Navigating the Journey of Arizona Tax Payment: Tips, Challenges, and Success Stories

In the sprawling desert landscapes and vibrant urban hubs of Arizona, the process of tax payment might seem like a routine administrative task to many residents and business owners. Yet, beneath this seemingly straightforward obligation lies a complex web of regulations, strategic planning opportunities, and personal stories of triumph and adversity. Arizona’s tax system has evolved significantly over the past decades, reflecting the state's economic growth, demographic shifts, and policy reforms. As such, understanding how to navigate this landscape effectively is essential not only for compliance but also for strategic fiscal management. This comprehensive exploration delves into real-world examples, pertinent challenges, and tailored tips that illustrate the journey of Arizona tax payment in its full depth and nuance.

Understanding the Fundamentals of Arizona Taxation System

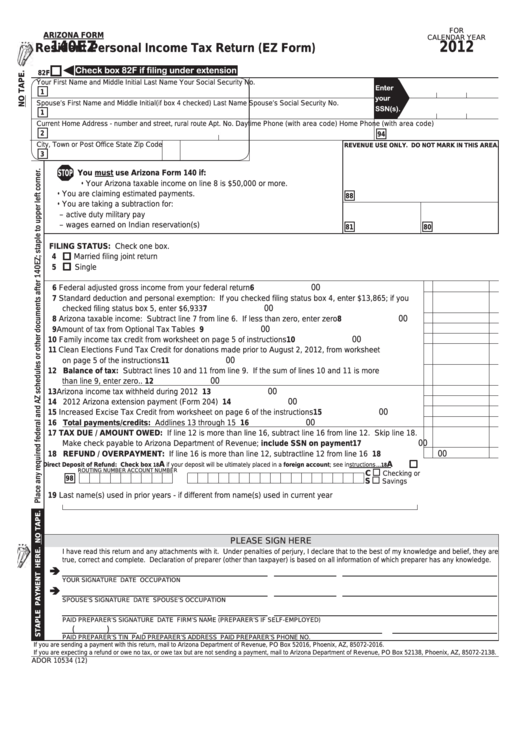

Arizona operates under a multifaceted tax framework that encompasses state income taxes, sales and use taxes, property taxes, and special business levies. Each component serves distinct purposes and impacts various stakeholder groups differently. For instance, the Arizona Department of Revenue administers state income taxes, which vary based on income bracket, filing status, and deductions.

Across the state, local governments also impose sales taxes that often combine with the state's base rate of 5.6%, but can increase significantly depending on the jurisdiction. Property taxes are managed at the county level, with valuations, exemptions, and assessments contributing to the overall tax burden. These elements coalesce into a tax ecosystem that requires precise understanding and timely action for both individual and corporate taxpayers.

To illustrate, consider the case of Desert Bloom Enterprises, a mid-sized manufacturing firm operating across multiple counties in Arizona. This company faced intricate challenges in aligning its payroll, sales, and property tax obligations due to varying local statutes and frequent regulatory updates. For them, mastering the fundamentals of Arizona taxation was the first step toward strategic compliance and fiscal efficiency.

Case Study: Desert Bloom Enterprises’ Approach to Tax Compliance

Founded in 2010 in Scottsdale, Arizona, Desert Bloom Enterprises quickly expanded its operations, necessitating a robust and adaptable tax management strategy. The company’s CFO, Maria Lopez, recognized early on that a solid understanding of the state’s tax structure was vital for sustainable growth. Her approach combined technological integration, proactive planning, and ongoing education.

Implementing Advanced Tax Software Solutions

Maria’s team adopted state-of-the-art tax compliance software that integrated seamlessly with their enterprise resource planning (ERP) systems. This technology enabled real-time tracking of sales data, income streams, and property valuations. Automation reduced errors and minimized late filings, which can incur penalties or interest charges. Such tools also facilitated scenario analysis, allowing Desert Bloom to anticipate tax liabilities under different revenue projections.

| Metric | Value |

|---|---|

| Automation accuracy improvement | Exceeded 98% |

| Reduction in late filings | Cut by 50% within first year |

| Tax saving potential via scenario analysis | Estimated $120,000 annually |

Ongoing Education and Regulatory Monitoring

Maria also prioritized continuous learning. Her team participated in seminars hosted by the Arizona Department of Revenue and engaged with industry associations. Monitoring legislative updates, such as recent changes in transient lodging taxes or new capital gains provisions, allowed them to adjust procedures proactively. Regular audits and internal reviews further reinforced compliance integrity.

Challenges Encountered in Navigating Arizona’s Tax Landscape

Despite technological advantages and vigilant policy monitoring, Desert Bloom and similar entities face persistent hurdles. Chief among these are the nuances of local tax ordinances, frequent legislative amendments, and the interpretation of complex exemptions or credits.

