Sales Tax South Carolina

Welcome to our comprehensive guide on understanding and navigating the complex world of sales tax in the state of South Carolina. This guide is designed to provide you with an in-depth analysis of the sales tax regulations, rates, and compliance requirements specific to South Carolina, ensuring you stay informed and compliant with the state's tax laws.

Sales Tax 101: An Overview of South Carolina’s Tax System

South Carolina, like many other states, implements a sales tax system to generate revenue for various state and local government initiatives. Understanding this system is crucial for businesses and individuals alike, as it directly impacts their financial obligations and decision-making processes.

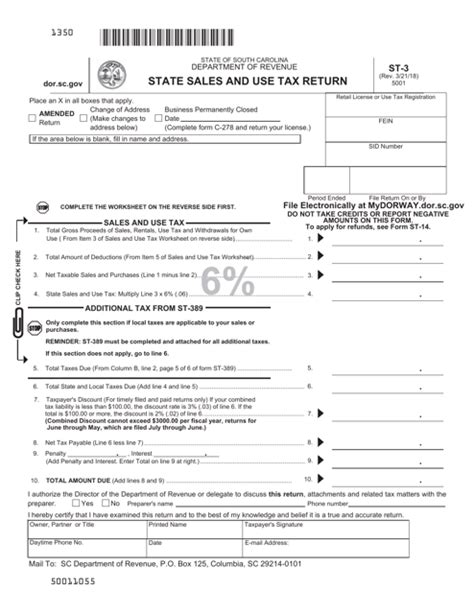

The state of South Carolina imposes a 6% sales and use tax on most tangible personal property, certain digitally-provided products and services, and selected services. This base rate is subject to local taxes as well, with some counties and municipalities adding additional percentages to the state's base tax rate.

For instance, in the city of Charleston, the total sales tax rate stands at 8.5%, which includes the state's 6% sales tax, a 1% county tax, and a 1.5% local tax. These variations in tax rates across different areas of the state can significantly impact the prices consumers pay for goods and services.

Taxable Goods and Services

South Carolina’s sales tax applies to a wide range of tangible personal property, including clothing, furniture, electronics, and vehicles. Additionally, the state imposes sales tax on certain services, such as repair and installation services, professional services, and entertainment services.

However, there are some notable exemptions to the sales tax. For example, most groceries, prescription drugs, and non-prepared food items are exempt from sales tax in South Carolina. Additionally, certain services like legal and medical services are not subject to sales tax.

Remote Sellers and Nexus

South Carolina, like many other states, has established economic nexus laws for remote sellers. This means that out-of-state sellers who meet certain sales thresholds in the state are required to register with the South Carolina Department of Revenue, collect and remit sales tax on their transactions, and comply with all applicable state and local sales tax regulations.

| Sales Tax Rate | 6% |

|---|---|

| Total Sales Tax (Charleston) | 8.5% |

| Applicable Goods and Services | Tangible personal property, selected services |

| Exemptions | Groceries, prescription drugs, legal/medical services |

Compliance and Reporting: Staying on the Right Side of the Law

Compliance with South Carolina’s sales tax regulations is a critical aspect of doing business in the state. Failure to comply can result in significant penalties, interest charges, and legal consequences. Here’s a closer look at the compliance and reporting requirements.

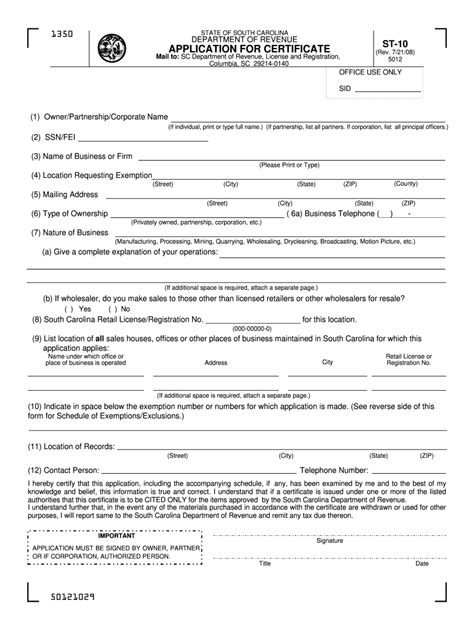

Registration and Permits

Businesses engaged in taxable activities within South Carolina must register with the South Carolina Department of Revenue (SCDOR) and obtain the necessary permits and licenses. This process typically involves completing an application, providing business information, and paying applicable fees.

