Virginia Sales Tax Rate

Virginia, the commonwealth state located in the Mid-Atlantic region of the United States, has a unique sales tax system that plays a significant role in its economic landscape. The sales tax rate in Virginia is an important aspect to understand, as it impacts businesses, consumers, and the overall revenue generation for the state. This article aims to provide an in-depth analysis of the Virginia sales tax rate, its structure, variations, and its implications for various industries and consumers.

Understanding the Virginia Sales Tax Rate

The sales tax in Virginia is a consumption tax levied on the sale of goods and certain services within the state. It is a crucial revenue source for the state government, funding essential public services and infrastructure development. The sales and use tax rate in Virginia is determined by the Virginia Department of Taxation and is applicable to most retail sales, leases, and rentals of tangible personal property, as well as certain services.

As of my last update in January 2023, the general sales tax rate in Virginia stands at 4.3%, which is imposed on most taxable goods and services. However, it is important to note that the sales tax rate in Virginia can vary depending on the jurisdiction and the nature of the transaction. This variability arises due to the presence of locality-specific taxes, which are additional sales taxes imposed by counties, cities, and other local authorities.

To provide a comprehensive understanding, let's delve into the different aspects of the Virginia sales tax rate, including its components, variations, and its impact on various sectors.

Components of the Virginia Sales Tax

The sales tax in Virginia is composed of two primary components: the state sales tax and the locality-specific sales tax. These components work together to form the total sales tax rate applicable to a transaction.

State Sales Tax

The state sales tax is the foundational component of the Virginia sales tax system. It is a uniform tax rate applied across the state and is set by the Virginia Department of Taxation. As mentioned earlier, the current state sales tax rate is 4.3%. This rate applies to a wide range of goods and services, including but not limited to clothing, electronics, groceries (excluding most food items), and many retail purchases.

Locality-Specific Sales Tax

In addition to the state sales tax, Virginia allows local jurisdictions, such as counties and cities, to impose their own sales taxes. These locality-specific taxes are often referred to as local add-on taxes or locality-specific surtaxes. The purpose of these additional taxes is to provide funding for local projects, initiatives, and services.

The rates of locality-specific sales taxes can vary significantly across Virginia. For instance, while some counties may have a local add-on tax of 0%, others can have rates as high as 4.0% or more. These variations create a complex sales tax landscape, with the total sales tax rate depending on the specific location where the transaction takes place.

To illustrate this, consider the following table showcasing the locality-specific sales tax rates for a few selected cities in Virginia:

| City | Locality-Specific Sales Tax Rate |

|---|---|

| Arlington | 1.0% |

| Charlottesville | 1.0% |

| Norfolk | 1.5% |

| Richmond | 1.5% |

| Roanoke | 1.0% |

As evident from the table, the locality-specific sales tax rates can vary even among nearby cities. This complexity underscores the importance of understanding the specific sales tax rate applicable to a transaction, especially for businesses operating in multiple locations or for consumers shopping in different areas.

Variations in Sales Tax Rates Across Virginia

As mentioned earlier, the sales tax rate in Virginia can vary significantly depending on the location of the transaction. This variation is primarily due to the presence of locality-specific sales taxes, which can be imposed by counties, cities, or other local authorities.

County-Level Variations

Virginia’s counties have the authority to impose their own sales taxes, often to fund specific projects or initiatives. These county-level sales taxes can vary considerably, with some counties opting for higher rates to support ambitious development plans, while others may have lower rates or no additional tax at all.

For example, Fairfax County, one of the most populous counties in Virginia, imposes a 1.0% locality-specific sales tax on top of the state sales tax, resulting in a total sales tax rate of 5.3% within the county. On the other hand, Loudoun County, located just west of Fairfax, has a lower locality-specific sales tax rate of 0.25%, leading to a total sales tax rate of 4.55%.

City-Level Variations

Cities in Virginia also have the authority to impose their own sales taxes. Similar to counties, these city-level taxes are used to fund local projects and initiatives. The rates of these city-specific sales taxes can vary significantly, leading to notable differences in the total sales tax rates across different cities.

Consider the city of Richmond, the capital of Virginia. Richmond imposes a 1.5% locality-specific sales tax, resulting in a total sales tax rate of 5.8% within the city limits. In contrast, the city of Alexandria, located just across the Potomac River from Washington, D.C., has a lower locality-specific sales tax rate of 0.75%, leading to a total sales tax rate of 5.05%.

Special Jurisdictions

In addition to counties and cities, there are other special jurisdictions in Virginia that have the authority to impose sales taxes. These include towns, incorporated areas, and special tax districts. These special jurisdictions may have unique sales tax rates to fund specific projects or initiatives, further contributing to the variability of sales tax rates across the state.

