assigned to a property by the Department of Finance. It’s a critical factor in determining the tax bill.

- Tax Rate: The tax rate is set annually by the city and can vary based on factors like the property’s location and its use. For instance, residential properties may have different tax rates compared to commercial properties.

- Exemptions and Abatements: NYC offers various exemptions and abatements that can reduce the taxable value of a property. These include senior citizen and veteran exemptions, as well as abatements for new developments or environmentally friendly upgrades.

It's important to note that NYC tax bills can be complex, and seeking professional advice from a tax consultant or accountant can be beneficial, especially for larger properties or complex ownership structures.

| Assessment Year | Average Assessed Value (Residential) | Tax Rate (Manhattan) |

|---|---|---|

| 2022 | $850,000 | 18.46% |

| 2023 | $900,000 (estimated) | 18.52% (estimated) |

Factors Influencing NYC Tax Bills

Several factors can impact the amount of tax you pay in NYC. Understanding these factors can help property owners anticipate and plan for their tax obligations.

Property Location

The location of a property is a significant factor in determining tax bills. NYC is divided into several tax classes, and each class has a different tax rate. For instance, Class 1 properties (which include one- to three-family homes) have a different tax rate compared to Class 4 properties (which include large multi-family dwellings and commercial properties). Additionally, tax rates can vary within a class based on the specific neighborhood or borough.

Property Type and Usage

The type and usage of a property also play a role in determining tax bills. Residential properties, commercial properties, and vacant land are taxed differently. For example, commercial properties often have higher tax rates compared to residential properties.

Assessed Value and Market Trends

The assessed value of a property is a critical factor in calculating tax bills. When the Department of Finance assesses a property, they consider its market value, which can be influenced by various factors such as renovations, market conditions, and comparable sales in the area. As property values rise, so do tax bills, and vice versa.

Exemptions and Abatements

NYC offers a range of exemptions and abatements that can reduce the taxable value of a property. These include:

- Senior Citizen and Disabled Person Abatements: Property owners who meet certain age or disability criteria can receive an exemption on a portion of their assessed value.

- Veteran Exemptions: Veterans who served during eligible periods of war can receive an exemption on a portion of their assessed value.

- Green Initiatives: Properties that incorporate environmentally friendly features or upgrades may be eligible for tax abatements.

- New Development Incentives: Certain areas in NYC offer tax abatements to encourage new development and revitalization.

Navigating NYC Tax Bills: Tips and Strategies

Understanding the complexities of NYC tax bills is the first step; the next is learning how to navigate them effectively.

Stay Informed

Keep up-to-date with changes in tax rates, assessment practices, and any new exemptions or abatements. The Department of Finance and the NYC government websites are excellent resources for this information.

Review Your Assessment

When you receive your property assessment, review it carefully. Ensure that the information is accurate, including the property’s physical description, size, and any recent improvements. If you disagree with the assessment, you have the right to appeal.

Explore Exemptions and Abatements

Research and understand the various exemptions and abatements available to you. If you believe you qualify for any, ensure you apply for them. This could significantly reduce your tax burden.

Consider Professional Advice

For larger properties or complex ownership structures, seeking advice from a tax professional or accountant can be beneficial. They can help you understand your specific tax obligations and explore strategies to minimize your tax liability.

Plan for the Future

Property taxes are an ongoing obligation. Plan your finances accordingly, ensuring you have sufficient funds set aside to cover your tax bills. Consider tax planning strategies, such as tax-efficient investments or leveraging tax-advantaged retirement accounts.

| Exemption Type | Eligibility Criteria | Potential Savings |

|---|---|---|

| Senior Citizen Abatement | Property owner must be 65 or older and meet income requirements | Up to $750,000 of assessed value exempted |

| Veteran Exemption | Property owner must be a veteran who served during an eligible period of war | Up to $5,000 of assessed value exempted |

| Green Abatement | Property must incorporate approved green features or upgrades | Up to 100% of assessed value exempted for 8 years (in certain cases) |

The Future of NYC Tax Bills

As NYC continues to evolve, so too will its tax system. Several key trends and initiatives are shaping the future of NYC tax bills.

Sustainable Development and Green Initiatives

NYC is committed to sustainable development and reducing its carbon footprint. As part of this initiative, the city offers various tax abatements and incentives for properties that incorporate green features or upgrades. This trend is likely to continue and may even expand, encouraging more property owners to adopt environmentally friendly practices.

Revitalization of Underdeveloped Areas

NYC is focused on revitalizing certain underdeveloped or underserved areas. This includes offering tax abatements and other incentives to encourage new development and investment in these areas. This strategy aims to stimulate economic growth and improve quality of life in these communities.

Digitalization of Tax Processes

The Department of Finance is increasingly digitizing its processes, making it easier for property owners to access information, file documents, and pay taxes online. This trend is likely to continue, offering greater convenience and efficiency for taxpayers.

Potential Tax Reforms

While NYC’s tax system is complex and often criticized, there have been calls for reform. Some proposed reforms include simplifying the tax structure, harmonizing tax rates across different classes, and introducing new exemptions or abatements. While these reforms are not imminent, they could significantly impact NYC tax bills in the future.

Conclusion

NYC tax bills are a vital aspect of property ownership in the city. Understanding how they work, what influences them, and how to navigate them is essential for effective financial planning. By staying informed, exploring available exemptions, and seeking professional advice when needed, property owners can effectively manage their tax obligations.

As NYC continues to evolve, so too will its tax system. Keeping abreast of these changes and adapting to new initiatives and trends will be key to staying ahead of the curve when it comes to NYC tax bills.

How often are NYC properties assessed for tax purposes?

+

NYC properties are typically assessed every 3 years. However, this can vary based on the property type and other factors. It’s always best to check with the Department of Finance for the most accurate information regarding your specific property.

Can I appeal my NYC property tax assessment?

+

Yes, if you believe your property has been unfairly assessed, you have the right to appeal. The process involves submitting a formal grievance with the NYC Tax Commission. It’s advisable to seek professional advice for a successful appeal.

What happens if I don’t pay my NYC property taxes on time?

+

Late payment of NYC property taxes can result in penalties and interest charges. In severe cases, the city can place a tax lien on your property, which can lead to foreclosure if not addressed promptly.

Are there any online tools to help me estimate my NYC property taxes?

+

Yes, the Department of Finance provides an online Property Tax Look-Up tool that allows you to estimate your property taxes based on various factors. This tool can be a helpful resource for budgeting and financial planning.

How can I stay updated on changes to NYC tax rates and regulations?

+

The best way to stay informed is to regularly check the NYC government and Department of Finance websites. They often publish updates and announcements regarding tax rates, regulations, and any new initiatives or programs.