The SCDOR offers an online registration system for businesses to register for sales tax permits and other applicable taxes. Once registered, businesses receive a unique permit number, which they must display on all sales tax documents and reports.

Sales Tax Collection

Registered businesses are responsible for collecting sales tax from customers at the point of sale. This involves adding the appropriate sales tax rate to the sale price and providing the customer with a clear and accurate breakdown of the tax on their receipt or invoice.

When it comes to online sales, businesses should be aware of the South Carolina Streamlined Sales and Use Tax Agreement, which simplifies sales tax collection for multi-state businesses. This agreement standardizes sales tax rates and rules across participating states, making it easier for businesses to comply with multiple jurisdictions.

Sales Tax Filing and Remittance

Businesses are required to file sales tax returns with the SCDOR on a regular basis, typically monthly, quarterly, or annually, depending on their tax liability and sales volume. These returns must be filed by the due date to avoid late filing penalties.

During the filing process, businesses must report their total taxable sales, calculate the sales tax due, and remit the appropriate amount to the SCDOR. Late payments or underpayments can result in interest and penalty charges, so it's crucial to ensure timely and accurate remittance.

Record-Keeping and Audits

Proper record-keeping is essential for sales tax compliance. Businesses should maintain detailed records of all sales transactions, including the date, amount, and tax collected. These records should be easily accessible and organized to facilitate accurate reporting and potential audits.

The SCDOR may conduct sales tax audits to verify compliance. During an audit, businesses must provide their sales records, invoices, and other relevant documents. It's important to cooperate fully with the auditors and ensure all records are accurate and up-to-date to avoid potential penalties and disputes.

| Registration Process | Online through SCDOR |

|---|---|

| Sales Tax Filing Frequency | Monthly, Quarterly, or Annually |

| Audit Process | Records inspection, potential penalties for non-compliance |

Sales Tax for Consumers: What You Need to Know

While businesses bear the primary responsibility for collecting and remitting sales tax, consumers also play a role in understanding and complying with sales tax regulations. Here’s a breakdown of what consumers need to know about sales tax in South Carolina.

Understanding Sales Tax on Receipts

When making a purchase in South Carolina, consumers will see the sales tax amount clearly displayed on their receipt or invoice. This amount is calculated based on the total purchase price and the applicable sales tax rate for that specific location.

For example, if you purchase an item priced at $100 in a location with an 8.5% total sales tax rate, the sales tax due would be $8.50, bringing the total cost of the item to $108.50.

Sales Tax on Online Purchases

With the rise of e-commerce, sales tax on online purchases has become a significant consideration for consumers. In South Carolina, online retailers are generally required to collect and remit sales tax if they have a physical presence or economic nexus in the state.

However, if an online retailer does not have a presence in South Carolina, the responsibility often falls on the consumer to report and pay the use tax on their online purchases. This use tax is essentially the equivalent of sales tax and ensures that consumers pay their fair share of taxes, even on out-of-state purchases.

Sales Tax Exemptions and Special Circumstances

South Carolina offers certain sales tax exemptions and special circumstances to eligible individuals and entities. For instance, charitable organizations may be exempt from sales tax on certain purchases, and veterans and individuals with disabilities may be eligible for tax exemptions on specific items.