Impact on Businesses and Consumers

The variations in sales tax rates across Virginia have significant implications for both businesses and consumers. For businesses, particularly those with multiple locations or an online presence, understanding and managing these variations is crucial for accurate tax compliance and pricing strategies.

Compliance and Pricing Strategies

Businesses operating in Virginia must navigate the complex sales tax landscape to ensure compliance with the varying rates. This often involves maintaining detailed records of sales transactions, including the location of the sale and the applicable tax rate. For businesses with an online presence, determining the appropriate sales tax rate based on the customer’s shipping address adds an additional layer of complexity.

From a pricing perspective, businesses may need to adjust their strategies to account for the varying sales tax rates. In areas with higher total sales tax rates, businesses might need to consider pricing their products or services competitively to remain attractive to consumers. On the other hand, in regions with lower sales tax rates, businesses may have an opportunity to highlight the savings to attract customers from neighboring areas.

Consumer Perspective

For consumers, understanding the sales tax rates in their area is crucial for making informed purchasing decisions. Consumers may compare prices across different locations or online retailers to find the best value, taking into account the varying sales tax rates.

Additionally, consumers may consider the impact of sales tax on their overall spending. In areas with higher sales tax rates, consumers may opt for more thoughtful or strategic purchasing habits, while those in regions with lower rates may feel more inclined to make impulse purchases or engage in discretionary spending.

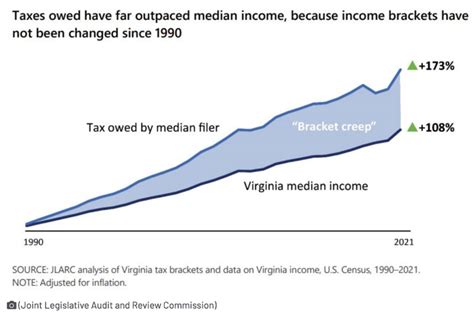

Future Implications and Potential Changes

The sales tax landscape in Virginia is dynamic and subject to change. While the state sales tax rate has remained relatively stable in recent years, there have been discussions and proposals for potential modifications to the sales tax system.

Potential Changes and Proposals

Some proposals have suggested increasing the state sales tax rate to generate additional revenue for specific initiatives or to offset budget shortfalls. These proposals often face careful scrutiny, as any increase in the sales tax rate can have a direct impact on businesses and consumers.

Additionally, there have been discussions about streamlining the sales tax system by reducing or eliminating the locality-specific sales taxes. While this could simplify the tax landscape, it may also impact the revenue streams of local governments, potentially affecting the funding for local projects and services.

Impact on E-Commerce and Online Sales

The growth of e-commerce and online sales has presented unique challenges for sales tax collection and compliance. Virginia, like many other states, has been navigating the complex legal and logistical aspects of collecting sales tax on online transactions.

As e-commerce continues to expand, the state of Virginia may need to adapt its sales tax system to ensure fair taxation of online sales. This could involve updating regulations and guidelines to effectively tax online transactions, particularly those with out-of-state sellers or marketplaces.

Conclusion

The Virginia sales tax rate is a multifaceted aspect of the state’s economic landscape, influenced by the interplay of the state sales tax and locality-specific taxes. The variations in sales tax rates across the state have significant implications for businesses and consumers, impacting pricing strategies, purchasing decisions, and local economies.

As Virginia continues to evolve, the sales tax system will likely undergo further scrutiny and potential changes. The state's ability to adapt its sales tax system to the changing landscape of e-commerce and online sales will be a key factor in maintaining a fair and effective taxation system.

For businesses and consumers alike, staying informed about the Virginia sales tax rate and its variations is essential for compliance, strategic planning, and making informed purchasing decisions.

How often does Virginia update its sales tax rates?

+Virginia’s sales tax rates are typically reviewed and updated annually. However, changes can occur more frequently, particularly in response to legislative actions or budget adjustments.

Are there any items exempt from sales tax in Virginia?

+Yes, Virginia has a list of exempt items, including most food items, prescription drugs, and certain educational materials. Additionally, there are specific exemptions for certain industries and organizations.

How can businesses stay updated on sales tax rate changes in Virginia?

+Businesses can subscribe to updates from the Virginia Department of Taxation or utilize tax compliance software that provides real-time updates on sales tax rates and regulations.

Are there any incentives for businesses to collect and remit sales tax in Virginia?

+Yes, Virginia offers various incentives and benefits for businesses that comply with sales tax collection and remittance requirements. These can include reduced tax rates, credits, or even grant opportunities.