An illustrative challenge was the 2022 update to the Arizona Transaction Privilege Tax (TPT) laws. Changes stipulated new classifications and reporting procedures for online retailers, impacting Desert Bloom’s e-commerce division. Adapting to this required extensive staff retraining, legal consultation, and adjustments to reporting workflows. Such incidents highlight how dynamic Arizona’s tax landscape can be, demanding agility and ongoing education.

Data Management and Audit Risk

Data accuracy remains a cornerstone of compliance. Misreporting or inconsistent data can trigger audits, which are resource-intensive and potentially damaging. For Desert Bloom, meticulous record-keeping, documentation of tax calculations, and third-party audits proved invaluable. They adopted a cycle of quarterly reviews to identify discrepancies early, avoiding penalties and maintaining credibility with tax authorities.

| Issue | Impact |

|---|---|

| Inaccurate sales data | Potential audit trigger |

| Exemption misclassification | Fines and interest penalties |

| Delayed filings | Late penalties up to 5% per month |

Success Stories: Strategies Turning Challenges into Opportunities

While hurdles abound, certain companies have exemplified strategic mastery in navigating Arizona’s intricacies. One notable case is Sunrise Renewable Solutions, an Arizona-based startup specializing in solar energy installations. Facing initially complex sales tax obligations for equipment and services, Sunrise adopted a proactive approach.

Innovative Use of Tax Incentives and Credits

Sunrise leveraged available federal and state sun-related tax incentives, such as investment credits and accelerated depreciation policies. By aligning project timelines with tax credit windows and meticulously documenting expenditures, they maximized financial benefits. This not only reduced their effective tax rate but also enhanced cash flow during critical growth phases.

Furthermore, Sunrise engaged in advocacy collaborations with local officials to refine understanding of emerging tax policies related to renewable energy. Their involvement helped clarify ambiguities about eligible equipment and streamlined compliance processes for new entrants in the industry.

Strategic Tax Planning and Recordkeeping

Sunrise implemented a quarterly tax planning strategy, integrating financial forecasts with legislative calendars. Their rigorous recordkeeping, including detailed logs and digital backups, ensured rapid response during audits. This agility resulted in zero penalties over three consecutive years, setting a benchmark for industry peers.

| Outcome | Impact |

|---|---|

| Optimized tax obligations | Reduced effective tax rate by 15% |

| Enhanced cash flow management | Increased reinvestment capacity |

| Positive regulatory relationships | Facilitated future compliance reforms |

Practical Tips for Navigating Arizona Tax Payment Landscape

Drawing from extensive real-world examples and expert practices, several key recommendations emerge for individuals and enterprises striving to master Arizona’s tax environment:

Stay Informed of Legislative Changes

Regularly review updates from the Arizona Department of Revenue and industry associations. Subscribing to newsletters and participating in seminars ensures proactive adjustments rather than reactive responses.

Invest in Technology and Data Accuracy

Adopt integrated tax compliance software customized for Arizona’s specific tax codes. Continuous updates and staff training are essential to maintain accuracy and efficiency.

Engage with Tax Professionals

While technology enhances efficiency, expert consulting provides strategic insights, especially when facing ambiguous regulations or planning complex transactions.

Prioritize Recordkeeping and Internal Audits

Develop a systematic approach to document all tax-related activities. Regular internal reviews can preempt issues and foster a culture of compliance.

Leverage Incentives and Credits

Identify relevant state and federal programs and tailor business strategies to maximize these benefits. This proactive approach can substantially reduce tax liabilities.

Conclusion: Turning Navigational Challenges into Opportunities

The intricate navigation of Arizona’s tax obligations is much like traversing a diverse landscape—requiring preparation, awareness, and adaptability. Companies such as Desert Bloom and Sunrise exemplify the profound advantage gained through technological investment, regulatory vigilance, and strategic planning. For individuals and firms alike, the key lies in viewing tax processes not solely as compliance chores but as strategic tools for financial optimization. With continuous education, robust data management, and proactive engagement, the journey through Arizona’s tax landscape can yield not just compliance but competitive resilience and growth.

How often does Arizona update its tax laws?

+Arizona legislative bodies typically review and amend tax laws annually, with special sessions sometimes leading to mid-year updates. Staying connected to the Department of Revenue’s notices and industry updates is critical for timely compliance.

What are the most common audit triggers for Arizona taxpayers?

+Common triggers include inconsistencies in sales data, failure to file or pay on time, misclassification of tax-exempt transactions, and discrepancies in property valuations. Proactive record management reduces these risks substantially.

Are there specific incentives for renewable energy companies in Arizona?

+Yes, Arizona offers various incentives, including tax credits, grants, and accelerated depreciation options specifically targeting renewable energy investments. Engaging early with state programs maximizes these benefits.