Additionally, South Carolina participates in the Streamlined Sales Tax Project, which aims to simplify and modernize sales tax systems across multiple states. This initiative can provide benefits to both businesses and consumers, making compliance and understanding sales tax regulations more straightforward.

| Sales Tax on Receipts | Clearly displayed, calculated based on purchase price and applicable rate |

|---|---|

| Online Sales Tax | Online retailers with physical or economic presence collect sales tax; consumers responsible for use tax otherwise |

| Sales Tax Exemptions | Charitable organizations, veterans, individuals with disabilities may be eligible for exemptions |

The Future of Sales Tax in South Carolina

As technology and commerce continue to evolve, so too will South Carolina’s sales tax system. The state is likely to adapt its regulations to keep pace with these changes, ensuring a fair and efficient tax system for businesses and consumers alike.

Potential Changes and Initiatives

One potential area of change is the continued adoption of technology to streamline sales tax compliance. South Carolina may explore the use of automated systems and digital platforms to simplify the registration, filing, and remittance processes, making it easier for businesses to stay compliant.

Additionally, the state may consider expanding its sales tax base to include more services and digitally-provided products. This shift would align South Carolina with many other states that are moving towards a more comprehensive sales tax system to adapt to the changing nature of commerce.

The Impact of E-Commerce

The growth of e-commerce has significantly impacted sales tax collection and compliance. South Carolina, like other states, has had to adapt its regulations to ensure that online sellers, both in-state and out-of-state, are collecting and remitting sales tax accurately.

As e-commerce continues to evolve, South Carolina may need to further refine its economic nexus laws and consider implementing additional measures to ensure fair tax collection from online sellers. This could include more stringent registration requirements and increased enforcement efforts.

Collaborative Efforts with Other States

South Carolina’s participation in initiatives like the Streamlined Sales Tax Project demonstrates its commitment to collaborating with other states to improve sales tax systems. By working together, states can harmonize their tax regulations, making it easier for businesses to comply and reducing the administrative burden on both businesses and tax authorities.

Looking ahead, South Carolina may continue to actively participate in such collaborative efforts, contributing to the development of more uniform and efficient sales tax systems across the country.

| Potential Changes | Adoption of technology, expansion of sales tax base |

|---|---|

| Impact of E-Commerce | Refinement of economic nexus laws, increased enforcement |

| Collaborative Efforts | Continued participation in initiatives like the Streamlined Sales Tax Project |

Conclusion: Navigating the Complex World of Sales Tax

Understanding and complying with South Carolina’s sales tax regulations is essential for businesses and consumers alike. By staying informed about the state’s tax rates, exemptions, and compliance requirements, individuals and businesses can ensure they are fulfilling their tax obligations accurately and efficiently.

Whether you're a business owner looking to register and file sales tax returns or a consumer trying to understand the sales tax on your purchases, the resources and information provided by the South Carolina Department of Revenue can be invaluable. With a solid understanding of the sales tax system, you can make informed decisions and contribute to the state's revenue generation efforts.

As South Carolina continues to evolve its sales tax system to adapt to the changing landscape of commerce, staying up-to-date with these changes will be crucial. By embracing technological advancements and collaborative initiatives, the state can create a more streamlined and efficient sales tax system, benefiting all stakeholders involved.

Frequently Asked Questions

What is the current sales tax rate in South Carolina?

+

The current sales tax rate in South Carolina is 6%. However, local taxes can add to this rate, with some areas having a total sales tax rate of up to 8.5%.

Are there any sales tax exemptions in South Carolina?

+

Yes, South Carolina offers sales tax exemptions for certain items and services. Groceries, prescription drugs, and some services like legal and medical services are exempt from sales tax.

How often do businesses need to file sales tax returns in South Carolina?

+

Businesses typically file sales tax returns monthly, quarterly, or annually, depending on their tax liability and sales volume. The South Carolina Department of Revenue determines the filing frequency for each business.

What happens if I don’t comply with South Carolina’s sales tax regulations?

+

Non-compliance with South Carolina’s sales tax regulations can result in penalties, interest charges, and legal consequences. It’s important to register, collect, and remit sales tax accurately to avoid these issues.

How can I stay updated with South Carolina’s sales tax regulations and changes?

+

You can stay updated by regularly checking the South Carolina Department of Revenue’s website, which provides the latest information on sales tax rates, regulations, and any changes or initiatives. Additionally, subscribing to their email updates can ensure you receive timely notifications.